CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

It’s time to say goodbye to your old reliable car, but should you sell it privately or trade it in? Both options have their pros and cons, but with the right approach, you can minimize financial losses. Here are 10 tips to help you make the best decision.

If a salesperson asks how much you want for your car, don’t give them a number. Let them make the first offer to avoid limiting your potential trade-in value. If asked, let them know that your primary interest is minimizing your net cost, or trade difference, after an allowance for your trade. Avoid providing any firm numbers, despite their repeated attempts to enquire, as they will be resolute in getting you to throw out the first number.

Trading in your vehicle at the dealership can save you on sales tax. When you trade-in, you subtract the value of your car from the sales price of the new one, and you only pay sales tax on the difference in value. For example, if your trade-in is worth $20,000 and your state has a 5% tax, you could save $1,000 compared to selling it privately.

If you’re just browsing, don’t clean out your car beforehand. A spotless trunk signals you’re ready to buy, potentially weakening your negotiation position.

Dealerships may offer more for your trade-in but mark up the price of the new car. Don’t be fooled by the dealer that simply offers you the highest price for your car, as they may be getting you on the other side. Always look at the total cost.

If selling privately, get the obvious repairs fixed up front, and perform the routine service, like an oil and filter change. If your vehicle needs obvious repairs, private buyers will discount its value by at least 2X of the cost of the repair, as they will be concerned that it can’t be fixed, or that repairs will end up being more costly. Buyers don’t want to inherit a problem; they want a car that they can drive home with confidence, and is trouble-free.

Run a vehicle history report before selling. Surprises on a report could deter buyers or lower your asking price. If you’re the original owner and have never had any problems or accidents, it’s possible to skip this step.

Present your service records and manuals in an organized manner to instill buyer confidence. If you have them, make sure to include the vehicle registration, window sticker and any operating manuals that you received, so that you can present them to any possible buyer.

If your trade-in doesn’t match the dealership’s typical inventory, expect a lower offer. If you are at the BMW dealership, and you’re looking to trade in your 10 year-old Corolla with 120,000 miles, don’t expect a good offer. They won’t want your car, and will sell it straight to a wholesaler. Keep this in mind when thinking about a trade-in.

For safety, meet prospective buyers in public spaces like designated safe meeting zones rather than your home.

If possible, pay off any loans before selling. Having a clean title in hand, goes a long way towards resulting in a seamless transaction, versus having to get a bank involved. Sometimes banks will take weeks to send you a title that is free of liens, and that is enough to sour a lot of car deals. Similarly, make sure that you ask the private buyer how they intend to pay for the car.

Selling or trading your car doesn’t have to be stressful. By fixing minor issues, getting paperwork in order, and strategically timing your sale, you’ll increase your chances of getting a good offer. The more certainty you provide the buyer, the more they’ll be willing to pay. Learn more about resale values with CarEdge Research.

Car buying can be overwhelming, but Deal School is here to help. CarEdge, led by father-son duo Ray and Zach Shefska, has updated the internet’s #1 free car buying course for 2024 and beyond. Designed to empower consumers, Deal School teaches buyers how to navigate the car buying process with confidence, saving money in the process.

👉 Enroll in Deal School for free

Deal School consists of four comprehensive units made up of 22 individual lessons, each designed to prepare you for every step of your car buying journey. Here’s a breakdown of what you’ll learn:

Each unit concludes with a quiz to test your knowledge and ensure you’re ready for real-life negotiations. With CarEdge’s Deal School, the car buying process is not only simplified, but consumers also gain the confidence to negotiate smarter deals, keeping more money in their pockets.

In addition to refreshed lessons with updated information and brand-new recorded lessons with Ray Shefska, Deal School 2024 introduces a free e-book filled with proven strategies to help you get the best deal on your next ride. This e-book is packed with insider knowledge, giving you a major advantage before stepping foot in a dealership. Print it off, take it with you, and shop for your next car with confidence.

CarEdge’s Deal School is the go-to resource for anyone looking to buy a car with confidence. You’ll learn everything from car-buying secrets to mastering the art of negotiation and understanding financing. Once you complete the course, you’ll be ready to secure the best deal on your next vehicle purchase.

👉 Sign up for Deal School today and start saving – It’s FREE!

As Hurricane Milton barrels toward Florida’s Gulf Coast, the automotive industry is bracing for significant losses. Over 122,000 new cars are parked in the storm’s projected path across Central Florida, with landfall expected on October 9th. While residents focus on evacuating, thousands of cars will be left behind to face damaging winds and floodwaters. Here’s a closer look at which automakers and regions will be most affected by Milton, from Tampa Bay to the Space Coast.

In the greater Tampa metro area alone, over 35,000 new cars are for sale, many of which are at serious risk of damage from storm surges predicted to reach up to 12 feet. Considering that about half of Tampa sits lower than 20 feet above sea level, storm surge will pose a major risk to all, not just cars. Local economies will feel the impacts for months to come. When it comes to the car market, Hurricane Milton could throw a wrench in year-end car sales that normally ramp up come November and December.

These are the major car brands with the largest new car inventory in the Tampa area:

These numbers reflect the total new car inventory for a 30-mile radius extending out from St. Petersburg, Florida as of October 7, 2024. Given these numbers, the Tampa area is facing potential losses that could impact local dealerships for months to come. In fact, Florida inventories and sales are so significant that Hurricane Milton could impact some automaker’s bottom lines.

See local car market data with CarEdge Pro

While the overall number of luxury cars in Milton’s path is lower, the percentage of their total U.S. inventory at risk is staggering. Brands like McLaren, Alfa Romeo, and Aston Martin have some of the highest proportions of their national inventory in Florida, making them particularly vulnerable:

With luxury vehicles making up a smaller market share, the impact of losing even a few hundred cars could cause significant disruptions for these high-end brands.

With a one-two punch from hurricanes Helene and Milton, the Southeastern US will be recovering for months to come. With the possibility of thousands of cars totaled from flood damage, the car market in Florida will be most impacted. In the short term, new and used car prices could jump as available inventory shrinks and car dealers look to make up lost profits.

As Florida car shoppers move north in search of undamaged inventory, the demand for new cars in the neighboring states of Georgia, South Carolina, and Alabaman may push prices higher. Unfortunately, recent events have taught us that car dealerships don’t hesitate to add ‘market adjustments’ to MSRPs when demand exceeds supply.

For those outside of the Southeast, it’s unlikely that car prices will be impacted by Milton. However for Floridians, a tough car market is about to get even more challenging.

Florida has long been known as one of the toughest states for car buyers. Uncapped documentation fees that average around $995—three times the national average—already make buying a car in the Sunshine State a costly affair. Florida also tends to have tighter inventory than other states. With the added destruction from Hurricane Milton, car buying could become even more difficult and expensive.

Post-hurricane recovery efforts could see dealerships facing inventory shortages, leading to inflated prices and markups above MSRP. With demand likely to outstrip supply, shoppers may also encounter more aggressive dealer fees in the months ahead. It’s times like these when a cap on dealer fees sure makes sense. Unfortunately, Florida is one of the only states without one.

Hurricane Milton is shaping up to be one of the most devastating storms for Florida’s automotive market. With thousands of new cars in the storm’s path, dealerships and automakers are likely to experience financial strain. If history is any lesson, this will inevitably trickle down to consumers. If you’re considering buying a car in Florida in the near future, prepare for higher prices and limited options as the state recovers from the storm.

For those in immediate need of a vehicle, buying a car out of state may be a better option as local inventory shrinks. As multiple storms hit the Gulf Coast, car buyers will need to cast a wider net to find deals and avoid potential markups.

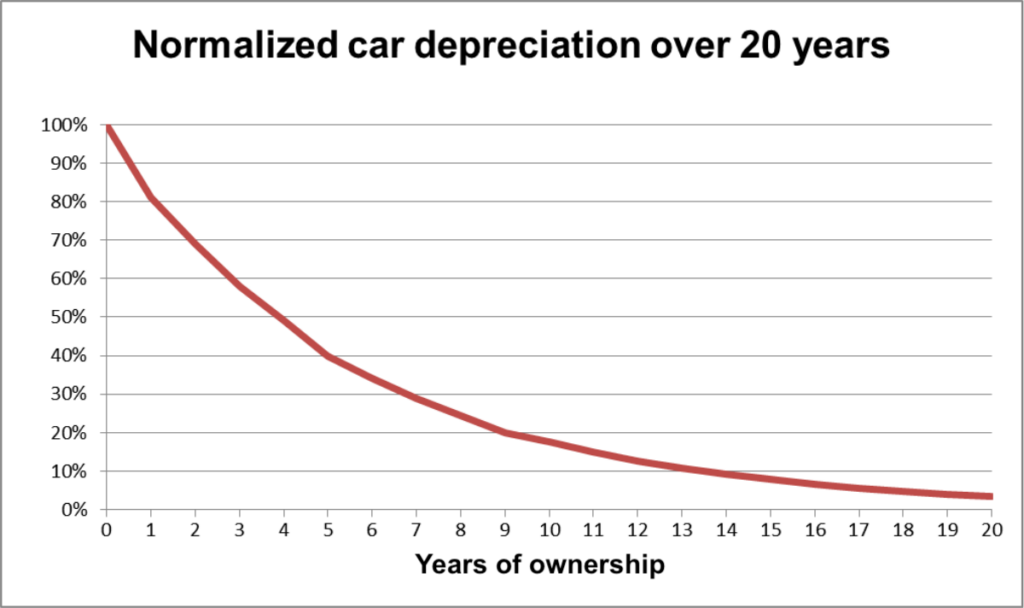

Car depreciation is what makes cars a bad investment—they always lose value over time. If we could sell our cars for what we paid, we’d be collecting them like baseball cards. But the reality is, 99.9% of vehicles lose value, just like rust on an old car.

Cars aren’t investments—they’re tools for transportation. On average, a new car loses 20% of its value in the first year and 40% by year three. Imagine buying a house for $500,000, only for it to drop to $300,000 in value three years later—that’s the same financial hit you take with many new cars. Here’s a closer look at what car buyers should expect with depreciation, and how to avoid the worst of it.

When you buy any new car, depreciation can’t be avoided. On average, new cars will lose around 20% of their value after one year of ownership. After that, they may lose about 15% more per year until the four-year mark.

However, not all cars depreciate equally. As an extreme example, we’ve seen low-mileage luxury cars and EVs lose over 50% of their value over just three years. The good news is that it doesn’t have to be this bad.

The worst depreciation happens in the first few years for a new car. By avoiding a brand-new vehicle and buying one that’s 2-5 years old, you can dodge the steepest drop in value. Let someone else take the loss! When you buy a gently used car, you will lose far less money to depreciation if you decide to sell your car in the future.

When it comes to new car depreciation, the numbers don’t lie. New car depreciation is unavoidable. A new car costing $40,000 can easily lose $16,000 in value over three years, costing the owner over $400 per month in depreciation. But if you buy that same car at three years old for $24,000, you’ll only lose $7,500 in value over the next three years—less than half the depreciation cost.

New 100% FREE car research tools mean that you have more ways than ever to see which cars depreciate the fastest. Check out the free CarEdge Research Hub for up-to-date car depreciation data.

Yes, there’s something special about driving a brand-new car. But unless you really love that new-car smell and pulling off those safety stickers, a slightly used vehicle offers the best bang for your buck. Be smart, shop wisely, and use our tools to find the best value on the market. Use the tools available today with CarEdge’s Research Hub – it’s 100% free data!

One of the most common questions we are often asked is, “When is the best time to buy a car in order to get the best price?” The answer is simple: year-end sales are your best bet. Let’s break down why the end of the year is ideal for negotiating a great car deal.

Dealerships are highly motivated to sell at the end of the month and year. Every day, sales managers review their inventory to identify which cars need to sell quickly. The longer a vehicle sits on the lot, the more it costs the dealer, which increases the likelihood of a discount.

Using CarEdge Pro, you can see how long cars have been sitting on dealer lots, giving you an edge in negotiations. Plus, dealerships push hardest at the end of the month to hit sales goals, offering the best deals during this period.

December 31st is the absolute best day to buy a car. Not only are year-end incentives in full swing, but dealerships are closing their financial books, and some may face inventory taxes on unsold cars. This creates even more pressure to clear inventory and offer deeper discounts.

Can’t wait for December? The last day of each month is also a great time to buy. Sales targets drive dealerships to offer better deals as they aim to hit their numbers. You can still find solid discounts, even if it’s not year-end.

Plan your car purchase for the end of the month for the best deal. To really maximize savings, head to the dealership on New Year’s Eve and be prepared to negotiate. Using CarEdge Pro, you’ll have the information you need to get a great deal before the clock strikes midnight. Rather have a pro negotiate for you? Learn more about CarEdge Concierge.

![Every Zero-Down Lease Deal This Month [October 2024]](https://caredge.com/wp-content/uploads/2024/03/2024-09-16_Cheapest-Leases-This-Month_Blog-Header-Image_1920x1080_v1-1080x675.jpg)

Finally, some good news for car shoppers: October 2024 is packed with zero-down lease deals. As year-end deals approach, manufacturers are rolling out some serious lease incentives to sell remaining inventory before the new year. Right now, it’s totally possible to get into a new car with no money down. Be sure to check back regularly, as automakers update these offers during the first week of each month!

The Best Lease Deal: Lease the 2024 Tacoma SR5 for $449/month with $0 due at signing. It’s very rare to see a best-selling truck lease special with no money down!

See Tacoma lease options, and browse listings near you.

The Best Lease Deal: Lease Toyota’s first EV, the bZ4X crossover, for just $359/month with zero due at lease signing.

See bZ4X lease options, and browse listings near you.

The Best Lease Deal: Returning lessees of any GM vehicle can lease the Encore GX for $333/month for 36 months with $0 due at signing.

See Encore GX lease options, and browse listings near you.

The Best Lease Deal: Returning lessees of any GM vehicle can lease the GMC Terrain for $370/month for 39 months with $0 due at signing.

See Terrain lease options, and browse listings near you.

🚗 See ALL of the best lease offers available this month

These October 2024 lease deals offer an excellent chance to drive away with a new vehicle with zero money down. Whether you’re looking for a truck, an electric SUV, or a traditional crossover, these zero-down leases are hard to beat. And now for even better news: We expect the number of zero-down leases to grow in the months ahead. With 2025 models arriving on dealer lots, year-end sales are set to be huge.

Keep checking back for updates, as more deals are on the horizon.

Buying a rental car can be an affordable way to get a newer vehicle, but it’s important to weigh the pros and cons. Rental cars are often priced lower than those privately owned, making them appealing to budget-conscious buyers. But are the risks worth it? Let’s weigh the pros and cons to find out.

Rental car companies like Hertz offer no-haggle prices on one to three-year old used cars, which can be significantly lower than the true market value. For example, a 2023 Tesla Model 3 could be thousands of dollars cheaper than its resale value. Additionally, rentals are well-maintained, with strict maintenance schedules and frequent cleanings. At least, that’s what’s supposed to happen. As many who have rented a car know, the experience can bring surprises, most notably unpleasant odors. With that said, let’s move on to the reasons why buying a rental car can be a bad idea.

While buying a rental car can save you money, it comes with some downsides. The most significant concern is high mileage. Rental cars often accumulate mileage faster than privately owned vehicles, leading to more wear on components. This is a big part of why rental cars are so affordable.

Additionally, while rental agencies maintain their fleets, cosmetic wear and tear from frequent use are not always addressed. Common signs of wear, like minor scratches or worn interiors, may still be present. Your rental car company should permit you to take the car to an independent mechanic for a pre-purchase inspection. These PPIs typically cost $100-$300, but it could easily identify problems that would cost you thousands of dollars.

Perhaps the most common complaint from those who rent cars is the smell. First, there are the lingering smells of previous drivers. Second, there are the odors that vehicle cleaning leaves behind. It’s not unusual to rent a car that somehow smells of cigarette smoke, even if smoking was never permitted in the vehicle. These odors can be very tough to eliminate.

Rental cars also tend to have limited features and are typically basic models without the higher-end trims or optional upgrades you might find in privately owned vehicles. Lastly, used car resale values may be lower than average, as many buyers shy away from purchasing former rental cars.

With the rise of electric vehicles in rental fleets, buying an electric rental car can be a cost-effective option for those looking to make the switch on a budget. Hertz is selling thousands of EVs after learning that renters are hesitant to give EVs a try on a time-constrained business trip or vacation. After all, charging is time-consuming. However, there are some precautions that every used EV shopper should take, whether buying from a rental car company or elsewhere.

Buying a rental car can be a cost-effective way to get a reliable vehicle, but it’s essential to weigh the pros and cons. High mileage, potential cosmetic wear, and limited features may not matter if your primary goal is affordability and ease of purchase. However, you should always get a vehicle history report and inspect the car carefully. If you’re looking for an affordable car without the frills, a rental car could be a smart choice. For EV shoppers, pay extra attention to battery health and charging history to ensure you’re getting a well-maintained vehicle.

See depreciation data, total cost of ownership, maintenance costs, and so much more at the 100% FREE CarEdge Research Hub.

Buying a car from a private seller can be tempting, especially when the price is right. But private sales come with risks that you need to be aware of before making a deal. Unlike dealerships, private sellers don’t have the same accountability, making it crucial for buyers to do their homework. Here are some important risks to consider when buying a vehicle through a private sale.

While dealerships rely on reputation, private sellers often aren’t as concerned about being 100% truthful. There’s little downside for them to leave out important details about the car’s condition, especially if it means losing money. That’s why it’s essential to approach private sales cautiously and assume the seller might not disclose everything. Always request a vehicle history report to get the facts.

One of the biggest risks when buying from a private seller is the potential for hidden liens on the vehicle. If there’s unpaid work or debts associated with the car, the new owner becomes responsible for them. A vehicle history report should help disclose any liens or outstanding debts, so make sure you check before purchasing. A hidden lien is rare, but a huge pain if it happens.

Private sellers may list their cars for sale after a dealer refuses to accept it as a trade-in, often due to mechanical issues. These problems may not be immediately obvious without professional diagnostic equipment. To protect yourself, always have the car inspected by a trusted mechanic before finalizing the sale. Learn more about Pre-Purchase Inspections.

While vehicle history reports provide valuable insight into a car’s past, they only contain what’s been reported. If an accident wasn’t documented, it won’t show up on the report. To avoid surprises, have a professional pre-purchase inspection check for signs of damage, such as mismatched paint or replaced body panels.

Each state has different safety and emissions standards, and just because a car passes inspection in one state doesn’t mean it will pass in another. Things like window tinting, ground clearance, or other modifications can become costly issues. Make sure the car meets your state’s requirements before making a purchase. If you live in a state with strict inspection criteria, buying a used car, especially an older car, will involve a higher risk of a failed state inspection, and the need for costly repairs.

Unlike dealerships, private sellers aren’t subject to the same regulations and oversight. If something goes wrong after the sale, your options for recourse are limited. Legal action against a private seller can be costly and time-consuming, leaving you with few alternatives if the car turns out to be less than advertised.

If you’re considering buying a car from a private seller, take steps to protect yourself. Obtain a vehicle history report, research expected resale values, and get a mechanic’s inspection. These steps will help ensure that you’re making a smart decision and not getting stuck with a vehicle that could end up costing you more in the long run. But here’s the bottom line: unless you personally know the seller and have a high amount of trust in them, it’s impossible to be 100% certain that you are avoiding the risks mentioned here.

Check out the following video for more information on today’s used car market:

As car prices remain high, many buyers are opting for longer car loans to keep their monthly payments manageable. According to new data from Edmunds, 84-month loans are on the rise. In fact, 84-month car loans have grown from 15.8% of new loans in Q1 2024 to 18.1% in Q3 2024. The average car loan term is now 68.8 months, remaining near all-time highs.

While these extended loan terms might lower monthly payments, they come with serious risks that could impact your finances for years to come. Here’s what you need to know, and how to play it smart when financing your car.

84-month loan terms are becoming popular, but that doesn’t mean they’re a good idea. In fact, far from it. As auto loan rates begin to fall, more car buyers are warming up to the idea of longer loan terms. This is a bad sign of things to come in 2025, unless consumers begin to think-twice about extending auto loans.

Our Q3 2024 CarEdge Negative Equity Report shows that 31% of drivers who financed their vehicle are underwater on their loans. The situation is worse for those with loans longer than 60 months, especially 84-month terms, which lead to slower equity growth and higher chances of negative equity. Among the survey respondents with 84-month loan terms, an astounding 71% are underwater. Clearly, longer loan terms increase the likelihood of negative equity for car owners.

One of the main reasons for this is depreciation. With long loan terms, cars lose value faster than the loan is paid off, leaving borrowers owing more than their vehicle is worth. With a longer loan, the gap between loan balance and vehicle value grows wider, putting drivers in a financially vulnerable position.

Why You Should Avoid 84-Month Loans:

Smart Car Buying Tips:

While the allure of lower monthly payments with an 84-month loan can be tempting, the long-term risks far outweigh the benefits. Negative equity, higher interest costs, and lack of financial flexibility are all too common with extended loan terms. To protect your financial future, it’s smart to opt for shorter loan terms, build equity faster, and avoid stretching your budget just to secure a lower payment.

For more in-depth information on auto depreciation, maintenance costs, and total cost of ownership for hundreds of models, visit the CarEdge Research Hub. It’s 100% free!

Fall is underway, and better truck deals are here. With 2025 models arriving daily and dealers eager to sell remaining 2024 inventory, it’s a great time for negotiating, or letting us do it for you. Here’s our guide to the top truck deals of October 2024, featuring low APR financing, cash offers, and lease deals.

Automakers release their deals between the first and fifth of each month, so check back soon for the latest.

Starting MSRP: $40,350+

Negotiability Score: Very High (141 days of market supply)

0% APR financing for 60 months

Nissan is fighting hard for truck market share in the U.S., with limited success. Today’s zero percent financing offer is the best truck deal today at 60 months. This offer expires on 11/02/2024.

See Nissan Titan listings with local market data

Starting MSRP: $36,820+

Negotiability Score: High (181 days of market supply)

2024 Ram 1500 and 2024 Ram 1500 Classic: 0.9% APR for 72 months

Ram trucks are slow-selling, even though they seem to be everywhere you look on the road. To alleviate Ram’s oversupply of trucks, they’re offering huge financing offers this month. This offer expires on 11/02/2024.

See Ram 1500 listings with local market data

Starting MSRP: $51,900+

Negotiability Score: High (117 days of market supply)

0% APR for 36 months

GM is offering big incentives on both the Sierra 1500 and Silverado 1500 this month. This offer expires on 11/02/2024.

See GMC Sierra 1500 listings with local market data

Starting MSRP: $48,645+

Negotiability Score: High (112 days of market supply)

0% APR for 36 months + NO payments for 90 days, or lease for $409/month for 36 months with $4,949 due

With 112 days of market supply, there’s an abundance of 2024 Silverado 1500s on Chevy dealer lots. These APR and lease offers are great deals for truck fans. This offer expires on 11/02/2024.

See Chevrolet Silverado 1500 listings with local market data

Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing the smart way, it’s all available for instant download. Ready to let a car buying pro take the wheel? CarEdge Concierge is the easiest way to buy a car today. Our team finds the vehicle you want, right down to the finest of details, and negotiates on your behalf. Home delivery is available. Learn more about CarEdge’s car buying service.