CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

If you’re thinking about buying or selling a vehicle in 2024, you’ve most likely encountered an unfortunate truth in today’s market: trade-in values have taken a dive. But what’s driving this decline, and how does it affect your next vehicle purchase? Will trade-in values fall further in 2024? Let’s delve into the dynamics of trade-in values in 2024, exploring the causes behind this trend and what you can expect when you decide to trade in your vehicle.

In 2024, trade-in values are trending downward, primarily due to a steady decline in used car values at wholesale auctions. Last year’s volatility in the wholesale used car market has led to an 11% drop in values within just two months towards the end of 2023. We’re seeing that trend carry over into 2024. Despite this decrease at the wholesale level, retail prices have remained stubbornly high, resisting substantial drops as dealers maintain higher price points.

The used car dealers who make offers for trade-ins are nervous about two things: the slowing used car market, and high interest rates. Many dealers suffered huge losses on electric vehicle trade-ins in 2023 as values went into freefall. The same could be said about other vehicle segments, from vans to luxury SUVs.

The used car market turmoil has resulted in trade-in values falling more dramatically compared to retail prices.

👉 See this week’s used car market update

CarEdge Co-founder Ray Shefska has some thoughts to share about trade-in values in 2024. Ray highlights that, despite the drops, trade-in values in 2024 are still far from what they used to be pre-pandemic. The automotive market is slowly inching towards a balance, but it’s a gradual process. “The car market remains out of balance due to the 16 million vehicles that were never built during the pandemic shortages. This shortfall will continue to impact the market throughout the decade, but we’re starting to see signs of improvement,” he noted.

What can you do to stay on top of the latest trends in trade-in values for your car? Get offers from online buyers with no strings attached! See real-time offers from online buyers with CarEdge.

According to Ray, 2024 is expected to bring back some normalcy in terms of market seasonality, which has been absent for a while. The early part of 2024 has already seen a dip in trade-in values, attributed to the post-December buying slump.

However, this trend is likely to reverse during the tax refund season in spring, which typically sees an uptick in used car purchases. This increase in demand often leads to a temporary boost in trade-in values.

“Post-tax season, I expect a slight decline in trade-in values in early summer, followed by a steady market until the year-end car buying season. Remember, depreciation is normal for every vehicle. What we’ve seen over the past few years was abnormal to say the least.”

Ray’s pulse on the market is rooted in over 40 years in the automotive industry. If anyone knows a thing or two about trade-in values, it’s Ray.

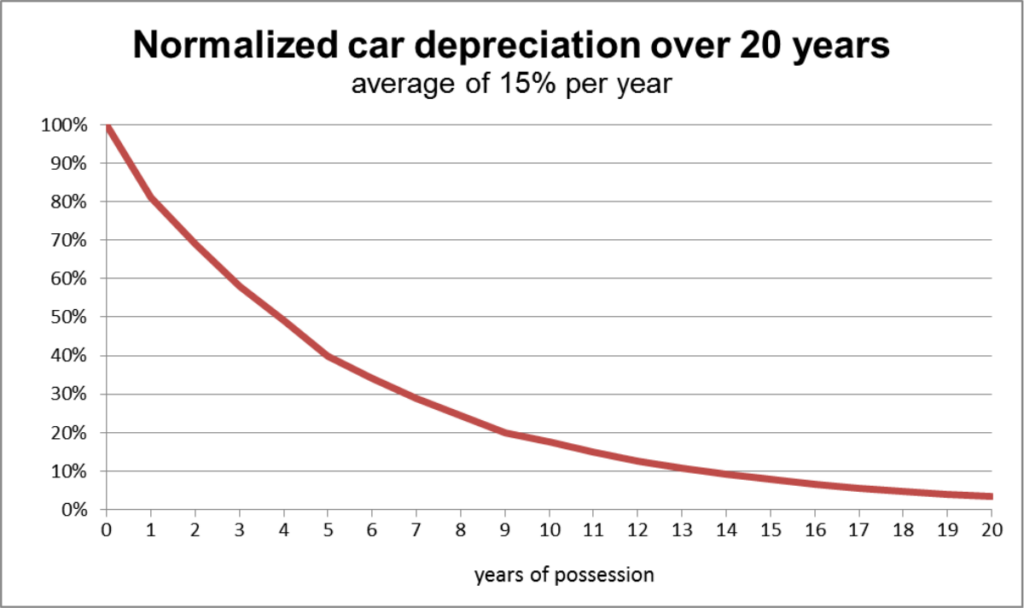

Historically, vehicle values take a 20% hit in the first year of ownership. It’s normal to lose around 40% of a car’s original value in the first five years.

Navigating the auto trade-in market in 2024 requires an understanding of these new trends and their underlying causes. From the pandemic’s lasting impact to the return of market seasonality, various factors are shaping trade-in values this year. Whether you’re planning to trade in your vehicle soon or later in the year, staying informed about these trends can help you make a more strategic decision, ensuring you get the best value for your car in a shifting market.

👉 Don’t forget to check your car’s trade-in values from online buyers (no spam, guaranteed!). Get your no-hassle offers here.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

It’s a new year, but car buyers are still facing some of the same challenges. In 2024, the dilemma of choosing between a new or used car is influenced by several factors, including depreciation rates, interest rates, price trends, and the lingering effects of the pandemic. Let’s break down what you need to know to make the best decision in 2024.

Key Takeaways:

The automotive landscape has seen dramatic shifts in trade-in and resale values over the past few years. In 2024, a trend that began last year is continuing: used car prices are declining in wholesale markets, impacting trade-in values significantly. The era of purchasing a new car and flipping it for profit is over. Instead, we’re returning to the traditional pattern where new cars lose a substantial portion of their value as soon as they leave the dealership.

This year, expect to see an uptick in subvented rates from captive lenders, as new car sales decelerate. Low APR offers are here to stay in 2024. Manufacturers are increasingly offering incentives to clear inventory, including surprising zero percent financing deals available in January. Despite stable interest rates, the high cost of loans remains a critical factor in the car market. Consequently, we anticipate a larger share of new car loans will be sourced through captive lenders like Hyundai Motor Finance, Ford Credit, and Toyota Financial Services.

Towards the end of 2023, data from Cox Automotive showed an uptick in 0% APR offers. We expect this trend to continue into 2024.

With the average used car loan rate now north of 13% APR, plenty of used car shoppers are checking out new car offerings to simply pay less interest.

Check out the best APR offers this month

Don’t pay dealer markups for any vehicle in 2024. No matter what the salesperson might tell you, we’re firmly in a buyer’s market. This isn’t 2022’s car market anymore.

After consecutive years of rising MSRPs, the tide is turning in 2024. Although prices for the latest models have increased for the 2024 model year, we don’t foresee this trend continuing once 2025 model pricing is announced.

Resistance to high prices is growing among consumers, evident in slowing sales and increasing inventory, particularly for expensive cars, SUVs, and trucks. This resistance is gradually influencing the used car market as well.

These 2023 models have the most remaining inventory, and high negotiability

Used-car wholesale prices have given up 53% of their pandemic gains. However, wholesale markets are largely off limits to the average car buyer. Unfortunately, this drop is less pronounced in retail prices. According to the Consumer Price Index, retail used car prices have given up just 36% of the pandemic price spike two years later. Retail used car prices are down 12.6% from the July 2022 highs.

Why are used car prices still high in 2024?

The auto market is still feeling the lasting effects of the pandemic-induced semiconductor chip shortage. Pandemic-related factory shutdowns resulted in 16 million vehicles never being produced. These missing vehicles contribute to a global shortage of used cars, expected to last until at least the late 2020s. Ray Shefska of CarEdge predicts a return to normalcy in the used car market might not occur until 2030.

In 2024, used car prices will continue their gradual decline, influenced by high interest rates deterring potential buyers. With new car loan rates exceeding 13% APR, a 20-year high, many buyers are turning away from used cars in favor of new vehicles with more attractive financing options. Indeed, new car deals make more sense for many buyers in 2024.

2024 presents a nuanced picture for car buyers. While new cars offer more favorable financing options and the appeal of owning a brand-new vehicle, they also come with the risk of rapid depreciation and of course, higher prices.

On the other hand, used cars, although more affordable, are still priced relatively high due to market shortages years ago. Ultimately, the decision depends on individual priorities, financial situations, and long-term plans for vehicle ownership.

Free Car Buying Help Is Here

Ready to outsmart the dealerships? We have FREE resources for new and used car buyers alike. Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

As we step into 2024, American drivers are noticing a larger auto insurance bill with their policy renewals. Based on an analysis of 97 million auto insurance quotes from Insurify, a clear picture emerges of the key trends in car insurance prices for this year. We’ll examine the factors driving up costs, and take a look at how consumers and the industry are adapting.

In 2023, auto insurance rates in the U.S. climbed 24% to an all-time record high. The spike in rates was driven by rising repair costs, natural disasters, and more frequent car accidents. This uptick in insurance costs led to record losses for insurers. The latest data suggests that car insurance premiums aren’t done climbing. Insurify projects that car insurance rates will increase by 7% in 2024. That’s almost double the typical annual rise.

The national average cost of a full-coverage policy now stands at $2,019 per year, amounting to 2.6% of the median household income. In comparison, state-minimum liability insurance averages at $1,154 annually.

In 2023, car insurance rates increased by 638% more than the average wage growth. Nearly 62% of Americans reported a rise in their car insurance rates, and about 22% experienced more than one increase in the same year.

To combat these hikes, many drivers opted to lower their coverage limits or increase their deductibles. Insurify’s data shows that most drivers took action to reduce their premiums, often accepting more risk in exchange for lower monthly premiums.

New York stands out with the highest car insurance costs in the country, averaging $3,374 annually for a full-coverage policy.

States with lower incomes are feeling the brunt of these insurance cost increases. Drivers in these states spend a larger portion of their earnings on car insurance, exacerbating the financial strain on households already facing economic challenges.

The past few years have been tough for the insurance industry. After suffering a $3.8 billion net underwriting loss in 2021, losses deepened to $26.9 billion in 2022. 2023’s numbers are still pending, but there were some signs of a recovery late in the year.

The rising costs of maintenance and repairs, increased severity of accidents, and pandemic-induced market fluctuations have all contributed to these losses. The Bureau of Labor Statistics reported an 8.46% increase year-over-year in auto repair costs as of November 2023.

Advanced vehicle technologies and electric vehicles bring new challenges, with repair costs for high-tech cars and EVs like Tesla being substantially higher. Insurance companies are increasingly forced to choose between writing a check for a $20,000 repair bill after a seemingly minor accident, or writing the car off altogether.

In light of the rising car insurance rates, here are some practical recommendations for car buyers looking to save money on their auto insurance in 2024:

By following these recommendations, car buyers can make more informed decisions and potentially save money on their auto insurance in 2024, despite the overall trend of rising rates.For more information on the latest auto insurance trends, check out Insurify’s latest update.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Why did most buyers stay away from used electric vehicles in years past? Most were fixated on the federal EV tax credit, which only applied to new EVs. Others were unsure about EV repair costs outside of warranty. But the calculus changes when used EV prices plummet like they have recently. Better yet, more and more models are qualifying for the federal used EV tax credit, which launched in January 2023. Here’s a look at the best used electric vehicle deals in December of 2023.

We’ve ranked the 10 best-selling EVs in America from most negotiable, to least negotiable based on market day supply.

New Average Transaction Price: $31,482

Used Average Transaction Price: $23,601

Used Market Day Supply: 100 days

Negotiability Score: Very High

The Chevrolet Bolt EV stands out as one of the most affordable electric vehicles in the American market. It’s an ideal entry-level EV, perfect for city driving and shorter road trips. Additionally, most used Bolt EVs fall within the price caps for the federal used EV tax credit, making them even more appealing.

However, the Bolt’s main drawback lies in its charging capabilities. With a peak charging rate of only 55 kW, it can take over an hour to gain 200 miles of range, which may be a concern for some buyers. In December, there are 3,487 used Chevrolet Bolts available for sale across America, with prices starting at just $10,995. Of these, 415 boast a clean record.

See pre-owned Chevy Bolt listings with the power of local market data.

New Average Transaction Price: $48,230

Used Average Transaction Price: $32,898

Used Market Day Supply: 85 days

Negotiability Score: Very High

The Volkswagen ID.4 boasts the advantage of being American-made at VW’s Chattanooga, Tennessee plant, making it eligible for the federal EV tax credit when new. Furthermore, used ID.4 models are available for around $25,000, potentially qualifying for the used EV tax credit as well. With charging speeds and range that are both average, it strikes a balance in the EV market.

However, the ID.4 is not designed for sporty performance; those seeking a more dynamic driving experience might consider other options on this list, excluding the Chevy Bolt. As of December, there are 655 used Volkswagen ID.4s for sale across America, with prices starting as low as $23,900, and 111 of these vehicles have a clean record

See pre-owned Volkswagen ID.4 listings with the power of local market data.

New Average Transaction Price: $56,546

Used Average Transaction Price: $41,100

Used Market Day Supply: 98 days

Negotiability Score: High

The Mustang Mach-E is a family-sized EV with the iconic Mustang’s spirit, offering a sporty edge to family hauling. However, it’s important to consider that its charging speeds are average, lagging behind competitors like Tesla, Hyundai, and Kia. For those interested, there are 1,327 used Mustang Mach-Es available for sale in America as of December, with prices starting at an enticing $23,999. Among these, 183 have a clean record.

See pre-owned Ford Mustang Mach-E listings with the power of local market data.

New Base MSRP: $74,990

Used Average Transaction Price: $39,674

Used Market Day Supply: 87 days

Negotiability Score: High

The Model S boasts luxury features and reliable fast charging, making it a premium choice in the electric vehicle segment. However, it’s important to note that it doesn’t offer the same cargo capacity as its siblings, the Model Y and Model X, which could be a deciding factor for some.

As of December, the market has 2,498 used Model S vehicles available across America, with prices starting remarkably low at $12,000 for a 2013 model. Among the listings, 363 have a clean record.

See pre-owned Tesla Model S listings with the power of local market data.

New Average Transaction Price: $52,520

Used Average Transaction Price: $40,834

Used Market Day Supply: 94 days

Negotiability Score: High

The Kia EV6, similar to the IONIQ 5, is renowned for its rapid charging capabilities and efficiency. However, buyers should note that it offers less interior cargo space typical of hatchbacks, rather than the larger capacity found in SUVs.

In the current market, there are 397 used Kia EV6s available for sale across America as of December, with the starting price at $24,922. Among these, 75 have a clean record.

See pre-owned Kia EV6 listings with the power of local market data.

New Base MSRP: $47,740

Used Average Transaction Price: $42,633

Used Market Day Supply: 57 days

Negotiability Score: Average

For car buyers considering a used Tesla Model Y, there are some key points to keep in mind. One of the major advantages is access to Tesla’s reliable and extensive Supercharger network, complemented by the convenience of frequent over-the-air updates that continually improve the vehicle.

However, potential buyers should be aware of occasional complaints regarding build quality issues. As of December, there are 2,226 used Model Ys available for sale across America, with prices starting as low as $27,500. Out of these, 339 have a clean record.

See pre-owned Tesla Model Y listings with the power of local market data.

New Base MSRP: $40,240

Used Average Transaction Price: $33,368

Used Market Day Supply: 65 days

Negotiability Score: Average

The Model 3 is known for its time-tested reliability, exceptional range and efficiency, and access to Tesla’s extensive Supercharger network. However, it’s worth noting that as a sedan, the Model 3 doesn’t align with the current trend favoring SUVs and trucks. In December, there are 6,591 used Model 3s on the market in America, with prices starting at an attractive $16,990. Of these, 533 boast a clean record.

See pre-owned Tesla Model 3 listings with the power of local market data.

New Base MSRP: $79,990

Used Average Transaction Price: $54,284

Used Market Day Supply: 63 days

Negotiability Score: Average

The Tesla Model X combines the spaciousness of an SUV with the touch of luxury, notably featuring its distinctive gull-wing doors. While these doors add a unique flair, they can sometimes be more of an inconvenience in practical use. For those eyeing a 2020 or newer Model X, be prepared to invest a minimum of $50,000.

In the used car market this December, there are 1,391 Tesla Model X vehicles available across America, with the starting price as low as $23,100. Among these, 204 have a clean record, offering a variety of choices for those seeking a blend of luxury, space, and electric efficiency in their vehicle.

See pre-owned Tesla Model X listings with the power of local market data.

New Average Transaction Price: $50,581

Used Average Transaction Price: $38,965

Used Market Day Supply: 58 days

Negotiability Score: Average

The Hyundai IONIQ 5 stands out in the EV market with its e-GMP powertrain, making it one of the fastest-charging affordable electric vehicles available today. Additionally, several listings now fall within the negotiation range of the $25,000 price cap for the federal used EV tax credit, making it an attractive option for budget-conscious buyers.

However, its design is polarizing, often eliciting strong opinions; you either love its unique look or don’t. As of December, there are 389 used Hyundai IONIQ 5s for sale in America, with prices starting at a competitive $22,758. Of these, only 73 have a clean record.

See pre-owned Hyundai IONIQ 5 listings with the power of local market data.

New Average Transaction Price: $71,118

Used Average Transaction Price: $68,430

Used Market Day Supply: 110 days

Negotiability Score: Very High

The Ford F-150 Lightning stands out as a full-sized electric truck capable of handling typical truck duties, a significant pro for those needing utility and eco-friendliness. However, like all electric trucks currently on the market, it experiences a significant reduction in range while towing, losing about half of its rated capacity.

Additionally, the F-150 Lightning’s charging speed is not the fastest; without access to home or workplace charging, adding 200 miles of range at a DC fast charger could take at least 45 minutes.

Ford dealers are resisting discounts, even after months of building inventory. That’s the sole reason why the F-150 Lightning isn’t ranked higher on this list of best used EV deals. In the used market, there are 516 F-150 Lightnings available for sale across America as of December, with prices starting at $39,995. Of these, only 56 have a clean record, offering options for those looking for a capable electric truck with practical utility.

See pre-owned F-150 Lightning listings with the power of local market data.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

As we wrap up summer and head into fall, the truck market is full of deals. With 2025 models arriving daily and dealers eager to sell remaining 2024 inventory, it’s a great time for negotiating, or letting us do it for you. Here’s our guide to the top truck deals of September 2024, featuring low APR financing, cash offers, and lease deals.

Starting MSRP: $40,350+

Negotiability Score: Very High (134 days of market supply)

0% APR financing for 60 months + up to $6,590 in cash savings

Nissan is fighting hard for truck market share in the U.S., with limited success. September’s zero percent financing offer is the best truck deal today. Plus, there are various cash offers that can total up to $6,590 in savings. Note that some of the cash incentives are only available as loyalty cash to current Nissan or Infiniti owners and lessees. This offer expires on 9/30/2024.

See Nissan Titan listings with local market data

Starting MSRP: $36,820+

Negotiability Score: High (202 days of market supply)

2024 Ram 1500: Up to $7,250 cash allowance on select V6 trucks

2024 Ram 1500 Classic: Up to $5,000 cash offer

Ram trucks are slow-selling, even though they seem to be everywhere you look on the road. To alleviate Ram’s oversupply of trucks, they’re offering big cash offers this month. This offer expires on 9/30/2024.

See Ram 1500 listings with local market data

Starting MSRP: $51,900+

Negotiability Score: High (108 days of market supply)

1.9% APR + $6,000 cash allowance with a trade-in

GM is offering big incentives on both the Sierra 1500 and Silverado 1500 this month. This offer expires on 8/2/2024.

See GMC Sierra 1500 listings with local market data

Starting MSRP: $48,645+

Negotiability Score: High (96 days of market supply)

1.9% APR for 36 months, or lease for $409/month for 36 months with $4,949 due

With 96 days of market supply, there’s an abundance of 2024 Silverado 1500s on Chevy dealer lots. These APR and lease offers are great deals for truck fans. This offer expires on 9/30/2024.

See Chevrolet Silverado 1500 listings with local market data

Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing the smart way, it’s all available for instant download. Ready to let a car buying pro take the wheel? CarEdge Concierge is the easiest way to buy a car today. Our team finds the vehicle you want, right down to the finest of details, and negotiates on your behalf. Home delivery is available. Learn more about CarEdge’s car buying service.