CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

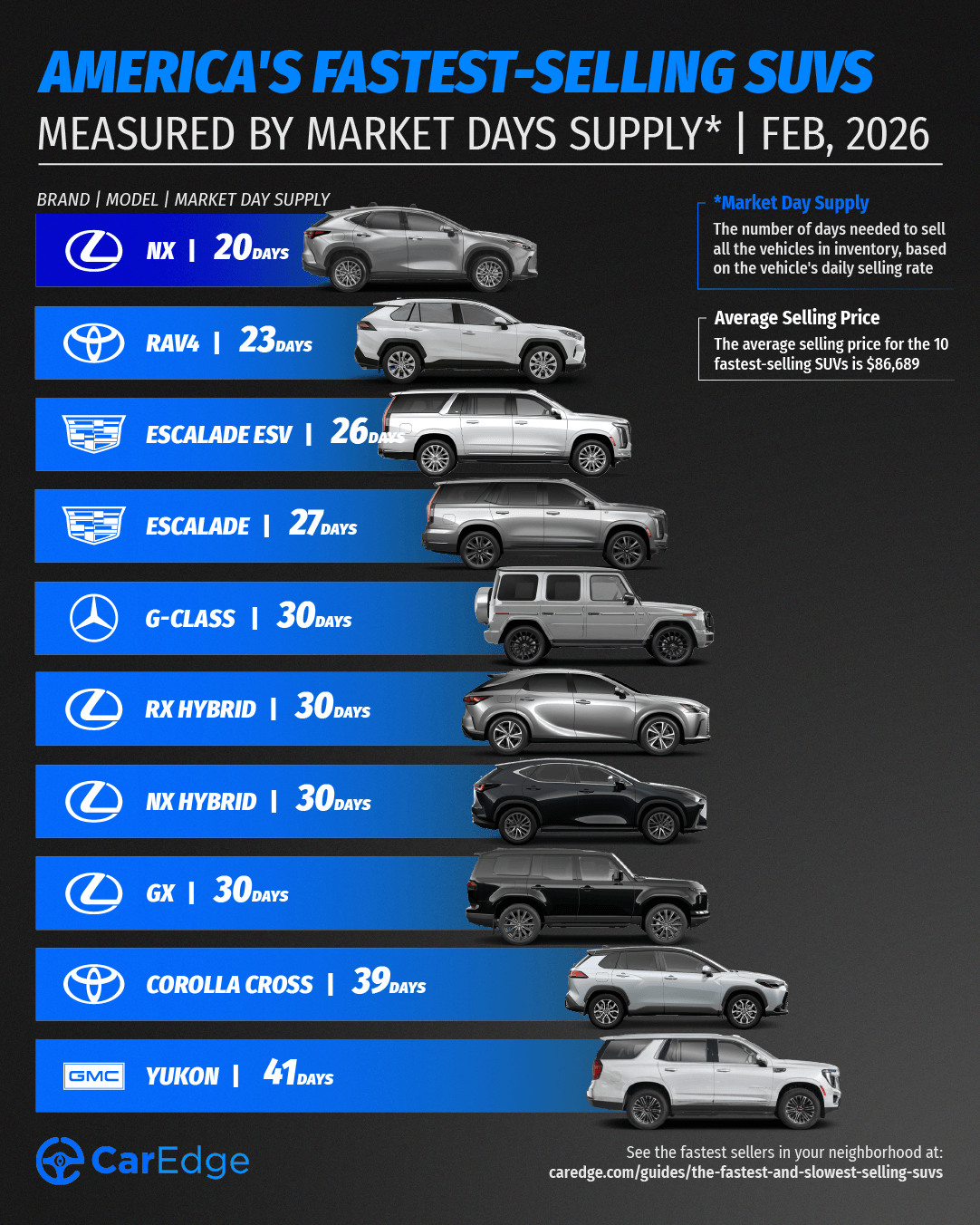

In 2026, some SUVs and crossovers are being scooped up as soon as they hit the lot, while others are sitting unsold for more than a year on average. Whether you’re a buyer looking for a deal or a seller trying to time the market, understanding which SUVs are moving (or not) is essential.

We analyzed February car market data to find the SUVs with the lowest and highest market day supply (MDS). MDS is a measure of how many days it would take to sell through current inventory at the current sales pace. Here are the winners and losers in 2026’s SUV market.

These are the fastest-selling SUVs and crossovers this month. These models have the lowest market day supply, which means they’re in high demand, and are likely harder to negotiate on due to limited availability.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Lexus | NX | 20 | 1,618 | 3,650 | $51,503 |

| Toyota | RAV4 | 23 | 23,903 | 46,640 | $37,389 |

| Cadillac | Escalade ESV | 26 | 994 | 1,695 | $127,407 |

| Cadillac | Escalade | 27 | 1,795 | 3,026 | $125,746 |

| Mercedes-Benz | G-Class | 30 | 937 | 1,417 | $204,981 |

| Lexus | RX Hybrid | 30 | 4,914 | 7,420 | $64,374 |

| Lexus | NX Hybrid | 30 | 2,511 | 3,796 | $54,465 |

| Lexus | GX | 30 | 2,378 | 3,593 | $80,947 |

| Toyota | Corolla Cross | 39 | 16,797 | 19,195 | $31,709 |

| GMC | Yukon | 41 | 4,643 | 5,139 | $88,369 |

Source: CarEdge Pro

Besides the surprise visit of four GM models on the list, February is yet another month dominated by Toyota and Lexus. The 2026 Lexus NX is the fastest-selling SUV right now, with inventory sitting on the lot for just 20 days on average. The newly-redesigned RAV4 is close behind. Cadillac’s Escalade and larger Escalade ESV are also quick sellers, marking a bright spot for otherwise slow-selling GM models.

What does it all mean? If you plan to buy or lease any of the above SUVs, especially those from Toyota and Lexus, expect to have less negotiating power than if you were to shop one of the slower-selling cars on the market. That doesn’t justify paying for dealer markups or unwanted add-ons. Stay away from those traps. But for these fast-selling SUVs and crossovers, paying MSRP would be a fair deal in 2026’s SUV market.

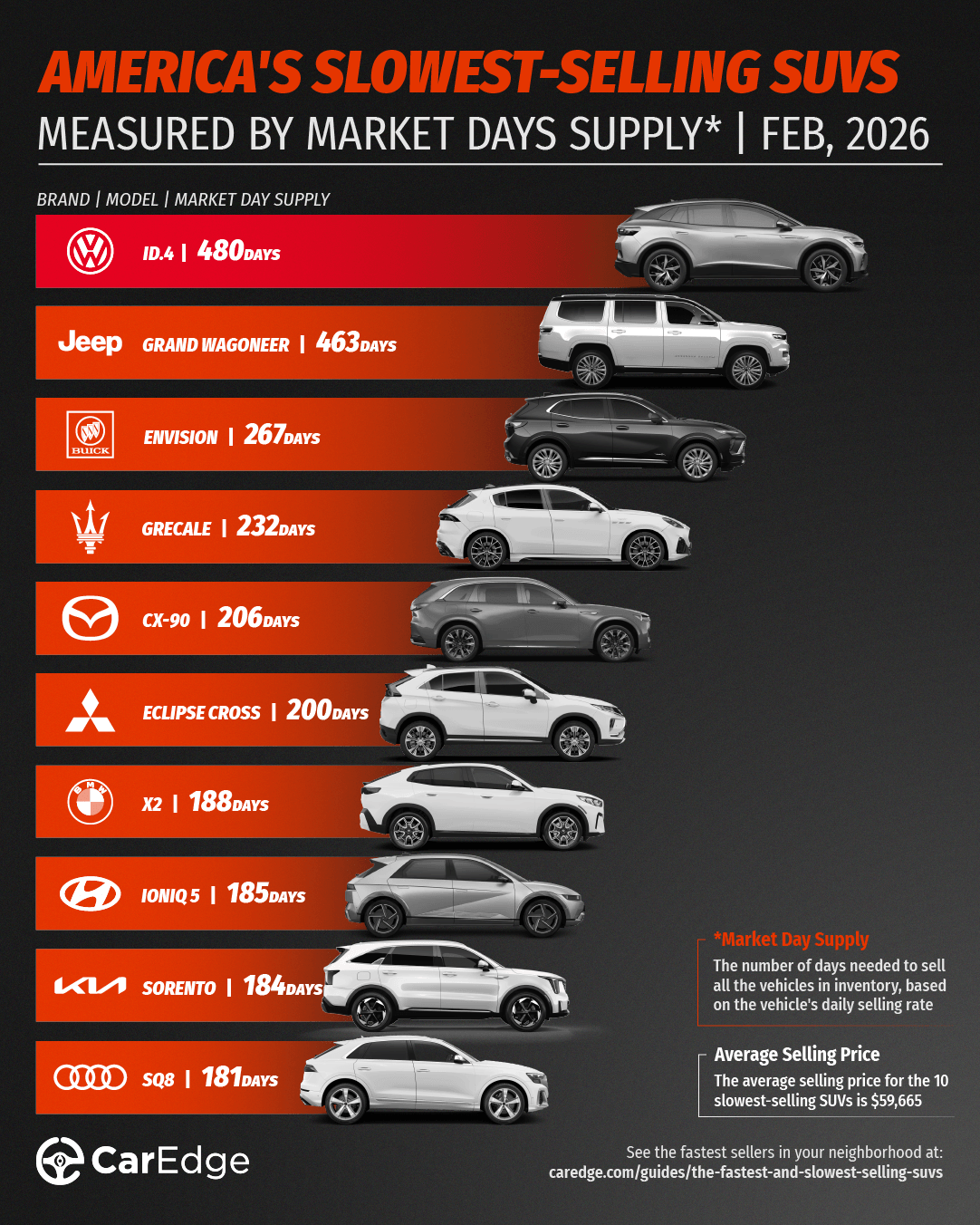

These SUVs have the highest market day supply, which means they’re sitting unsold for longer. Buyers may be able to score better deals on these slowest-selling SUVs in February, especially with this AI negotiator doing the work for you.

| Make | Model | Market Day Supply | Total For Sale | 45-Day Sales | Average Selling Price |

|---|---|---|---|---|---|

| Volkswagen | ID.4 | 480 | 1,482 | 139 | $49,534 |

| Jeep | Grand Wagoneer | 463 | 4,510 | 438 | $85,252 |

| Buick | Envision | 267 | 11,337 | 1,910 | $40,994 |

| Maserati | Grecale | 232 | 583 | 113 | $85,649 |

| Mazda | CX-90 | 206 | 15,991 | 3,486 | $48,214 |

| Mitsubishi | Eclipse Cross | 200 | 2,658 | 597 | $30,111 |

| BMW | X2 | 188 | 1,392 | 333 | $52,698 |

| Hyundai | IONIQ 5 | 185 | 10,276 | 2,506 | $45,901 |

| Kia | Sorento | 184 | 36,137 | 8,845 | $40,047 |

| Audi | SQ8 | 181 | 518 | 129 | $118,251 |

Source: CarEdge Pro

With the federal EV tax credit now over, the Volkswagen ID.4 is at the top of the list for the second month in a row, with well over one year of supply. The IONIQ 5, one of the fastest-charging EVs on the market, is also taking half a year to sell. Several of the others fall into the luxury segment. With recent inflation and persistently high interest rates, buyers are thinking twice about buying luxury vehicles.

Just two Stellantis models are in the bottom 10 this month. That’s a big improvement after dominating the slowest-sellers last year. However, Jeep’s Grand Wagoneer is still in second place. It has been a slow-selling model for most of the past year, despite seeing major price cuts several months ago.

For any of these slow-selling SUVs, prices will be more flexible if you come equipped with negotiation know-how.

If you’re looking for a deal, start with the slowest sellers this month. High inventory levels mean dealers are likely motivated to talk pricing if you negotiate with confidence. It’s always best to take a look at the best incentives of the month, too.

“If you’re shopping for a slow-selling SUV, the ball is in your court,” says auto industry veteran Ray Shefska. “Dealers know those vehicles aren’t moving, and that gives you the upper hand in price negotiations.”

Shopping Toyota, Honda, or Lexus? Expect tighter inventory and less room for negotiation. You may need to move quickly if you find the right trim. However, this is no reason to pay for unwanted add-ons or dealer markups!

With CarEdge Concierge, our experts do the legwork for you, from researching inventory to negotiating with dealers. Already know what you want? Use our AI Negotiation Expert service and have CarEdge AI negotiate with car dealers anonymously!

Explore more free tools and resources with car buying guides, cost of ownership comparisons, and downloadable cheat sheets. There’s no reason to shop unprepared in 2026.

CarEdge is a trusted resource for car buyers, offering data-backed insights, negotiation tools, and expert guidance to help consumers save time and money. Since 2019, CarEdge has helped hundreds of thousands of drivers navigate the car-buying process with confidence. Learn how to buy a car the easy way at CarEdge.com.

Trading in your car doesn’t have to mean leaving money on the table. With the right preparation and knowledge, you can get the best trade-in value and walk into the dealership with confidence. The key is treating your trade-in as what it really is: a separate transaction that deserves your full attention.

Too many car buyers let dealers bundle their trade-in into the new car purchase, which makes it nearly impossible to know if you’re getting a fair deal on either transaction. This CarEdge guide will show you the smart way to approach your trade-in.

Before you even think about walking into a dealership, do your homework.

Check online valuation tools: Use Kelley Blue Book (KBB), Edmunds, and online buyers like CarMax and Carvana to get an estimated value for your car. This gives you a range of what you might expect.

Check local listings: See what similar cars in your area are selling for. Be sure to compare make/model, mileage, condition, year, and location (local market influences price). See local listings with Car Search.

Get multiple appraisals: Take your car to different dealerships and get online offers. More options = better deal.

Having your paperwork in order makes the process smoother and shows you’re serious about the trade-in.

Title: If you own the car outright, bring the title. If you still owe, bring the payoff statement from your lender.

Registration: Ensure the car is registered and that you have the up-to-date documents.

Insurance: Show proof of insurance to prove the car has been properly maintained.

Maintenance records: If you’ve kept up with regular maintenance (oil changes, brakes, etc.), having these documents can increase the value. For cars routinely serviced at a dealership, these records may already be available online.

Any accessories or extra parts: Include anything you’ve added (new tires, roof racks, custom wheels, etc.).

Loan payoff balance: If there’s still a loan balance, bring the details about what’s left to pay off. You have two options if you still owe money on the car: (1) Pay off the remaining balance directly, or (2) Roll the negative equity into your next car loan (though this will increase your payments, often by a lot).

First impressions count, and a well-maintained vehicle often gets a higher offer.

Exterior: Wash the car. This makes it easy to see the condition of the exterior.

Interior: Clean out trash, vacuum the floors, and wipe down surfaces.

Odor: Neutralize any lingering smells (smoke, pets, etc.) with air fresheners or fabric sprays.

Tires: If they’re worn, don’t worry: it’s not worth it to replace your tires before trading in. You’d be unlikely to receive the value of new tires in added trade-in value. Why? Many trade-ins are sent to dealership auctions, where they are sold to the highest bidder.

Engine bay: Clean it (just don’t use anything too harsh). A clean engine bay makes the car look well-maintained. Here’s a quick guide.

Take care of minor repairs that might be turning off buyers.

Address safety issues: Make sure things like brakes, lights, and other critical systems work properly.

Mechanical problems: If the car has engine, transmission, or suspension issues, it may be worth fixing small things that can raise the car’s value.

Check fluid levels: Top off the oil, coolant, brake fluid, and transmission fluid—this shows the car’s been taken care of. Even the windshield washing fluid should be checked.

Before walking in, know your car’s trade-in value and be prepared to negotiate. Have your offers from online buyers written down on paper, or better yet, printed out for leverage at the dealership.

Have a firm minimum in mind: Know what bottom price you’re willing to accept. This should be based on the online offers you will have received, and the KBB or Edmunds value. Having a minimum in mind will help you avoid emotional or hasty decisions.

Know what similar cars are selling for in the area: The dealer will want some room for profit, but you can still use nearby listings to show that you know what your car is worth.

Bring printed online offers and valuation estimates: Show the dealer that you’ve done your homework.

Be ready to walk away: Don’t let the first offer sway you. If they lowball, you can take it elsewhere.

When the dealer makes an offer, get it in writing so that you have a reference point.

If they try to adjust or lower the price, you’ll have the original offer to fall back on. Getting offers in writing can also serve as a tool for negotiating with other dealers.

Remember, the number one rule of trading in your car is to always treat your trade-in as a separate transaction. Don’t let the dealer tie your trade-in value to your purchase of a new car. That’s a recipe for getting a lowball offer.

Following this checklist will put you in a strong position to get top dollar for your trade-in. But what if you could let the experts handle it? CarEdge’s car buying service doesn’t just help you maximize your trade-in value—we negotiate your entire deal from start to finish.

Your personal CarEdge Concierge negotiates with dealers on your behalf to ensure you’re getting the best possible price on your new vehicle while getting you the most for your trade-in.

We keep these transactions separate (just like you should), and we have the market data and dealer relationships to get you a deal you can feel confident about.

Ready to make your trade-in easy? Let CarEdge do the negotiating for you.

After seven consecutive years of declining U.S. sales, Stellantis is asking the impossible of its dealer network: sell 25% more vehicles in 2026. The ambitious target comes at a time when the automaker’s brands dominate the wrong kinds of headlines, from the slowest-selling cars in America to the bottom of the reliability rankings.

At the recent NADA Show, Stellantis executives announced they’re targeting retail sales of 1.15 million vehicles this year, according to Automotive News. In a flat or slightly declining market, hitting that 25% gain means clawing back serious market share from competitors. Retail sales chief Jeff Kommor told Automotive News that the company just wants to get back to where it was three years ago, before former CEO Carlos Tavares drove it into the ground. Tavares left just over a year ago.

But here’s the problem: Stellantis vehicles aren’t moving off dealer lots.

According to CarEdge data, Stellantis brands like Jeep, Dodge, Maserati, and Alfa Romeo have taken at least three of the ten spots in the slowest-selling cars rankings for eight months straight. In February, the Jeep Grand Wagoneer sits in second place with 463 days of market supply. Only the Volkswagen ID.4 has more inventory sitting around. The Dodge Charger and Maserati Grecale also made the list.

This puts dealers in an impossible spot. As Sean Hogan, chairman of the Stellantis National Dealer Council, told Automotive News, if the “customer doesn’t passionately love your product, it’s not going to sell.” That’s a product problem, not a dealer problem.

So what happened? Why did customers stop buying Jeeps and Dodges?

Reliability is a huge issue. Consumer Reports ranks Jeep dead last in reliability out of 31 brands. Dead last. Dodge, Alfa Romeo, and Chrysler all sit in the bottom quartile too. When buyers can’t trust a vehicle to stay out of the shop, they go somewhere else.

Then there’s pricing. The Ram 1500 Laramie now starts at $63,625 with destination fees. That’s up 45% from $43,675 just five years ago. The Ram 1500 Limited has jumped 30% since 2021 alone. The Jeep Grand Wagoneer, America’s second-slowest selling vehicle, averages $85,200. Who would’ve guessed a decade ago that a Jeep would cost $85,000?

The lineup just isn’t what it used to be. Stellantis killed off most of the V8s and Hemi engines that made Dodge and Ram famous. Yes, there are rumors they’re coming back, but the damage is done. The electric Dodge Charger bombed so badly it basically turned the 2023 gas Charger and Challenger into instant classics.

Stellantis is trying. New CEO Antonio Filosa wants to repair dealer relationships, and there’s a product refresh coming. Examples include the redesigned Jeep Cherokee and gas-powered Dodge Charger Sixpack. They’ve bumped up advertising money for dealers, too, raising local contributions from $250 to $400, according to Automotive News.

But new ads and a couple fresh models won’t fix reliability problems, sky-high prices, and damaged brand reputation overnight. Kommor says dealers are “equipped to make that happen,” noting that 1.15 million is less than what they sold from 2019-2022. True, but those years had different products with more affordable prices.

Stellantis dealers have some challenges ahead. They know you can’t get a 25% sales increase when your inventory sits for over a year without selling. Until corporate fixes the actual product and pricing problems, it will be tough for dealer efforts alone to close that gap.

A prominent venture capitalist believes we’ll see Chinese automakers announce their U.S. market entry this year. Steve Greenfield, general partner at Automotive Ventures, says the most likely path involves partnerships with existing American automakers through joint ventures. With the current tariff and policy environment are certain headwinds, automakers could decide that the benefits to their businesses outweigh the challenges.

These collaborations could benefit both sides: Chinese manufacturers get access to the lucrative U.S. market, while legacy automakers gain critical insights into how their competitors are building vehicles faster and cheaper than anyone else.

Here’s why at least one financial figurehead thinks it’s just around the corner, and which Western automakers could have an appetite for such a move.

Speaking at the American Financial Services Association Vehicle Finance Conference, Greenfield laid out a scenario where Chinese brands partner with U.S. automakers to build cars domestically with American workers. The real prize? Access to Chinese manufacturing insights.

“As the Chinese did to us 20 years ago over in China, we need to figure out how they’re building cars faster and cheaper,” Greenfield told Automotive News. If legacy automakers can learn these techniques through partnerships, “they’re actually going to be more healthy as a result.” Greenfield’s comments were first reported in Automotive News.

The stakes are high. Chinese automakers have already captured significant global market share, and Greenfield warned that struggling legacy brands face a real threat. For manufacturers that can’t compete, the Chinese auto industry “is going to drive bankruptcies,” he said. “The weakest will die.”

China’s automotive industry has a fundamental advantage: they built their entire sector from scratch using modern techniques learned from global partners. The result? Vehicles that are “dramatically better” at their price points, according to Greenfield.

And with the promise of quality cars under $20,000, Chinese manufacturers could solve America’s affordability crisis—assuming they can navigate tariffs and find the right partners to enter the market.

Which legacy automakers are most likely to partner with a Chinese automaker as soon as this year to bring a new, mass-market, affordable car to the U.S.? At this point, we can only speculate. But we do have some clues.

In 2024, Ford CEO Jim Farley’s daily driver was a Xiaomi SU7, a car he openly admitted he “didn’t want to give up.” Why did he drive a Chinese car for six months? It’s common for automakers to sample their competition, but could it have been the start of something more?

Here’s why that’s unlikely: Farley himself has become a close ally of the White House, taking part in events with President Trump as recently as December. With the ‘America First’ push of the current administration, it’s highly unlikely that Ford will do a 180 and partner with a Chinese competitor—at least in the current automotive environment. Besides, Ford has recent wins from the deregulation of fuel economy standards, which helps them sell their most profitable vehicles: full-size trucks.

Nissan’s global sales are down 41% from their peak in 2017. In the U.S., Nissan has fared about the same, seeing sales fall 42% in that same period. And unsurprisingly, Nissan is running out of cash. After a possible partnership with Honda fell through last year, could Nissan be the surprise gateway for Chinese automakers to enter the U.S. market? Possibly. They certainly have the incentive to change how they sell cars—and to do so quickly.

One more possibility is through a European behemoth like Volkswagen Group, Mercedes-Benz, or BMW. European OEMs have a few years of experience battling Chinese car brands for market share on their home turf, something American automakers lack. VW’s sales have been essentially flat so far this decade as competition from the likes of BYD, XPeng, and Nio makes dominating the European market tougher. Now, 1 in 10 cars sold in Europe is made by a Chinese brand.

German legacy brands BMW and Mercedes-Benz are also possibilities. What better way to innovate rapidly than to bring the best of China’s luxury auto segment to the West through a partnership? It’s not likely, but it’s possible. After all, Mercedes’ global sales volume fell by 9% in 2025.

We’ll keep an eye out for any hints or suggestions from automakers. Perhaps Greenfield’s speculation isn’t rooted in concrete facts. But as a venture capital veteran, he’s likely on to something. He’s made a very successful career out of following the money—and being right.

Toyota’s February deals have just arrived. With Presidents Day sales now in focus, we’ve gathered the best offers from America’s most popular car brand. Don’t expect zero-percent financing or zero-down lease deals, since Toyota’s strong sales mean they don’t usually need big incentives to sell cars. With their reputation for reliability and the best resale value, Toyotas sell themselves.

Still, some of these offers are better than expected. Note that all Toyota offers expire on March 2, 2026, and may vary by region. Here are the best Toyota deals in February.

Lease the 2026 Corolla LE from $209/mo for 39 months with $3,999 due at signing. See offer details.

The Corolla is a budget commuter’s dream. Great fuel economy, a reliable powertrain, and modern features make it a popular choice even after the downfall of sedans. That’s why this offer is special. This is one of the cheapest lease deals in February, period.

See Corolla listings near you with market insights

Lease the 2026 Camry LE from $289/mo for 39 months with $3,999 due at signing. See offer details.

America’s best-selling sedan is seeing more discounts as more drivers shift to crossovers. That’s great news for anyone in the market for a reliable, affordable Toyota.

See Camry listings near you with market insights

Finance the all-new 2026 RAV4 with 5.99% APR for 72 months, or lease the outgoing 2025 model from $329/mo for 36 months with $3,999 due at signing. See offer details.

For 2026, the RAV4 is getting its first major overhaul since 2019. Although it’s now better than ever, don’t expect big manufacturer incentives for the most popular crossover in America. Toyota sold 480,000 copies last year.

See RAV4 listings near you with market insights

Lease the 2026 Tacoma from $289/mo for 39 months with $3,999 due at signing. See offer details.

The redesigned Tacoma delivers best-in-class off-road capability, and now comes with an optional hybrid powertrain. Despite no notable upgrades for 2026, the higher Tacoma trims will now cost you several hundred dollars more.

See Tacoma listings near you with market insights

Finance the 2025 Tundra at 0.99% APR for 72 months, or the 2026 Tundra at 2.99% APR for 72 months. The 2025 i-FORCE MAX hybrid is also eligible for $5,000 in cash incentives. See offer details.

The Tundra is known as one of the most reliable full-size trucks on the market, but it’s not cheap. Prices have increased by about $500-$1,000 for the 2026 model year. Save the most by opting for the low-APR financing offer for the 2025 model.

See Tundra listings near you with market insights

Get $6,500 in lease cash on the 2026 Toyota bZ. See offer details.

Toyota’s all-electric SUV was renamed and greatly improved for the 2026 model year. The bZ now features faster charging, quicker acceleration, better infotainment, and more range.

See bZ4X listings near you with market insights

On the hunt for the best Toyota deal in February? Be sure to shop the deals. Toyota simply doesn’t offer the magnitude of manufacturer incentives that other brands do. Why? They don’t need to! Toyota models consistently rank among the fastest-selling cars in America. But that doesn’t mean you should let your guard down.

Always be on the lookout for unwanted add-ons or dealer markups, even at well-regarded Toyota dealerships. Check out our simple (and free) guide on what fees to look out at the dealership. No matter how popular the 2026 RAV4 or TRD Pro Tacoma becomes, you should never agree to markups or forced add-ons. Remember, if it’s taxable, it’s negotiable!

And if you decide you’d rather have a car buying pro negotiate your deal for you, check out CarEdge Concierge and the ultimate DIY toolkit. We’re simply here to help!

👉 Stay on top of the best Presidents Day deals at our Monthly Deal Hub. New offers are announced during the first week of each month!