CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In May 2025, the used car market is heating up — and fast. Between rising prices, a shortage of low-mileage vehicles, and renewed demand driven by economic uncertainty, it’s officially a seller’s market. But that doesn’t mean buyers are out of luck. Here’s what’s driving the shift, how used car prices are trending, and what shoppers can do to stay ahead of the game this summer.

CarEdge’s own Ray Shefska recently checked how much his 2020 MINI Clubman was worth on the used market. Just six weeks after receiving a $16,600 offer, that same car was valued at $19,000 — a 15% increase in value. While Ray’s experience may sound extreme, it perfectly illustrates the broader trends driving up used car prices this spring.

So what’s going on? Several forces are converging this spring to push prices higher:

One result? The average age of a used car for sale is now 6.7 years — a 26% increase from 2020, when the average was just 5.3 years according to Manheim. However, many buyers still prefer a more gently-used vehicle, so younger pre-owned cars are selling for a steep premium in 2025.

👉 Track your car’s value for free with the CarEdge Garage

After peaking above $28,000 in 2022, average used car prices dipped to just under $25,000. But now, prices are bouncing back.

Cox Automotive reports that the supply of used cars under $15,000 — often the most in-demand by budget-conscious buyers — is at its lowest level since 2021. These affordable vehicles are also selling the fastest.

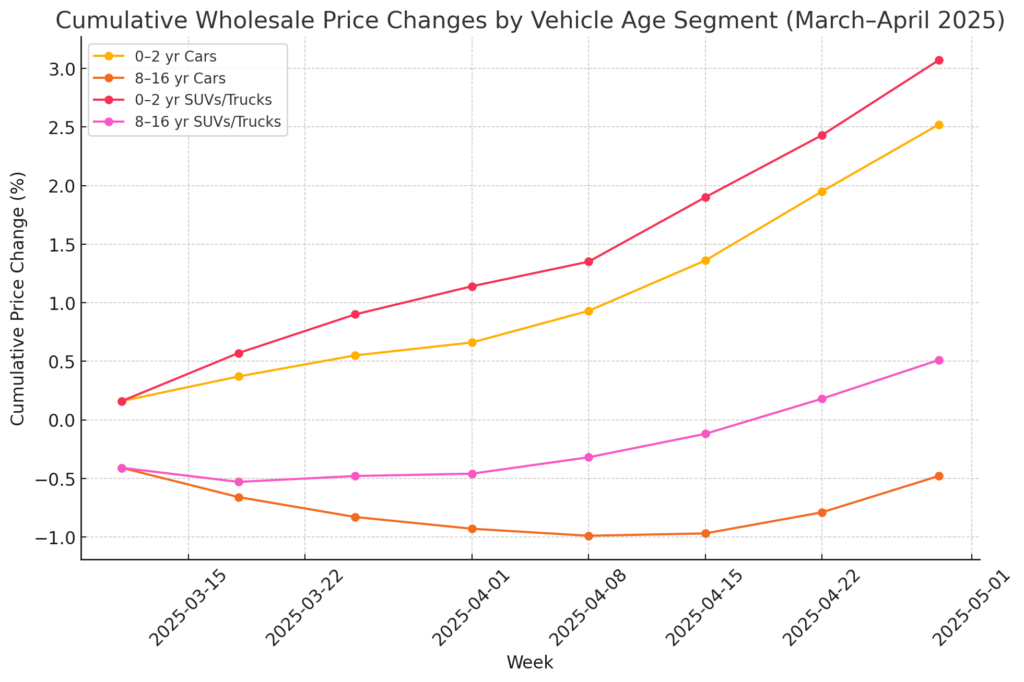

Wholesale price data from Black Book shows that used car values are up 2.75% over the past two months — but that’s just the average. Zoom in on the most desirable vehicles, and the price increases are even sharper.

Vehicles that are 0 to 2 years old are appreciating much faster than older cars. Buyers have caught on to the sharp depreciation that hits new cars as soon as they leave the lot — and they’re now prioritizing lightly-used vehicles instead.

That’s creating a perfect storm: low supply, high demand, and rapidly climbing prices for newer used cars. Meanwhile, older vehicles — especially those over 6 years old — are either holding steady or even losing value.

The takeaway? The younger the used car, the stronger its market value right now.

We track used car prices weekly here. Add this to your bookmarks if you’re in the market!

If you’re thinking about selling a car that’s less than five years old — especially one with low mileage — now is the time. Dealers and private buyers are paying top dollar for clean, late-model vehicles.

💰 See your car’s value instantly — and get a cash offer on the spot!

Yes, prices are rising. But used car shoppers still have a chance to land a great deal — especially if new car incentives dry up due to tariff pressures or reduced inventory. Here’s how to stay ahead:

Use CarEdge Car Search to locate used cars that have sat on dealer lots the longest. These units are often the most negotiable.

Arm yourself with free negotiation cheatsheets and walk into the dealership with confidence. A well-informed buyer is a powerful buyer.

A pre-purchase inspection can save you thousands down the road. It’s your best defense against buying a lemon.

Keep your options open. If one deal falls through or a dealer won’t budge on price, move on. Also, don’t get talked into paying for overpriced add-ons or junk fees. Here’s what’s legit, and what’s a ripoff.

Feeling overwhelmed? Let a professional handle the hard part. CarEdge’s Car Buying Service offers expert help — and now features our most affordable option ever.

The 2025 used car market is undergoing rapid changes heading into May. Values are rising, inventory is tightening, and shoppers are rushing to lock in deals before prices rise further. Whether you’re selling a low-mileage car for top dollar or hunting for a well-priced used vehicle, the key is to do your homework, whether you’re buying or selling.

Car buyers are eagerly anticipating Memorial Day sales, traditionally a prime time for deep discounts and attractive incentives. However, early indicators suggest that 2025’s deals may fall short of expectations. This year, several headwinds—including ongoing tariff uncertainty, persistently high auto loan rates, and shrinking vehicle inventories—are clouding the outlook for May promotions. These factors are likely to dampen the kind of aggressive incentives shoppers have come to expect from Memorial Day car sales.

Here’s why some auto industry analysts are bracing for a quieter sales weekend in 2025.

According to Cox Automotive, the industry-wide new vehicle supply dropped to just 70 days at the start of April, a 23% decline from March. CarEdge Pro reports that inventory levels remained similarly tight in late April. This spring rush has been fueled in part by buyers trying to get ahead of potential price hikes tied to looming tariff concerns.

As Memorial Day approaches, inventory constraints are particularly pronounced at brands like Lexus, Toyota, Honda, and Subaru. With fewer cars on the lot, these automakers are unlikely to offer standout holiday deals this year.

But there’s still hope for deal hunters—if you know where to look.

Several brands are sitting on inventory levels well above the industry average heading into May. These brands have over 90 days of market supply, and are likely to have the best Memorial Day car sales in May 2025:

These car brands will have more flexible pricing and stronger incentives as they look to catch up to the competition. Many are also still working through large volumes of unsold 2024 models—more on that below.

👉 See the fastest and slowest-selling new cars right now

Manufacturers are under pressure to clear out 2024 models, four months into the new year. In April 2025, 348,000 of the 3.1 million new cars for sale in America were 2024 models. Many of them are trucks like the Ford F-150 and Ram 2500. There are also plenty of last year’s electric vehicles that remain unsold. These are prime targets for zero percent financing Memorial Day specials.

Here’s a look at cars and trucks with the most remaining 2024 inventory as Memorial Day 2025 approaches:

| Make | Model | Unsold 2024s (in April 2025) |

|---|---|---|

| Ford | F-150 | 32,189 |

| Ford | Bronco | 18,555 |

| Ram | Ram 2500 | 10,080 |

| Ford | Expedition | 8,699 |

| Acura | ZDX | 4,238 |

| Jeep | Grand Cherokee | 3,709 |

| Lincoln | Nautilus | 2,375 |

| Lincoln | Corsair | 2,049 |

Unsold 2024 models will be the most negotiable cars in May 2025. You should be able to confidently negotiate at least 15% off MSRP for any remaining 2024 model, even those impacted by auto tariffs. Use CarEdge Pro to find aging car inventory in your city.

Low APR deals are a win-win for both dealers and buyers. For dealers, it’s about liquidating stock without slashing sticker prices dramatically, which can devalue the brand. For buyers, these subsidized rates lower the monthly payment, making an upgrade more feasible. Expect to see APR offers as low as 0% for qualified buyers on select models, alongside generous cash-back offers and lease deals.

In fact, there are already several 0% APR offers on the market today…

👉 See the best APR and cash offers this month

As we inch closer to Memorial Day, certain vehicles stand out for their negotiability. While the specific models and deals will be confirmed as the holiday approaches, here are some categories to watch:

This Memorial Day, CarEdge is your go-to resource for navigating these sales. Not only will we provide a one-stop resource for the best car sales, we’ll also share car market insights that you won’t find anywhere else. 👉 Bookmark this page and check back in early May to see what automakers have to offer! Head to this page for the best deals right now, no matter when you’re reading this.

Spring is usually a strong season for car sales, and automakers are feeling the pressure to move aging inventory as tariff uncertainty mounts. Even as some brands are making progress, others — like Ram, Nissan, and Infiniti — still have plenty of unsold vehicles. That means buyers can expect another round of aggressive financing offers, employee pricing programs, and big discounts on leftover models when May deals are announced.

Here are five automakers on track to offer the biggest discounts in May 2025.

Ram’s inventory is stuck in neutral with over 144 days of supply. That’s twice the industry average of 74 days of supply in April 2025. Ram dealers still have more trucks than they can sell, including plenty of aging inventory:

Ram’s “Freedom of Choice” program is back, offering buyers either employee pricing or traditional cash incentives. In most cases, employee pricing isn’t the better deal. In April, current lessees could get up to $10,500 off a 2025 Ram 1500, or $4,000 in brand loyalty cash on the 2024 Ram 2500.

Expect those same offers to continue in May — especially since inventory hasn’t budged. With tariffs already impacting Ram 2500s built in Mexico, there’s extra urgency to sell them now.

See Ram Deals and Discounts Near You

Ford is keeping the pressure on with its “From America, For America” employee pricing offer extended through May. And while the campaign helped lower inventory from 139 to 109 days of supply, Ford still has more to sell.

Even with employee pricing, shoppers should compare deals carefully. Some traditional APR offers or cash discounts may offer better savings than the flat-rate pricing Ford advertises. Here’s our full review of Ford’s employee pricing offer.

Compare Ford Offers In Your Area

In recent months, Nissan’s financial struggles have been in the spotlight. Unless sales improve, Nissan could be headed for serious trouble. However, Nissan’s situation has improved in April, but they’re far from out of the woods. Inventory levels remain high enough to justify continued deals in May.

Incentives are still aggressive. Expect low-APR offers (perhaps 0% APRs) on models like the Rogue and Altima, lease specials on the refreshed Armada and Murano, and clearance pricing on aging stock. And for fans of the discontinued Nissan Titan pickup, this is your last chance — just 399 new Titans remain on sale.

See Today’s Best Nissan Incentives

Infiniti has quietly become one of the most overstocked luxury brands. Nissan’s luxury nameplate is even making appearances on the list of slowest-selling cars today. With 131 days of supply, dealers are eager to make sales — especially on slow-moving models. Only Jaguar has slower-selling luxury cars right now.

While the QX60 is made in Tennessee, other Infiniti models built in Mexico and Japan may face price hikes. That makes May a good time to buy before those increases take effect.

Check Infiniti Offers Near You

Jeep’s Freedom of Choice employee pricing offer seems to be working — inventory dropped slightly in April — but it’s still 62% above the industry average.

Expect Jeep to continue its low-APR financing and patriotic marketing through May. Whether you’re eyeing a Grand Cherokee, Gladiator, or Wagoneer, there’s still plenty of room to negotiate, especially on leftover 2024s.

Find the Best Jeep Deals In Your ZIP Code

May 2025 is shaping up to be a great month for car shoppers, especially if you’re flexible about the brand or model. Jeep, Nissan, Infiniti, Ram, and Ford are all under pressure to move vehicles quickly. That gives you the upper hand in negotiations.

For car buyers, that means:

🚗 Before you buy, make sure you’re getting the best deal possible. Use CarEdge’s Free Car Buyer’s Guide to compare offers, track inventory trends, and negotiate with confidence. We’re simply here to help!

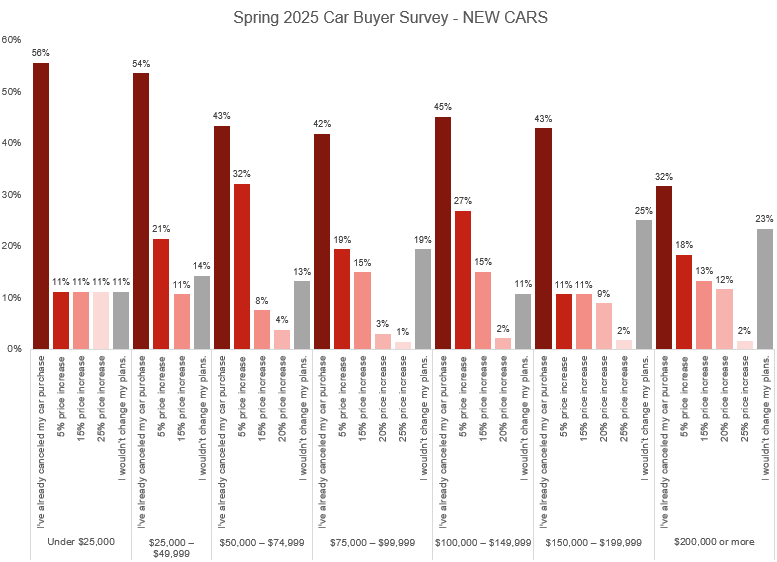

Amid a volatile market and looming auto tariffs, a new consumer survey conducted by CarEdge reveals that most Americans are unwilling—or unable—to tolerate further increases in car prices and monthly payments. The Spring 2025 Car Buyer Survey, which gathered over 400 responses from prospective new and used car shoppers, shows just how sensitive demand is to monthly payment hikes.

“These numbers make it clear: new car affordability is reaching a breaking point,” said Zach Shefska, Co-Founder and CEO of CarEdge. “If monthly payments increase even slightly, automakers are going to lose a huge chunk of their customer base.

From 2022 to 2024, incentives were increasing. Now, that trend is reversed, with incentives making up just 7% of the average transaction price. With auto loan rates averaging 9% APR for new cars, any decline in manufacturer incentives could spell trouble for buyers and sellers alike.”

The latest CarEdge Car Buyer Survey highlights a striking reality: car buyers at all income levels are reaching their breaking point.

Even middle-income households are feeling the pressure:

And while some might assume high earners are unaffected by today’s car prices, the data says otherwise:

“Car affordability impacts all households,” said Shefska. “Even six-figure earners are pushing back. That should be a wake-up call to automakers who have spent years increasing MSRPs and abandoning affordable (sub $25,000) vehicles.”

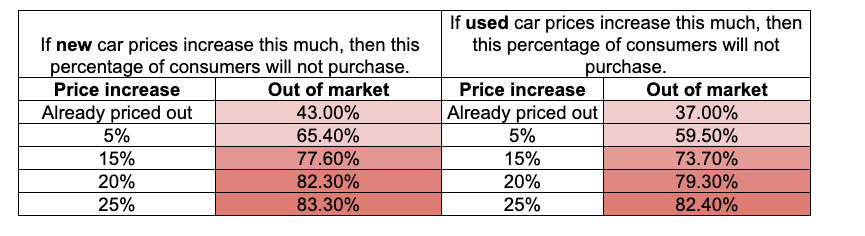

Across the board, households making over $100,000 per year are more price-sensitive than expected, with many drawing firm lines as affordability concerns mount. It’s not just new car shoppers who are reconsidering making a vehicle purchase. We see similar trends among used car buyers:

Shockingly, among households earning over $200,000 per year considering a used vehicle, one quarter say they’ve already canceled their purchasing plans. That’s the same percentage as those in the same income bracket who say they wouldn’t change their plans even if used car prices rose by 25%.

These findings come at a time when tariffs are threatening to push car prices even higher. The Trump administration’s recent pause on some trade duties does not include the automotive sector, where tariffs on imported vehicles remain in place.

“Any further price increases—whether from tariffs, panic buying, or other pressures—are likely to trigger a significant drop in demand,” noted Ray Shefska, CarEdge Co-Founder and used car sales veteran with 43 years of experience. “Automakers should think twice before pushing through further price hikes without offering offsetting incentives.”

The average new car transaction price is $47,962, according to Cox Automotive. A 5% increase in new car prices would send average transaction prices above $50,000 for the first time. Our data suggests that if that were to happen, 65% of would-be new car buyers would be out of the market.

Used Car Prices Are Not Immune

While the average used car is more affordable than a new one, used car prices are not insulated from the effects of rising new car prices. If tariffs or production constraints push new car prices even higher, many buyers will inevitably turn to the used car market—increasing demand and potentially driving up prices for pre-owned vehicles.

As of April 2025, the average used vehicle listing price stands at $25,180, well below the 2022 peak of over $28,000—but still high by historical standards.

“As demand shifts into the used market, we will see a second wave of price inflation,” Zach Shefska warned. “That could squeeze budget-conscious buyers even further and delay car ownership for many. We have already seen material price increases at dealer wholesale auctions, and we anticipate price increases to show up on the showroom floor quickly.”

About CarEdge

Founded in 2019 by father-and-son team Ray and Zach Shefska, CarEdge is a leading platform dedicated to empowering car shoppers with free expert advice, in-depth market insights, and tools to navigate every step of the car-buying journey. From researching vehicles to negotiating deals, CarEdge helps consumers save money, time, and hassle. Join the hundreds of thousands of happy consumers who have used CarEdge to buy their car with confidence. With trusted resources like the CarEdge Research Center, Vehicle Rankings and Reviews, and hundreds of guides on YouTube, CarEdge is redefining transparency and fairness in the automotive industry. Follow us on YouTube, TikTok, X, Facebook, and Instagram for actionable car-buying tips and market insights.Contact for Media Inquiries:

[email protected] | www.CarEdge.com

Buying a car is one of the biggest financial decisions most people make. But not everyone walks into the dealership with the same game plan. At CarEdge, we’ve seen the best and worst of car buying strategies — and let’s just say some deals are smarter than others.

Whether you’re buying, leasing, shopping new, or going used, here are the smart moves we recommend — and the costly mistakes to avoid.

Smart buyers always secure financing ahead of time. This gives you a baseline to compare against dealer financing, strengthens your negotiating position, and protects you from inflated interest rates.

Finance your car like a pro with this Free Financing Cheat Sheet

Smart shoppers don’t stop at MSRP. They research the true market value, calculate taxes and fees, and request the final out-the-door price upfront — often by phone or email. As long as you share your ZIP code for tax and fee calculations, there’s no reason a dealer can’t share their out-the-door price.

Concerned about your trade-in? Tell them you want to treat that as a separate transaction, and it shouldn’t impact the OTD price.

Want a better deal? Smart buyers shop at the end of the month, end of the quarter, or during model year transitions. Dealers are more motivated to close deals when sales targets are on the line.

See the slowest-selling cars in America. These models are highly negotiable!

It’s not just about the price of the car. Smart buyers also negotiate:

Take these FREE Cheat Sheets with you to the dealership – you’ll be glad you did!

Smart lessees understand their contract’s money factor, residual value, and capitalized cost — not just the monthly payment. They negotiate the selling price just like a cash buyer and always request the lease worksheet before signing.

Sound intimidating? No worries — Here’s our Complete Guide to Leasing a Car

A low monthly payment might look good, but it often hides a bad deal. Uninformed buyers don’t calculate total cost — or worse, they fall for 84-month financing just to “make it work.” Car salespeople are trained to manipulate loan terms so that even buyers with poor credit and little money for a down payment can get into a car that’s outside their budget. Financially, this is a recipe for disaster.

Every car buyer should focus on one number: the out-the-door price. The OTD price is not just the selling price of the car, it also includes taxes and fees so you know how much you’re really paying. Check out our free OTD price calculator for real-world examples.

The worst way to start a deal is blind. Shoppers who skip research are more likely to overpay, fall for sales pressure, or miss out on available incentives.

Luckily, we’ve got exactly what you need to do your research. Here are just a few of our best free resources:

Free Original Window Sticker – Know ALL about the vehicle before you head to the dealership.

Check for the latest incentives – See 0% APR financing, cheap lease offers, and cash deals.

See how your car ranks – Compare depreciation, maintenance and insurance costs, and more with CarEdge’s Research Hub.

Car Buying Calculators – From car loan calculators to depreciation forecasts, and everything in between.

We’re on a mission to demystify car buying, selling, and ownership for all. We’ve got car buying help for every budget.

Smart buyers use tools like CarEdge’s Car Value Comparison tool to know exactly what their vehicle is worth. The uninformed? They let the dealer set the price.

Always treat your trade-in as a separate transaction. Expect the dealership salesperson try and force the transactions together, but make it clear you’re not interested in that.

[Free Guide] Car Trade-In Tactics for Success

A “sign and drive” lease might seem simple — until you get hit with overage fees or lease-end penalties. Always review the full lease terms and avoid large down payments.

Avoid Costly Mistakes with These 7 Cheat Sheets, From Leasing to Buying & More!

Not always. Some used vehicles cost more to finance than new ones — and buyers often skip vital checks like accident history, open recalls, or a mechanic’s inspection. Learn more about the importance of a pre-purchase inspection. Don’t get stuck with an unreliable car!

In 2025, the average used car loan rate is about 14% APR. That’s about 5% more than new car loan rates. Car buyers with excellent credit can even qualify for zero percent financing on select models. Always consider the total cost of ownership before deciding which vehicle is best for your budget.

Car buying doesn’t have to be intimidating — but it does require a plan. Whether you’re buying or leasing, the smartest thing you can do is show up informed and ready to negotiate.

Need help getting the best deal?

📞 Talk to a CarEdge Concierge for white-glove service — have us negotiate your deal from start to finish!

📊 DIY negotiators save BIG with CarEdge Pro. See local pricing and market trends before you buy.