CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

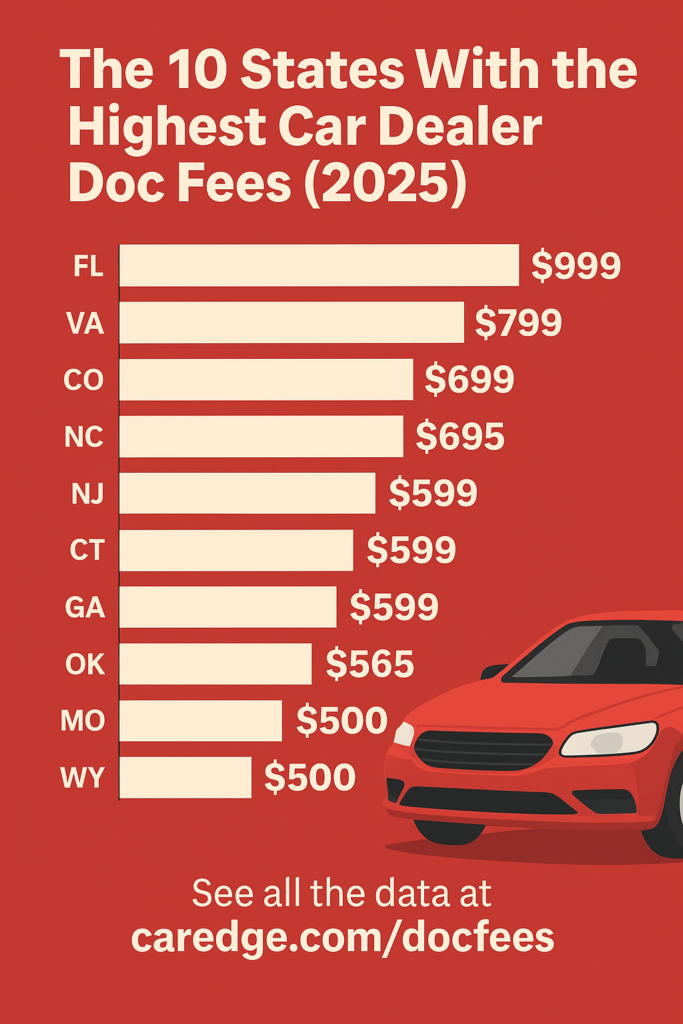

Through the ups and downs of the auto market, one thing remains the same: every state has a documentation fee. Also known as a doc fee, this isn’t like the other fees you’ll encounter. Be sure to familiarize yourself with what car dealer fees you should and shouldn’t pay.

The price of a car is never what it seems. There’s the selling price, the fees, the add-ons, and taxes. When it’s all said and done, you end up with the out-the-door price, and one of the line items you’ll see on your purchase agreement is a “doc fee”. Car dealer doc fees show up on EVERY car deal, and on this page we’ve aggregated all the car dealer doc fees by state for 2025.

Some states (like California and New York) cap the dealer doc fee. Others, such as Florida, don’t cap the doc fee. We’ve gathered the average doc fee that you should expect a dealership to charge in every state. If a dealer is charging more, you should try to negotiate the price down. Download this FREE negotiation cheat sheet!

We’ve also included the average title and registration fee you should expect to pay in each state.

| State | Average Doc Fee | Title Fee | Total Registration Fees | More Info |

|---|---|---|---|---|

| AK | $299 | $15 | $245 | More info |

| AL | $489 | $18 | $393 | More info |

| AR | $129 | $10 | $28 | More info |

| AZ | $499 | $4 | $564 | More info |

| CA | $85 | $25 | $524 | More info |

| CO | $699 | $7 | $595 | More info |

| CT | $599 | $25 | $180 | More info |

| DC | $300 | $26 | $185 | More info |

| DE | $475 | $35 | $45 | More info |

| FL | $999 | $75 | $297 | More info |

| GA | $599 | $18 | $20 | More info |

| HI | $395 | $5 | $78 | More info |

| IA | $180 | $25 | $333 | More info |

| ID | $399 | $14 | $126 | More info |

| IL | $347 | $155 | $151 | More info |

| IN | $199 | $15 | $38 | More info |

| KS | $499 | $10 | $80 | More info |

| KY | $450 | $6 | $26 | More info |

| LA | $425 | $77 | $64 | More info |

| MA | $459 | $75 | $60 | More info |

| MD | $499 | $100 | $187 | More info |

| ME | $499 | $33 | $40 | More info |

| MI | $260 | $15 | $128 | More info |

| MN | $125 | $8 | $69 | More info |

| MO | $565 | $9 | $57 | More info |

| MS | $425 | $8 | $719 | More info |

| MT | $299 | $12 | $237 | More info |

| NC | $699 | $56 | $370 | More info |

| ND | $299 | $5 | $123 | More info |

| NE | $299 | $10 | $83 | More info |

| NH | $375 | $25 | $51 | More info |

| NJ | $695 | $60 | $271 | More info |

| NM | $339 | $3 | $60 | More info |

| NV | $499 | $20 | $49 | More info |

| NY | $175 | $50 | $146 | More info |

| OH | $250 | $15 | $31 | More info |

| OK | $599 | $11 | $100 | More info |

| OR | $250 | $106 | $169 | More info |

| PA | $449 | $58 | $39 | More info |

| RI | $399 | $53 | $58 | More info |

| SC | $400 | $15 | $40 | More info |

| SD | $200 | $10 | $122 | More info |

| TN | $499 | $14 | $29 | More info |

| TX | $150 | $33 | $74 | More info |

| UT | $299 | $6 | $57 | More info |

| VA | $799 | $15 | $36 | More info |

| VT | $200 | $35 | $78 | More info |

| WA | $199 | $15 | $73 | More info |

| WI | $299 | $165 | $85 | More info |

| WV | $250 | $15 | $52 | More info |

| WY | $500 | $15 | $616 | More info |

In today’s market you will likely not be able to negotiate the dealer doc fee. That being said, we have this complete guide to car dealer fees you should never pay.

You can find this data incorporated into our out the door price (OTD) calculator. When you are shopping for a new or used car it is important that you understand the total “out the door” price that you will be paying. Dealers like to get you to talk about monthly budget, however the most important things is to negotiate the OTD price.

Registration fees and taxes are generally paid in the state where you reside and where the vehicle will be titled and registered. If you buy from a dealership, they may collect your home state’s taxes and registration fees at the time of purchase and handle the paperwork for you. This saves you lots of time and hassle. If the dealer doesn’t handle it, you’ll need to register the vehicle yourself at your local Department of Motor Vehicles (DMV) or equivalent agency. Unfortunately, vehicle registration fees are not negotiable, and are set by state law.

Here’s a look at vehicle registration fees by state as of 2025:

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

2023 Update: Major revisions to the EV tax credit were signed into law as part of the Inflation Reduction Act of 2022.

Here’s what you need to know about the latest EV tax credit revision proposal:

As you can see, the EV tax credit is becoming a lot more complicated.

All 755 pages of the Inflation Reduction Act can be read here. The EV tax credit begins on page 381.

The EV tax credit update is not all good news. Several popular electric models would be kicked out of the tax credit until assembly, battery production and raw materials sourcing happens in North America.

These are electric vehicles that would not qualify for the tax credit under the proposed revision:

Official eligibility is a moving target it seems. We recommend checking the latest updates directly from the U.S. government at fueleconomy.gov for a list of eligible vehicles.

But don’t forget about state incentives…

See the states with the BEST EV incentives, from sales tax exemptions to generous rebates!

In 2023, current EV tax credits are nonrefundable, meaning the best you can get from the current EV tax credit is cancelling out other federal income taxes you owe, with no refund beyond that. The revised electric vehicle tax credits will become refundable beginning in 2024, meaning you could potentially get money back from the government for simply buying an EV.

Thinking about buying an extended warranty? Get a free quote from CarEdge first!

Let’s break down the proposed 2022 EV tax credits. Don’t forget to check out the best state-level EV incentives too.

The Build Back Better Act would have increased the maximum electric vehicle tax credit to $12,500, however it was defeated in Congress. The BBB EV tax credit provisions controversially included an additional $4,500 incentive for EVs assembled at unionized plants.

The original EV tax credit in place from 2009 to August 2022 took away the incentive once an automaker sold 200,000 EVs or PHEVs. For this reason, Tesla and GM had lost eligibility, but are now getting it back (as long as vehicles remain under the price caps).

The new clean vehicle credit establishes the following income caps based on adjusted gross income (AGI):

Great news for Model Y buyers, but bad news for fans of the IONIQ 5, EV6 and several other foreign-made electric cars. The Inflation Reduction Act’s Clean Vehicle Credit returns incentives to some, and takes incentives away from others.

See the FULL list of qualifying electric vehicles here.

This page will update as we learn more about proposed updates to EV tax credits in 2022.

The latest on used car prices:

Used car prices typically follow seasonal patterns. Winter, and the fourth quarter are traditionally when the used car market experiences most of its yearly depreciation. So far, in this fourth quarter of 2021 used car prices have appreciated 5%.

We all know that used car prices have been increasing this year, and the latest data from Black Book suggests we’re going to continue to see used car values appreciate through the end of this year. That being said, we are starting to see some mixed signals from other data providers. Cox Automotive recently shared data that used car inventory levels have increased in November. Although used car prices have continued to increase, we could potentially be seeing a softening in the market if inventory levels continue to rise.

In this post we’ll run through the latest data on used vehicle values. We will update this page weekly as we get new data and information to share. If you have specific questions about used car prices please ask them on the CarEdge Community Forum.

To get the Black Book value of your vehicle you can do that here: https://app.CarEdgemember.com/trade-in

Let’s dive in.

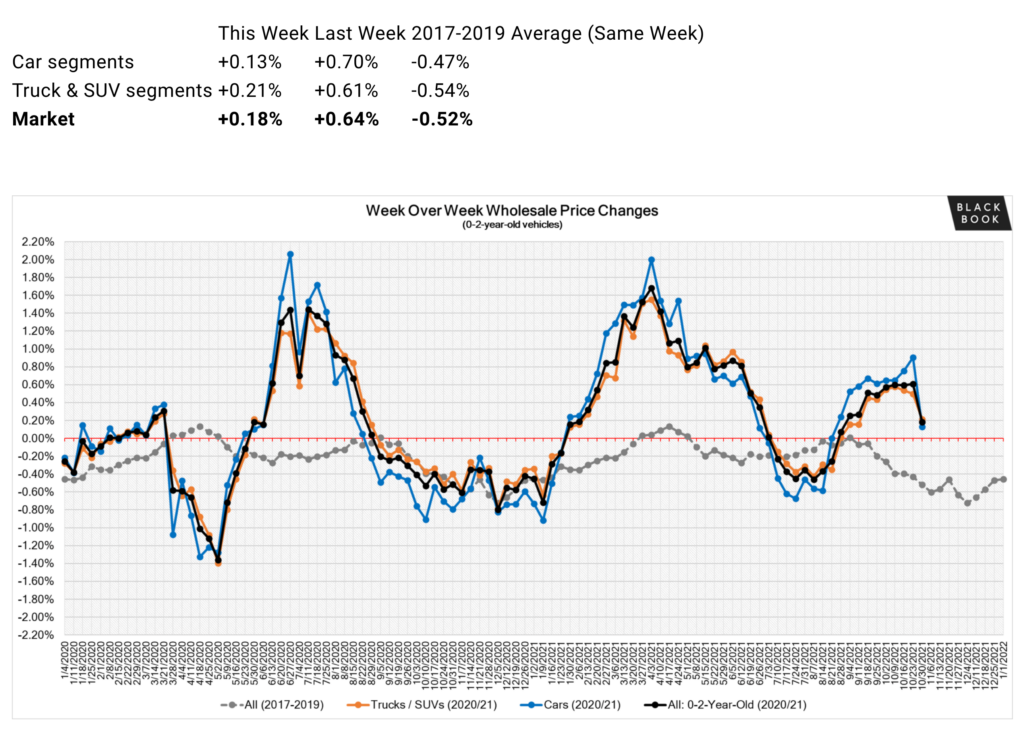

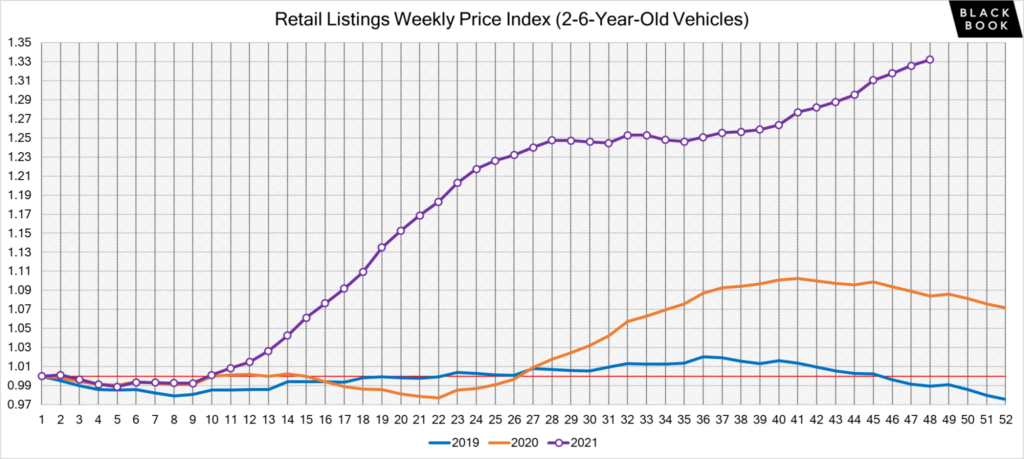

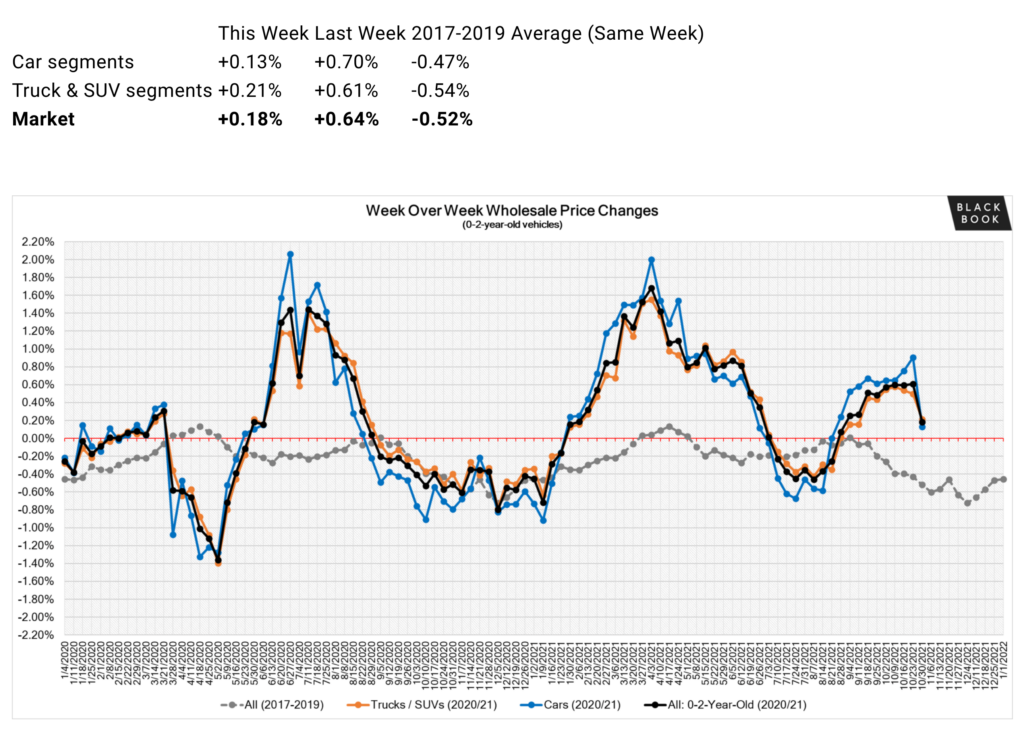

Wholesale used car prices have continued to increase. Data from Black Book shows that wholesale used vehicle prices have appreciated 48% in 2021 alone. The purple line represents 2021 wholesale weekly price changes. The blue line represents 2019 (the last “normal” year) of data we have. You can see drastic differences between the two lines.

As wholesale prices have continued their ascent, retail used car prices have followed suit. Retail used car prices are up more than 33% since the beginning of this year. Again, look at the purple (this year) and blue (2019) lines in the graph below. It’s incredible to see the stark difference between the two.

As you are likely well aware, used car prices have skyrocketed because of the ongoing chip shortage and lack of new vehicles. We have updated data on new car inventory levels for the month of November, and they are not pretty.

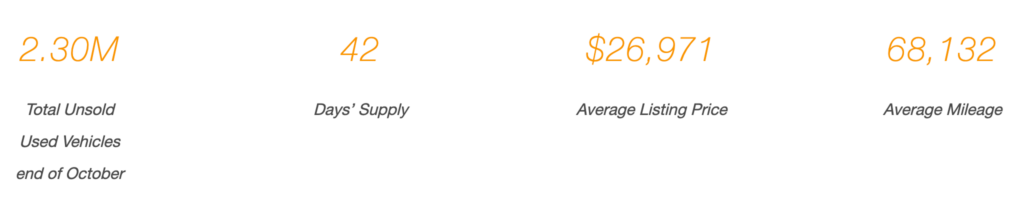

That being said, wholesale used car inventory levels have ticked up so far in November. Data from Cox Automotive showed positive signs in terms of inventory with October inventory levels up 200,000 units from September. September ended with 2.28 million used vehicles in inventory, while October ended with 2.30 million. October’s supply was still about 8% lower than 2020.

Cox also estimates the days supply of used car inventory. It is at 42 for the month of October, the same as September. Their data suggests that about 1.65 million used vehicles were sold in October 2021, up 400,000 units from the 1.61 million sold in September. October sales ran about 7% below the same year-ago period.

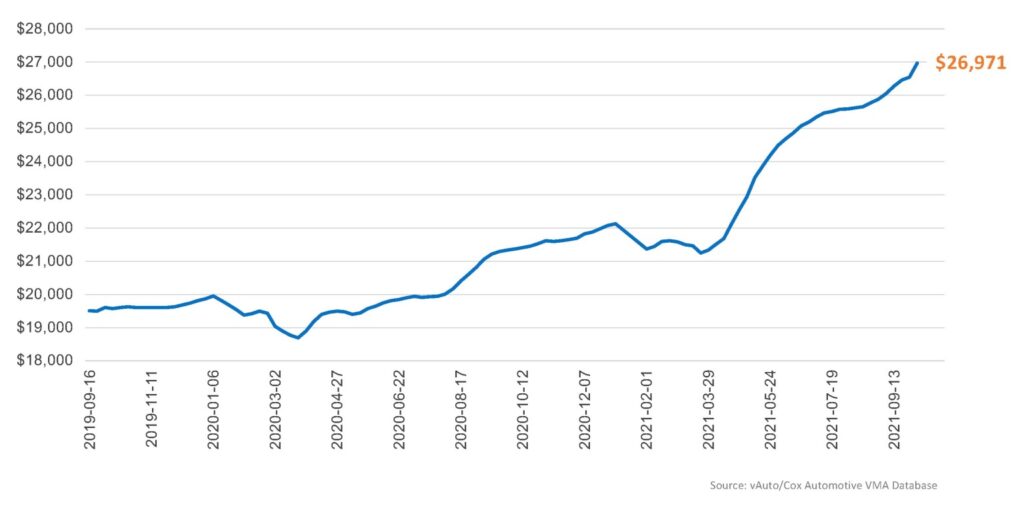

Both Cox and Black Book show retail used car prices hitting all-time highs. Cox has the average listing price for used vehicles at a new record of $26,971. That’s a $400 increase from September ($26,548).

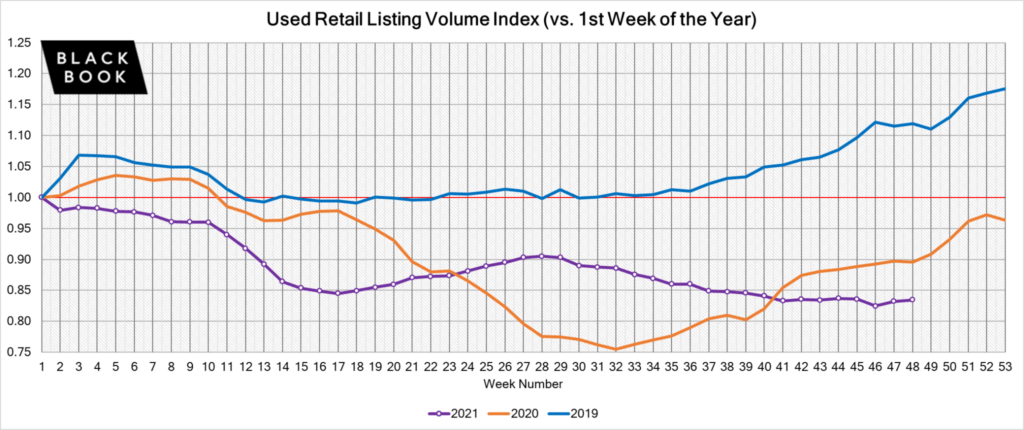

One of the most interesting data points Black Book tracks is used vehicle retail listings volume. This means how many used vehicles are listed for sale in the United States each week. Data from Cox suggests inventory levels are edging higher, and Black Books data shows the same thing. We see a slight week-over-week increase in retail listing volume.

Again, the purple line represents this year, and the blue line shows 2019. Typically we would see an increase in retail listing volume at this time of year, however right now the volume is still low and not increasing. This simply means there are less used vehicles for sale than earlier in the year, and the lowest level we’ve seen so far this year.

That being said, we did see another week of wholesale price increases, our 13th straight week of appreciation. Last week cars appreciated .70%. This week that sunk down to .13%. Trucks and SUVs increased .61% last week, and increased modestly by .21% this week. The used car market as a whole was up .18%, considerably lower than last week.

Toyota’s new car sales volume was down 29% in October. Toyota’s biggest sellers posted double digit declines in sales volume in October: Camry down 40 percent; RAV4 down 39 percent; Tacoma sales declined 38 percent; Highlander off 19 percent and Corolla sales off a staggering 61 percent.

It wasn’t just Toyota. Honda sales volume dropped 24% in the month too.

Used car prices will continue to appreciate as long as automakers are struggling to produce enough new vehicles. These recent earnings reports highlight how much the major manufacturers are struggling to stock their dealer’s lots.

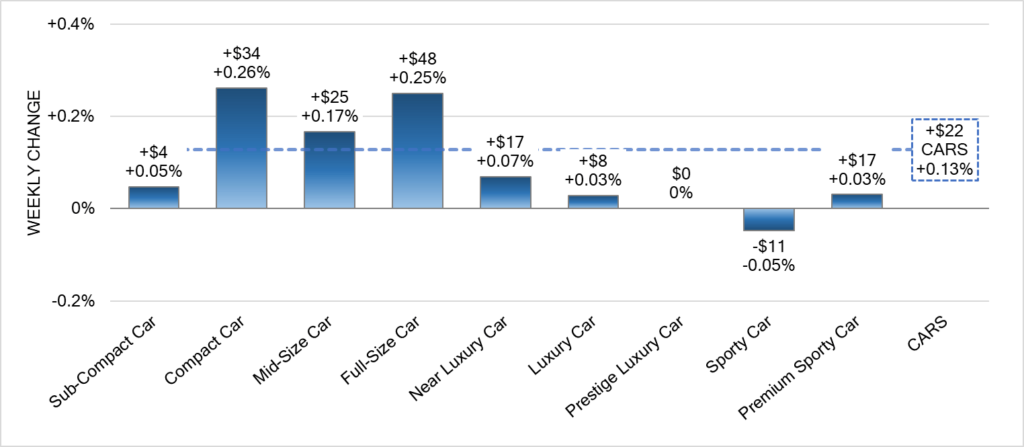

Black Book supplies us with compelling data on the change in used car prices broken down by segment of vehicle. This past week compact cars appreciated in value the most. These are your Subaru Imprezas, Ford Fiestas, Nissan Versas, Mazda Mazda3s, Ford Focus, etc.

Sporty cars are finally depreciating! This time of year is seasonally when sports cars depreciate the most.

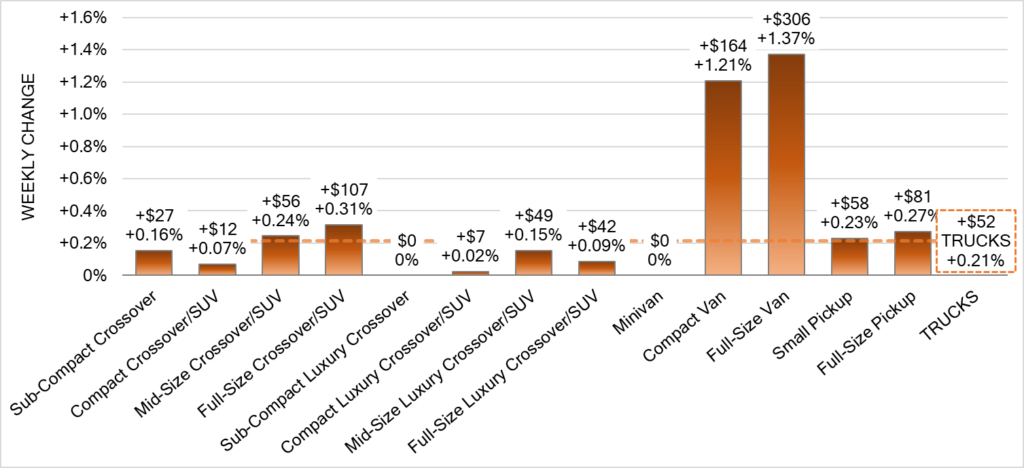

Compact vans and full-size vans continue to increase in value rapidly. Their value increased well over 1% week-over-week. Full-size vans have increased in price 42 out of the past 43 weeks.

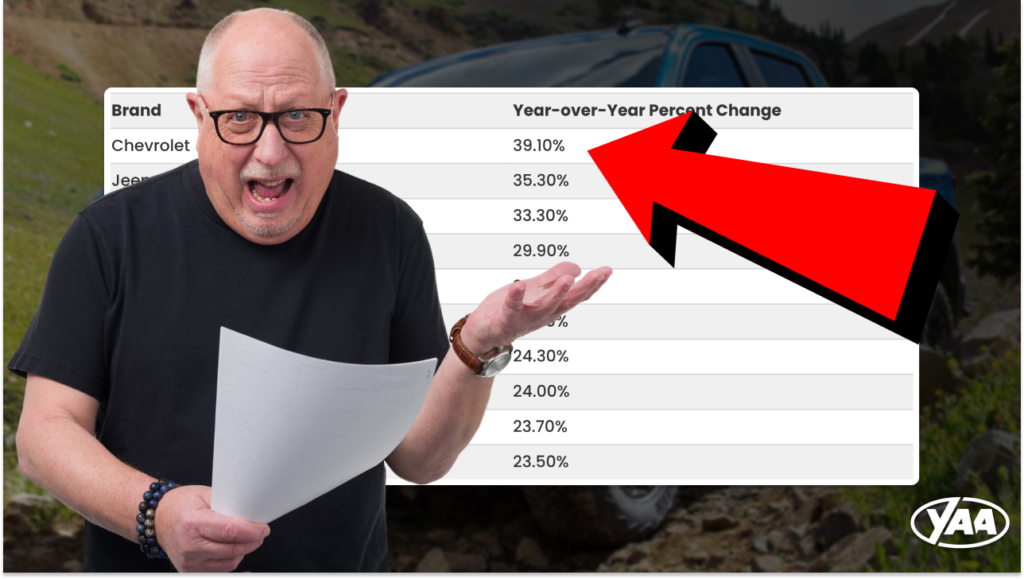

We recently published data on which brands have seen their new and used prices increase the most (and least) year-over-year: https://caredge.com/guides/which-brands-prices-have-increased-the-most-least-in-2021/

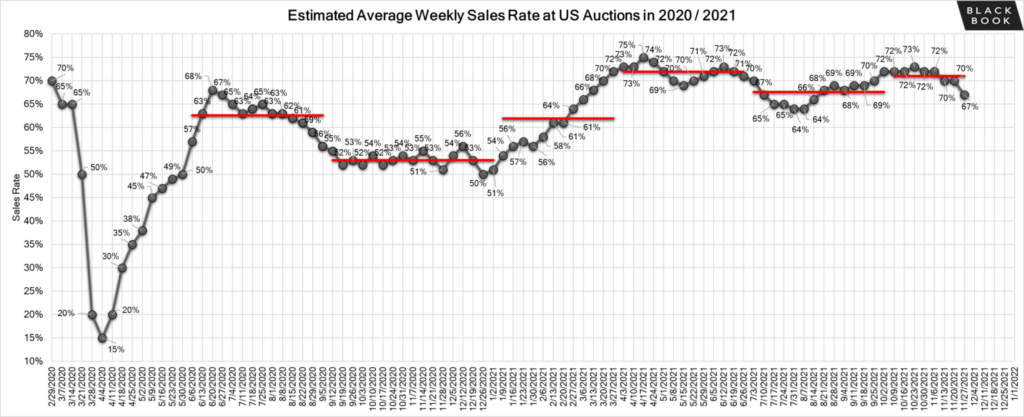

Black Book provides “sales rate” data from the wholesale used car auctions.

Directly from Black Book:

The weekly estimated average sales rate has remained stable at the 70% mark for the 2nd week in a row. This time last year, the estimated average weekly sales rate was around 51%, so while floor prices continue to rise, buyers continue to purchase vehicles at auction at a higher rate.

Typically the holiday season signals an increase in newer used vehicles. This is because of lease returns and rental vehicles coming to the auction. This year that is not happening to previously expected levels. While there was a slight uptick in newer model year vehicles rolling across the lane this past week, a significant portion of vehicles are arriving damaged.

Franchise car dealers are grounding lease returns and not sending them to auction. Fierce competition at the auctions can be mostly attributed to large independent dealerships and rental companies. Because of inventory scarcity, we have seen bidding wars across the country. Wholesale values and floors continue to increase and give no indication of slowing down.

We’ve heard stories from our community of similar experiences at the auction, and it appears that rougher and rougher vehicles are crossing the auction block at this time.

No. From all of the data we’ve been able to get our hands on, it looks like there isn’t a single style of vehicle or particular nameplate that is not increasing in value right now. We know that certain vehicles are appreciating less than others, however all vehicles are increasing in value right now.

Luxury vehicles, and in particular luxury SUVs are appreciating much less rapidly than other vehicles. Take for example the Mercedes-Benz GLC, it has only appreciated 8% year over year. This further reinforces the theory for why the Mirage has increased in value nearly 50%; consumers need affordable and attainable used cars, not expensive and luxurious ones.

Although our crystal ball has been notoriously cloudy here at CarEdge, we feel confident in saying that used car prices will continue to increase well into 2022. Even when automakers get production back up to speed for new vehicles, there will be lingering effects from this period of time where they have not been able to produce at expected capacity.

Also, the price to produce new vehicles has gone up. As a result of the chip shortage (and other supply chain issues), we expect MSRP on new vehicles to be considerably higher than before. Why? Because the manufacturers costs are increasing, and they will likely pass that along to the consumer. As a result, the demand for used cars will continue to be high because used cars (especially vehicles like the Mitsubishi Mirage) will be the only “attainable” price point vehicles for many people.

For these reasons, we think week over week, and month over month used car price increases will continue for at least another 12 months.

If used car prices are likely going to continue to appreciate, it would make sense to hold onto your used vehicle and wait to sell it. That being said, our best recommendation is to track the value of your used vehicle weekly. To do this we encourage you to use the “value my vehicle” section of your CarEdge account. You should also get quotes from Carvana, Vroom, CarMax, etc.

There may be small fluctuations in price from week to week, but we expect the price of your vehicle to gradually increase overtime. The indicator for when to sell will be when you see week over week declines in the value of your vehicle.

Our recommendation has been, and will continue to be to stop buying cars! We’re so passionate about this that we even made a website: http://stopbuyingcars.com/

However, if you need to buy a used car right now, here’s what you need to remember.

The only way to know if you’re getting a fair deal is to get the out-the-door price from the seller and then compare that to the vehicle’s value. To get the out-the-door price follow this guide:

To know if the vehicle’s price is fair, we encourage you to run the VIN through the CarEdge vehicle valuation page and to also get a quote from Carvana to see what they would pay to buy the car right now. If the Carvana quote is close to what you are paying for the vehicle, then it’s likely a pretty fair deal.

In today’s market, with “rougher” used cars for sale it is critically important that you get a pre-purchase inspection done on the vehicle you are thinking of purchasing. We have heard too many horror stories of people buying used cars “as-is” and then getting stuck with a piece of junk. Avoid that, and get a PPI!

Last but not least, consider getting an extended warranty on your used vehicle. CarEdge partnered with AUL Corporation to sell extended warranties with a flat markup, transparent pricing, and free consultations with an Auto Advocate. If we can help you protect your use car, we want to. More on that here: https://caredge.com/extended-warranty/ and request a free quote here: https://app.CarEdgemember.com/service-contract

Buying a car is already a complex process, and purchasing a vehicle in another state can make it even more overwhelming. With inventory levels fluctuating, many car buyers are expanding their search beyond to find the right vehicle at the best price. We’ll walk you through the entire process, from understanding the steps involved to figuring out tax requirements and transportation logistics.

Buying a vehicle in another state is eerily similar to buying a car at your local dealership with a few exceptions. The steps to the sale are:

At a high level, that’s how you buy a car in another state. Let’s break each step down a bit further.

As with any car deal, the first step is to negotiate the OTD price with the salesperson or sales manager. When buying a vehicle in another state you’ll likely be unfamiliar with their taxes and fees. It is incredibly important that you tell the dealership what your zip code is so that they can calculate your taxes and fees based on your location. We’ll touch on this more below, but taxes are paid where you register your vehicle, not where you purchase it. If the dealership doesn’t know your zip code, they won’t be able to provide you with an accurate out the door price quote.

We strongly recommend that you reference the CarEdge OTD Price Calculator to verify that the dealership’s OTD price matches up with the correct tax, title, and registration rates in your state.

Do you know what happens if you arrive at the dealership without a competitive financing pre-approval in hand? The finance office will be THRILLED because to the dealership, they instantly realize they have the upper hand.

Dealers routinely mark up finance offers before presenting them to customers. It’s one way they make money. Be sure to bring a competitive financing offer from a credit union!

If you’re purchasing a used vehicle from another state there are a few extra considerations you should be aware of. First, you should absolutely consider arranging for a pre-purchase inspection to make sure the vehicle is in good working condition. Second, you’ll need to ensure the vehicle can pass your state’s inspection and emissions testing. By conducting a pre-purchase inspection you’ll likely become aware of any issues that would preclude the vehicle you’re thinking of buying from passing your state’s inspection.

To arrange for a pre-purchase inspection from out of state you have a few options:

After an inspection report has been received and you’ve agreed to an OTD price, you’ll want to place a deposit down on the vehicle. When buying a vehicle in another state, the last thing you want to do is fly there, or arrange shipping, only to see the price change at the eleventh hour. To protect yourself from last minute changes, place a deposit on the vehicle, and also request to sign a copy of the buyer’s order. Request that the sales manager at the dealership does the same too.

The final step in the out of state purchase process is to take delivery of the vehicle. This is when you will meet with the Finance and Insurance Manager to review loan options and insurance products. As with buying a vehicle locally, you can (and should) come in pre-approved with outside financing and extended warranty coverage quotes.

Depending on what state you are purchasing the vehicle from, you may be able to “take delivery” remotely (sign all the paperwork electronically) and have the vehicle shipped to you. More on that below.

Yes, if you buy a car in another state you can drive it back home to where you live. Unless of course you decide to buy a car in the state of Massachusetts …

In every state except Massachusetts you will receive a temporary license plate from the state where you purchased the vehicle. This temporary tag (also referred to as “drive off tags”) will allow you to legally operate the vehicle after purchasing it.

When you arrive back in your home state you will then go to your local department of motor vehicle and register the vehicle. This is when you will receive your permanent plates for the vehicle.

Why is Massachusetts different from all the other states? That’s a great question. Their laws around vehicle registration are infuriatingly complex and cumbersome. Auto Influence wrote a great article on the Massachusetts Problem here: https://www.autoinfluence.com/the-ins-and-outs-of-temporary-plates/

When you purchase a vehicle out of state, you pay taxes in the state where you register the vehicle, not where you purchased it. The actual process of calculating the correct tax amount and remitting it to your home state can be handled differently.

For example, if it’s a neighboring state, the dealership where you purchase the vehicle will collect and remit the taxes and fees for you. You’ll then receive your permanent plates and registration in the mail. Many dealerships have software that allows them to calculate the proper sales tax and registration fees for different states, and in neighboring states they may feel comfortable handling that for you.

If you’re buying from a further away state, or if the dealership doesn’t offer to handle tax and registration remittance for you, you should contact the dealership’s title department to see if they can walk you through the steps you’ll need to take back in your home state. At this point it is also helpful to consider contacting a local dealership and asking them for assistance too. If you have a local tax professional they would also be able to help. You can of course also refer to your state and local tax laws and remit payment on your own.

Let’s say you purchase out of state and you pay for sales tax, but it is the wrong amount. What happens then? When you go to register your vehicle at your local department of motor vehicle you will either receive a credit from them, or you will owe them additional money.

Yes, absolutely. This is a very common practice and could financially make a lot of sense for you. The dealership where you purchase the vehicle may recommend a particular shipping company and you should see what their quote is. You should also shop the quote and get bids from other providers as well.

Shipping options will range from open air freight to closed container shipping.

When you buy with CarEdge, we ship your vehicle to you. Learn more about the benefits of buying with CarEdge.

Yes. The registration process is different in each state, however you can buy a vehicle in one state and register it in your home state. You’ll need to make sure the vehicle can pass your state’s emissions test and road worthiness inspection.

You’ll also need to confirm that the vehicle title is clear of any liens.

If you’re buying a vehicle in another state and you have a trade-in, you should strongly consider treating your trade-in as a separate transaction from your purchase. More on that here: https://caredge.com/guides/car-trade-in/

Yes, you can lease a vehicle from another state, however some dealership’s will not allow you to. The complexity of out-of state leases is high, and some dealerships do not want the burden of mistakenly calculating the wrong taxes and fees on a lease. Before negotiating an OTD price with an out of state dealership, we would encourage you to ask them if they’re willing to lease you the vehicle with you being from another state. Be prepared to give them your zip code since each state treats leases differently.

In conclusion, buying a vehicle in another state can seem like a daunting task, but with the right knowledge and guidance, it can actually be a smart move that saves you money. By taking the time to research the laws and regulations in the state you plan to buy from, and working with a reputable dealer or private seller, you can find the car of your dreams without breaking the bank.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download.

In 2025, more drivers are opting to “factory order” a vehicle instead of buying one off the lot. This trend began during the new car shortages of the pandemic, and has stuck around ever since. For many car buyers, factory ordering is an unfamiliar purchase process and can be intimidating. We’re here to help you make sense of it all.

Everyday on the CarEdge Community Forum we field questions such as:

We’ll address these questions (and more) below.

Let’s dive in.

The steps to factory order a car isn’t too terribly complicated, however, for many, it’s an entirely unfamiliar process. Because of the ongoing chip shortage, many dealerships will likely proactively ask you to order a vehicle instead of purchasing one on their lot. Here’s the roadmap for factory ordering a car in 2025:

The simple “18 steps to factory order a car” … Simple, eh? Let’s break things down a bit more.

Can you negotiate on a factory order car? Yes, yes, yes. You can, and you should negotiate the price of your factory ordered vehicle.

There is a common misconception that because you are “custom ordering” a vehicle you cannot negotiate with the dealer, simply because it is “custom”. That couldn’t be further from the truth. From the dealership’s perspective a factory order is just like any other car deal. It’s a piece of inventory that they’ll make front-end and back-end profit on. As a customer, you should treat it the same way too.

So when do you negotiate on a factory order? At the time of placing the order. Not when you take delivery of the vehicle!

This is another common misconception when it comes to factory ordering a car. You need to negotiate when you first place the order, not when you take delivery. Why? Because the dealership treats the ordered vehicle similarly to any other sales. When your salesperson/sales manager is putting together the “deal jacket” (industry lingo for all the paperwork associated with your car deal), they will have an out-the-door (OTD) price associated with the deal. That OTD price shouldn’t be MSRP + fees + taxes + tags/registration. Instead, if you negotiate with them it should be MSRP – dealer discount + fees + taxes + tags/registration.

Enjoying this guide Check out The Car Buyer’s Glossary of Terms, Lingo, and Jargon

If you don’t negotiate with them then, the assumption is that the deal is at MSRP, and your leverage (once the vehicle is on the dealer’s lot) is lesser. Especially in the current market where inventory is so scarce.

It’s also important to negotiate the price upfront, because you want to “lock-in” the price so that there are no surprises when you finally take delivery. More on that below.

What can you negotiate when you factory order a vehicle? It’s simple, all the same things you would negotiate when you purchase a car off the lot. Remember, if it’s taxable, it’s negotiable!

Negotiate on taxable fees (doc fees, processing fees, etc.), and on the vehicle’s selling price. In today’s market be prepared to negotiate off additional dealer markup. This has become very common because of the lack of supply.

We encourage you to read success stories from other CarEdge community members to hear what types of deals they have been able to secure, and how they did it.

Manufacturers incentives are applied at the time you take delivery of the vehicle, not at the time of placing the order. For example, if you order a truck today you will negotiate the OTD price with the salesperson and sales manager today. You will then take delivery of the truck 8 weeks later. At that time you will be eligible for any applicable manufacturer incentives that are currently active. You will not be able to retroactively receive the incentives that were in place when you ordered the vehicle.

That being said, you can ask the sales manager to see if they can “lock-in” the current incentives on the deal, however they likely will not be able to.

Negotiating a factory ordered vehicle is very similar to negotiating a vehicle that is on the dealer’s lot. If you are unfamiliar with that process, please consider going to Deal School, or signing up for a CarEdge Membership so that we can help you.

That being said, there is one distinct difference between negotiating a vehicle on a dealer’s lot and one that is ordered. That distinction is floor-plan assistance.

What the heck is floor-plan assistance you wonder?

You may be more familiar with “holdback” which is a form of “under the line” profit that dealerships collect from the manufacturer. In addition to holdback, dealerships also receive floor-plan assistance and advertising assistance from their manufacturer.

Floor-plan assistance is a set aside amount of money for each vehicle (it appears on most dealer invoices) that the manufacturer gives to the dealership to offset the interest expense associated with “floor-planning” the vehicle. You may not have known this, but car dealerships do not pay cash for their inventory. They finance it, just like you or I would. That means they have an interest expense on each vehicle that is on their lot.

Floor-plan assistance helps offset this cost for the dealership.

Why is this important? Because since you are factory ordering your vehicle and will likely take delivery within a few days of it arriving at the dealership, the dealer will not incur any meaningful interest expense. That means the floor-plan assistance from the manufacturer is pure profit for them.

As you can tell by now, factory ordering a car is very similar to purchasing a vehicle straight off the dealer’s lot. It isn’t too terribly different, however there are some distinct changes in the process. That being said, are there any particular “red flags” you should watch out for when placing a factory order? The answer is “yes”.

This is a major red flag. If the dealership isn’t willing to negotiate on the price when you place the order you can guarantee that two things will happen when the vehicle does arrive:

We’ve heard too many stories of people “ordering” a vehicle and not negotiating the price in advance, only to have a nasty surprise when it finally does arrive at the dealership.

Dealer-installed accessories are added by the dealer when they receive a vehicle. You’ve likely seen these on an OTD price worksheet in the past. Things like wheel locks, or LoJack are common dealer-installed accessories.

A common line you’ll hear from a salesperson or sales manager is “we can’t take that off, we put it on every car.” Well, the great thing about factory ordering a vehicle is that the dealership doesn’t have to install any of their accessories, because you’ll take delivery as soon as the vehicle arrives.

If the dealership is persistent about not removing them, that’s a red flag, because it’s a truly illogical argument.

You’ve negotiated your OTD price and you’re ready to put down a deposit to hold the vehicle. Woohoo! The only way to really make the agreed upon OTD price legitimate is to have a mutually signed buyer’s order. That, plus the deposit and the signed build sheet, make it clear that the price is the negotiated price.

If a dealership won’t sign a buyer’s order, that’s a red flag. You don’t want to arrive the day your vehicle is ready only to find out that the negotiated selling price you had is no longer agreeable to the dealership (this has been happening with more and more frequency as of late), and the only way to protect yourself from that is to have the signed agreement.

If they won’t do it, that’s a no-go.

When you factory order a car you will need to put down a deposit on the vehicle. This is typically $500 to $1,000. If the dealership does not request a deposit, or if they won’t accept your deposit, that means the vehicle you’re “ordering” isn’t really your vehicle. Just like the signed buyer’s order, if you can’t get a deposit down, you’re in for a rude surprise when the vehicle finally does arrive.

To “lock-in” your build and the OTD price, have both the dealership and yourself sign a buyer’s order, and put down the requisite deposit amount that they require.

This is an unfortunate, albeit common occurrence. If you’ve followed our steps and placed an order and then the dealership has gone silent, be sure to go up the chain of command at the dealership to contact someone in a leadership position to get information about your order. This is all about being your own advocate. We encourage you to use our email templates when contacting the dealership.

Have other questions about factory ordering? Please post them on the CarEdge Community here: https://community.caredge.com/home

We hope this helps. Please consider sharing it with anyone you know who might find it valuable.