CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

As 2023 winds down, the new car market is ripe with opportunities for big savings. As inventory climbs and 2024 models arrive, dealers and OEMs have an added sense of urgency to sell cars. We’ve gathered the best year-end deals in 2023, spotlighting the top picks for drivers looking to upgrade without breaking the bank.

👉 Also: The 5 Best End of Year Truck Deals

Starting MSRP: $29,300

Current Market Day Supply: 144 days

Negotiability Score: High

0% APR for 60 months + No payments for 90 days

The CX-5 comes with standard all-wheel drive, a rarity outside of Subaru. A flood of 2024 model year CX-5s have recently arrived at dealership lots, and with zero percent financing, it’s clear that Mazda is looking to sell them in a hurry. Mazda also has several models at 0.9% to 1.9% APR in December.

See 2024 Mazda models at $500 below invoice, and 2023 Mazda models at $1,000 below invoice!

Starting MSRP: $51,900

Current Market Day Supply: 79 days

Negotiability Score: High

$6,500 purchase allowance + $1,500 engine credit for the Elevation trim with the Turbo High-Output Engine for a total of $8,000 in cash incentives.

According to the fine print, buyers must be the current owner or lessee of a GMC or Buick vehicle to qualify for this year-end truck incentive. Costco members get an additional $1,000 in cash incentives.

See GMC Sierra 1500 listings with local market data

Starting MSRP: $28,750

Current Market Day Supply: 50 days

Negotiability Score: Average

0% APR for 60 months + no payments for 90 days + $3,000 bonus cash

The 2024 Hyundai Tucson also qualifies for 0% APR this month. Next year, the Santa Fe will undergo a controversial facelift, bringing unconventional looks to this popular SUV.

See Hyundai Santa Fe listings with local market data

Starting MSRP: $48,700

Current Market Day Supply: 112 days

Negotiability Score: High

0.9% APR for 48 months + $7,500 cash incentives + $1,000 trade assistance

The 2023 Kia EV6 is one of the fastest charging EVs on the market. The EV6 won several awards last year, and has stellar ratings from Consumer Reports. This offer compensates for the loss of the federal EV tax credit, but state and local incentives may still apply.

See Kia EV6 listings with local market data

Starting MSRP: $25,900

Current Market Day Supply: 132 days

Negotiability Score: High

0% APR for 36 months for the 2023 and 2024 Altima, + $500 Nissan loyalty cash

Altima sales were up 35% in 2022, giving Nissan a shot at recovering from years of market share losses to Toyota and Honda. Following efficiency upgrades, the Altima gets up to 39 miles per gallon on the highway.

See Nissan Altima listings with local market data

More deals this way 👉 The 5 Best End of Year Truck Deals

At CarEdge, December is the highlight of our year. It’s a time when high vehicle inventories merge with attractive year-end deals, and with the potential rise in financing rates on the horizon, it presents a prime opportunity to land an amazing deal on a new car. These 5 top picks represent incredible value. You could even call it a buyer’s market (for this month, at least).

👉 Don’t miss the complete guide to ALL of the best end of year deals

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

December brings enticing year-end deals, especially for Toyota fans. While interest rates have risen, Toyota offers exceptionally low rates through manufacturer incentives, alongside impressive lease deals. These are the top Toyota offers this month.

Toyota’s end-of-year deals feature APRs as low as 2.99%, and cash offers over $1,000. For even better deals, check out our 5 Top Picks For December.

2023 Camry, 2023 RAV4 (excludes hybrids), 2023 Corolla and Corolla Hatchback (excludes hybrids): 3.99% APR for 48 months, 4.99% APR for 60 months, 5.49% APR for 72 months + $1,000 cash offer (applied to down payment when you finance with Toyota Financial Services)

2023 RAV4 Hybrid and Corolla Hybrid: 4.99% APR for 48 months, 5.99% APR for 60 months, 6.49% APR for 72 months

2023 Highlander (FWD models only): 2.99% APR for up to 72 months

2023 Highlander hybrid: 4.99% APR for 48 months, 5.99% APR for 60 months, 6.49% APR for 72 months

2023 Tacoma (4×2 models): 2.99% APR for 60 months, or 3.49% APR for 72 months

2023 Tacoma (all trims, including 4×4): 3.99% APR for up to 72 months

2023 Tundra: up to $1,500 cash offer (applied to down payment when you finance with Toyota Financial Services)

See Toyota listings with local market data.

Learn more about these December deals at Toyota.com

The sales and incentives we’ve all been waiting for are finally here. In a perfect storm of high inventory, stagnant sales, and a surge of 2024 models arriving by the day, it’s safe to say that the car market has finally flipped. With Toyota inventory higher than it has been for over two years, buyers have additional negotiating power in the final weeks of 2023.

Don’t go it alone when you shop dealership lots. Take CarEdge Data with you! CarEdge Data takes the guesswork out of car buying. See the real-time fair price, local inventory numbers, days on the market and more for every listing. Learn more about CarEdge Data.

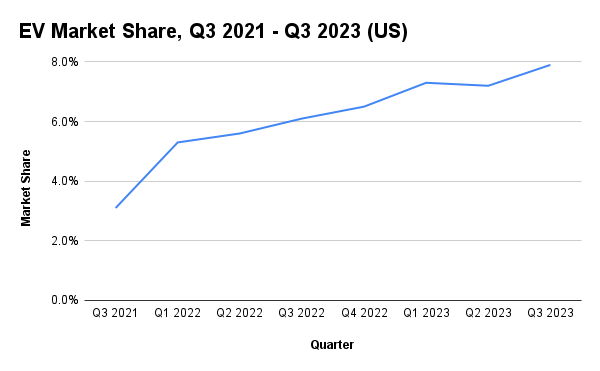

As electric vehicles increasingly populate the roads, understanding the ins and outs of the EV market can equip car buyers with leverage to negotiate big savings. Currently accounting for 7.9% of new car sales in America, the EV market is undeniably expanding. However, it’s not without its challenges. We’ll delve into the complexities behind the EV market’s growth, the latest EV inventory update, and which models have the best year-end deals this December.

The EV market is growing, with electric vehicles now making up 7.9% of all new car sales in America. However, the market is experiencing its share of challenges. While some new electric models fly off the lots, others linger far longer.

What’s behind the buildup of EVs on dealer lots? First, it’s worth pointing out that OEMs have ramped up production, sending more cars to dealer lots. But as it turns out, there aren’t as many buyers as they’d hoped for. And 57% of EV buyers are still opting for a Tesla, which sells directly to consumers. Other direct-to-consumer newcomers like Rivian, Fisker, and Lucid are also growing in market share.

On top of that, there’s a natural shift happening in the market for EVs, one that’s been expected for a while. As 2024 approaches, we’re coming to the end of the ‘early adopter’ phase of EV sales. Many of the higher-income, more tech-curious drivers who were eager to go electric have already purchased an EV. What’s left is the rest of the auto market, which makes up the vast majority of buyers.

Why aren’t more car buyers choosing an EV? The lack of reliable charging infrastructure is the most commonly cited reason, with higher prices being a close second. Another reason for EV hesitation is the uncertainty of possible repair costs outside of warranty. Sure, fuel savings can add up quickly, but what would it cost to replace a damaged battery pack? Savvy buyers want to know more about the total cost of ownership.

But make no mistake: EV sales are still growing. They’re just not growing exponentially like they did a few years ago. Here’s a look at quarterly EV market share in America over the past three years.

All analysts predict EV sales to grow in the future, but the extent of growth varies. The consensus average stands at 35% EV market share in 2030. Growth rates will have to accelerate in order to achieve that. Time flies, and we’re only six years away.

At CarEdge, we preach that to find the most negotiable cars, follow the inventory numbers. A key factor in understanding these sales dynamics is Market Day Supply. This indicator shows how long it would take to sell off current inventory at recent sales rates.

The entire new car market is undergoing a rapid rise in inventory. Our latest new car inventory update shows that several domestic car brands are seeing in excess of 75 days of market supply in December. In a healthy ‘normal’ market, that number is 45 to 60 days of supply.

EV inventory has grown steadily in 2023. CarEdge Data has revealed some eye-opening figures. New EV inventory has reached unprecedented levels.

Take the Ford Mustang Mach-E, for instance. Its supply has skyrocketed to 337 days, a stark contrast to its initial hype as a ‘Tesla-killer’. Other popular models like the Hyundai IONIQ 5 and IONIQ 6 are facing 125 and 156 days supply, respectively, despite their acclaimed ultra-fast charging speeds and industry accolades. The Kia EV6 is right up there too with 153 days of supply, more than double the inventory of one year ago. Nissan’s follow-up to the LEAF, the Ariya, now has an MDS of 209 days. Perhaps buyers are balking at a $50,000+ price tag for a Nissan crossover. Who would have thought?

Surprisingly, some of the least recommended EVs are selling more quickly. The Subaru Solterra actually has a relatively normal supply right now with a market day supply of 57 days. The Toyota bZ4X sits at 87 days. The Lexus RZ has 78 days of market supply. Why wouldn’t we recommend these three popular EVs for most buyers? They charge quite a bit slower than other options on the market for a similar price. Yet, loyal Subaru, Toyota and Lexus fans seem to be buying them.

Most other EV models are sitting on dealer lots for much, much longer.

Here’s a snapshot of the current dealer inventory for new electric vehicles in America, excluding Tesla and other direct-to-consumer brands. We’ve included data from December and October to shed light on recent inventory trends:

| Make | Model | Day Supply (10-2023) | Day Supply (12-2023) | Total For Sale (12-2023) |

|---|---|---|---|---|

| Audi | Q4 e-tron | 111 | 148 | 2967 |

| Audi | Q8 e-tron | 98 | 117 | 3194 |

| Audi | e-tron GT | 62 | 229 | 834 |

| BMW | i4 | 60 | 82 | 3775 |

| BMW | i5 | N/A new model | 114 | 2275 |

| BMW | i7 | 129 | 151 | 2032 |

| BMW | iX | 81 | 113 | 4148 |

| Cadillac | Lyriq | 151 | 139 | 3981 |

| Chevrolet | Bolt EV | 60 | 113 | 2390 |

| Chevrolet | Bolt EUV | 57 | 75 | 5585 |

| Ford | Mustang Mach-E | 204 | 337 | 25334 |

| Ford | F-150 Lightning | 182 | 124 | 13174 |

| Genesis | GV60 | 190 | 178 | 1723 |

| GMC | Hummer EV | 80 | 58 | 876 |

| Hyundai | Kona EV | 60 | 109 | 214 |

| Hyundai | IONIQ 5 | 102 | 125 | 8816 |

| Hyundai | IONIQ 6 | 73 | 156 | 5869 |

| Jaguar | I-Pace | 647 | 682 | 379 |

| Kia | EV6 | 106 | 153 | 4741 |

| Kia | EV9 | N/A new model | N/A new model | 547 |

| Lexus | RZ | N/A new model | 78 | 2441 |

| Mercedes | EQS | 221 | 159 | 4224 |

| Mercedes | EQS SUV | 221 | 176 | 86 |

| Mercedes | EQE | 144 | 190 | 1397 |

| Mercedes | EQE SUV | 100 | 89 | 3198 |

| Mercedes | EQB | 88 | 93 | 3628 |

| Nissan | Ariya | 108 | 156 | 5435 |

| Nissan | Leaf | 161 | 209 | 2706 |

| Porsche | Taycan | 239 | 142 | 2735 |

| Subaru | Solterra | 96 | 57 | 1306 |

| Toyota | bZ4X | 102 | 87 | 2459 |

| Volkswagen | ID.4 | 125 | 103 | 11140 |

| Volvo | C40 | 128 | 105 | 808 |

| Volvo | XC40 Recharge | N/A | 137 | 1519 |

This is NOT normal, folks. You can’t sugarcoat the fact that in America, electric vehicles are not selling as quickly as automakers had expected. That’s precisely why so many are sitting on dealer lots right now.

High interest rates are also a factor, as the cost of financing a $50,000+ vehicle is unattainable for many. The average price of an electric vehicle is $51,762 as of our latest EV price update.

Yes, EV inventory is sky-high, but what does this mean for potential EV buyers? First, the bad news. Our CarEdge Coaches are quite frankly shocked by how stubborn car dealers are refusing to lower EV sticker prices. Even with 150 to 300+ days of supply, up to 6 times the norm, most Ford dealers haven’t discounted Mustang Mach-Es or F-150 Lightnings. The same rings true for Mercedes-Benz’s growing electric lineup.

The good news is that increasing inventory suggests that buyers certainly have more room to negotiate. This is especially true for models with a higher days supply. Recent spikes in EV inventory have already led to some CarEdge Community members successfully negotiating significant discounts off EV sticker prices. This trend indicates that EVs, contrary to what dealers will tell you, are indeed negotiable. Importantly, buyers should come prepared with negotiation know-how and recent car market insights. Prepare to save big on your next car with Deal School (100% FREE).

Here’s our comprehensive list of the best year-end EV sales, along with our negotiability score based on the inventory numbers shared above:

2023 Subaru Solterra: 0% APR for 72 months

2023 Ford Mustang Mach-E: 0.9% APR for 60 months + $3,000 cash offer+ No payments for 90 days

2024 Kia EV6: 0.9% APR for 48 months + $3,750 cash offer

2023 Nissan Ariya: 2.9% APR for 36 months + up to $3,750 cash offer

Tesla Model 3 RWD: $329 per month for 36 months with $4,500 due

Chevrolet Bolt EUV: $369/month for 36 month with $6,659

Tesla Model Y RWD: $399 per month for 36 months with $4,500 due

Kia EV6: $379/month for 36 months with $4,999 due

2023 Subaru Solterra: $399/month with $0 down payment

BMW i4: $499/month for 36 months with $4,599 due

Volvo XC40 Recharge and Volvo C40: Up to $8,500 in lease credit for qualified lessees

See all of the best year-end car deals in December

Despite dealers’ reluctance to reduce sticker prices, high inventory presents a unique negotiation opportunity for EV buyers. For those equipped with the right market insights and negotiation strategies, the end of 2023 could be the perfect time to secure big savings on an electric vehicle.

Remember, knowledge is power in this market, and being well-informed can lead to significant savings on your next EV purchase. Keep an eye on the market trends and be ready to make a smart, well-negotiated buy as we step into the new year.

Take this with you: 100% Free Car Buying Cheat Sheet

The FTC’s Combating Auto Retail Scams Rule (CARS Rule) is a significant stride in bringing transparency and honesty to the car buying and leasing process. This initiative was significantly bolstered by CarEdge, a key player in rallying public support for the rule. In early 2022, CarEdge leveraged the power of community to highlight the need for such regulations and led the call for public action. The result was thousands of public comments in support of the regulation, and ultimately, meaningful progress towards changing car buying for the better.

Here’s a look at what the new CARS Rule means for car buyers and auto dealers moving forward.

The Federal Trade Commission’s new CARS Rule enforces four fundamental principles of truth and transparency in the auto retail industry, which reputable dealers already practice. It’s seen as a significant win for consumers, offering them the same standards of truth and transparency that apply in other transactions. This new regulation takes effect on July 30, 2024.

Here’s how the CARS Rule protects consumers and benefits honest car dealers:

1. The rule prohibits deceptive information about pricing, financing, add-ons, and other ‘material’ information

2. Dealers are required to disclose the offering price – the actual price anyone can pay for the car – excluding only required government fees

3. It is illegal for car dealers to charge for add-ons that don’t provide a benefit to consumers

4. Dealers are now required to get customers’ express, informed consent before charging them for any amount

The rule provides clear legal provisions to protect consumers and adds confidence in their dealings with car dealers. For honest dealers, it levels the playing field by setting uniform standards that all dealers must meet. This enables them to compete fairly based on accurate claims about price, financing, and services.

The rule prohibits misrepresentations about material information and requires dealers to clearly disclose the offering price of a vehicle (the out-the-door price), excluding only mandatory government charges. It also mandates that dealers must inform consumers that they can refuse optional add-ons and must disclose the total payment amount, including any conditions.

Additionally, the rule makes it illegal for dealers to charge for add-ons that don’t benefit the consumer. This is a major win for car buyers following the proliferation of anti-consumer pricing during the car shortages of 2022. Finally, good news is here for those contemplating a car purchase.

To ensure adherence to the rule, the FTC has laid out guidelines for clear and conspicuous disclosures. These disclosures must be understandable to ordinary consumers and in the same language as the advertisement or communication. The rule also covers practices in languages other than English, ensuring that all consumers receive the same level of protection regardless of the language used.

Read the complete FTC guidance here

This is a major win for American consumers. The rule sets a standard for clear and conspicuous disclosures and includes specific recordkeeping requirements for dealers. Now, for the first time, violations could lead to significant penalties. The rule represents a major step forward in protecting consumers and ensuring fair competition among auto dealers.

CarEdge will continue to push for meaningful change, always with the goal of taking the hassle out of car buying.

Learn more about how CarEdge is changing car buying for the better.

Let’s clear the air right off the bat. December is the best time to buy a car if you’re in the market for one. At CarEdge, we’re all about doing what’s smart for your wallet. Even with the best offers in years, and prices slowly falling, it continues to make the most sense to keep driving the vehicle you have. But for those pondering buying now or holding off until 2024, here are three reasons why December is the car buying month you’ve been waiting for.

As we usher in December 2023, new-vehicle inventories have soared to levels not seen since spring 2021, marking a significant turnaround. Cox Automotive reports a robust 70-day supply of vehicles as we step into the month, a stark contrast to the inventory drought experienced just a year ago. New car inventory in America, now at about 2.5 million vehicles, has seen an additional increase of 100,000 in November alone.

This surge represents a gain of 890,000 vehicles compared to the previous year, and the highest new car inventory since the early months of 2021. Before the COVID-19 pandemic, new car inventory levels typically hovered between 3 million and 4 million vehicles in the U.S. The past year’s recovery, particularly evident from summer 2022, marks a pivotal shift in the availability of new vehicles for consumers.

Inventory has reached a 2-year high just as OEMs approach the new year, a time when they’re eager to sell 2023 model year vehicles to make way for incoming 2024s. This inventory rebound is a promising sign for buyers. When inventory rises, deals and incentives are sure to follow. And right on cue, massive deals are here.

See the Most and Least Negotiable New Cars Today

The cost of financing a car purchase hasn’t been this high since the late 1990s. In December, the average new car loan finance rate is 9.96% APR. Used car loan rates are even higher, nearing 14% APR.

Following the Federal Reserve’s recent decision to maintain the federal funds rate between 5.25 to 5.5 percent, many are wondering if we’re done with rate hikes. This marks the third time in the last four meetings that the Fed has opted for rate stability, despite having raised rates a total of 11 times in this economic cycle to counter high inflation.

However, the question looms: how will new car financing costs change in 2024? The answer lies in the word ‘incentives’.

As we enter the peak of December’s year-end car sales, automakers are rolling out their best financing offers of the year. But with borrowing costs at near 20-year highs, these attractive incentives from OEM’s captive lenders are likely to vanish come early January. Automakers aren’t offering low APR deals because they want to, they’re doing it because they need to sell cars before the new year arrives.

Click here for our FREE auto finance cheat sheet!

It’s becoming clear that interest rates will hardly budge in 2024. The median of financial industry’s projections predicts that the Federal Funds Rate at 5.1% at the end of 2024, representing just one 25 basis point interest rate cut for all of next year.

In other words, December 2023 will feature more low-APR offers than we should expect to see until this time next year. The generous 0% APR to 1.9% APR deals from brands like Mazda and Hyundai are expected to be short-lived.

In the new year, new car shoppers should expect more 3.9% to 4.9% APR offers, and far fewer zero percent financing incentives.

This December, car buyers are presented with a rare opportunity: securing low-interest rates through manufacturer incentives, complemented by some exceptionally lucrative cash offers and great lease deals. The increasing cost of borrowing is driving automakers and dealerships to entice buyers with more attractive financing options, even as these rising rates add to the pressure on dealerships to offload their inventory.

Automakers don’t mind leasing their new car inventory one bit. When a car is leased, a third-party financer takes ownership of the vehicle, so the car dealer and automaker still get the benefit of ‘selling’ the car.

In December, there are some truly amazing lease offers. Here are a few of the standout lease deals this month:

See ALL of the best lease offers in December

Leading the charge with zero percent financing on select models are automakers like Mazda, Nissan, and Hyundai. Once a staple in the auto market, 0% APR deals have become a rarity in today’s high-interest rate climate. Not far behind are brands like Kia, Honda, and several Mazda models, offering enticing 0.9% APR deals. Plus, there are’s an abundance of 1.9% APR offers from General Motors, including for the Silverado 1500.

This array of year-end sales provides an unmatched opportunity for car buyers looking for value in a turbulent market.

Explore all the best year-end car sales here.

At CarEdge, December is the month we’ve all been waiting for. The combination of high inventories, appealing year-end deals, and the likelihood of returning to high financing rates creates a unique window for securing a great deal on a new vehicle.

Ready to approach car buying with behind-the-scenes market insights? Try CarEdge Data for local price and inventory updates in real-time. CarEdge Data equips you with negotiation leverage like never before!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!