CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

In a move that has stunned consumer advocates, the California Senate just passed a bill that would dramatically increase the fees car dealers can charge buyers. This comes even as lawmakers publicly pledge to address affordability in the state. Senate Bill 791 shows that many California lawmakers have other intentions.

On June 3, 2025, Senate Bill 791 passed with overwhelming bipartisan support. This bill would allow California car dealers to charge up to $500 in documentation fees, up from the current cap of $85. That’s a 500% to 600% increase in car buying fees, depending on the vehicle’s price. The bill still must pass the Assembly before heading to Governor Newsom’s desk.

“This is the opposite of saving money for people,” Rosemary Shahan, president of Consumers for Auto Reliability and Safety, told CalMatters. “It’s just benefiting car dealers at the expense of car buyers.”

Supporters of the bill, including the California New Car Dealers Association, argue that inflation and new state regulations have made it more expensive to process transactions, including loan paperwork and DMV registration. They say the $85 cap hasn’t kept up with reality.

But opponents are calling it a “junk fee”, one that will quietly increase the cost of buying a car without improving the vehicle or experience for the customer.

“It’s amazing how lobbyist’s dollars can influence politicians to vote against their constituents’ best interests, ” said Ray Shefska, CarEdge Co-Founder and 43-year auto industry veteran. “This bill reinforces that in America, whether it be national, state or local, we have the best politicians money can buy. When things are already barely affordable, let’s by all means make it even more difficult for people buying cars in California.”

See which car buying fees are legit, and which should be negotiated.

Despite growing political attention on “junk fees” in everything from travel to event tickets, only one state senator voted against the bill: Sen. Henry Stern (D-Calabasas). He called out what he sees as a pattern of bad behavior from auto dealers, and said they “haven’t earned the trust to justify this major increase.”

Other lawmakers who voted in favor of the bill include:

According to Digital Democracy, the California New Car Dealers Association has donated nearly $3 million to lawmakers since 2015, including $28,700 to Senator Jones, and $13,000 to Senator McGuire.

One Republican senator, Roger Niello, recused himself from voting altogether due to his family’s involvement in car dealerships.

Notably, the bill exempts state government vehicle purchases from paying the fee, even as everyday Californians would be required to pay it in full.

The bill now moves to the California Assembly, where lawmakers are expected to negotiate its final terms. Cortese has hinted that the $500 cap may be reduced to win Governor Newsom’s support.

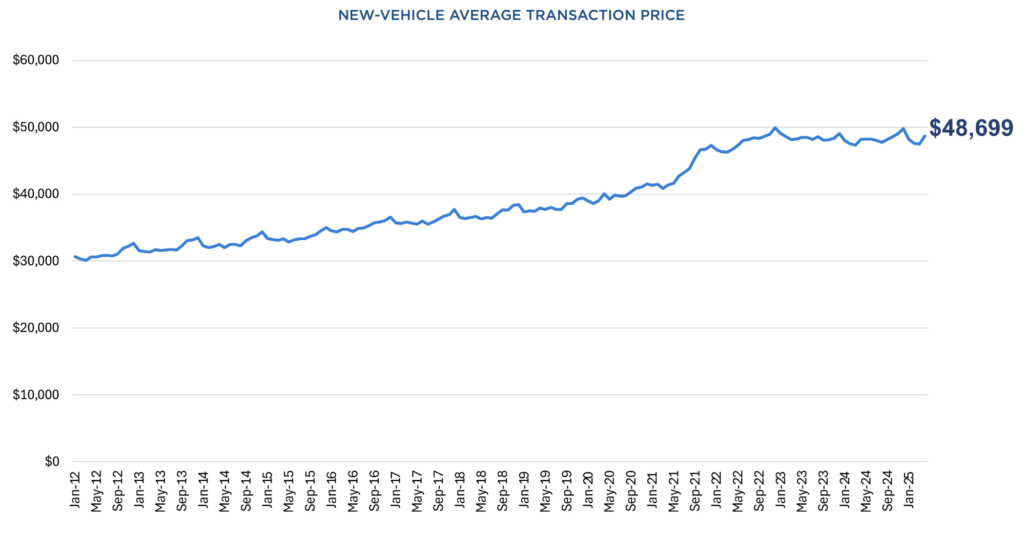

Still, with the average new car now costing $48,699, a 1% documentation fee could mean hundreds in extra charges for buyers already navigating record-high prices, interest rates, and tariffs.

At CarEdge, we believe buyers should know exactly what they’re paying for — and why. Hidden fees like this make it harder for consumers to make informed decisions and harder still to afford the car they need.

If you believe car buyers deserve transparency — not hidden fees — contact your California Assembly representative today and urge them to vote NO on Senate Bill 791. Tell lawmakers that affordability means protecting consumers, not padding dealership profits.

Find Your Representative and Take Action Now

Your voice matters. Let Sacramento know: No more junk fees.

Don’t go it alone in today’s murky car market. Learn how you can save more and buy confidently with CarEdge’s free tools.

![These Fourth of July Car Deals Are Already Live [2025]](https://caredge.com/wp-content/uploads/2025/06/2025-Ford-F-150-Tremor-1080x675.jpg)

Time sure flies, doesn’t it? The Fourth of July is just around the corner, and several automakers aren’t wasting any time rolling out their big summer sales. All of the deals below are officially available through July 7, 2025, but keep in mind: the rest of the industry is likely to wait until July 1 to drop their July 4th incentives. Check back each week as more sales roll in!

Honda is coming out strong this summer with low APR and competitive lease offers across its most popular models — including the all-new Prologue EV.

Compare Honda deals with local market insights, or see offer details.

Ford is continuing its Employee Pricing for All promotion through July 7, 2025. While it sounds appealing, the reality is more nuanced, as we explored in our guide to employee pricing. That said, one deal is worth noting, mostly since the F-150 is so popular:

Truck fans, be sure to check out the best truck deals from competitors this month. More deals could drop closer to the holiday weekend, so stay tuned.

Compare Ford deals with local market insights, or see offer details.

Hyundai is offering well-rounded incentives across its gas, hybrid, and electric lineup — including the first-ever 2026 IONIQ 9, a 3-row EV SUV.

Compare Hyundai deals with local market insights, or see offer details.

Nissan just announced 0% financing offers for two popular SUVs: the Rogue and Pathfinder. The 2025 Pathfinder is an especially great deal for families in search of three rows.

Compare Nissan deals with local market insights, or see offer details.

Kia is leaning into low-APR financing and EV incentives for the summer season.

Compare Kia deals with local market insights, or see offer details.

Genesis has some of the best luxury car incentives in June, and these offers last through Fourth of July weekend.

Compare Genesis deals with local market insights, or see offer details.

These are just the early birds. Most automakers are likely to unveil their Fourth of July incentives closer to the start of the new month. With auto loan rates remaining around 10% APR for new cars (and even higher for used cars), you can’t argue with the financing deals were already seeing. Leasing is looking like an increasingly great option, too.

Keep this page bookmarked — we’ll update it regularly as new Fourth of July car deals roll out.

Need help negotiating? CarEdge Concierge can help you get the best price — without the hassle.

Head over to our Best Deals Hub for the rest of this month’s standout offers.

A major milestone is fast approaching in the auto market: the average new car selling price is about to surpass $50,000 for the first time. After years of rising MSRPs, stubbornly high interest rates, and climbing insurance costs, drivers are feeling the pressure from every angle. However, there are still ways to find value if you know where to look. Here’s why industry experts are confident that new car prices will reach this unfortunate milestone in 2025, and what car buyers can do to still come out on top.

According to the latest data from Cox Automotive, the average new car transaction price currently sits at $48,699, just shy of the December 2022 peak of $49,929. Car price inflation has been unstoppable since the COVID-19 pandemic. While prices cooled slightly at times in 2023 and 2024, two key developments are pushing them back up again:

1. 2026 model year pricing is arriving, and most prices are marching higher.

2. Tariffs on imported vehicles are beginning to trickle into pricing. Even American-made cars are being hit as global supply chains prove tough to adapt to the new trade landscape. In response, automakers like Subaru and Ford have already announced mid-year price hikes. We could see more sneaky price increases from other brands this summer.

It’s important to remember: the $50,000 figure is just an average. There are still dozens of new cars for sale under $30,000 in 2025, though the number is shrinking. The last new car under $20,000, the Nissan Versa, is being discontinued after this year. If you’re shopping with a tighter budget, check out our list of new cars under $25,000 in 2025.

Not all cars are getting more expensive in 2025. In fact, a few are seeing price cuts. Let’s take a look at where there’s wiggle room, and where prices continue to rise.

Prices aren’t rising evenly across the market. In fact, some of the biggest increases are hitting the most budget-conscious buyers.

Prices are rising fastest for these cars:

These cars are holding steady (for now):

If you’re buying a car this summer, all hope is not lost. With inventory rising for certain brands and models, some cars and trucks are more negotiable than others. Our data tools make it easy to spot where the deals are. Check out CarEdge Pro to see how you can find the most negotiable new and used cars in your area. Ready for pros to take the wheel? Let us negotiate on your behalf to help you save thousands.

“This isn’t the time to walk into a dealership unprepared,” says Ray Shefska, Co-Founder of CarEdge. “Car prices are high, interest rates are brutal, and insurance isn’t letting up. But there are deals to be had if you know where to look — and how to negotiate. That’s what we help people do every day.”

It’s also important to remember that price is just one part of the equation. New car loan rates remain near 30-year highs, averaging around 9% APR, while used car loans hover around 14% APR. On top of that, auto insurance rates jumped 15% in 2024 and are still climbing. That’s why it’s essential to factor in the total cost of ownership, not just the sticker price. Use our free CarEdge cost of ownership tools to get the full picture before you buy.

We’ll be watching the market closely this summer and will keep you posted as prices continue to evolve. Hopefully we’re wrong, but all signs point to the $50,000 average becoming the new normal sometime in 2025.

From 0% financing to zero-down leases, June 2025 is shaping up to be a surprisingly strong month for new car deals. Despite pressure from tariffs and the arrival of fresh 2026 models, these automakers are stepping up to lure in buyers. In fact, a few early Fourth of July promotions are already live.

Let’s dive into this month’s top offers.

0% APR for 60 months plus $1,750 bonus cash

Nissan’s Summer Sales Event is finally delivering the goods. In addition to 0% APR, buyers can opt for 1.9% APR for 72 months — still a fantastic offer.

Looking to lease? Nissan is advertising $299/month for 39 months with $4,329 due for the Rogue Platinum AWD.

👉 See local Nissan Rogue listings with pricing insights

0% APR for 60 months plus $1,000 bonus cash

This is one of the best deals available on a three-row SUV this month. Like the Rogue, Nissan’s 1.9% APR for 72 months is also available if you need a longer term.

👉 See local Nissan Pathfinder listings with pricing insights

0% APR for 72 months

With seating for up to eight and the efficiency of a plug-in hybrid, this is a family-focused minivan deal. Chrysler is also offering a lease at $499/month for 36 months with $4,449 due at signing. Don’t expect incentives like this on a minivan from Toyota or Honda!

👉 See local Chrysler Pacifica listings with pricing insights

0% APR for 60 months

Chevy still has around 200 of the outgoing 2024 Tahoes to move. With 0% APR financing, this is a rare opportunity to score a deal on one of America’s most popular full-size SUVs.

👉 See local Chevrolet Tahoe listings with pricing insights

Zero-down lease deal

GM is offering current lessees of 2020+ models a $297/month lease with $0 down, $0 first month, and $0 security deposit. Others can still get in with $2,250 due at signing. This is one of just two true zero-down lease deals this month.

👉 See local Buick Encore GX listings with pricing insights

0% APR financing for 60 months, or lease the Model 3 for 24 months with $0-down and $349/month.

Just a few years ago, we’d never expect to see a Tesla with 0% financing or zero-down leases. But in June 2025, this Model 3 deal is one of the best in the EV segment, especially considering Tesla’s low maintenance costs and premium tech.

👉 Configure your Tesla Model 3, or see used Model 3 listings near you

1.9% APR for 72 months

No tricks here! Stellantis is offering 1.9% APR regardless of down payment, so buyers with solid credit can finance this full-size truck for less. Truck deals like this are usually only for last year’s model, but not this time.

👉 See local Ram 1500 listings with pricing insights

1.9% APR for 72 months

While Jeep is pushing employee pricing, the 1.9% APR financing will save more for most buyers. This hybrid SUV has plenty of inventory, so deals should be negotiable.

👉 See local Jeep Grand Cherokee 4xe listings with pricing insights

2.99% APR for 60 months, or lease from $249/month for 36 months with $3,699 due.

A sub-3% interest rate is rare for Honda, especially on the Accord. This midsize sedan offers exceptional value, reliability, and low total cost of ownership.

👉 See local Honda Accord listings with pricing insights

$6,500 cash back with trade-in or lease from $429/month with $3,369 due

Truck shoppers take note: Chevy’s cash back offer equals nearly 10% off MSRP, and the lease is highly competitive. Compared to Ford’s employee pricing deals, the Silverado is clearly the better value in June.

👉 See local Chevrolet Silverado 1500 listings with pricing insights

From 0% APR on SUVs to rare zero-down lease offers, June 2025 presents a golden opportunity for summer buyers and lessees prepared to act quickly. With fresh 2026 pricing arriving and tariffs adding uncertainty, we don’t expect these deals to last beyond the Fourth of July.

Want expert help navigating these deals?

Get the insider pricing, expert negotiation, and peace of mind you deserve.

👉 Have experts negotiate your car deal

👉 Prefer DIY negotiation? Use CarEdge Pro to know what to pay

Each week, CarEdge rounds up the latest mainstream vehicle recalls so you don’t have to dig through the fine print. All recall data is sourced directly from the National Highway Traffic Safety Administration (NHTSA).

If you’re not sure whether your car has an open recall, check right now using the NHTSA recall lookup tool — all you need is your VIN.

Issue: The center information display may go blank when shifting into reverse, violating FMVSS 111 on rear visibility.

Remedy: Nissan dealers will update the display software free of charge. Owner notification letters are expected to be mailed by July 1, 2025.

See if your Nissan is included in this recall.

Issue: A software issue may impact the dashboard infotainment system and rear camera function.

Remedy: Dealers will push out an over-the-air software update. Ford will begin mailing safety notifications by June 16, 2025, with a second letter to follow when the fix is ready.

See if your Ford or Lincoln vehicle is included in this recall.

Issue: Moisture can enter the reverse light assembly and cause light failure.

Remedy: Dealers will replace both reverse light assemblies and repair wiring as needed, free of charge. Notification letters will be mailed starting June 30, 2025. For more help, contact Toyota at 1-800-331-4331.

See if your Toyota Tundra is included in this recall.

Issue: A software bug may distort the rearview camera image when reversing, failing FMVSS 111 standards.

Remedy: Dealers will update the camera software at no cost. Letters to owners will begin mailing July 18, 2025. VW customer service can be reached at 1-800-893-5298.

Check if your Atlas or Atlas Cross Sport is impacted by this recall.

Even a minor recall can impact your safety. Always check your vehicle’s recall status by entering your VIN at the NHTSA Recall Lookup. If you’re car shopping, don’t forget that CarEdge Car Search shows you open recalls before you buy, so you can make an informed decision.

Check out car listings with recall information, local market insights, and more →