CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Jeep sales are slipping in 2024. Yes, the brand known for all-terrain traction is having a really hard time keeping up in today’s new car market. Inventory is piling up, 2023 models remain unsold, and yet, prices are soaring higher than ever. It seems that Jeep has plunged headlong into a sales crisis, leaving their brand new vehicles gathering dust on dealer lots.

At CarEdge, we’re all about empowering car buyers to take control of their deal. If you’re in the market for a new or used Jeep, you won’t want to miss this one. For the savvy Jeep fan, major savings could be on the horizon. Let’s dive in.

Inventory is the lifeblood of the car industry, and Jeep is no exception. An abundance of cars on the lot can indicate slow sales, creating an environment where buyers could potentially nab themselves an attractive deal. Simply put, it’s a buyer’s market when there’s too much inventory. That’s generally the case for any product, but it’s especially true for automakers as 2024 models pile on to dealer lots.

This year, however, it appears that Jeep has been having a hard time selling their cars. 2024 model-year inventory is through the roof, and last year’s cars are still in need of an owner. It’s amazing how much 2023 inventory Jeep still needs to sell, with nearly 48,000 new 2023 models on dealer lots nationwide. Shockingly, Jeep still has 2,000 new 2022 models that remain unsold.

But let’s look deeper into the data. The Market Day Supply (MDS), the measure of how long it would take to sell all current inventory at the current sales rate, can provide critical insights into the state of sales. Right now, Jeep’s MDS dominates the list of the new cars with the most inventory. This is an alarming sign that Jeeps are spending far too much time on lots before finding a home.

Here’s a quick breakdown of every Jeep model’s inventory:

| Make | Model (New 2023) | Market Day Supply | Nationwide Inventory |

|---|---|---|---|

| Jeep | Renegade | 211 | 10,765 |

| Jeep | Cherokee | 170 | 3,571 |

| Jeep | Grand Wagoneer | 313 | 3,744 |

| Jeep | Gladiator | 201 | 20,965 |

| Jeep | Wagoneer | 172 | 3,921 |

| Jeep | Grand Cherokee | 187 | 39,874 |

| Jeep | Grand Cherokee L | 175 | 20,526 |

| Jeep | Compass | 217 | 25,768 |

| Jeep | Wrangler | 96 | 1,496 |

| Jeep | Wrangler Unlimited | 170 | 27,837 |

| Jeep | Brand Total | 153 | 143,003 |

It’s clear that the Renegade, Cherokee, Compass, Gladiator and Grand Wagoneer are struggling the most with high MDS and large amounts of inventory still unsold, but they’re not outliers. All Jeep models aside from the Wrangler Unlimited have over 100 day supply right now.

In the auto industry, a market day supply of 60 to 70 days is considered ‘healthy’. Jeep’s inventory has a high fever right now, and the only remedy is to sell cars soon.

For comparison’s sake, here are the ten new car models with the highest inventory right now.

| Make | Model | Market Day Supply | Average Transaction Price | Total For Sale | Total Sold (45 Days) |

|---|---|---|---|---|---|

| Ram | Ram 2500 Pickup | 460 | $88,679 | 33,908 | 3,316 |

| Dodge | Hornet | 432 | $37,588 | 5,790 | 603 |

| Ram | Ram 3500 Pickup | 367 | $81,263 | 12,164 | 1,492 |

| Jeep | Grand Wagoneer | 336 | $104,821 | 3,487 | 467 |

| Chrysler | Pacifica Hybrid | 331 | $56,181 | 7,310 | 995 |

| Jaguar | F-Type | 292 | $100,916 | 603 | 92 |

| BMW | 5-Series | 288 | $70,658 | 1,881 | 294 |

| Dodge | Challenger | 273 | $52,012 | 20,574 | 3,386 |

| Ram | Ram 1500 Pickup | 238 | $60,765 | 60,606 | 11,454 |

| Mercedes-Benz | EQS | 212 | $123,179 | 4,837 | 1,025 |

Still not convinced it’s that bad? Here are the new cars with the lowest inventory. Note that this list is the result of both high sales volumes AND low production numbers for some automakers.

| Make | Model | Market Day Supply | Average Transaction Price | Total For Sale | Total Sold (45 Days) |

|---|---|---|---|---|---|

| Chevrolet | Colorado | 19 | $41,495 | 3,796 | 8,954 |

| Toyota | Corolla Hybrid | 23 | $26,563 | 1,020 | 2,034 |

| Toyota | Prius | 24 | $34,185 | 1,600 | 2,974 |

| Mercedes-Benz | GLC | 27 | $57,272 | 1,873 | 3,103 |

| Honda | Civic | 27 | $27,151 | 10,418 | 17,118 |

| Honda | CR-V | 27 | $35,902 | 25,208 | 42,535 |

| Toyota | Sienna | 28 | $50,963 | 5,939 | 9,556 |

| GMC | Canyon | 28 | $49,415 | 1,375 | 2,184 |

| Toyota | Corolla Cross | 31 | $31,515 | 9,251 | 13,253 |

| Kia | Carnival | 31 | $42,360 | 3,871 | 5,583 |

Despite these alarming figures, Stellantis, the parent company of Jeep, remains undeterred. In fact, it appears that they are doubling down on their strategy of ‘price high, hope for the best’. The average transaction price for a Jeep is now $53,913. For the first time ever, Jeep buyers are more likely to pay luxury prices than anything remotely resembling the sub-$40,000 prices of yesteryear.

And Stellantis is all-in on luxury pricing. The critically-acclaimed Jeep Grand Wagoneer starts with an MSRP north of $60,000, with most on the lot going for well over $75,000. A quick glance at CarEdge Car Search shows that even a humble Wrangler Unlimited is likely to cost you north of $50,000. See for yourself.

When it comes to an automaker’s #1 way to sell cars, Stellantis seems to be neglecting the Jeep brand. That would be incentives. Or in Jeep’s case, the lack thereof.

We track manufacturer incentives monthly, and it couldn’t be more clear that Jeep’s parent company is in no hurry to move inventory. Despite dominating the Top 10 list for the most inventory, Jeep is nowhere to be seen on the list of best incentives this month. You’d think there would be a correlation there. Not so!

To make matters worse, Jeep dealers have become notorious for making customers jump through hoops to get a fair price. We’ve recently seen $100,000+ Jeeps, and an abundance of bait and switch dealer pricing.

Here’s one of many examples that car buyers have shared on the CarEdge Community Forum. This Jeep dealer in Florida adds several thousand dollars in pointless fees to the already sky-high sticker price:

On top of the B.S. ‘Naples Advantage’ fee, there’s a $1,198 doc fee. That’s because Florida is one of the only states that doesn’t put a limit on doc fees, and dealers love taking advantage of that. Yup, over $1,000 to ‘file the paperwork’.

It is abundantly clear that Jeep dealer pricing is reliant on unaware, unsavvy car buyers who will pay the sticker price without hesitation. Fortunately, the car buyer in this example was a CarEdge member, and knew how to push back against B.S. dealer ripoffs.

This reliance on consumers’ lack of awareness doesn’t just reflect poorly on the dealers – it’s a black mark on Jeep itself. Jeep, it’s time to take better care of your customers!

Unlike car buyers in decades past, you now have a powerful tool at your disposal: information. Knowledge is power in negotiation, and these high inventory numbers reveal a potentially golden opportunity. For the prepared and knowledgeable buyer, Jeeps will become increasingly negotiable in 2024. But as we’ve seen, don’t expect dealers to be giving out great deals. You’ll almost certainly have to work for it.

Our CarEdge Car Coaches understand this and are ready to help you save thousands on your next vehicle. They know that the first step in getting a good deal is understanding the market conditions. Our team of experts is ready to help you identify savings opportunities, no matter what new or used car you’re in the market for.

Looking for DIY car buying help? Our CarEdge Data plan is just for you. Using behind-the-scenes market insights and the data goldmine found in every CarEdge Report, you’ll be equipped with insider tools to save you big-time.

In summary, be savvy, do your research, and don’t be afraid to walk away if the deal isn’t right. It’s a great time to be a Jeep buyer—if you know what you’re doing. Dealers might be playing hardball, but you can play the game too. And now, you have the data to back you up.

Looking to save with Fourth of July car sales? Our team at CarEdge has curated a list of standout offers that could save you 10% or more on your next vehicle. These deals are currently unfolding in a changing car market, with some brands eager to sell, and others not so much.

Who has the best car deals right now? Is now the best time to buy? Exactly how much should you negotiate? We’ll answer these questions and more. Let’s dive in!

When it comes to manufacturer incentives, automakers are all over the place with their pricing and deals right now. It pays to know where the best deals are. These five automakers are in a hurry to sell cars, and you, the car buyer, can benefit.

Browse Ford listings in your area

Ford’s dealer lots are filling up, and you know what that means: bring on the incentives! For the Ford Edge, they are offering 0% APR for 72 months, and for the Mustang, buyers can qualify for 0% APR for 60 months. The Bronco Sport, Expedition, Explorer, and F-150 come with a 0.9% APR for 60 months.

Additionally, the F-150 also qualifies for up to $2,000 in cash rebates. Ford is having a really hard time selling electric vehicles like the Mustang Mach-E since Tesla undercut pricing, so don’t hesitate to negotiate EV prices this summer. More on that here.

Browse Hyundai listings in your area

Hyundai is celebrating this Fourth of July with a range of deals across several of their models. The Santa Fe and Tucson models come with a 0.99% APR for 48 months. The all-new Ioniq 5 is available with a 1.49% APR for 60 months. Hyundai’s electric sales have slipped since the brand lost eligibility for the federal tax credit here in the States. Lastly, the Kona, Kona Electric, and Sonata all come with a 1.99% APR for 48 months.

If you’re on the hunt for Car and Driver’s 2023 EV of the Year, the all-new Hyundai IONIQ 6, you can secure 2.75% APR for 60 months (but again, there’s no federal tax credit). Don’t forget to check EV incentives in your state.

Browse GMC listings in your area

2023 GMC Sierra 1500: Buyers can enjoy a 0.9% APR plus $1,250 cash back. Plus, with high lot inventory (over a 100 day supply in most areas), dealers are often willing to sell the Sierra 1500 well below the sticker price.

Browse Nissan listings in your area

This brand has several great financing deals across their model lineup. Nissan’s Fourth of July offers include 0% for 60 months for the Titan, 0% for 36 months for the Murano and Rogue, 1.9% for 36 months for the Armada and Rogue Sport, and 2.99% for 36 months for models including the Altima, Ariya, Frontier, Kicks, Leaf, Maxima, Pathfinder, Sentra, and Versa.

Browse Honda listings in your area

This Fourth of July offers some appealing finance offers for Honda fans. You can snag the powerful Ridgeline at 0.9% APR for 36 months. For those needing a roomy SUV, the Passport is advertised at 2.9% APR for 48 months. Looking to get into an Accord, Accord Hybrid, Civic, CR-V, CR-V Hybrid, HR-V, Odyssey, or a Pilot? These models are all available at a competitive 3.9% APR for 48 months.

Our CarEdge Car Coaches help thousands of buyers find and negotiate the best deals, from trade-ins to purchasing and everything in between. While they’re helping our members, they learn a lot about the state of the auto market.

In recent days, our Coaches have helped our members negotiate incredible deals with brands such as Jeep and Ram. Jeep Grand Cherokees, with great incentives and high inventory, are leading to considerable discounts. Similarly, Ram trucks, especially mid-trim variants of the Ram 1500, are a bargain.

Justise, one of our Car Coaches, says that Ford has some great deals right now. He helps hundreds of car buyers save thousands of dollars every week, so he’s all about the deals. Justise says the Ford Escape and Ford Edge are currently sporting up to 8% discounts in the form of manufacturer rebates, plus extra negotiability with the dealer adding up to over 10% off of MSRP.

The Ford F-150 isn’t lagging behind either, with over 10% being routinely taken off the listing price via rebates and dealer discounts.

Jerry, another one of our fantastic Car Coaches, has identified stellar deals as well. Mazda, with decent availability, is offering discounts of 5% to 8%. Honda Ridgelines are seeing significant cuts of up to $4,000 – $5,000.

Subaru is offering up to 5% discounts and even good leases on the Crosstrek and Forester. If you’re considering VW, you can expect about 7% off on the Volkswagen Atlas.

As the Fourth of July approaches, the CarEdge Team has been working tirelessly to bring you the best car deals in the market. Leveraging our industry insights and car buying tools, we’ve discovered where you could save thousands on a new car purchase this summer.

We’ve combined the best deals curated by our team of professional car buyers with the latest Market Day Supply (MDS) data for every brand in the American auto market to pinpoint the best new car deals this Independence Day.

What exactly is MDS, and why should you care? MDS is a measure of how long the current inventory of a specific car model or brand would last, assuming no additional inventory is added, and sales continue at the current rate. If MDS is high, that generally means there’s an excess of supply over demand, which gives buyers more bargaining power and the potential for bigger discounts.

Don’t expect to see MDS advertised by dealers. Car dealers most certainly would rather you NOT become familiar with how the auto market really works. We’re here to change that. See Market Day Supply and other crucial data points with every new and used car listing in your area at CarEdge Car Search.

Now, on to our findings.

Having choices is always a good thing when you’re shopping for a car. Where there’s a glut of inventory, better deals are sure to follow. Here are the brands with the most inventory right now: Ram (215 MDS), Jeep (170 MDS), Jaguar (149 MDS), Chrysler (146 MDS), and Volvo (143 MDS). Note that Stellantis, who has been struggling with sales, dominates this list. Manufacturer incentives aside, these are the brands that will be most negotiable on dealer lots.

Even better, here’s the latest inventory for every major automaker in America. Note: direct to consumer automakers like Tesla are not included, as they don’t maintain lot inventory.

| Brand | Total Brand MDS | Total New Inventory |

|---|---|---|

| Acura | 66 | 26,201 |

| Alfa Romeo | 127 | 2,814 |

| Audi | 100 | 51,251 |

| BMW | 47 | 32,090 |

| Buick | 112 | 44,964 |

| Cadillac | 46 | 16,203 |

| Chevrolet | 61 | 208,177 |

| Chrysler | 146 | 18,677 |

| Dodge | 85 | 41,620 |

| Ford | 86 | 313,689 |

| GMC | 77 | 89,172 |

| Genesis | 97 | 14,258 |

| Honda | 31 | 97,334 |

| Hyundai | 60 | 108,351 |

| Infiniti | 124 | 18,401 |

| Jaguar | 149 | 2,301 |

| Jeep | 170 | 176,107 |

| Kia | 35 | 62,345 |

| Land Rover | 61 | 7,986 |

| Lexus | 36 | 29,989 |

| Lincoln | 115 | 20152 |

| Mazda | 74 | 64677 |

| Mercedes-Benz | 81 | 59353 |

| Mini | 103 | 8457 |

| Mitsubishi | 76 | 14313 |

| Nissan | 69 | 118133 |

| Porsche | 99 | 13151 |

| Ram | 215 | 111401 |

| Subaru | 43 | 57218 |

| Toyota | 32 | 172851 |

| Volkswagen | 61 | 43565 |

| Volvo | 143 | 36094 |

Honda, Lexus, Kia, Toyota and Subaru are seeing the lowest new car inventory right now, and as a consequence, are less likely to offer attractive deals this July 4th.

On the flip side, Stellantis, GM and Ford have the most inventory. If you’re looking to save thousands off of MSRP, this is your best bet.

Looking for a great deal on something else? Our Car Coaches are always ready to assist you, no matter what car your heart is after. Here’s how we can help.

In the realm of car buying, timing can be everything, and the industry hides a secret that could save you a significant sum. On average, new car incentives are 40% higher during a specific time of the year. Surprisingly, it’s the last week of the year where dealers rush to shift the remaining stock from the previous model year, offering buyers enhanced incentives and negotiation power.

However, the total cost consideration is not as straightforward as it appears. Despite potential year-end savings, rising interest rates, the highest seen in over a decade, can potentially offset your savings, leading to increased monthly payments. Therefore, while end of year sales traditionally offer great deals, current market conditions make this Fourth of July an equally enticing time to consider buying a car.

This is especially true if you’re prepared to negotiate!

Don’t miss these 5 car buying tips for 2023 – they can save you thousands!

In the auto market, the art of negotiation can be the difference between overpaying and a fantastic deal. Particularly in the current market, when inventory is high, and brands are eager to sell, leveraging your negotiation skills could result in thousands of dollars in savings. Keep in mind that high MDS numbers mean more wiggle room for negotiations. So, whether you’re eyeing a Jeep Grand Cherokee or considering a Ford F-150, remember, a well-negotiated deal can lead to considerable savings this Fourth of July.

Ready to master the art of negotiating your next car purchase to save thousands of dollars? You came to the right place! Our team of CarEdge Car Coaches helps hundreds of car buyers just like you become empowered consumers ready to take control of your deal. When you enter the dealership equipped with CarEdge Data and the wisdom and skills shared by your CarEdge Coach, you’ll be ready to conquer car buying once and for all.

Regardless, we hope to see you at the CarEdge Community Forum, where tens of thousands of like-minded drivers share the best deals and car buying tips in the internet’s most inclusive, welcoming automotive community. We’re here to help!

Used car price trends in 2023 have been difficult to keep track of. One week prices are going up, the next week prices are falling down.

Don’t worry, CarEdge has got your back.

Whether you are in the market to buy a used car, or are thinking about selling a car you already own, we’ve crunched the numbers so that you can clearly understand what trends are happening in the used car market right now.

Buckle up, let’s explore these essential insights together.

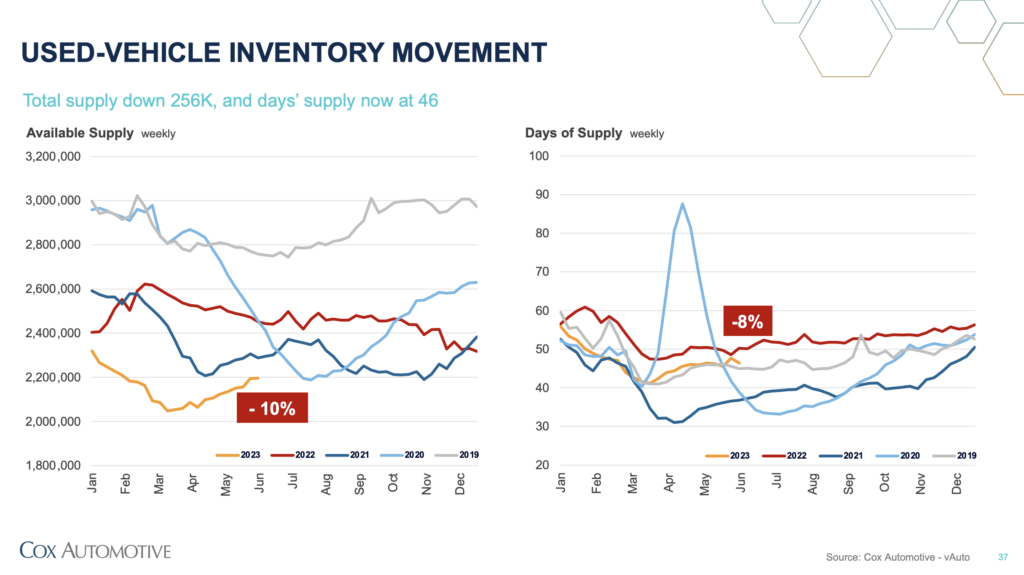

A new analysis from Cox Automotive shows that used car sales are slowing, and at the same time available used vehicle inventory is diminishing.

The multi-year chip shortage that reduced global production of new vehicles in 2021 and 2022 means there are fewer 1 and 2 year old used cars in the market today. This lack of supply is keeping used car prices elevated even as the average interest rate on a used car reaches 13.5%.

Nationwide, used car supply stands at approximately 2.2 million units, a decrease of 256,000 compared to June of the prior year. Quality used cars are still fetching a premium at dealer auctions, however they are fewer and further between.

What goes up, must come down. But when it comes to the used car market of the past 24 months that hasn’t been the case. Where do things stand in mid-2023? “I think the used car market is in flux,” notes Ray, “we are seeing a steady decline in wholesale values at the auctions that is barely reflected on the retail side.” He further explains that quality late-model used cars remain in short supply and still command high prices, stating that “those retail prices won’t be dropping much, if at all, in the near term.”

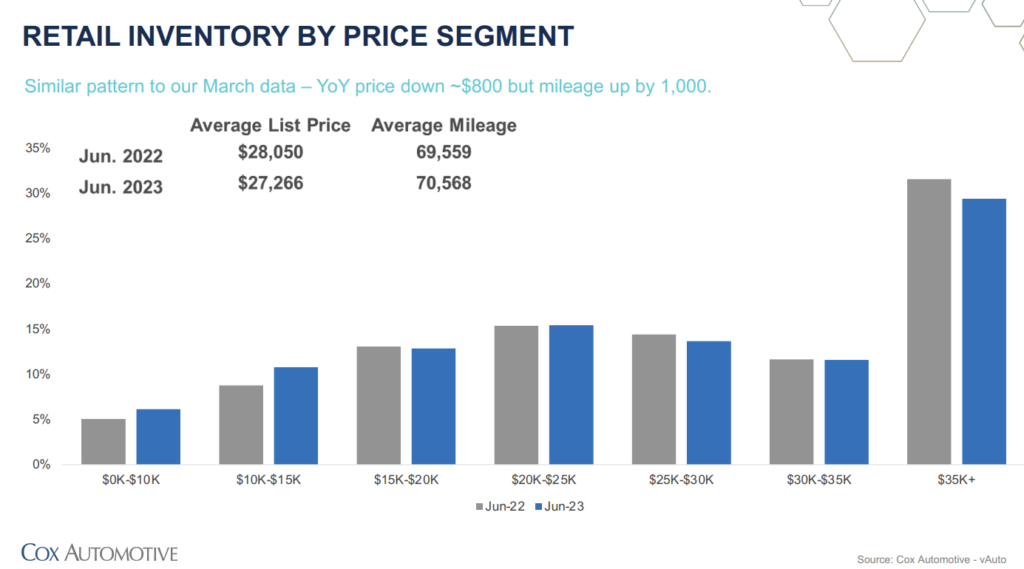

Used car price trends in 2023 look very different across the various segments of vehicles that are sold in the United States. Over the past 24 months we saw major increases in price for “cheaper” used vehicles ($10,000 or less), as consumers looked for any car that could reliably get them from point a to point b without breaking their bank.

Interestingly today, the largest dips in wholesale used car prices are being seen in lower-quality cars and “cheaper” vehicles. This could signal some relief for consumers who are looking for something reasonably priced. “The lower quality cars at the auctions are what are seeing the real declines in values, so whatever retail future price drops that there are will probably be reflected mostly in this group of vehicles,” Ray explained.

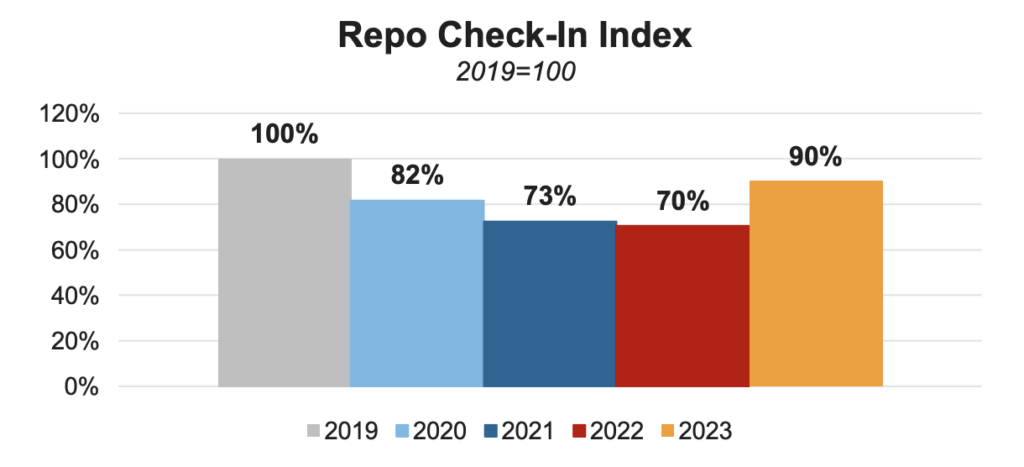

This trend coincides with auto repos increasing significantly. During the pandemic very few vehicles were repossessed. Now, as auto loan delinquency rates increase, we are seeing the number of repo vehicles showing up at dealer auctions increase as well. Typically repossessed vehicles have been treated a bit more “roughly” than other sources of used vehicle inventory (lease returns for example).

Financial institutions are tightening their lending guidelines in response to higher loan delinquency rates. This shift will significantly influence overall sales as it will be more difficult for consumers to find deals within their monthly budget or get approved for financing.However, those with the capacity to purchase the more expensive, higher-quality used cars are likely to continue doing so due to their financial capability to weather these lending challenges. “Those who can and do buy the overpriced newer used cars can and will continue to do so because A) they can put more money down to qualify for a loan and B) they have the ability to be able to afford the higher payment.”

On the flip side, those aspiring to purchase older, cheaper cars may encounter obstacles in qualifying for loans under these stringent guidelines, potentially precipitating a steeper price decline in this vehicle category. Looking forward, high retail prices for low-mileage vehicles a few years old are expected to persist due to ongoing customer demand and limited availability. “I believe that high retail prices will continue well into the future for the 1,2 and 3-year-old lower mileage vehicles because of continued high customer demand and limited availability. I believe that we will still be complaining about high retail prices for quite some time.”

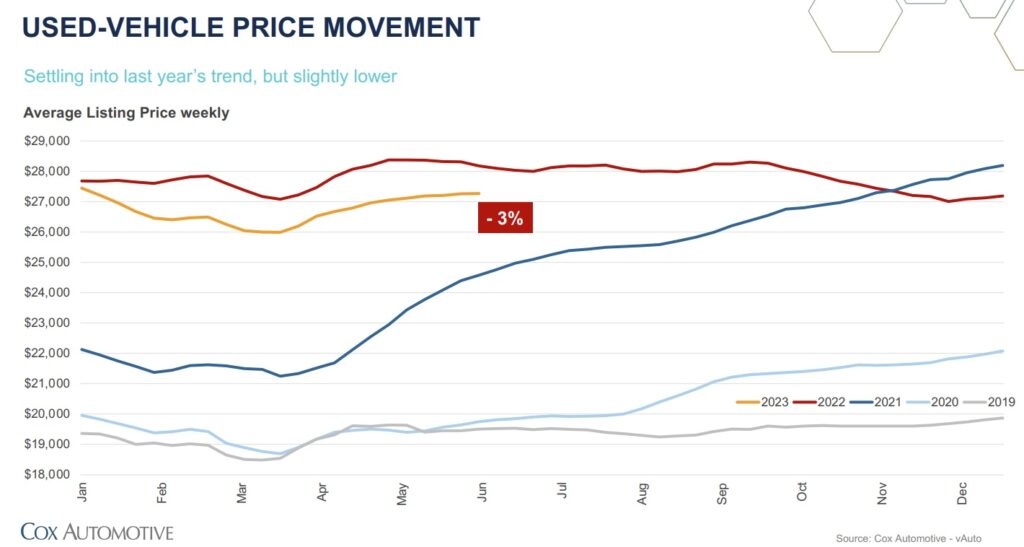

Although the average listing price for used cars in America has dipped 3% since this time last year, they are still near all-time highs. To give some perspective, the average used car price is 39% higher than in 2019 and into pre-pandemic 2020. This dip may represent a relative ‘cooling off,’ but used car prices remain far from pre-pandemic norms.

While retail prices for used cars have dipped slightly since the beginning of 2023, wholesale prices have stabilized, returning to where the year began. This shift might hint towards an equilibrium in the market after a period of intense fluctuations.

An interesting trend is the rising mileage of used car inventory. This change signifies that more drivers are holding onto their cars for longer, a response to continually increasing new car prices that outpace overall inflation. As the cost of buying new becomes less attainable, owners are maximizing the value of their existing vehicles.

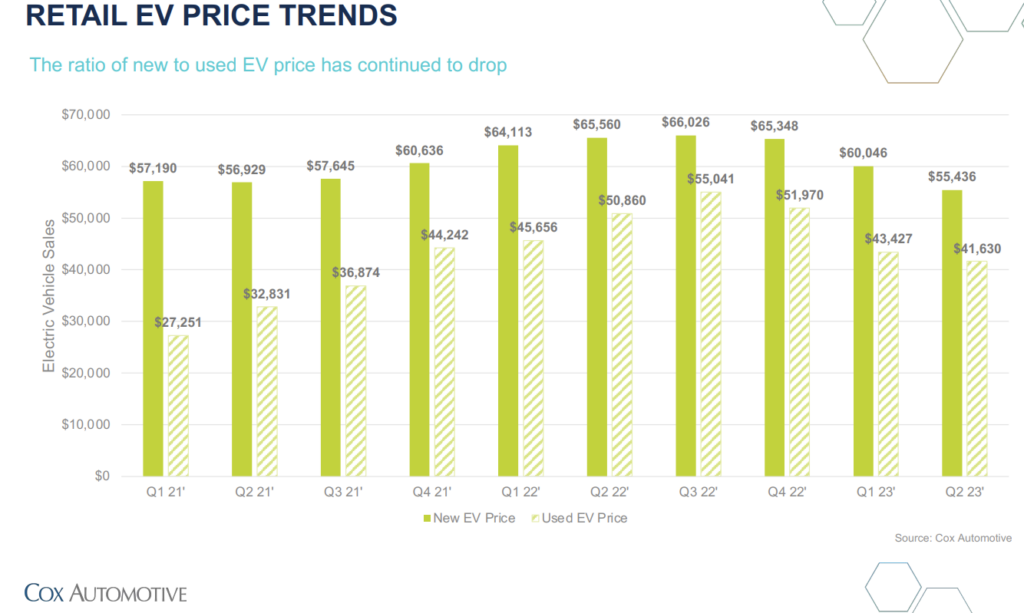

In the world of EVs, things are always changing. Over the past year, the gap between new and used EV prices has narrowed significantly. The rise in new EV inventory, up by a staggering 342% year-over-year, coupled with multiple price adjustments from Tesla, has led to a major correction in the used EV market.

In Q2 of 2023, the average price of a used EV stands at $41,630, quite a bit lower than the $50,000 average a year ago. However, considering the unavailability of federal incentives for used EVs over $25,000 and the abundance of local, state and federal incentives for new EVs, many buyers may still find buying a new EV to be their best bet. For a complete list of eligible cars, check out fueleconomy.gov.

Even though used car prices are experiencing a slight drop, it’s not enough to counteract the significant increases we’ve seen over the last few years. However, with new car inventory increasing rapidly, we’re witnessing the return of buyer incentives, leading to potentially better deals. Moreover, buying new often comes with the added benefit of a full manufacturer warranty.

Stay tuned to CarEdge for the latest insights on car buying trends as we continue to monitor these evolving market conditions. Whether you’re considering a used or new vehicle, we’re here to help you make the most informed decision. Looking for behind-the-scenes market data for new and used vehicles? CarEdge Data is the perfect plan. Ready to dig deep with your top picks? Run a CarEdge Report for the most insights you’ll find anywhere.

Our Coaches are always ready to guide you through your deal with our CarEdge Coach plan.

We’re here to help!

Florida Governor Ron DeSantis has approved a bill partially banning direct-to-consumer car sales in the state, a move set to make the most pro-dealer state even more of a car dealer’s paradise. The legislation, heavily influenced by the Florida Automobile Dealers Association (FADA), also imposes restrictions on automakers, limiting their ability to penalize dealers who choose to mark up car prices. The new Florida law is being lauded by car dealer associations. Make no mistake: House Bill 637 is bad news for consumers, no matter how you look at it.

The Florida dealer lobby played an instrumental role in drafting and pushing through the bill (HB 637). For dealers, their efforts have paid off. The legislation mandates that traditional automakers must sell their vehicles through approved dealers, reinforcing the conventional car sales model and curbing the growing trend of direct-to-consumer sales.

However, the law includes a specific exception for electric vehicle giant Tesla. Tesla was the first to find success with its direct-to-consumer model. By including an exception for automakers who have never sold via a dealership model, Florida is steering clear of a clash with the #1 EV seller. This exception could potentially pave the way for other electric vehicle brands like Lucid and Rivian to continue their direct-to-consumer sales in the Sunshine State.

FADA President, Ted Smith, addressed this carve-out. “We made a clear delineation between a manufacturer that has never had dealers and maybe never will, and those who have been heavily dependent upon their dealerships to be their marketing and sales presence in Florida.”

Another part of the bill allows dealers to set their own prices without adhering to the manufacturer’s suggested retail price (MSRP). The new law prohibits automakers from penalizing dealers for markups. The bill also explicitly restricts automakers from limiting allocation to dealers who impose markups. Equally, automakers are prevented from rewarding dealers who choose to sell at or below MSRP.

But wait, there’s more. The bill states that manufacturers must pay dealers eight percent of the revenue from any post-purchase electronic vehicle upgrades or activations sold within the first two years of purchase. This includes both one-time and subscription-based upgrades, potentially pushing prices higher for these additional services. Evidently, car buyers will have even more reasons to reconsider subscriptions for heated seats or over-the-air updates for acceleration boosts.

These changes highlight the huge influence of dealer lobbies in the United States. In the most recent election cycle, 85.5% of U.S. Representatives and 57 Senators received campaign contributions from auto dealers. This influence is so great that even the Consumer Financial protection Bureau (CFPB), established in 2011 to protect consumer interests, has a provision prohibiting the agency from directly monitoring dealerships.

Ultimately, the landscape of car buying continues to evolve, with power plays between manufacturers, dealers, and legislators. At CarEdge, we’re committed to helping you navigate car buying to find the best deals.

Browse cars with behind-the-scenes market data with CarEdge Car Search. Ready to unlock the full suite of data for a car you’re serious about? CarEdge Report is your one-stop shop for deal analysis. Get 1:1 expert guidance as you learn how to negotiate the BEST deal with CarEdge Coach.

Stay tuned as we continue to monitor the impact of this new Florida Law on car buyers in Florida and potentially beyond.

The current landscape of the car market is an intricate maze of fluctuating inventory levels and shifting price tags. Your guiding light through this labyrinth? Knowledge, of course. The knowledge that shines the brightest is the understanding of Market Day Supply (MDS). This illuminates the number of days it would take to sell all the inventory of a particular model, assuming no new cars enter the market and the current sales rate holds steady. A high MDS suggests a surplus that may give you, the buyer, some bargaining leverage. In contrast, a low MDS may indicate the sellers have the upper hand.

By exploring CarEdge Data, we’ve highlighted which new cars in 2023 have the best and worst reliability ratings, and what the inventory data tells us about them. We think you’ll agree that these insights are rather fascinating, and provide you with the knowledge to navigate the market like a pro.

Using CarEdge Data, we analyzed nationwide supply and sales data for the ten most reliable cars in America, according to Consumer Reports. Here’s the data, and what it means for buyers.

| CR Reliability Ranking | Make | Model | Starting Price | Market Day Supply | Total For Sale | Total Sold (45 Days) |

|---|---|---|---|---|---|---|

| 1 | Toyota | Corolla Hybrid* | $24,145 | 24 | 11887 | 22588 |

| 2 | Lexus | GX | $59,775 | 56 | 3358 | 2679 |

| 3 | MINI | Hardtop 2 Door and 4 Door | $26,795 | 95 | 2809 | 1329 |

| 4 | Toyota | Prius | $28,445 | 23 | 1314 | 2574 |

| 5 | Mazda | MX-5 Miata | $29,215 | 85 | 1184 | 631 |

| 6 | Lincoln | Corsair | $40,085 | 96 | 3315 | 1550 |

| 7 | Toyota | Corolla* | $22,795 | 24 | 11887 | 22588 |

| 8 | Subaru | Crosstrek | $26,290 | 18 | 238 | 598 |

| 9 | BMW | 3 Series | $44,795 | 67 | 2642 | 1778 |

| 10 | Toyota | Prius Prime | $33,345 | 43 | 630 | 664 |

Firstly, the reliability leaderboard has a strong Toyota presence. Models like the Toyota Corolla Hybrid, Toyota Prius, and Toyota Corolla claim high reliability ratings from Consumer Reports. These models fly off the dealer lots relatively quickly with a Market Day Supply of just 23-24 days, showing the high demand for reliable Toyota cars. Data was unavailable for the Corolla Hybrid, so we have included the latest numbers for the overall Corolla model. These popular, reliable cars will be less negotiable due to higher demand and quicker sell times.

CarEdge’s Ray Shefska made it clear that despite great reliability and high demand, the days of being forced into paying a dealer markup are long gone. “No matter what the dealer tells you, never pay a markup or so-called ‘market adjustment’ for a new Toyota. The car market is very different in 2023 compared to the madness we saw during the chip shortage.”

Next, the MINI Hardtop (2 Door and 4 Door) and Lincoln Corsair, despite their high reliability, have a much longer MDS (95 and 96, respectively), suggesting these reliable models may not be as in-demand. You’ll have more leverage negotiating these prices, especially with industry knowledge and familiarity with how to work a deal.

The Subaru Crosstrek, another model with a high reliability rating, stands out with the lowest MDS among the top 10 reliable cars, indicating the supply can barely keep up with demand. CarEdge Car Coach Justise says that Subaru has been the low-inventory king for many years, and that’s not changing any time soon.

Looking at the price tags, the most reliable vehicles come with a broad range of starting prices, from $22,795 (Toyota Corolla) to $59,775 (Lexus GX). This proves that reliability isn’t necessarily associated with a steep price.

Car buyers aren’t racing to dealer lots for the models known for poor reliability. Unfortunately, American brands dominate the bottom ten.

| Make | Model | Starting Price | Market Day Supply | Total For Sale | Total Sold (45 Days) |

|---|---|---|---|---|---|

| Jeep | Wrangler | $36,990 | 98 | 26726 | 12330 |

| Mercedez-Benz | GLE | $58,850 | 69 | 5700 | 3733 |

| Jeep | Gladiator | $40,785 | 289 | 20945 | 3260 |

| Chevrolet | Silverado 1500 | $36,300 | 93 | 68320 | 33219 |

| GMC | Sierra 1500 | $37,100 | 121 | 30856 | 11477 |

| Chevrolet | Bolt | $27,495 | 35 | 3026 | 3908 |

| Ford | Explorer | $38,355 | 93 | 28323 | 13688 |

| Nissan | Sentra | $21,145 | 60 | 13381 | 10048 |

| Lincoln | Aviator | $54,735 | 178 | 4360 | 1103 |

| Hyundai | Kona Electric | $34,885 | n/a | n/a | n/a |

The Chevrolet Silverado 1500, despite its less than stellar reliability, has a significant volume on sale but a relatively high MDS. The takeaway? It’s plentiful but not necessarily popular.

Two other models, the Jeep Gladiator and Lincoln Aviator, despite their lower reliability, have very high MDS (289 and 178, respectively). It appears these models may be the wallflowers of the dealership lots.

Meanwhile, the Nissan Sentra holds its own despite lower reliability, with a fairly low MDS (60). Its budget-friendly starting price may be a contributing factor.

Interestingly, the Hyundai Kona Electric does not have available market or sales data, shedding little light on its demand or supply status.

As we can see, both highly reliable and less reliable cars come with a wide range of starting prices. This indicates that the cost is not necessarily a reliable indicator of its reliability.

Now, armed with these insights, you can navigate the market better. Whether you’re looking for a reliable titan like the Toyota Corolla, or even considering a less reliable model like the Chevrolet Silverado 1500, understanding the role of market days’ supply can give you the edge in your car-buying journey. Where there’s more inventory, greater negotiability is sure to follow.

Don’t forget to check out CarEdge Car Search, where auto industry insiders see behind-the-scenes data with every new and used car listing!

But we won’t leave you just yet. We want to arm you with more resources to make your journey smoother. One such tool is our free Car Buying Cheat Sheet. This popular resource can enhance your understanding of the market and help you zero in on the perfect car at the perfect price.

For a more detailed understanding, download your first CarEdge Report today. This report offers a comprehensive breakdown of key numbers in a simple and digestible format, setting you up for success at the negotiation table.

And if you’re looking for a personalized touch, CarEdge Coach is your ticket to savings. Our expert car buyers can offer personalized advice and help you negotiate thousands off your next car.

Don’t navigate the car market alone; let CarEdge steer you in the right direction. You’ll be thankful you did.