CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In the worst of the pandemic downturn, all but three car brands saw decreases in sales. One of the brands to grow against all odds was Mazda. Why are more drivers choosing Mazda, and will the brand that relies on conquests to grow be able to keep up the pace? How do Mazda deals compare to offers from Honda and others? Let’s take a look at why Mazda’s reliability, pricing and brand reputation are all at the top of the game right now.

In 2022, Mazda sold 294,908 vehicles in the US, with the CX-5, CX-30, and CX-9 being the crowd favorites. Despite witnessing an 11% sales drop in 2022, Mazda’s sales trajectory from 2019-2021 was overwhelmingly upward. In contrast, Honda experienced a substantial 33% sales decrease in the same year, while Toyota saw a 9% reduction. The significant sales decline of Japanese automakers, including Honda, is primarily attributed to persistent supply chain issues in the first half of 2022.

Let’s be clear: Mazda is no GM or Ford when it comes to volume. Last year, Mazda had just 2.1% of market share in U.S. light duty vehicle sales. But it’s the growth that counts. Back in 2017, Mazda’s market share was 1.7%. It’s not exactly quick growth, but it’s an upward trend that continues to this day.

There’s a lot to love about Mazda’s number one strength: reliability. Mazda has earned a spot in the list of the 10 Most Reliable Brands for over a decade, yet the brand doesn’t have the same household reputation for quality that Toyota and Honda enjoy. We think it’s time to change that, as Mazda has earned a top-tier reputation in today’s auto market.

In the most recent Consumer Reports reliability ranking, Mazda is in 4th place, just above Honda in 5th. The year prior, Mazda was in second place, while Honda was in 5th. In 2020, Mazda shocked the industry when it scored first in reliability, beating even Toyota.

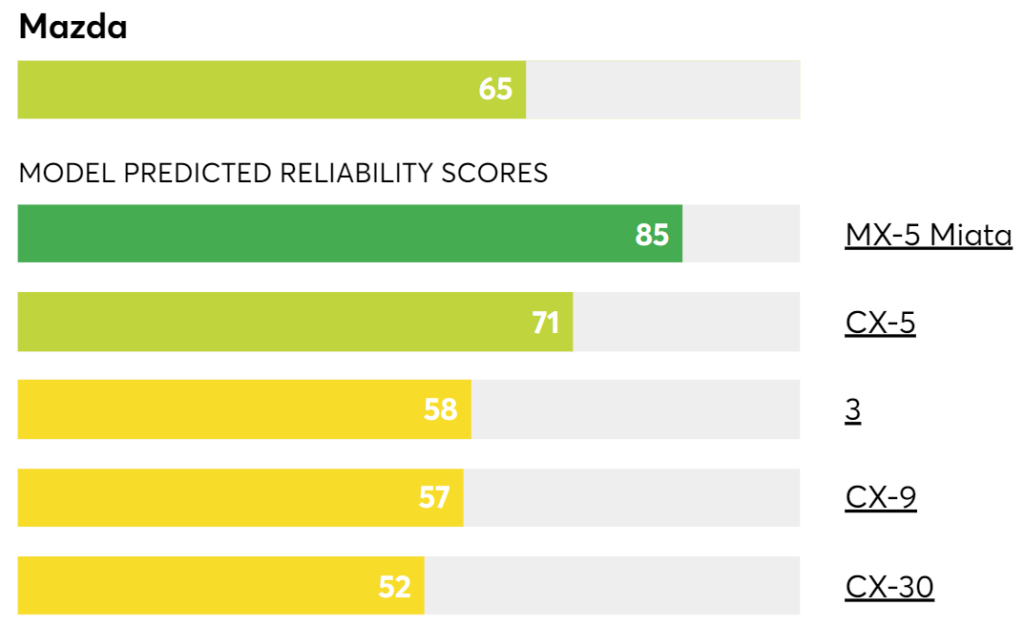

This year, Toyota and BMW (to everyone’s surprise) knocked Mazda down a few spots. Mazda’s overall brand scored 65, while the reliability leader Toyota scored 72 points. Honda scored 62 points. In case you’re wondering, no brand ever scores close to 100, although the ratings are officially on a 100-point scale.

What are the most reliable Mazda models? According to Consumer Report, the most reliable Mazda cars and SUVs are the MX-5 Miata, CX-5, Mazda 3, CX-9 and CX-30. Here’s how they scored.

Bargain-conscious car buyers should seriously start paying closer attention to local inventory numbers. Mazda currently has 106 days of inventory nationwide, with 84,876 new cars for sale in America. Honda has only 34 days of supply, with 96,517 vehicles for sale. This gives Mazda shoppers a huge advantage when it comes to negotiating prices.

Here’s inventory for the top-selling Mazda models

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Mazda | CX-5 | 87 | 29,993 |

| Mazda | CX-30 | 106 | 19,258 |

| Mazda | CX-9 | 41 | 158 (discontinued) |

| Mazda | CX-50 | 113 | 8,848 |

| Mazda | Mazda3 | 143 | 10,256 |

See local Mazda inventory and price trends with CarEdge Data.

Inventory is one of the primary drivers of new car negotiability. Mazda has over three times the inventory of Honda. Buyers are scrambling for any new Honda that shows up on dealer lots, but Mazda shoppers are greeted with plenty of options to choose from, inherently reducing the stress of car shopping. But does Mazda have any great deals? Let’s find out.

This month, Mazda is offering some compelling finance and lease options. In October, Mazda is offering enticing deals on various models. For the 2024 Mazda CX-5 Turbo, 2024 CX-90, and the 2023 MX-5 Miata, customers can take advantage of a low 0.9% APR for 36 months. Most other 2023 Mazda models are available with a 2.9% APR for 36 months, while most 2024 models come with a 3.9% APR for the same period.

Mazda’s lease deals are attractive too. Lease the CX-5 for $379/month for 36 months with just $2,999 due at signing. That’s not a bad deal considering how much drivers love the CX-5. The similar CX-30 lease starts at $301/month for 36 months with $2,999 due.

The all-new CX-90 is a larger Mazda SUV that the automaker has been promoting heavily in recent months. This more luxurious Mazda’s lease offer starts at $474/month for 36 months with $4,999 due. Yes it’s more expensive, but the CX-90 has 25% more cargo area than the CX-5.

All in all, these lease offers are worth considering for budget-minded shoppers who value reliability and modern amenities.

It is plausible to consider Mazda as the contemporary equivalent of Honda in the current auto market for some consumers. With its impressive reliability, competitive pricing, and growing brand reputation, Mazda is not only drawing attention but is also emerging as a preferred choice for many. Its robust sales, even in challenging times, further underscore its rising popularity and the value it offers to customers in the automotive landscape.

Plus, Mazda actually has plenty of inventory on dealer lots right now. That is a reason to celebrate, because as we like to say: more inventory means more deals.

Looking for car buying help? Our team of Car Coaches is ready to assist! From DIY market data to personalized, 1:1 car buying help, the CarEdge Team is here for you. Learn more about our money-saving services today.

Check out these member success stories to see how much drivers like you are saving!

October is turning into a great month for new car incentives, especially for fans of particular brands. Despite rising interest rates and the chronic affordability crisis, offers of low APRs and affordable leases are here for a limited time. Here’s a look at the best car deals in October.

Seeking to finance your new vehicle with a low interest rate? Given that the average APR for new car loans is now over 9%, securing a low rate isn’t easy. However, these brands are stepping up to the plate with tantalizing APR offers this October. Be sure to check offers for your ZIP code, as these represent the latest new car incentives on the East Coast.

Slash Your Car Loan Interest: Expert Tips for New and Used Car Buyers

In a serious effort to attract buyers, the following models are all advertised for 0% APR in October: Chevrolet Silverado 1500, 2023 Nissan Altima, and Nissan Rogue.

Honda Ridgeline, Hyundai IONIQ 5, IONIQ 6, Kia EV6, Niro EV, 2024 Nissan Altima, and Subaru Solterra EV: Get your hands on these models with 0.9% APR for qualified buyers. The best of the batch is definitely the Altima, one of the top-selling sedans today.

Nissan Armada, Buick Enclave, Buick Envision, and Toyota bZ4X: These models are available with a 1.9% APR. Those considering Toyota’s first EV, the bZ4X, should be aware that charging is slower than average, especially for the all-wheel drive version. We think the stand-out deals here are from Buick.

Chevrolet Trax, Trailblazer, Equinox, Blazer, and Traverse: Secure any of these sought-after Chevy SUVs with an APR as low as 2.1% for well-qualified buyers.

Here’s every automaker’s best financing offers this month.

How to Finance a Car Like a Pro: The Ultimate Auto Financing Cheat Sheet

Cadillac is providing up to $1,500 cash incentives on the XT4, XT5, and XT6.

Chevrolet offers no payments for 90 days plus a $750 cash allowance on the Silverado 1500. Dodge is not to be outdone with up to $5,500 cash allowance on the Durango and a $2,000 cash offer on both the Challenger and Charger.

If you’re in the market for a Kia or Hyundai EV, there are great cash offers in the form of lease discounts.

When it comes to new car incentives, more shoppers are considering a lease as MSRPs soar ever higher. These are the best lease deals this month.

With the Hyundai Elantra at $219 per month with $3,499 due and the Honda Accord at $299 per month with $3,299 due, sedan lovers have attractive options.

The Chevrolet Equinox at $299 per month for 24 months with $2,339 due and the GMC Terrain at $189 per month for 24 months with $4,879 due provide compelling offers for families.

The hot-selling Hyundai Santa Fe is available for $269 per month for 36 months with $3,999 due.

The 2024 Buick Envista is a subcompact SUV with by far the most modern design of any Buick in ages. Lease an Envista for as low as $199/month for 24 months with $3,396 due.

For truck fans, the Toyota Tacoma at $364 per month for 36 months with $3,064 due is a strong contender.

Those in need of a larger pickup truck will be fans of the Silverado 1500 Crew Cab LT, which can be leased for just $399/month for 24 months with $5,129 due.

Electric vehicle enthusiasts have the Tesla Model 3 rear-wheel drive at $399 per month for 36 months with $5,594 due as a prime option. Tesla EVs do qualify for the federal tax credit, so purchasing is worth considering too. The Model Y lease for $569 per month for 36 months with $5,804 due is an amazing value, but again, prices have dropped so far that buying is arguably a better option.

Those looking for a non-Tesla are likely considering the award-winning Hyundai IONIQ 5 and its sedan sibling, the IONIQ 6. This month, Hyundai is offering the IONIQ 6 for $349/month for 36 months with $4,999 due. The larger IONIQ 5 can be leased for $399/month for 36 months with $4,999 due at signing. Hyundai says that these terms include a $7,500 discount that is meant to replace the federal EV tax credit.

As we transition into the year-end season with November and December car sales on the horizon, anticipate a surge in enticing new car incentives from more automakers, introducing not only low APR offers but also compelling lease deals. The end of the year is always the best time to buy, and this year will be no different.

If the vehicle on your wish list didn’t make the cut in this month’s selection of the best deals, don’t fret. Patience, in this scenario, will indeed be a virtue that will be handsomely rewarded.

Ready to work 1:1 with a car buying pro? Learn more about CarEdge Coach, your path to the most savings and the least stress. Prefer a DIY path to car buying? With CarEdge Data, you have the tools at your disposal to find the best deals and identify opportunities for negotiation.

And of course, we have hundreds of 100% free car buying guides just a click away. Don’t forget to connect with the CarEdge family over on our Community Forum.

The National Highway Traffic Safety Administration (NHTSA) has intensified and broadened its inquiry into alleged “catastrophic engine failures” in Ford Broncos. The expanded investigation now encompasses over 700,000 vehicles across the Ford and Lincoln brands.

Initially, in July 2022, the NHTSA began investigating more than 25,000 2021 Broncos fitted with 2.7-liter EcoBoost engines. The probe was initiated in response to three petitions for a defect investigation and 26 complaints pertaining to unexpected losses of power during highway travel without the possibility of restarting.

These power losses were attributed to severe engine failures due to malfunctioning engine valves. Friday’s update from the NHTSA reveals the upgrade of this probe to an engineering analysis. This update followed Ford’s submission of 328 customer complaints, 487 warranty claims, and 809 engine exchanges involving 2021-22 models of Ford Bronco, Edge, Explorer, and F-150, as well as Lincoln Aviator and Nautilus vehicles. The said vehicles were equipped either with 2.7-liter or 3.0-liter EcoBoost engines.

Separately, Ford is under investigation for mishandling recalls. Ford also leads in recalls, with 44 issued already this year.

During the investigation, multiple factors were identified that could cause the engine’s intake valves to fracture, leading to catastrophic engine failures and loss of power. Ford acknowledged the issues, stating that vehicles with fractured intake valves typically require complete engine replacements.

Interestingly, Ford disclosed that the defective intake valves, made from a particular alloy named Silochrome Lite, tend to fail early. This alloy can become extremely hard and brittle if overheated during the component’s machining process. In response, Ford implemented a design modification in October 2021, changing the valve material to an alloy less prone to overheating.

According to a document detailing the investigation, the majority of these valve failures have likely already occurred. Nevertheless, the NHTSA has decided to advance the investigation to thoroughly assess the scope and frequency of the allegations. This move also aims to evaluate the efficacy of Ford’s improvements in manufacturing practices related to the defective component.

Upon completing the preliminary evaluation, the NHTSA will either conclude the investigation or proceed to the next phase. If they find a safety-related defect, the agency may issue a recall. Thankfully, no reports of related injuries, accidents, or deaths have been reported.

If a Ford and Lincoln recall is issued, which is increasingly likely, the following 2021-2022 models would be impacted:

Although no official recall has been issued for this specific investigation as of October 2023, Ford leads the auto industry in recalls overall. Check if your vehicle’s VIN number has been recalled for any reason at the NHTSA official recall checker.

Through the ups and downs of the auto market, one thing remains constant and crucial for car buyers to know: the best time to buy is the end of the year. As 2023’s year end car sales and special offers are just around the corner, patience will reward Ford buyers with huge discounts. Here’s a look at why Ford’s end-of-year sales are on track to be big, and which Ford models are set to receive the largest discounts.

How could we possibly forecast massive Ford discounts a few months out? It’s as simple as this: Ford has too many new cars sitting on dealership lots, and it’s getting worse. Car dealers can’t let inventory sit for too long due to ‘floorplanning costs’. They finance the lot inventory they hold, and with high interest rates, they’ll eventually be losing money if they hold on to a vehicle for too long.

Ford’s inventory problem is growing worse. Auto industry measures inventory by ‘market day supply’. Market day supply (MDS) in the auto industry represents the number of days it would take to sell current vehicle inventory at the existing sales rate. Let’s take a look at the numbers:

July 4 – 86 days (313,689 cars)

August 15 – 96 days (318,339 cars)

September 29 – 112 days (373,059 cars)

Where is Ford inventory headed from here? The UAW strikes are the wild card, but other than that, there’s not much pointing towards quicker sales and a trend towards normal inventory without the introduction of big sales and special offers.

If you don’t think 112 days worth of unsold inventory is bad, here’s how Ford’s top competition stands today in terms of market day supply of new cars:

Honda – 35

Kia – 38

Toyota – 41

Chevrolet – 66

Hyundai – 68

Volkswagen – 81

Nissan – 84

Jeep – 176

Ram – 279

Yes, Jeep and Ram have far worse oversupply woes today, but that’s no excuse for Ford executives who will soon be deciding how far they’re willing to go with year-end sales in the months ahead.

Next, we’ll look at the five Ford models with the highest negotiability.

When you take a look at the Ford models with the highest inventory, some surprises may be in store:

F-150 Lightning – 256 days (7,749 for sale)

Mustang Mach-E – 191 days (23,256 for sale)

Explorer – 170 days (41,974 for sale)

Mustang – 150 days (11,291 for sale)

Edge – 149 days (27,245 for sale)

Market day supply of Ford’s top-selling model, the F-150, sits at 120 days with 101,256 for sale nationwide.

Conversely, the Maverick, Ranger, and Bronco all have current supplies below 60 days. These are the only Ford models that will be difficult to negotiate right now, but even with these, it’s not impossible (especially with the help of a Car Buying Coach).

These are the current deals for these models right now, and why for most of them, patience is key for a better deal.

Financing: 2.9% APR for 48 months + $500 cash

3.9% APR for 60 months + $500 cash

1.9% APR for 36 months + $500 cash

Lease offers: Lease a F-150 Lightning XLT for $600/month with $6,251 due.

See Ford offers for your ZIP code.

Why you should wait: It’s worth repeating the wildest statistic in all of this Ford update. There’s a 256-day supply of F-150 Lightnings! It’s near the top of EV inventory among all OEMs, and you think this is as good as Ford incentives will get? Think again. As we approach the end of 2023, Ford is all but guaranteed to introduce greater cash incentives, and maybe even 0.0% or 0.9% APR for the Lightning. With a truck this expensive (the average selling price of the F-150 Lightning is $80,500), APR offers carry more weight.

Browse Ford F-150 Lightning listings with local market data.

Financing: 0% APR for 36-60 month loans; 1.9% APR for 72 months. This offer applies to all trim options.

Leasing: As low as $451/month for 36 months with $4,894 due.

See active Ford offers for your ZIP code.

0% financing is a great deal right now. The average new car APR is north of 7% right now, so anything under 3% is great. But zero percent? Even better. If you can secure this offer with NO dealer markups, we say go for it.

Year-end sales are likely to introduce bigger cash incentives with continued 0% APR financing, at least until Mustang Mach-E inventory drops below 100 days of supply. We’re not sure when that will happen, but one thing’s for sure: we’re a long way from it.

Browse Ford Mustang Mach-E listings with local market data.

Financing: 2.9% APR for 60 months + $1,000 cash offer. Those purchasing after the end of a Ford lease are eligible for $2,000 in additional ‘renewal cash’. Before 10/2/2023, an extra $1,000 in cash incentive is available, for a grand total of up to $4,000 off.

Leasing: As low as $439/month for 36 months with $4,969 due at signing.

See active Ford offers for your ZIP code.

Why you should wait: Ford seriously needs to sell some Explorers. With a 170-day supply and 2024 models arriving soon, even better incentives are just around the corner. Be on the lookout for 0% APR financing for a limited time, likely sometime later this fall.

Browse Ford Explorer listings with local market data.

Financing: Ford is not advertising any current APR offers for the Mustang. Contact your local dealer for more information.

Leasing: As low as $459/month for 36 months with $3,509 due

See active Ford offers for your ZIP code.

Why you should wait: There are no active Mustang finance offers as of late September, but that won’t be the case if Mustang inventory remains high come November and December. We recommend waiting until APR offers return to visit the dealership. Alternatively, you can always check your local credit union or community bank for competitive rates.

Browse Ford Mustang listings with local market data.

Finance offers: Ford is not advertising any current APR offers for the Edge. Contact your local dealer for more information.

Leasing: As low as $389/month for 36 months with $4,339 due at signing.

See active Ford offers for your ZIP code.

Just as with the Mustang, better special offers will be available as year-end sales approach. If you’re in the market for an Edge, it will likely be worth the wait if you can hold out until November or December.

Browse Ford Edge listings with local market data.

With the close of 2023 approaching, prospective Ford buyers have something to look forward to: significant year-end discounts on various models, making the wait worthwhile. Ford’s year-end sales are poised to offer considerable savings, a welcomed relief given the current state of the auto market. This anticipation is not unfounded as there is a growing inventory of new Ford vehicles piling up on dealership lots, signaling inevitable price cuts to clear the backlog.

High interest rates are compelling dealers to quickly turn over their financed inventory to avoid accruing floorplanning costs. As Ford’s market day supply (MDS) – the industry metric for gauging inventory – shows an upward trajectory from 86 days in July to a staggering 112 days in late September, it’s clear that dealerships will soon be compelled to offer enticing discounts.

When compared to the MDS of competitors, Ford’s situation becomes even more apparent. Big discounts are all but guaranteed in the months ahead.

Gone are the days of navigating car buying alone and unprepared. Our team at CarEdge has helped thousands of car buyers negotiate great deals, and we’re excited to help you buy a car that you’re proud of. Learn more about CarEdge Coach, Consults and DIY Data products that give you the knowledge and know-how to negotiate like a pro.

Knowledge is power, and with CarEdge’s insights, you’ll be equipped to seize the best deals as soon as they roll out.

Right now, there’s just a 38-day supply of new Kia vehicles in the U.S. What this means is, at the current sales pace, all 68,541 new Kia cars and SUVs would be sold in just over a month without new inventory. But how does this compare to other car brands? And more importantly, which Kia models give you the most room for negotiation, and which ones too hot to handle? Let’s dive into the details.

The average selling price of a new Kia car today is $33,340. This statistic is striking, especially as Kia introduces more models priced over $50,000 and discontinues its most affordable one. As of today, Kia’s brand remains synonymous with affordability, but that could be changing soon. Kia is up against stiff competition as buyers flock to the only remaining affordable cars on the market.

How does Kia compare to the competition? Let’s take a look at the latest new car inventory by brand:

| Make | Market Day Supply (October) | Change vs Last Month |

|---|---|---|

| Kia | 37 | +9 |

| Honda | 34 | +6 |

| Toyota | 40 | +10 |

| Hyundai | 68 | +18 |

| Chevrolet | 66 | +12 |

| Nissan | 83 | +12 |

| Volkswagen | 80 | +17 |

| Ford | 112 | +23 |

| Jeep | 176 | +30 |

Kia is near the bottom of the pack when it comes to new car inventory right now. Only Honda has fewer cars on the lot or in transit. This is similar to last month, despite all brands increasing their inventory as daily sales rates slow and new 2024 models arrive on lots.

The most surprising number here is Hyundai’s latest inventory. For the first time in many months, Hyundai has higher-than-average inventory. With 68 days of supply at current selling rates, Hyundai has almost double the inventory of its sibling Kia. Hyundai Motor Company owns half of Kia.

American automakers can’t seem to sell cars right now. Chevrolet is close to average with a 66-day supply, but Ford and Jeep are swamped with cars they can’t sell. Ford’s inventory woes could be related to the recent announcement that they’re pausing construction on their $3.5 billion EV factory.

From Ford to Chevrolet, Jeep to Ram, dealers are stubbornly keeping listing prices higher than one would expect considering the oversupply of new cars.

If your goal is to save thousands of dollars on your new Kia, it’s important to look a bit closer at the details. For that, we need to look at today’s inventory numbers across the Kia model lineup.

Using the tools available through CarEdge Data, we analyzed Kia inventory for every model on sale in America. These numbers reflect nationwide supply. You can check out local Kia inventory using CarEdge Data.

| Make | Model | Market Day Supply | Total For Sale | Average Transaction Price |

|---|---|---|---|---|

| Kia | Forte | 29 | 8,150 | $23,687 |

| Kia | Carnival | 30 | 4,024 | $42,620 |

| Kia | Rio | 31 | 1,879 | $19,433 |

| Kia | Telluride | 31 | 8,208 | $49,430 |

| Kia | Stinger | 33 | 188 | $47,998 |

| Kia | Soul | 34 | 3,941 | $23,869 |

| Kia | Sportage | 36 | 11,172 | $34,460 |

| Kia | Seltos | 40 | 5,067 | $27,953 |

| Kia | Sorento | 54 | 11,811 | $41,001 |

| Kia | Niro | 56 | 4,575 | $35,378 |

| Kia | EV6 | 83 | 4,104 | $53,668 |

| Kia | Brand Average | 37 | 68,141 | $33,430 |

The most negotiable Kia models are the ones with the highest market day supply right now. This month, the all-electric Kia EV6 tops the list by a long shot. There’s an 83-day supply of new EV6’s, and that’s actually an improvement from last month. In July, EV6 inventory peaked at a mind-boggling 146 days of supply, but has been drifting downward ever since.

The EV6 was a hot seller in 2022, but the model lost eligibility for the federal EV tax credit due to the Made-in-America requirement.

Other more negotiable Kia models are the Niro (56 days of supply), and the Sorento (54 days of supply). The Niro is simply a bit too compact for most of today’s SUV buyers, so that’s likely to blame for slower (but not terrible) sales.

When it comes to the Sorento, it is clear that it’s a slow seller for what most would argue is a justified reason. The Sorento has by far the worst reliability ratings of any new Kia model. The Sorento scored a 5 on Consumer Reports’ reliability ratings. Yes, that’s on a 100-point scale.

The good news is that every other Kia model they’ve tested scored MUCH better.

Here’s the complete breakdown of Kia’s most recent reliability scores by model.

In late 2023, the Kia Forte, Carnival, Rio, and Telluride are the least negotiable new Kia models. The Kia Rio’s presence among the least negotiable Kia’s is interesting to say the least. The Rio is getting discontinued in the United States after 2023. This is despite the Rio being a popular and very affordable compact car. The Rio is one of the last new cars with a base MSRP starting under $20,000.

Automakers are sticking to their very unfortunate and anti-consumer plan of getting rid of affordable base models. Through August, Kia has sold 19,100 Rio’s in America this year. The EV6 can’t beat that, and the Niro and Carnival are not too far ahead. Why, then, is Kia discontinuing the Rio? Simply put, Kia doesn’t make enough profit from each Rio they sell. Budget-conscious car buyers love the Rio, but that doesn’t seem to matter to the big OEMs who want to force every driver into a $40,000+ car.

Soon, there will be even more demand for the Kia Forte, which is about to earn the title of ‘Most Affordable Kia Car’ with the passing of the Rio. The Forte is a hot seller, with just 29 days of supply. We expect the Forte’s market day supply to drop further as the last of the Rio’s are sold, forcing budget buyers to consider the slightly larger size and price tag of the Forte.

The Carnival and Telluride are in high demand right now, with about a one-month supply of each. These Kia’s aren’t cheap, and if it weren’t for the EV6 and upcoming EV6 electric SUVs, they would represent the top-of-the-line for the brand.

In order to successfully negotiate any of these models, be sure to work with a pro-consumer, honest Kia dealership. Browse local Kia listings with the power of market data with CarEdge.

Despite tight inventory, Kia is still advertising special offers this month. These are the best Kia deals worth your consideration in today’s market of high interest rates.

0.9% APR for 48 months

Up to $5,000 cash back

Note: The EV6 does not qualify for federal EV incentives, but may qualify for state and local incentives. The Niro EV charges painfully slow, and is not much cheaper, so we can only recommend the EV6.

See Kia EV6 listings with local market data.

2.9% APR for 48 months

See Soul, Forte and Stinger listings near you with local market data.

Kia also has a number of lease deals advertised. Check your local lease offers at Kia.com.

Despite the slim pickings with some Kia models, it’s still possible to negotiate a deal to be proud of. There’s no reason you should have to pay for dealer markups, forced add-ons, or overpriced warranties. If a dealer is attempting to force any of these B.S. charges and fees onto your deal, walk away, or work with a professional Car Buying Coach.

Ready to negotiate like a pro? Try CarEdge Coach and CarEdge Data today! With these tools at your disposal, you can take control of your car buying experience, understand market dynamics, strategize effectively, and secure the best deal possible. We’re simply here to help!

In the meantime, here are our reader favorites (100% FREE):