CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

The last time a car commercial grabbed your attention with an attractive lease deal, you were probably bombarded with a flurry of rates, payments, and terms squeezed into a mere thirty seconds. So, what exactly is a car lease?

An auto lease is a long-term rental agreement for a vehicle, governed by specific terms and conditions. The lease terms are mutually decided by the customer and dealership. Intriguingly, a third-party leasing company takes actual ownership of the vehicle and then leases it to you.

Let’s dissect a vehicle lease agreement into its four primary components:

These core factors dictate the overall cost of the lease, subsequently influencing your monthly payment.

Let’s take a closer look at each of these four parts of an auto lease. Once we’ve covered the basics, we’ll familiarize you with the parts of a lease contract, so you know exactly what you’re getting into. Skip ahead to the example here if you like.

The cap cost diverges from the out-the-door price, which integrates the vehicle price with all taxes and fees. Instead, you negotiate the cap cost during a lease, representing the sum the leasing company pays for the car. This figure typically includes:

It’s important to note that some of these expenses, like security etching or nitrogen-inflated tires, are negotiable. To provide context: a $1,000 increase in cap cost approximates to an additional $27 monthly on a 36-month lease.

Before committing, scrutinize every detail of the buyer’s order, distinguishing legitimate fees from the negotiable ones.

We’ll take a look at the parts of an auto lease contract in a bit, or you can skip ahead to it here.

This value mirrors the car’s projected worth at the end of the lease. Depreciation during the lease term is what you’re paying for. If, for instance, the residual on a 36-month lease stands at .75 (75%), you’re essentially covering the 25% anticipated depreciation over that period.

Residual values, set by the leasing company, vary depending on the yearly mileage you’re permitted (standard figures being 7,500, 10,000, 12,000, or 15,000 miles). Dealerships cannot modify these values, with the sole exception being adjustments for additional allowed mileage. This residual is disclosed, highlighting what you’d need to pay if you wish to purchase the vehicle at the lease’s end.

Similar to an interest rate on a car loan, the money factor can be marked up, benefiting the dealer. Dealers typically receive a money factor (for instance, .00125) from a lender, and might mark it up by 50 to 100 basis points. The disparity between this base rate and the marked-up rate translates into profit for the dealer.

Pro Tip: Always aim to haggle the money factor close to its buy rate.

Sales tax varies state-by-state. See your state’s tax rates here. While most states append the tax to the lease’s total price, others like New York, New Jersey, Minnesota, Ohio, and Georgia impose it upfront on the overall lease payments. Virginia, Maryland, and Texas, on the other hand, tax the total selling price (cap cost). Though non-negotiable, understanding your state’s tax nuances is crucial for understanding what you can afford in any car deal.

At CarEdge, we’re always working on something new to help demystify car buying, car selling, and ownership. If you’re considering a new car lease, estimate your monthly payment in seconds with our latest free tool: our car lease calculator.

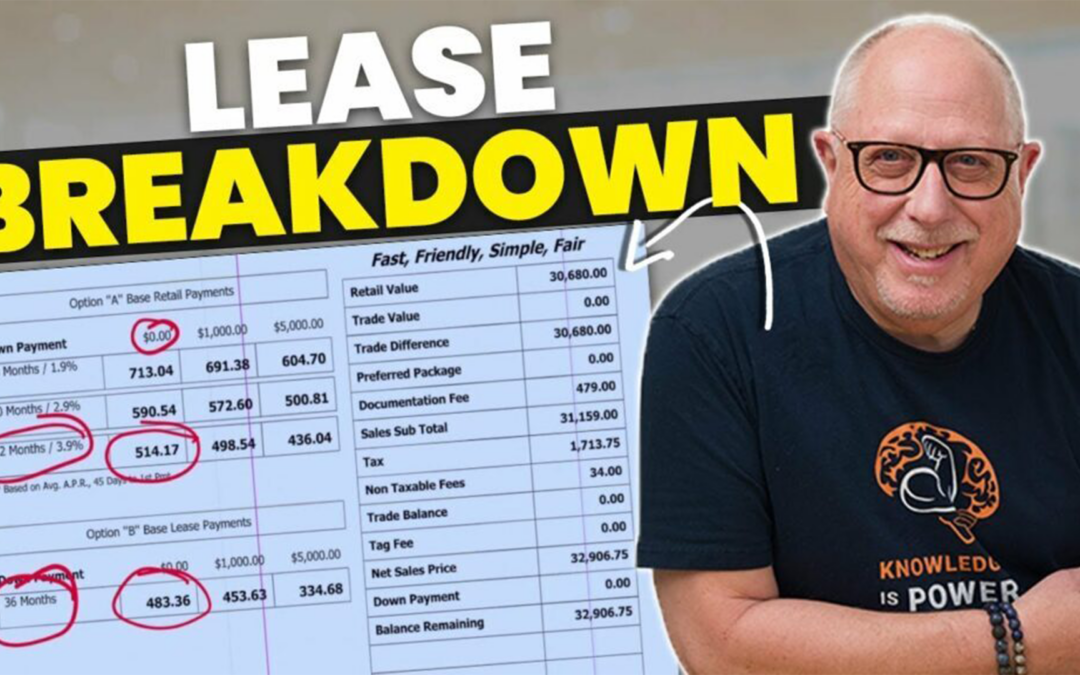

There’s no better way to learn than to work through a real example. That’s exactly what we’re about to do by breaking down the parts of a real auto lease contract.

In this image, we can see the first few lines of a lease contract. Expect this portion to contain the contact information for you and the lessor, who is the dealer. There will also be information about the specific vehicle you are leasing. Make sure the VIN number matches the car you want! If you have a trade-in, that information will be listed here too.

The next part of your vehicle lease agreement includes some very important information. First, check the ‘Amount due at lease signing’, which is box #2 in our example. Does it match the deal you’re expecting?

Now let’s move on to box #3. Check the box for the remaining months of payments after the first payment. This number should say 23 if you’re signing a 24 month lease, 35 if you’re signing a 36 month lease, and so on. This is how you confirm that you’re getting credit for the first month’s payment, which is due at signing in most cases.

Below that, you’ll see an itemized list of what you’re paying at lease signing. Pay attention to the details in section 6.

You should see the license, title, registration and tax fees listed. You’ll also see the Doc Fee, which varies by state.

Pay careful attention to the line items that may be dealer add-ons that you don’t want. In section 6 in our example, lines A.11 through A.13 are where we would see this.

Section 6.B line #2 is where you would see any rebates or incentives you’re expecting. If you’re expecting an electric vehicle tax credit, for example, it should be shown here.

Now, make sure the ‘Total’ number equals what you expect.

The above section explains how your monthly payments are calculated. It can be tough to follow, but we’ll highlight which parts are most important to double-check.

Section 7.A is the total price of the vehicle, which should be MSRP, or ideally discounted from MSRP, plus any additional fees you agree to.

In this example, the total price includes the agreed upon selling price of $57,409 plus the acquisition fee of $650 and the electronic filing fee of $33 for total price of $58,092.

Double check this number. If the gross capitalized cost is higher than you’re expecting, find out why. Is there a dealer markup on the vehicle? You’re paying more than you should if so.

What is a ‘rent charge’, you ask? The rent charge is the total interest that is paid during the term of the lease. The rent charge is based on the agreed upon money factor used in the lease calculation.

Ensure that the allowed mileage matches what you expect. Learn what the excess mileage rate is if you exceed the limit.

Towards the end of this section, you’ll see the ‘total monthly payment’. Is this what you expect? This is how much you’re agreeing to pay every month.

You need to make sure that the discounted selling price that you negotiated matches line A in section 11. Section 11 line B will also list any accessories or options that you have agreed to be added to the selling price, such as excess wear and tear protection, tire and wheel insurance or even a service contract. Please make sure that nothing has been added that you have not agreed to.

Read the first line in bold. You do NOT have to purchase add-ons or protection products to enter into the lease. No matter how hard the salesperson pitches their value, remember that you can say no. If you do agree to any, they should be listed here.

The total taxes to be paid for the lease are included. Make sure this number is what you expect. Taxes and state fees are estimated because if the state increases the sales tax rate or vehicle registration rates during the term of your lease agreement you will have to pay the new rates and fees.

Below these first few pages of the car lease agreement, you’ll have standard disclosures for your auto insurance policy information, vehicle warranties, and additional terms and conditions. Wondering what happens if your leased car gets stolen? You’ll find that information here.

Every week, our team of Car Coaches helps hundreds of drivers negotiate the best lease terms. It’s a commonly held misconception that leases aren’t negotiable, but that’s far from the truth. With basic knowledge of how to navigate an auto lease contract, you can stay in control of your deal.

Ready to work with an auto industry insider for the most savings? Here’s how we can help.

We also have hundreds of free resources, including these reader favorites:

Stop by the CarEdge Community forum! We’d love to see you there.

As the seasons transition, so does the car market! September has welcomed surprisingly great new car incentives from some brands, and pathetic offers from others. Auto manufacturers are eager to push 2023 models into the limelight before the new year arrives. If you’re in the market for a new car, now’s your golden opportunity. Here’s a roundup of the most enticing offers for buying and leasing.

The highest interest rates in 20 years are not stopping OEMs from launching great financing deals in September. In fact, we were shocked at the abundance of 0.0%-0.9% APR offers. Automakers likely see this month as the last chance to sell 2023 models before they take on a dated feel. Some of your favorite brands are offering jaw-droppingly low interest rates.

Let’s take a look at the best of the best. For a complete list of new car financing offers, head to this resource.

Hyundai: As low as 0.9% APR for all 2023 models, including the popular Palisade, Santa Fe, Sonata and more. The IONIQ 5 EV also qualifies for up to $7,500 in cash incentives. See details at HyundaiUSA.com.

Kia is also offering 0.9% APR financing for all 2023 models for well-qualified buyers. See details at kia.com.

Honda: 0.9% APR for the Honda Accord (including Hybrid), Civic Hatchback, Civic Sedan, CR-V, HR-V, Odyssey, Passport, Pilot, Ridgeline. See details at Honda.com.

Toyota: 1.9% APR financing. See details at Toyota.com.

Chevrolet: 0% financing for the Silverado 1500, and no payments for 90 days (Truck Season Sale). Trailblazer, Equinox, Blazer, Traverse all qualify for 2.1% APR. For all other models, including the Tahoe, Suburban, Colorado and Bolt, Chevy says to contact a dealer for the latest offers.

Ram, Ford, Nissan: Can you believe it? A straight 0.0% APR for many 2023 models. Unfortunately, the automakers say you must contact a dealer for specific offers.

Mazda: As low as 0.9% APR for all 2023 models, including the CX-30, CX-9, and other models.

GMC: APR as low as 0.9% for most models, including the Sierra 1500, Terrain, Yukon, and more.

When it comes to cash incentives, electric vehicles are stealing the show. Especially those not falling under the revised federal EV tax credit. Here’s where you can save the most:

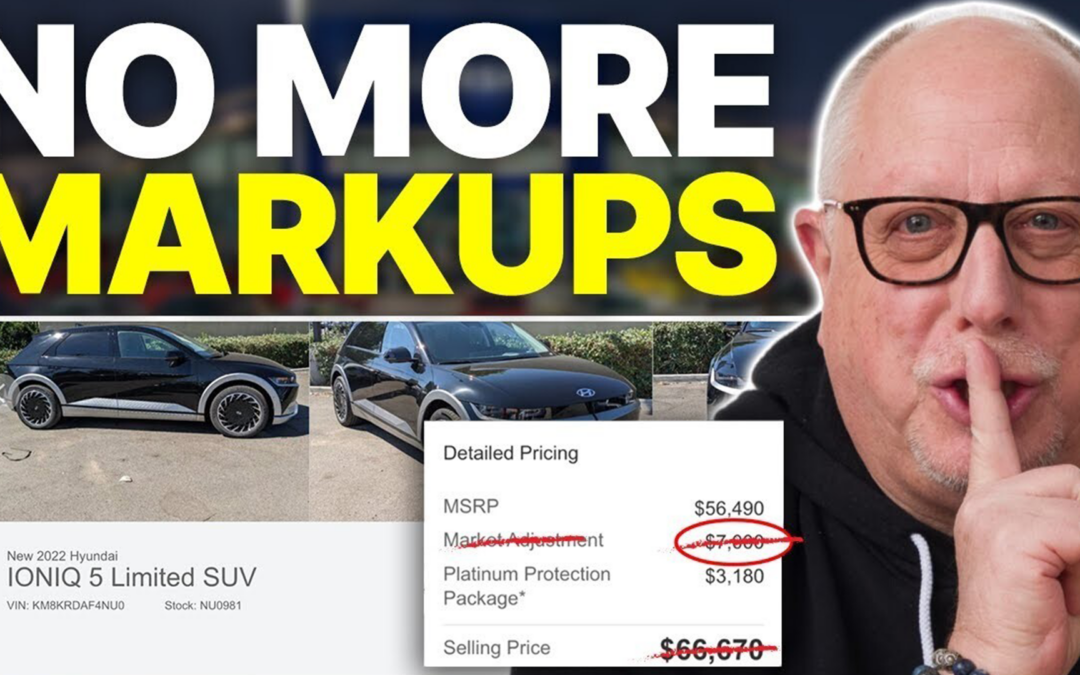

Hyundai IONIQ 5: A huge $7,500 off for some trim options. Caution: some dealerships continue to mark up their Hyundai EVs. The deals ARE out there! See details at HyundaiUSA.com.

Kia EV6, Niro EV, Chevrolet Bolt: Up to $5,000 off. Learn more about Kia deals at kia.com and see Chevrolet offers at chevrolet.com.

Toyota bZ4X: Another whopping $7,500 off. Caution: Toyota’s first EV charges slowly. Think about your charging needs and preferences before buying any EV. Learn more about this offer at Toyota.com.

Nissan Ariya (all-new) and LEAF: $3,750 cash incentive. See details at NissanUSA.com.

Ford: An enticing $3,000 off for both the Mustang Mach-E and F-150 Lightning. See details at Ford.com.

Toyota Prius Prime PHEV: Up to $4,500 off. Learn more at Toyota.com.

Stellantis is bringing stellar new car incentives this month, but their bloated inventory numbers show that they may have no choice. They are offering almost 15% off MSRP for some models, including the Jeep Cherokee, Gladiator, and others. This translates to up to $7,000 for higher trims. And for the Ram 1500? Up to $4,000 off the MSRP!

Ready to drive the latest models without the long-term commitment? Here are the most attractive lease offers.

We detail ALL of the best lease deals from every major brand here.

Hyundai Venue: $151 per month with $3,281 due (Details)

Hyundai Kona: $202 per month with $4,212 due (Details)

Hyundai Elantra: $219 per month with $3,499 due (Details)

Kia Forte: $229/month for 36 months with $2,799 due (Details)

Subaru Legacy: $269 per month for 36 months with $3,255 due (Details)

Honda Civic Sedan: $259 per month for 36 months with $3,399 due (Details)

Toyota Corolla: $321 per month for 36 months with $3,031 due (Details)

Chevrolet Equinox: $299 per month for 24 months with $2,339 due (Details)

GMC Acadia: $289 per month for 24 months with $2,999 due

Mazda CX-30: $301 per month for 36 months with $2,999 due at signing. (Details)

Hyundai Santa Fe: $269 per month for 36 months with $3,999 due (Details)

Honda CR-V: $309 per month for 36 months with $3,399 due (Details)

These are the best truck lease deals right now:

Ram 1500: $359/month for 42 months, $5,599 due at signing (Details)

Silverado 1500 4WD LT: $399 for 24 months with $5,124 due (Details)

Toyota Tacoma: $364 per month for 36 months with $3,064 due (Details)

There are reasons to consider leasing an EV these days. There are fuel savings, the novelty of transportation reimagined, exhilarating performance, and lower emissions. Plus, EV leases are becoming more affordable! The most compelling reason to lease an EV is the protection from ending up with an outdated car. With a lease, you’ll be able to upgrade to a faster charging, longer range model when your lease term is complete. That’s a lot better than being stuck with a slow charging, less-than-capable electric vehicle in a few years!

Here’s a look at the best EV lease deals this month:

| Make | Model | Trim | Months | Monthly Payment (Pre-Tax) | Due at Signing |

|---|---|---|---|---|---|

| Kia | Niro EV | Wind | 24 | $189 | $3,999 |

| Kia | EV6 | Light Long Range | 24 | $219 | $3,999 |

| Toyota | bZ4X | XLE | 36 | $359 | $0 |

| Ford | F-150 Lightning | XLT Standard Range | 36 | $550 | $7,059 |

| Ford | Mustang Mach-E | Premium AWD | 36 | $366 | $5,575 |

| Chevrolet | Equinox EV | 2LT | 24 | $299 | $3,169 |

| Hyundai | Ioniq 5 | SE Long Range | 24 | $189 | $3,999 |

| Hyundai | Kona EV | SE | 24 | $189 | $3,999 |

| Tesla | Model 3 | RWD | 36 | $309 | $2,999 |

| Tesla | Model Y | Long Range AWD | 36 | $339 | $2,999 |

The automotive landscape is in flux, and upcoming weeks may bring even more enticing new car incentives. With rising interest rates surpassing 7%, coupled with MSRP escalations and a cooling used car market, the scales tilt towards reduced demand for brand-new vehicles. Reduced demand almost always results in stronger manufacturer incentives to lure in buyers. This is particularly evident for the high-ticket trucks and SUVs.

Keep track of new cars with the most and least inventory for the latest negotiability updates.

As you head out to shop the dealer lots, remember this: if it’s taxable, it’s negotiable. Even the models with the tightest supply are negotiable with the help of a CarEdge Coach. Check out these car buying success stories!

Take this FREE resource with you: The Ultimate Car Buying Cheat Sheet (Downloadable)

Ready to work 1:1 with a car buying pro? Learn more about CarEdge Coach, your path to the most savings and the least stress. Prefer a DIY path to car buying? With CarEdge Data, you have the tools at your disposal to find the best deals and identify opportunities for negotiation.

And of course, we have hundreds of 100% free car buying guides just a click away. Don’t forget to connect with the CarEdge family over on our Community Forum.

Honda inventory is rising, and is now the highest it’s been since before the pandemic. As a result, Honda models are more negotiable today than at any point in recent years. Across the brand, there’s a 47-day supply of new Honda cars and SUVs.

The current state of Honda’s inventory offers insights into which models provide more wiggle room for negotiation and which ones are a tighter squeeze. Plus, we’ll take a look at the best Honda offers this month. Let’s delve into the numbers and see where you might find the best deals.

Savvy car buyers have a little-known trick up their sleeve: market day supply. Previously, market day supply (MDS) was only used by auto industry insiders. We’re out to change that.

Market Day Supply takes into account the existing inventory of a new or used vehicle, and the selling rate over the last 45 days. What you get is the number of days it would take to sell ALL vehicles in stock at current selling rates, assuming no new inventory was added. In simple terms, MDS reflects the level of demand for a car. High MDS almost always means high negotiability. Low MDS suggests that deals will be harder to come by.

For starters, a ‘healthy’ MDS in the car market is somewhere between 45 and 60 days of supply. Anything below 20 days is a real shortage, and anything above 80 is a serious oversupply. Today, Honda averages a healthy 47 days of supply. For Honda, this is quite high.

When assessing the most negotiable new Honda models based on present market supply, three models stand out: the HR-V, Odyssey and surprisingly, the remaining 2023 CR-Vs. These vehicles offer buyers a good chance to get a sweet deal.

Here’s the latest Honda inventory nationwide. We’ve included used Honda inventory numbers to highlight possible opportunities for better deals, depending on the model.

For local market numbers, check out CarEdge Data.

Honda Sedans:

| Model | New/Used | Market Day Supply (October '23) | Market Day Supply (December '23) | Total For Sale |

|---|---|---|---|---|

| Accord | New 2024 | N/A | 56 | 23,548 |

| Accord | New 2023 | 30 | 58 | 2,662 |

| Accord | Used 2022 | 49 | 60 | 2,204 |

| Accord | Used 2021 | 49 | 54 | 3,285 |

| Accord | Used 2020 | 43 | 48 | 3,384 |

| Civic | New 2024 | N/A | 50 | 17,167 |

| Civic | New 2023 | 34 | 62 | 360 |

| Civic | Used 2022 | 50 | 60 | 2,038 |

| Civic | Used 2021 | 53 | 58 | 2,196 |

| Civic | Used 2020 | 40 | 46 | 4,245 |

Honda SUVs and Trucks:

| Model | New/Used | Market Day Supply (October '23) | Market Day Supply (December '23) | Total For Sale |

|---|---|---|---|---|

| CR-V | New 2024 | 24 | 34 | 33,171 |

| CR-V | New 2023 | 12 | 99 | 1,106 |

| CR-V | Used 2022 | 45 | 60 | 2,383 |

| CR-V | Used 2021 | 47 | 62 | 4,186 |

| CR-V | Used 2020 | 41 | 51 | 5,743 |

| HR-V | New 2024 | 47 | 58 | 21,075 |

| HR-V | New 2023 | 151 | 891 | 691 |

| HR-V | Used 2022 | 59 | 48 | 1,957 |

| HR-V | Used 2021 | 52 | 54 | 2,331 |

| HR-V | Used 2020 | 39 | 50 | 1,427 |

| Odyssey | New 2024 | N/A | 45 | 8,089 |

| Odyssey | New 2023 | 31 | 120 | 512 |

| Odyssey | Used 2022 | 74 | 79 | 833 |

| Odyssey | Used 2021 | 61 | 62 | 1,116 |

| Odyssey | Used 2020 | 51 | 61 | 1,098 |

| Passport | New 2024 | N/A | 55 | 2,720 |

| Passport | New 2023 | 45 | 30 | 3,003 |

| Passport | Used 2022 | 56 | 76 | 604 |

| Passport | Used 2021 | 60 | 71 | 1,379 |

| Passport | Used 2020 | 53 | 61 | 664 |

| Pilot | New 2024 | N/A | 45 | 12,496 |

| Pilot | New 2023 | 26 | 45 | 522 |

| Pilot | Used 2022 | 52 | 71 | 1,760 |

| Pilot | Used 2021 | 48 | 59 | 3,032 |

| Pilot | Used 2020 | 47 | 62 | 1,560 |

| Ridgeline | New 2024 | N/A | N/A | N/A |

| Ridgeline | New 2023 | 39 | 53 | 6,904 |

| Ridgeline | Used 2022 | 57 | 63 | 424 |

| Ridgeline | Used 2021 | 61 | 64 | 370 |

| Ridgeline | Used 2020 | 47 | 57 | 576 |

On the other hand, the least negotiable models in the Honda lineup, perhaps unsurprisingly, are the popular CR-V and the spacious Passport. But don’t lose hope; while new models might be challenging to haggle over, there’s a silver lining.

A closer look at Honda’s inventory reveals that the used car market offers a more balanced playing field. For those eyeing a Honda, it seems that the gently used 2021-2022 models are where the action is. Cars from this year appear to be in ample supply, making them a prime target for savvy buyers aiming for a reasonable deal.

Remember: in general, 2021-2022 used Honda models are in high supply. However, there are nuances from one model to the next. For specific data points for particular models in certain markets, we recommend CarEdge Data.

We track the used car market weekly here, and it’s clear that wholesale prices are in freefall. Slowly but surely, these price declines are translating to retail markets. It seems that used car dealers are fighting the overall market’s downward trend as long as they can.

Even with low inventory for its most popular models, Honda is offering great financing and lease deals this month. Caution: dealers are known to add ‘market adjustments’ onto the price tag of the popular, low inventory models. We do NOT think any Honda buyers should agree to pay any dealer markups in today’s market. Need assistance negotiating markups and fees? Speak to a CarEdge Car Coach today.

The average APR for a new car loan is 9.95%, so these deals are worth considering.

Ridgeline: Enjoy a 0.9% APR for 24 to 36 months (or 2.9% APR for up to 60 months).

Accord and Passport: 2.9% APR for up to 40 months.

Other Models: 3.9% APR for up to 48 months (or 4.9% APR for up to 60 months).

See offer details at Honda.com

Accord: Drive away with a lease at $299/month for 36 months, with an initial payment of $3,299.

Civic Sedan: Get behind the wheel for $259/month, with $3,299 down.

CR-V: Lease deals start as low as $309/month for 36 months with a down payment of $3,399.

Passport: If size matters, this larger vehicle is available starting at $369/month for 36 months, with $4,899 down.

See offer details at Honda.com

The key to negotiation lies in understanding the dynamics and positioning oneself strategically. So gear up, arm yourself with this intel, and drive into your Honda negotiation with confidence. Remember, even in a market pinch, there’s NO justification for overpriced add-ons or inflated warranties.

Ready to negotiate like a pro? Try CarEdge Coach and CarEdge Data today! With these tools at your disposal, you can take control of your car buying experience, understand market dynamics, strategize effectively, and secure the best deal possible. We’re simply here to help!

In this market analysis driven by CarEdge Data, we’ll take you on a tour through the market day supply of new cars across all 50 states and break down the inventory for the five major automakers. Armed with data, you’ll be in the best position to negotiate a great deal on your next vehicle.

Looking for the best and worst states to buy a car? We’ll answer these questions and more with the latest data. You’ll also want to check out the states with the highest fees and taxes.

At CarEdge, we leverage cutting-edge tools to dig deep into the auto industry. One crucial metric we focus on is ‘market day supply, also known as ‘MDS’. Essentially, it provides an estimate of how many days it would take to sell off the current inventory of vehicles at the present rate of sales, assuming that no new vehicles are added to the inventory.

In a balanced market, a 60-day supply of new cars is considered the standard, providing a decent equilibrium between supply and demand.

Anything substantially above this indicates an oversupply, while anything below 40 days suggests a shortage. This information serves as a starting point to identify potential negotiation leverage for smart car buyers like you.

Let’s dive in and take a look at automotive trends across the United States. We’re looking at overall new car supply in all 50 states, and supply numbers for the top-selling brands in the U.S.: Ford, Toyota, Chevrolet, Honda, and Hyundai.

Use the sort feature by clicking on the arrows at the top of each column.

| State | New Car Inventory (Day Supply - All Makes) | Ford Days Supply | Toyota Days Supply | Chevrolet Days Supply | Honda Days Supply | Hyundai Days Supply |

|---|---|---|---|---|---|---|

| Alabama | 68 | 130 | 40 | 53 | 34 | 58 |

| Alaska | 92 | 106 | 13 | 97 | 40 | 120 |

| Arizona | 74 | 104 | 44 | 58 | 35 | 81 |

| Arkansas | 69 | 109 | 13 | 59 | 18 | 78 |

| California | 73 | 95 | 41 | 65 | 43 | 71 |

| Colorado | 69 | 95 | 42 | 49 | 28 | 89 |

| Connecticut | 75 | 118 | 47 | 54 | 32 | 55 |

| Delaware | 78 | 116 | 48 | 61 | 31 | 68 |

| Florida | 72 | 97 | 46 | 71 | 33 | 51 |

| Georgia | 67 | 86 | 36 | 64 | 33 | 61 |

| Hawaii | 83 | 105 | 23 | 152 | 69 | 86 |

| Idaho | 76 | 90 | 36 | 61 | 20 | 79 |

| Illinois | 70 | 126 | 42 | 54 | 25 | 59 |

| Indiana | 69 | 92 | 40 | 60 | 22 | 65 |

| Iowa | 80 | 112 | 45 | 60 | 32 | 60 |

| Kansas | 70 | 87 | 47 | 61 | 39 | 35 |

| Kentucky | 67 | 84 | 37 | 54 | 28 | 52 |

| Louisiana | 74 | 124 | 38 | 66 | 28 | 56 |

| Maine | 69 | 100 | 42 | 53 | 31 | 58 |

| Maryland | 72 | 107 | 51 | 68 | 27 | 68 |

| Massachusetts | 70 | 103 | 49 | 57 | 31 | 67 |

| Michigan | 69 | 106 | 40 | 52 | 26 | 60 |

| Minnesota | 75 | 89 | 42 | 63 | 37 | 67 |

| Mississippi | 69 | 106 | 31 | 61 | 26 | 58 |

| Missouri | 75 | 98 | 51 | 49 | 28 | 68 |

| Montana | 77 | 84 | 42 | 74 | 35 | 75 |

| Nebraska | 80 | 114 | 59 | 60 | 24 | 84 |

| Nevada | 75 | 87 | 35 | 70 | 28 | 87 |

| New Hampshire | 69 | 104 | 40 | 82 | 33 | 52 |

| New Jersey | 67 | 108 | 51 | 62 | 35 | 52 |

| New Mexico | 71 | 86 | 33 | 69 | 22 | 76 |

| New York | 68 | 93 | 46 | 61 | 30 | 52 |

| North Carolina | 66 | 100 | 37 | 53 | 23 | 60 |

| North Dakota | 82 | 104 | 49 | 85 | 23 | 70 |

| Ohio | 71 | 103 | 41 | 64 | 23 | 72 |

| Oklahoma | 72 | 90 | 29 | 59 | 23 | 62 |

| Oregon | 85 | 88 | 52 | 86 | 46 | 188 |

| Pennsylvania | 73 | 103 | 43 | 68 | 31 | 53 |

| Rhode Island | 82 | 93 | 43 | 65 | 41 | 57 |

| South Carolina | 63 | 116 | 36 | 66 | 25 | 46 |

| South Dakota | 94 | 92 | 52 | 89 | 26 | 123 |

| Tennessee | 69 | 91 | 49 | 66 | 29 | 69 |

| Texas | 69 | 92 | 34 | 58 | 32 | 58 |

| Utah | 72 | 99 | 27 | 41 | 26 | 91 |

| Vermont | 116 | 127 | 73 | 71 | 190 | 132 |

| Virginia | 68 | 92 | 47 | 63 | 27 | 63 |

| Washington | 76 | 94 | 50 | 82 | 38 | 87 |

| West Virginia | 74 | 97 | 45 | 66 | 29 | 57 |

| Wisconsin | 74 | 111 | 44 | 59 | 24 | 75 |

| Wyoming | 95 | 65 | 61 | 106 | 49 | 143 |

There’s a lot to digest in the above table, so we’re going to focus in on the states with the highest and lowest new car inventory overall, and for each of the five best-selling car brands in America.

If you’re looking for more room to negotiate, consider buying a car in states with high inventory levels. Not sure where to start? Here’s our guide to buying a car in another state.

Vermont leads with an impressive 116-day supply, followed by Wyoming at 95 days, South Dakota at 94 days, and Alaska at 92 days. Other states rounding off the top ten in this category include Oregon, Hawaii, North Dakota, Rhode Island, Iowa, and Nebraska—all well above the 60-day norm.

On the flip side, states like South Carolina, North Carolina, Georgia, Kentucky, New Jersey, Alabama, New York, Virginia, Arkansas, and Colorado have the lowest new car inventories, all hovering around the 60-70 day supply mark.

Negotiating a new car is certainly not impossible in these states, as our team of Coaches has helped hundreds of buyers in these states this year alone. But with the tightest inventory, it’s simply smart buying to be aware of the overall market from day one.

You might be asking, if a balanced market hovers at a 60-day supply, why are the states with the lowest inventory still above this mark? Well, these numbers are an average across all brands—from the glut of Ram trucks to the scarcity of Hondas and Subarus. For specifics on make and model for any zip code or region, CarEdge Data has you covered.

Next, we’ll dive deeper and take a closer look at the five best-selling automotive brands in America. There are some BIG differences between the top players when it comes to inventory on dealer lots.

Ford inventory is among the highest in the auto market right now, with the brand having a 97-day supply of new cars nationwide. In some states, Ford’s inventory exceeds 120-day supply.

If you’re eyeing a Ford, states like Alabama, Vermont, Illinois, Louisiana, and Connecticut offer the most room for negotiation due to 100+ day supplies of new cars.

Conversely, Wyoming, Montana, Kentucky, New Mexico, and Georgia are your least favorable states in terms of Ford inventory.

Notably, Ford’s electric Mustang Mach-E, traditional Mustang, and Explorer have the most supply, while the Maverick and Ranger are relatively sparse and tougher (but not impossible) to negotiate.

Browse local Ford listings with the power of data.

Toyota’s nationwide average stands at a tight 42-day supply. Vermont, Wyoming, Nebraska, Oregon, and South Dakota have the highest inventory for Toyota. In contrast, states like Arkansas, Alaska, Hawaii, Utah, and Oklahoma have the least Toyota inventory.

The Sequoia, Corolla, and Sienna are currently in high demand, all with less than 40-day supplies. The electric bZ4X, 4Runner, and Crown have the highest inventory numbers, and as a result, the highest negotiability from the get-go.

See localized inventory, price and negotiability with CarEdge Data.

Chevrolet averages a balanced 61-day inventory nationwide. For Chevy, Hawaii, Wyoming, Alaska, South Dakota, and Oregon are your go-to states for choice and negotiability, while Utah, Missouri, Colorado, Michigan, and North Carolina are less ideal with tighter supply.

The Silverado and Equinox are most abundant on dealer lots. The Corvette, Trax, and Colorado have the least inventory.

Honda’s supply averages a mere 32 days nationally, owing to lingering effects of the supply chain shortages that every automaker previously dealt with. States like Vermont, Hawaii, Wyoming, Oregon, and California have the highest Honda inventory, but nowhere even comes close to Vermont.

There are just five Honda dealerships in Vermont, but between them there are 1,014 new Hondas for sale. Day’s supply sits around 180 days, which is highly unusual for Honda. Perhaps Honda buyers in New England should consider heading to The Green Mountain State for the greatest negotiability.

Arkansas, Idaho, New Mexico, Indiana, and Oklahoma offer the least room for negotiation with the lowest Honda inventory. When it comes to model inventory, the HR-V and Passport have the greatest supply nationwide, while the CR-V and Pilot are much harder to come by.

Hyundai has been steadily climbing the ranks in the battle for automotive market share. As Summer 2023 winds down, Hyundai’s inventory numbers are looking healthy, and notably better than competitors Honda and Toyota. There’s currently a 62-day supply of new Hyundai’s nationwide, with quite a bit of variability from one state to the next.

Hyundai inventory is most abundant in Oregon, Wyoming, Vermont, South Dakota, and Alaska. In contrast, Kansas, South Carolina, Florida, New York, and New Jersey have less stock.

The IONIQ 6 and IONIQ 5 are abundant, while the Venue and Elantra are in short supply. Hyundai and sibling Kia have really struggled to sell EVs ever since the revamped federal tax credit removed eligibility due to the ‘Made in America’ requirement.

See Hyundai inventory and price data near you.

Ready to utilize data for unparalleled negotiating leverage? We’ve got tools to suit your needs and budget. From free resources to expert car buying help, we’ve got it all. Enjoy these reader-favorite free car buying tools:

Ready to negotiate a sweet deal? Collaborate with a Car Buying Coach for insider-only insights or opt for a one-time consultation through CarEdge Consult. For the DIY aficionados out there, CarEdge Data provides the robust market intelligence you need to navigate your car buying journey.

Regardless of your budget, we have a plan to help you save thousands. Embark on your informed car buying adventure today with peace of mind! With CarEdge, you’ll know you got the BEST deal.

Subaru inventory is flourishing more than most would anticipate. While variability exists from one dealership to another and from one market to the next, armed with the latest car market data, you’re well-positioned to negotiate favorable deals on Subarus today. Currently, Subaru has a 67-day supply of new cars and SUVs across its range. Interestingly, some models are quite negotiable. Let’s delve deeper into the best Subaru deals available this month, followed by insights on how you can harness market data to negotiate Subaru prices.

Here’s a summary of the big picture today. Interest rates have risen 300% since 2021, and gone are the days of zero percent financing. In 2023’s auto market, any APR below 4% is considered a great deal. These are Subaru’s best financing offers today:

These are Subaru’s best leases this month.

Equipped with the latest inventory data, it’s clear which Subaru models and trims are up for negotiation. High inventory indicates a higher likelihood of dealerships being willing to adjust prices, especially considering the escalating interest rates they grapple with for unsold cars. Although Subaru has historically maintained low inventories, the current scenario offers some pockets of opportunity.

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Subaru | Ascent | 66 | 6,992 |

| Subaru | Solterra | 82 | 2,092 |

| Subaru | Crosstrek | 61 | 18,096 |

| Subaru | Forester | 74 | 26,782 |

| Subaru | Outback | 80 | 24,836 |

| Subaru | Impreza | 63 | 4,031 |

| Subaru | Legacy | 58 | 3,498 |

| Subaru | WRX | 83 | 3,339 |

| Subaru | Brand Average | 71 | 89,879 |

The most negotiable new Subaru models include:

The Solterra EV, in particular, is trailing behind its competitors like the Hyundai IONIQ 5, Kia EV6, and even the Volkswagen ID.4. And it’s nowhere near the Tesla Model Y, which has become much more affordable in 2023. This slow sales momentum, combined with its not-so-impressive charging speeds, makes it a prime candidate for negotiation. However, it does NOT qualify for the federal EV tax credit! See which EV models do here.

As for the other models, Subaru sedans have always been the slower sellers, but it’s the first time that the popular Forester and Outback have been this negotiable in years.

Considering the flood of 2024 Subaru inventory arriving on dealer lots this month, all Subaru models are negotiable right now.

Let’s took a closer look at the inventory and negotiability for Subaru’s top selling models. Using this information, we’ve seen which trims are in highest supply, and which are surprisingly negotiable today. Note that Subaru has some 2023 inventory to clear out, and these are selling slowly compared to 2024 models.

Here’s a look at the best-selling Subaru model, the Subaru Crosstrek. Last year, Subaru sold 155,000 of these, which was slightly more than the Outback.

| Year | Model | Trim | Market Day Supply (2023) | Total For Sale |

|---|---|---|---|---|

| 2023 | Crosstrek | Base | 68 | 6 |

| 2023 | Crosstrek | Premium | 750 | 50 |

| 2023 | Crosstrek | Sport | 205 | 41 |

| 2023 | Crosstrek | Limited | 293 | 91 |

| 2024 | Crosstrek | Base | 24 | 504 |

| 2024 | Crosstrek | Premium | 37 | 5,679 |

| 2024 | Crosstrek | Sport | 44 | 1,472 |

| 2024 | Crosstrek | Limited | 47 | 2,963 |

Looking at the market day supply for each Crosstrek trim level and model year, we can see that these are the most negotiable today:

Subaru’s second-best seller, the Subaru Outback, has significantly higher inventory than the Crosstrek. In 2022, Subaru sold 147,000 Outbacks in the United States. Here’s a complete look at Subaru Outback inventory today.

| Year | Model | Trim | Market Day Supply (2023) | Total For Sale |

|---|---|---|---|---|

| 2023 | Outback | Base | 77 | 12 |

| 2023 | Outback | Premium | 34 | 91 |

| 2023 | Outback | Onyx Edition | 23 | 121 |

| 2023 | Outback | Limited | 18 | 305 |

| 2023 | Outback | Touring | 24 | 177 |

| 2023 | Outback | Wilderness | 19 | 106 |

| 2024 | Outback | Base | 66 | 198 |

| 2024 | Outback | Premium | 56 | 3,789 |

| 2024 | Outback | Onyx Edition | 82 | 2,683 |

| 2024 | Outback | Limited | 64 | 5,913 |

| 2024 | Outback | Touring | 59 | 2,636 |

| 2024 | Outback | Wilderness | 66 | 2,904 |

As we can see, these are the Outback trim options with the highest inventory in terms of market day supply, and as a result are the most negotiable:

Next up, the Subaru Forester. Subaru’s #3 model had 114,000 sales last year in America. Subaru hasn’t delivered any 2024 model years just yet. Here’s the complete breakdown of Forester inventory today:

| Year | Model | Trim | Market Day Supply (2023) | Total For Sale |

|---|---|---|---|---|

| 2023 | Forester | Base | 27 | 553 |

| 2023 | Forester | Premium | 32 | 3,080 |

| 2023 | Forester | Sport | 43 | 2,230 |

| 2023 | Forester | Limited | 51 | 3,854 |

| 2023 | Forester | Wilderness | 66 | 3,986 |

| 2023 | Forester | Touring | 75 | 3,662 |

| 2024 | Forester | Base | 0 | 0 |

| 2024 | Forester | Premium | 0 | 0 |

| 2024 | Forester | Sport | 0 | 0 |

| 2024 | Forester | Limited | 0 | 0 |

| 2024 | Forester | Wilderness | 0 | 0 |

| 2024 | Forester | Touring | 0 | 0 |

These are the most negotiable new Foresters today:

Soon, 2024 Forester inventory will arrive on dealer lots. Once that happens, 2023 models will become much more negotiable. If you’re in the market for a new Forester, we recommend waiting until the 2024 models arrive so you can score a sweet deal.

We analyzed thousands of data points to find the most negotiable used Subaru models today. It quickly became clear that there’s a lot of variability in used Subaru inventory. For some models, there’s A LOT of inventory and high negotiability. For others, not so much.

| Model | New/Used | Market Day Supply | Total For Sale |

|---|---|---|---|

| Ascent | used | 59 | 3920 |

| BRZ | used | 71 | 607 |

| Crosstrek | used | 51 | 7,353 |

| Forester | used | 56 | 14,413 |

| Impreza | used | 59 | 7,176 |

| Legacy | used | 66 | 5,528 |

| Outback | used | 56 | 16,591 |

| Solterra | used | 183 | 179 |

| WRX | used | 76 | 3,283 |

We found that in general, 2018-2019 model year Subarus have the highest inventory today.

Among models, Subaru sedans like the Legacy, Impreza and WRX definitely have the most inventory. Let’s take a look at the details.

These are the best model years in terms of inventory and negotiability for every Subaru model:

| Model | Year | Market Day Supply | Total For Sale |

|---|---|---|---|

| Ascent | 2021 | 67 | 953 |

| BRZ | 2018 | 110 | 71 |

| Crosstrek | 2019 | 64 | 1,421 |

| Forester | 2018 | 72 | 1,367 |

| Impreza | 2014 | 65 | 556 |

| Legacy | 2019 | 95 | 646 |

| Outback | 2018 | 62 | 1,660 |

| Solterra | 2023 | 178 | 182 |

| WRX | 2022 | 91 | 621 |

When it comes to overall highest inventory (and highest negotiability), the winners are [almost] all sedans. The Solterra EV snuck into the top spot as EV competitors simply offer faster charging and more range. Subaru’s cars aren’t as popular as they were a decade ago, but that can be to your advantage at the negotiating table.

| Model | Year | Market Day Supply | Total For Sale |

|---|---|---|---|

| Solterra | 2023 (used) | 178 | 182 |

| Legacy | 2019 | 95 | 646 |

| WRX | 2022 | 91 | 621 |

| WRX | 2015 | 87 | 348 |

| Legacy | 2022 | 86 | 364 |

| Legacy | 2021 | 77 | 416 |

| Legacy | 2018 | 75 | 467 |

| Legacy | 2020 | 73 | 718 |

| Forester | 2018 | 72 | 1,367 |

| Ascent | 2021 | 67 | 953 |

Want to elevate your savings even further? Ready for even more insider data? Collaborate with a Car Buying Coach to negotiate using insights only industry insiders are privy to. If a one-time consultation is more your style, CarEdge Consult offers expert advice tailored for your needs. For those looking to embark on a DIY car buying journey powered by rich auto market data, CarEdge Data is your go-to resource. Embark on your Subaru buying journey today, fortified with market intelligence!

Compare premium plans to see how we can help you save thousands. We’ve got options for every budget.