CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Ever wondered why the allure of an affordable new truck seems more like a mirage these days? Despite the lot inventories of best-sellers skyrocketing far beyond the norms of a healthy market, securing an affordably priced new truck has become tougher than ever.

So, what’s behind this paradox? The answer lies in the automakers’ strategic drift from the production of affordable base models. But, is this strategy set to steer the truck industry into troubled waters? Let’s uncover the truth using CarEdge and MarketCheck’s latest data on the state of the truck market in 2023.

There’s an interesting trend that the top-selling trucks in America all share: as the total production figures rebounded from pandemic lows, the production of affordable base models hasn’t kept pace. The strategic move by automakers to limit the production of entry-level models has created scarcity, contributing to their increased prices.

Focusing on one of the best-selling trucks in America, the Ram 1500, CarEdge Data reveals that there are 53,652 new Ram 1500s on sale across the nation. However, the most affordable trim option, the Ram 1500 Tradesman, only makes up a mere 3,445 of this total. Despite having a starting price of just $37,090, the Tradesman, as a result, seems like a near-mythical entity in dealer lots.

The scarcity of base model Ram 1500s isn’t the only issue; the prices of these scarce models have surged as the supply diminished. The Ram 1500 Classic witnessed a 26% price hike from 2019 to 2023, while its inventory dropped by a whopping 88%.

Sadly, the trend isn’t exclusive to Stellantis. Both the F-150 XL and the Chevrolet Silverado Work Truck have also followed the same downward trajectory in their base models’ production:

The Silverado 1500 Work Truck experienced a 41% price increase since 2019, even though its inventory has decreased by 33% over the same period. Today, the base model Work Truck represents a meager 6% of the 67,795 brand-new Silverados available on the market.

Despite the combined U.S. sales of America’s three top-selling trucks rising by 2.5% from the pre-pandemic norms of Q1 2020, the inventory of base models like the F-150 XL sits at just 54% of the pre-pandemic levels.

Here’s a look at how overall truck sales (across all trims) has risen back from pandemic lows, despite leaving affordable base trims behind:

Similarly, the Silverado Work Truck is at a mere 49% of early 2020’s inventory. The worst hit is the Ram 1500 Classic, languishing at 23% of January 2020’s inventory, notwithstanding the overall Ram 1500 sales recovering to 91% of the pre-pandemic levels.

The picture is clear: truck inventories have fully recovered from the inventory woes of 2021, but affordable base models were largely left out of the picture. The result: truck buyers are pushed towards more expensive truck options, feeding into the ultimate goal of the automakers – ever higher profits.

From skyrocketing destination charges to the elimination of popular base models, it’s apparent that automakers are leaving no stone unturned in their bid to maximize profits from each sale. However, this aggressive strategy has not been left unchecked. Consumers are pushing back, sparking significant changes in the industry. A classic example is Honda, which, within a year of canceling the base LX trim for the CR-V and Civic, reversed their decision due to consumer pressure. Kia, too, had to reintroduce its most affordable EV6 after initially discontinuing it.

Car buyers push back, forcing the return of base models

The real question now is, will truck lovers follow suit and make their voices heard? And more importantly, will the major automakers – Ford, GM, and Stellantis – heed the call, or continue their current strategy, potentially alienating millions of middle-class loyal customers?

Don’t let the ever-changing trends in the auto market throw you off guard. Navigate the landscape like a pro with CarEdge Data and get the latest industry insights at your fingertips. Ready for 1:1 help with your deal? With CarEdge Coach, our Car Coaches are at your side via live chat every step of the way, ensuring you find the perfect vehicle at an unbeatable price.

Already found the truck of your dreams? Get comprehensive market price data for every new or used truck listing with CarEdge Reports, included with our Data and Coach plans. Let CarEdge steer you towards your perfect ride. We’re here to help!

As 2023 model year lineups were announced last year, a sizable portion of the automotive industry faced widespread criticism for eliminating their most affordable vehicles from the lineup. At a time when new car prices were running away from the middle class, the most affordable versions of popular cars were sacked.

Now, in 2024, car manufacturers are reversing course. Are we about to see the resurrection of affordable cars? Or are we getting our hopes up too soon? Let’s take a look at where we’ve been, where things stand today, and where we’re headed as new car sales continue through yet another volatile year.

You could say Tesla started it all when they axed the much-hyped $35,000 version of the Model 3 years ago. However, legacy automakers are a different animal entirely, so we’ll fast forward to 2022. Late last year, Honda led the charge with changes to their product lineup, and were soon followed by Kia and Jeep. Within months, multiple base models were discontinued in the United States, sending entry-level prices through the roof overnight for some of the most popular cars in America.

This was no small move. Together, these manufacturers account for 30% of new car sales in the U.S. The effects were swift and significant, leading to an outcry among car buyers, and as one Kia representative put it, ‘unprecedented demand’ for what had previously been seen as unwanted, unpopular base trims.

Automakers cited lower sales numbers and the supply chain woes of 2021-2022 when explaining the abrupt decision. However, in doing so, they overlooked the crucial role these base models play in catering to the needs of lower-income and budget-conscious drivers. Without affordable base models, a large chunk of the market would be priced out, and would simply take their business to used car lots.

Fast forward to 2024, and some of these same automakers are now making a U-turn, resurrecting their affordable vehicles. The most shocking reversal comes from none other than…. Honda.

Honda ruffled feathers when it eliminated the most affordable Honda Civic, the LX base model, in late 2022. This decision followed an earlier price hike between $1,000 – $2,000 for the 2023 model year. Consequently, budget-conscious commuters, the heart of Honda’s fanbase, were left reeling just as interest rates climbed higher. Further compounding the issue, the CR-V, America’s #2 best-selling SUV, also lost its base trim.

As the base trims were dropped, the entry-level price for the Civic increased from $22,350 to just north of $25,000 for the EX. For the CR-V, the base price jumped by almost $5,000 overnight to $31,610.

The rationale behind these decisions might have been an attempt to boost profits amidst supply chain issues that had plagued Honda since 2021. However, by mid-2022, the automaker’s US sales had plummeted 50% year-over-year.

Now, Honda seems to be having a change of heart. In response to decreasing new car prices and slowed sales, the company has announced the return of the more affordable CR-V in 2024. The CR-V LX, without a sunroof, power-adjustable driver’s seat, and with just a single climate control zone, now lists for $28,410 plus a $1,295 destination fee.

Around the same time as Honda’s controversial move, Kia also announced the cancellation of the most affordable version of its popular electric car, the Kia EV6. This caused the base price of the EV6 to soar by $7,300, or 18%, to nearly $49,000. Furthermore, the beloved gas-powered Kia K5 also lost its LX base trim, pushing the entry price to $26,195.

Kia, once known for affordability, seemed to be pushing further into premium territory.

However, 2023 and 2024 have seen Kia backtrack somewhat, albeit with certain conditions. The automaker is now offering the EV6 Light in select western US states. The EV6 Light has even returned to Kia’s online configurator.

We call this a win for consumers, especially considering that Kia’s EVs lost the federal EV tax credit this year due to the Made in (North) America requirement.

As far as the Kia K5, the entry-level LX trim has yet to return. The K5 now starts at $26,515 with destination fees. For reference, the 2019 Kia Optima started at $23,915, or 11 percent less than today’s K5.

There’s a 399 day supply of Jeep Renegades nationwide, according to the car buying tools available through CarEdge Pro. This didn’t happen overnight. Jeep’s inventory has been building for months. In fact, every Jeep model has over 100 day’s supply, far above the industry’s healthy standard of 60 days.

You would have thought that Jeep’s parent company Stellantis would have seen the writing on the wall, and perhaps even would have considered lowering prices or introducing incentives.

What we got was the complete opposite. The boxy, poor-selling and unreliable Jeep Renegade lost its Sport base trim for the 2023 and 2024 model years. What happened next? Jeep’s inventory just kept on climbing, and now leads the industry for number of cars on the lot.

Here’s a full breakdown of Jeep inventory today, and where the best deals could be negotiated.

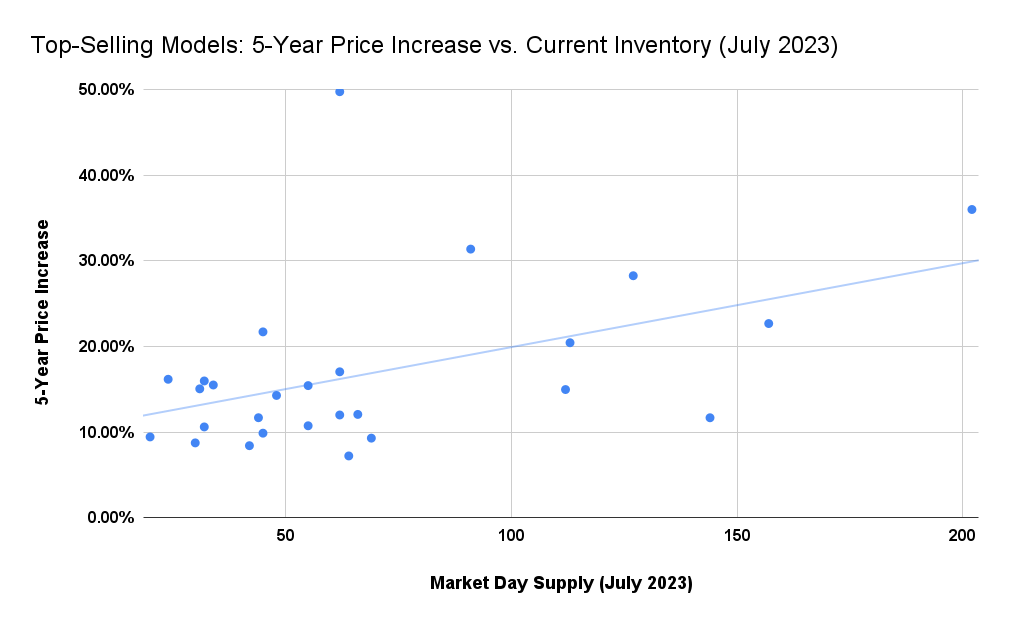

In the past five years, new car prices have risen by a staggering 37%. However, there seems to be a light at the end of the tunnel. Our own analysis reveals that automakers who have hiked prices the most are paying the price in the form of WAY too much inventory. See for yourself in the graph below showing how much inventory is on the lot for top-selling models that received price hikes this year.

Buyers are pushing back against runaway new car prices. Dealers are loaded with inventory that won’t sell. See which automakers are suffering the consequences right now, and how YOU can use this as negotiation leverage.

When it comes to the car market, we’re no stranger to the ups and downs. Get ready for yet another market adjustment, according to at least one group of experts.

A report by industry analysts at AlixPartners forecasts a steady decline in new car transaction prices over the next few years.

By 2025, the analysts expect the average transaction price to decline to around $42,000, down from where it stands today near $46,000.

What do they expect to drive this downward trend in prices? The dynamics don’t “mean the price of the same vehicle comes down,” Mark Wakefield, global co-leader of the automotive & industrial practice at AlixPartners, said at a press conference. “The predominant driver of that is mix shift and trim shift within a product to reduce the higher, more profitable vehicles and get more volume out.”

In other words, it looks like automakers are coming to their senses (at least somewhat) and are planning to make higher numbers of lower-trim vehicles at more accessible price points.

What if there was a way to guarantee you never overpay for a car again? We’re here to make that a reality for you. Don’t let the journey to your dream car be a bumpy one. Our CarEdge Coaches are ready to guide you every step of the way, ensuring you find the perfect vehicle at an unbeatable price.

Or, if you’re a do-it-yourself enthusiast, use CarEdge Pro to get the industry insights you need to negotiate like a pro.

Let CarEdge steer you towards your perfect ride. We’re here to help!

![Car Price Inflation Is Real – These Brands Are the Worst [2025 Update]](https://caredge.com/wp-content/uploads/2023/07/2024-08-22_Big-Data-Update_-Car-Price-Inflation_Blog-Header-Image_1920x1080_v1-1080x675.jpg)

This decade has brought a whirlwind of challenges for the automotive industry. From pandemic shortages and EV investments to today’s inflation and tariff pressures, lack of stability would be an understatement. So, how have car prices fared over the last five years? Across the new car market, average transaction prices have increased by 30% from Q2 2020 to Q2 2025. The average selling price for a new car now stands at $48,749.

But some automakers seem to have thrown caution to the wind, pushing their prices far higher. Here’s a look at car price inflation over the last five years.

Leading the pack in price hikes is Volkswagen Group, which includes VW, Audi, Porsche, Bentley, and Lamborghini in the United States. The average transaction price for Volkswagen Group has increased by 38% from Q2 2020 to Q2 2025, which is quite a bit higher than the overall economy’s inflation (25%) over the same period.

Hyundai Group (which includes Kia) and Honda are close behind. Hyundai Group prices are up 34% in the first half of this decade. EVs like the new IONIQ 9 are a big reason for the price hike. Honda prices increased by 33% from 2020 to 2025 as MSRPs increased and buyers showed increasing preference for larger SUVs. Honda’s best-seller, the CR-V crossover, saw base MSRPs jump from $26,345 in 2019 to $31,495 in 2025.

General Motors is next in line, with prices up 30% since 2020. Chevrolet and Cadillac prices have risen as EVs have populated the lineup, and trucks like the Silverado 1500 get ever more expensive. In 2020, the Chevy Silverado 1500 RST started at $38,695. For 2025, that same spec of the Silverado starts at $52,345.

However, there’s a bright spot in the data. Ford, Stellantis, Nissan, and Subaru price increases were below the overall rate of inflation over the past five years. Data was unavailable for Mazda.

Subaru seems to have taken a different strategy with a five-year transaction price increase of only 15%, well below the pace of overall inflation. Subaru has managed to maintain an upward trajectory in terms of market share. This gain, paired with standard offerings like all-wheel drive, could be a testament to the importance of price competitiveness in the industry.

Nissan, on the other hand, has likely seen less price increases for a different reason. Nissan has been losing U.S. market share for years as Toyota, Honda, Hyundai, and Kia win over budget shoppers. When demand falls, dealer markups and MSRPs soften. Since 2019, Nissan transaction prices have risen 14%. And now, two of Nissan’s most popular and affordable models, the Altima and Versa, are being discontinued next year.

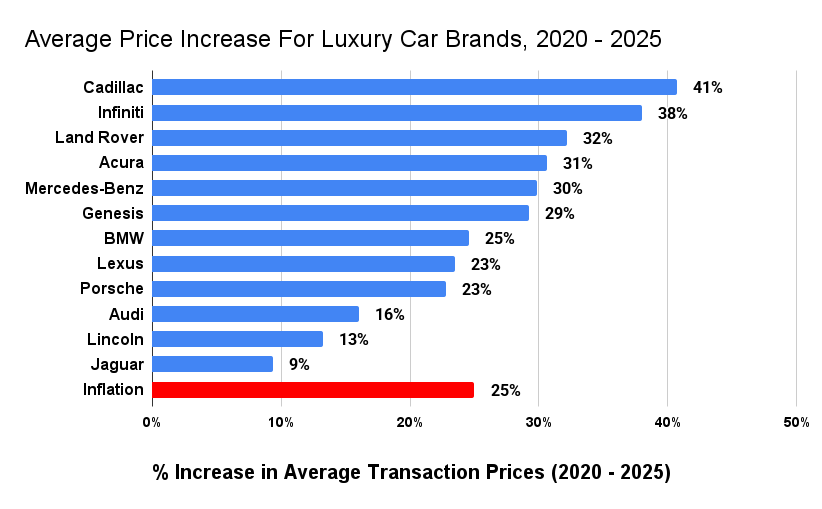

To the detriment of vehicle affordability, luxury cars are more popular than ever. More drivers are paying over $80,000 for a new car or truck than ever before. Oddly enough, luxury car prices haven’t climbed quite as much over the past half-decade. While mainstream car brands saw prices climb 30%, luxury brands increased by 25% from 2020 to 2025.

Here’s a look price inflation for some of the best-selling luxury brands in America compare. Note that Tesla is not included due to lack of publicly-available data from 2020.

Prices for new Cadillac, Infiniti, Land Rover, Acura, and Mercedes-Benz cars have all had average selling prices rise more drastically than their luxury competitors. All of these luxury cars now sell for at least 30% more than the did just five years prior.

On the other hamd, the luxury car brands with the lowest price increases are Jaguar, Lincoln, and Audi. Audi’s sales have slipped as the brand’s EVs fail to keep up with the competition in the crowded luxury crossover segment.

It’s true that new cars are a lot more expensive these days, but that doesn’t mean you have to surrender and sign whatever the dealer offers. There are still practical ways to save, even in 2025. Here are a few smart car buying tips from CarEdge Co-Founders, father-and-son duo Zach and Ray Shefska:

Use Market Data, Not MSRP

Rely on real-time transaction and listing data (like CarEdge Pro) to understand what others are actually paying in your area.

Target the Slow Sellers

Focus on vehicles with high inventory and long time-on-lot. Dealers are more willing to negotiate on slow movers. We’ve got tools to help you find negotiable inventory.

Look for Dealer-Backed Incentives

Even when automaker incentives are weak, individual dealers may offer their own discounts, especially near end-of-month or quarterly sales targets.

Negotiate More Than Just Price

Push for better financing terms, trade-in value, or extras like extended warranties or free maintenance. Here’s our guide to what’s negotiable at the dealership.

Time Your Purchase Strategically

Shop at the end of the month, end of the quarter, or during seasonal clearance events (like model year transitions). There’s even a better time of the day to buy! Be sure to check out our free tips for timing your purchase right.

Use AI Tools to Level the Playing Field

AI can be terrifying, but it can also be extremely helpful. CarEdge’s AI Negotiator can take the pressure off and ensure you don’t overpay. How does CarEdge AI work? Tell us what car you want, and our AI Negotiator will contact dealers and negotiate pricing for you! It’s really, really cool.

Ready for some expert car buying help to ensure you pay a fair price? That’s why we created CarEdge, the ultimate car buyer’s advocate. Learn more about how our team of consumer advocates is ready to assist you with your deal at CarEdge.com.

In 2025, the car market is changing. For the first time in years, great deals can be won with negotiation know-how. Utilizing tools like CarEdge’s FREE Car Buyer’s Guide can give you a better idea of current inventory levels and help you determine where the best deals might be.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download.

We’re constantly told that electric vehicles are the future. But a closer look at recent sales data suggests that, for some models at least, the future isn’t quite here yet. Let’s switch gears and delve into fresh data to understand what all the fuss is about.

The market for electric cars, trucks and SUVs is growing, no doubt about it. Our updated analysis of EV market share has EV sales above 7 percent for the first time. However, as with any burgeoning market, there are growing pains. Some new electric models are spending months on dealer lots, while others seem to be driving off as soon as they arrive.

So, what’s causing these unexpected hold-ups in EV sales? To answer that, we need to take a closer look at a metric of market health that is too often overlooked by car buyers: days supply. “Days supply” is a term used in the automotive industry to represent the number of days it would take to sell all of a particular car model in inventory, given the current sales rate.

In 2023, the days supply of non-Tesla EV models keeps getting weirder and weirder. Why don’t we have Tesla data to share? Well, no one has that except Tesla, since they sell direct-to-consumer, along with Rivian, Polestar, Lucid and a few other low-volume automakers. Analysts have to wait until sales numbers are released for any real insight. We DO, however, have some interesting USED Tesla numbers to dig into. More on that in a bit.

The latest from CarEdge Data reveals some surprising numbers. New EV inventory is above and beyond anything we’ve ever seen before.

The Mustang Mach-E, despite being highly anticipated and once labeled a ‘Tesla-killer’, now has a supply of 153 days. Meanwhile, other popular EVs like the Hyundai IONIQ 5 and 6, are taking 110 and 159 days, respectively, to sell. The IONIQ 5 was last year’s Car and Driver EV of the Year, only to pass that same title on to the IONIQ 6 in 2023. You’d think they’d be selling like crazy, right?

And that’s not all. Nissan’s Ariya is sitting for a whopping 219 days before finding a new home, and the Subaru Solterra isn’t far behind with 199 days.

Here’s current dealer inventory for every new electric vehicle in America, except Tesla and the other direct-to-consumer automakers.

| Make | Model | New/Used | Days Supply (7/28/23) |

|---|---|---|---|

| Ford | Mustang Mach-E | new | 210 |

| Chevrolet | Bolt EV | new | 44 |

| Chevrolet | Bolt EUV | new | 33 |

| Hyundai | IONIQ 5 | new | 116 |

| Hyundai | IONIQ 6 | new | 159 |

| Genesis | GV60 | new | 200 |

| Kia | EV6 | new | 146 |

| Volkswagen | ID.4 | new | 150 |

| Audi | Q4 e-tron | new | 153 |

| Porsche | Taycan | new | 152 |

| Mercedes | EQS | new | 194 |

| Mercedes | EQB | new | 101 |

| BMW | i4 | new | 61 |

| BMW | i7 | New | 174 |

| Volvo | C40 | new | 132 |

| Subaru | Solterra | new | 199 |

| Nissan | Ariya | new | 176 |

| Nissan | Leaf | new | 140 |

| Toyota | bZ4X | new | 190 |

| Ford | F-150 Lightning | new | 103 |

| GMC | Hummer EV | new | 90 |

Remember when GM executive Bob Lutz couldn’t stop hating on Tesla? For years, he went on and on about how the then-EV startup was doomed to fail. Making cars was just too hard and unprofitable, he said.

Three short years later, and boy was he wrong. Tesla is STILL the king of EV sales, and to rub salt on the wound, Tesla is now convincing one legacy automaker after another to adopt their once proprietary charging standard, GM included. What does all of this have to do with EV inventory numbers in 2023? Let me explain.

Tesla’s bold pricing strategy is driving a shift in the EV market. They initiated massive price cuts this year, predominantly affecting their widely circulated Model 3 and Model Y, and creating a ripple effect in the sector.

These strategic reductions, alongside stabilizing gas prices, rising interest rates, and thrifty consumers, resulted in less demand. When demand dropped, Tesla lowered prices.

Tesla’s price reductions triggered a downward trend in the new EV market. The Model Y began 2023 at $65,990 in the U.S., but price cuts and a cheaper base variant slashed the base price of the Model Y to $47,240 by early May. With access to the Supercharger network, over-the-air updates and longer range, many drivers looking to go electric simply went for the Tesla, leaving the competitors to pile up on dealer lots.

By the way, used Tesla models are still in demand. Days supply remains just slightly above average, and far below new EV inventory. Here’s a look at used Tesla inventory nationwide in July 2023:

| Make | Model | New/Used | Days Supply | Total For Sale | Total Sold (45 Days) |

|---|---|---|---|---|---|

| Tesla | Model Y | used | 65 | 1889 | 1304 |

| Tesla | Model 3 | used | 56 | 4564 | 3664 |

| Tesla | Model S | used | 91 | 2470 | 1218 |

| Tesla | Model X | used | 73 | 1382 | 850 |

Let’s take a closer look at the demand issue. Despite the buzz, not all EVs are finding eager buyers right off the bat. Let’s plug into a few potential reasons: price, charging infrastructure, vehicle range, and brand reputation.

First, despite the falling prices and high inventory, electric cars are expensive. The average EV price remains about 15% higher than that of the average conventional car. Those who really put on the miles can recoup that money through fuel and maintenance savings, but what about urban dwellers who may drive just 5,000 miles a year?

This higher upfront cost might deter many potential buyers, especially those with a limited budget or those who drive less frequently.

Secondly, the charging infrastructure for EVs is still developing and leaves much to be desired. This is especially true in rural America. Those who live in apartments, condos, or similar situations may not have any way to charge at home to begin with. And then there are variables like cold weather, towing, and high-speed driving that all impact an electric vehicle’s range, and undermine consumer confidence in EVs.

Lastly, there’s a cultural shift required to adapt to the EV lifestyle. Transitioning from gas stations to charging points, understanding charging times, and adjusting to the inability to simply work on your car in the garage are just some of the challenges for the everyday driver. In addition, for those who love the roar of an internal combustion engine or frequent long, remote road trips, an EV might not be ideal.

These are the BEST EVs for families today (price, range and more)

So what does this mean for you, the potential EV buyer? If you’re considering one of these slow-sellers, you might be able to secure a great deal. Some (but not all) dealers could be more than ready to sell their electric inventory, which could increase your negotiating power.

In fact, even before the most recent spike in electric vehicle inventory, we shared a few of the many examples of CarEdge community members negotiating thousands off of EV sticker prices. Yup, EVs are indeed negotiable!

Take this negotiation cheat sheet with you to the dealership!

What does it all mean for manufacturers? These trends could be a wake-up call. Legacy automakers and newcomers alike may need to adjust their strategies, rethink pricing, improve vehicle specs, or invest more in marketing and public education to attract buyers who may be on the fence about going electric.

Perhaps it’s too early to claim that these EVs are ‘struggling’. After all, every new technology takes time to become mainstream. And as more people embrace the benefits of electric driving, demand for these slow-selling models might well pick up speed.

But for now, savvy buyers could use this opportunity to drive a hard bargain on a brand-new EV.

Ever heard the phrase ‘patience is a virtue’? In the world of used car buying, it’s more than just a virtue – it’s a strategy. With recent fluctuations in used car prices, knowing when to dive into the market can be the difference between an okay deal and a fantastic bargain. But when will car prices drop? As it turns out, the answer lies in understanding the data behind the trends. We’ll unpack the latest used car market update to reveal why the smartest buyers might want to play the waiting game.

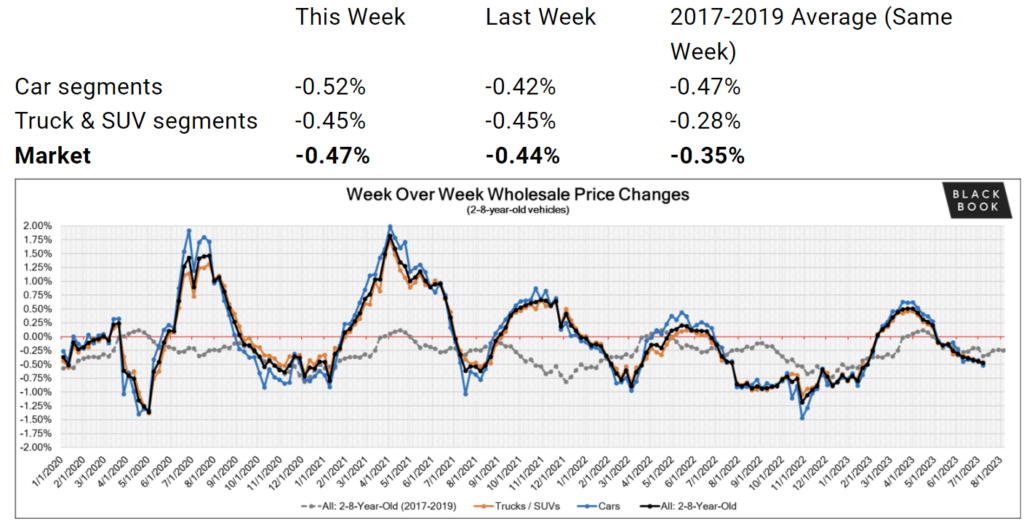

The latest numbers from Cox Automotive are making headlines. In June, wholesale used car prices dropped by -4.2%, with an overall decrease of -10.3% compared to the previous year. June’s decrease was an all-time record for the month, and is second only to the pandemic plunge in car prices during April of 2020.

Here’s where some of the headlines are missing the point: the sharpest declines are being seen at wholesale auctions. These are the auctions that the dealers themselves buy from, not where the average consumer will find their next ride. Surely wholesale price trends will be mirrored in retail prices quickly, right? Not so fast.

On the retail side, the used car price decreases have been more modest. Retail used car prices fell by just -0.5% over the last month, revealing an unsurprising mismatch between wholesale and retail trends. Let’s dig a bit deeper into that…

But why does this gap between wholesale and retail used car prices exist? Simply put, retail prices typically lag behind wholesale trends. This is due to the time it takes for changes in the wholesale market to trickle down and affect retail prices. Dealers want to squeeze every possible dollar out of their inventory, so it takes a while for market trends to finally be reflected in sticker prices (and negotiability).

Therefore, if you’re planning to buy a used car, it’s likely worth waiting 30, 60, or even 90 days. The drastic declines in wholesale auctions seen today will likely translate to better retail prices in the coming months.

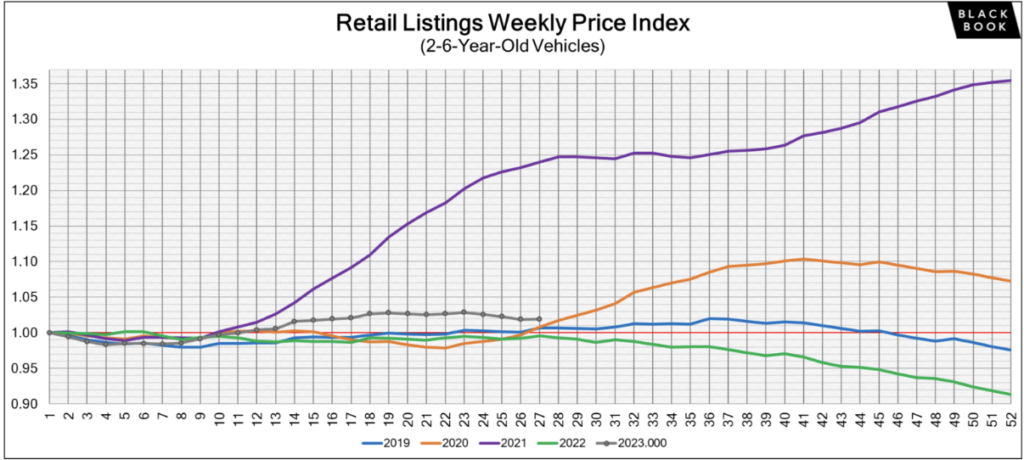

Why not now? Consider the following: We track used car prices weekly here with the help of Black Book. In the graph below, you can clearly see the marginal price movement on the retail side of the market. Retail used car prices in fact remain above where they started 2023.

In this next graph from Black Book, we see the more noteworthy price declines on the wholesale side.

Before you head to the dealership, know this: retail car prices typically lag behind wholesale price trends by one to three months. To save the most on your used car, we recommend waiting 30, 60 or 90 days for retail prices to really come down.

Rushing out to dealer lots today could cost you, as dealers today are very likely to ‘play dumb’ and hold off on lowering prices for as long as they can.

These changes don’t just affect buyers; they also have significant implications for those looking to sell or trade in their vehicle. The most immediate impact of falling used car prices is a decrease in trade-in values. If you’re certain about selling or trading in your car, it’s wise to complete the sale as soon as possible to get the best value.

Compare offers from trusted online buyers with CarEdge today before used car values plummet…

These price trends come alongside a decrease in retail sales for June and a continued rise in used car inventory. ‘Days supply,’ a common industry metric used to compare inventory while also factoring in the daily sales rate, continues to climb for most used vehicle segments. This means that more cars are available, but they are also staying on the lot longer.

Interestingly, the major vehicle market segments saw their seasonally adjusted prices remain lower year over year in June. Compared to June 2022, pickups and vans have fared better than most, losing 6.6% and 8.5% respectively. Sports cars took the hardest hit at 14.8% year-over-year, while compact cars lost 12.6%, and midsize cars dropped by 12.2%. When compared to last month, all segments were down, with compact and midsize cars experiencing the most significant declines.

The rapid fall in used car prices has put car dealerships in a tough spot. Dealers (and their lenders) are under a significant cash crunch. You’re not the only one borrowing money for your next car. Dealers themselves have to pay interest for every day a car sits unsold on their lot, creating a time-is-money dilemma. Car dealerships typically take out loans to purchase inventory at auction, and then pay interest on that loan until the car is sold. This hidden expense is called ‘floorplanning costs’, and they’re rising for dealers in a time of interest rate hikes.

They desperately want to make the most money possible from the sale of each car on their lot. This is their path to profits. However, quickly-changing market dynamics are throwing a wrench in their plans. As used car values fall quickly, dealers are finding themselves in a precarious situation.

Using the market analysis tools available through CarEdge Data, we identified the ten mainstream used cars with the MOST inventory today. These are the used cars that you’re more likely to negotiate a better deal with today.

| Make | Model | Days Supply | Total For Sale | Sold (45 Days) |

|---|---|---|---|---|

| Jeep | Grand Cherokee WK | 155 | 947 | 275 |

| Ford | F-350 | 123 | 1188 | 436 |

| Chevrolet | Impala Limited | 119 | 658 | 248 |

| Chevrolet | Bolt EV | 114 | 1913 | 753 |

| Jeep | Grand Cherokee L | 113 | 3653 | 1451 |

| Jeep | Grand Wagoneer | 110 | 556 | 227 |

| Audi | A8 | 106 | 692 | 294 |

| Ram | 1500 | 106 | 3535 | 1501 |

| Volkswagen | ID.4 | 105 | 675 | 289 |

| Audi | e-tron | 104 | 882 | 382 |

Are there really any surprises here? Trucks can’t sell right now, and just the other day we did a deep-dive into Jeep’s unprecedented glut of inventory.

In the weeks and months ahead, we fully expect to see more models reaching over 100 days supply on the used car market. Electric vehicles and trucks are piling up on dealer lots as we speak!

Negotiating will be tougher with these models in short supply. Note that this list is full of vans and SUVs. These family haulers remain in demand, but the good news is that van and SUV prices have fallen more than the overall market average in recent months. Follow our weekly used car price updates here.

| Make | Model | Days Supply | Total For Sale | Sold (45 Days) |

|---|---|---|---|---|

| Tesla | Model 3 | 55 | 4439 | 3635 |

| Toyota | Sequoia | 55 | 833 | 685 |

| Toyota | Sienna | 55 | 5938 | 4881 |

| Honda | Fit | 54 | 1961 | 1635 |

| Subaru | Ascent | 54 | 3567 | 2946 |

| Ford | Transit | 52 | 961 | 826 |

| Lexus | RX Hybrid | 52 | 804 | 692 |

| Chrysler | Voyager | 50 | 1555 | 1408 |

| Honda | Odyssey | 49 | 6272 | 5791 |

| Porsche | 718 | 49 | 505 | 464 |

There’s more money-saving data where that came from! Try CarEdge Data today to unlock the auto market insights dealers don’t want you to see.

While the current market might seem chaotic, let’s not forget that “patience is a virtue”. As we’ve seen, smart car buyers will benefit significantly from holding off for the next 30 to 90 days. This brief period of waiting will yield better deals and greatly increased negotiability as dealers become eager to offload their inventory. It’s not about being lucky – it’s about being patient and strategic.

To navigate the changing used car market, consider getting expert help from CarEdge. Our CarEdge Data plan provides you with up-to-date, behind-the-scenes market insights that can help you seize the best opportunities. Featuring the latest Black Book vehicle valuations, CarEdge Fair Price and official recommendation for every listing, and three CarEdge Reports per month, you’ll have the tools you need to secure a great deal.

Likewise, a CarEdge Coach can guide you through the process, ensuring you’re equipped with the knowledge and confidence to make the most out of your car buying experience.

Remember, the savviest of car buyers follow the data, not the headlines. Stay patient, stay informed, and get ready to snag that excellent deal on your dream used car soon!