CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

When searching for the best new car deals, a powerful tool is the latest local inventory data. Equipped with behind-the-scenes market insights, you’re setting out with negotiation leverage on your side. The best way to compare apples to apples in new car inventory is with a little-known metric: market day supply. Market Day Supply (MDS) refers to the number of days it would take to sell all current inventory at the current rate of sales, without any new supply being added. MDS isn’t perfect, but it’s one of the best tools we have for gauging supply and demand in the new car market.

With a mix of leftover 2023 models and newly arrived 2024s piling up on dealer lots, now is the perfect time to put your car buying toolkit to work to hunt down some deals.

We’ve used CarEdge Data to identify the new car brands with the most and least inventory in every region in America. Skip ahead to your region using the table of contents below.

These are the most and least negotiable new cars in Maine, Massachusetts, Connecticut, Rhode Island, New Hampshire, and Vermont in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 314 | 1754 |

| Chrysler | 260 | 838 |

| Ram | 258 | 4448 |

| Jeep | 249 | 12836 |

| Buick | 131 | 1036 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 48 | 13930 |

| Lexus | 48 | 1956 |

| BMW | 49 | 3000 |

| Honda | 57 | 8134 |

| Cadillac | 64 | 636 |

As is the trend in recent times, Stellantis brands dominate the list of most negotiable new cars in New England. Asian automakers like Toyota, Lexus, and Honda have the least inventory.

See local market inventory for specific models with CarEdge Data.

This region includes the states of New York, New Jersey, Pennsylvania, Delaware, Maryland, and Washington DC this month.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 311 | 9182 |

| Chrysler | 218 | 3028 |

| Jeep | 198 | 35721 |

| Ram | 192 | 12880 |

| Mazda | 120 | 24950 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| BMW | 46 | 9378 |

| Honda | 48 | 24661 |

| Lexus | 49 | 8008 |

| Toyota | 50 | 36908 |

| Cadillac | 55 | 3254 |

Stellantis brands take the top spot yet again. These are the same brands we saw on this list over most of the past year. However, it is interesting to see Mazda inventory so high on the East Coast.

See local market inventory for specific models with CarEdge Data.

This region includes Virginia, North Carolina, South Carolina, Florida, Georgia, Tennessee, West Virginia, Kentucky, Alabama, Mississippi, Louisiana, and Arkansas in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 365 | 29398 |

| Ram | 211 | 33461 |

| Jeep | 184 | 37196 |

| Chrysler | 166 | 3694 |

| Buick | 125 | 11446 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 38 | 75528 |

| Honda | 43 | 33148 |

| Kia | 46 | 21222 |

| Lexus | 46 | 14694 |

| BMW | 53 | 13157 |

There’s a whole year of inventory for new Ram trucks in the Southeast right now. Toyota, Kia, Honda, and BMW are far less negotiable with slim supply.

See local market inventory for specific models with CarEdge Data.

This region includes Ohio, Indiana, Michigan, Illinois, Wisconsin, Iowa, Missouri, Minnesota, Kansas, Nebraska, South Dakota, and North Dakota right now.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 354 | 13671 |

| Ram | 178 | 28066 |

| Jeep | 164 | 35543 |

| Chrysler | 142 | 4302 |

| Buick | 129 | 18753 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Lexus | 38 | 4786 |

| Toyota | 41 | 30521 |

| Honda | 43 | 23579 |

| Cadillac | 53 | 4754 |

| BMW | 62 | 7074 |

As expected, Stellantis brands like Dodge, Ram, and Jeep have the highest inventory and therefore the most negotiability in the Midwest.

See local market inventory for specific models with CarEdge Data.

In the Southwest region, we’ve included the states of Texas, Oklahoma, New Mexico, Arizona, and Nevada in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 361 | 16824 |

| Chrysler | 229 | 2190 |

| Ram | 188 | 21176 |

| Jeep | 178 | 20976 |

| Nissan | 123 | 30298 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 39 | 28338 |

| Lexus | 47 | 7636 |

| Kia | 50 | 10604 |

| Cadillac | 50 | 4032 |

| Honda | 51 | 17611 |

This month, Nissan joins Stellantis brands in the ranks of most negotiable new cars based on inventory.

See local market inventory for specific models with CarEdge Data.

In this region, we have California, Oregon, Washington, Alaska, and Hawaii this month.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 396 | 10698 |

| Ram | 265 | 13031 |

| Jeep | 220 | 17964 |

| Chrysler | 212 | 2496 |

| Nissan | 134 | 19606 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Toyota | 39 | 41813 |

| Honda | 49 | 26063 |

| BMW | 50 | 11087 |

| Kia | 56 | 11823 |

| Cadillac | 58 | 2190 |

Looking for car deals on the west coast? Follow the inventory! Stellantis brands like Dodge, Ram, Jeep, and Chrysler are the most negotiable car brands in states like California and Oregon.

See local market inventory for specific models with CarEdge Data.

In the Mountain West region, we have Colorado, Utah, Wyoming, Montana, and Idaho in early 2024.

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| Dodge | 352 | 1682 |

| Chrysler | 210 | 369 |

| Jeep | 199 | 6543 |

| Ram | 180 | 6723 |

| Nissan | 151 | 4845 |

| Make | Market Day Supply | Total For Sale |

|---|---|---|

| BMW | 40 | 987 |

| Toyota | 47 | 9400 |

| Honda | 57 | 3283 |

| Lexus | 57 | 1125 |

| GMC | 65 | 3221 |

Nissan joins Dodge, Ram, Jeep, and Chrysler on the list of most negotiable car brands in 2024. BMW, Toyota, Honda, and GMC have the least inventory in the Mountain West.

See local market inventory for specific models with CarEdge Data.

Did you notice a trend in the data? It’s abundantly clear that Stellantis brands (Chrysler, Dodge, Jeep, and Ram), are having a VERY tough time selling cars in 2024. Everywhere you look, Stellantis’ vehicles are sitting on the dealership lots for longer than any other cars today. Does that make them more negotiable? Yes, but not always. The dealer has to be reasonable and motivated to sell. By you arriving with this powerful market data in hand, you’re setting off on the right foot. Negotiation know-how is worth a lot in today’s car market!

👉 Try our 100% FREE car buying course: Deal School from CarEdge

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

It’s a new year, but car buyers are still facing some of the same challenges. In 2024, the dilemma of choosing between a new or used car is influenced by several factors, including depreciation rates, interest rates, price trends, and the lingering effects of the pandemic. Let’s break down what you need to know to make the best decision in 2024.

Key Takeaways:

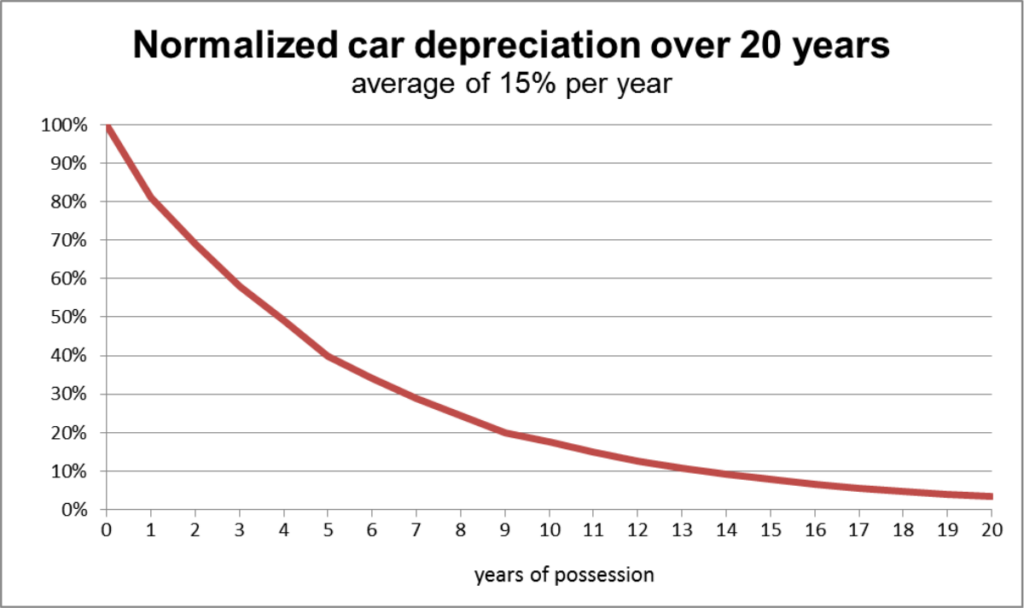

The automotive landscape has seen dramatic shifts in trade-in and resale values over the past few years. In 2024, a trend that began last year is continuing: used car prices are declining in wholesale markets, impacting trade-in values significantly. The era of purchasing a new car and flipping it for profit is over. Instead, we’re returning to the traditional pattern where new cars lose a substantial portion of their value as soon as they leave the dealership.

This year, expect to see an uptick in subvented rates from captive lenders, as new car sales decelerate. Low APR offers are here to stay in 2024. Manufacturers are increasingly offering incentives to clear inventory, including surprising zero percent financing deals available in January. Despite stable interest rates, the high cost of loans remains a critical factor in the car market. Consequently, we anticipate a larger share of new car loans will be sourced through captive lenders like Hyundai Motor Finance, Ford Credit, and Toyota Financial Services.

Towards the end of 2023, data from Cox Automotive showed an uptick in 0% APR offers. We expect this trend to continue into 2024.

With the average used car loan rate now north of 13% APR, plenty of used car shoppers are checking out new car offerings to simply pay less interest.

Check out the best APR offers this month

Don’t pay dealer markups for any vehicle in 2024. No matter what the salesperson might tell you, we’re firmly in a buyer’s market. This isn’t 2022’s car market anymore.

After consecutive years of rising MSRPs, the tide is turning in 2024. Although prices for the latest models have increased for the 2024 model year, we don’t foresee this trend continuing once 2025 model pricing is announced.

Resistance to high prices is growing among consumers, evident in slowing sales and increasing inventory, particularly for expensive cars, SUVs, and trucks. This resistance is gradually influencing the used car market as well.

These 2023 models have the most remaining inventory, and high negotiability

Used-car wholesale prices have given up 53% of their pandemic gains. However, wholesale markets are largely off limits to the average car buyer. Unfortunately, this drop is less pronounced in retail prices. According to the Consumer Price Index, retail used car prices have given up just 36% of the pandemic price spike two years later. Retail used car prices are down 12.6% from the July 2022 highs.

Why are used car prices still high in 2024?

The auto market is still feeling the lasting effects of the pandemic-induced semiconductor chip shortage. Pandemic-related factory shutdowns resulted in 16 million vehicles never being produced. These missing vehicles contribute to a global shortage of used cars, expected to last until at least the late 2020s. Ray Shefska of CarEdge predicts a return to normalcy in the used car market might not occur until 2030.

In 2024, used car prices will continue their gradual decline, influenced by high interest rates deterring potential buyers. With new car loan rates exceeding 13% APR, a 20-year high, many buyers are turning away from used cars in favor of new vehicles with more attractive financing options. Indeed, new car deals make more sense for many buyers in 2024.

2024 presents a nuanced picture for car buyers. While new cars offer more favorable financing options and the appeal of owning a brand-new vehicle, they also come with the risk of rapid depreciation and of course, higher prices.

On the other hand, used cars, although more affordable, are still priced relatively high due to market shortages years ago. Ultimately, the decision depends on individual priorities, financial situations, and long-term plans for vehicle ownership.

Free Car Buying Help Is Here

Ready to outsmart the dealerships? We have FREE resources for new and used car buyers alike. Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

As we step into 2024, American drivers are noticing a larger auto insurance bill with their policy renewals. Based on an analysis of 97 million auto insurance quotes from Insurify, a clear picture emerges of the key trends in car insurance prices for this year. We’ll examine the factors driving up costs, and take a look at how consumers and the industry are adapting.

In 2023, auto insurance rates in the U.S. climbed 24% to an all-time record high. The spike in rates was driven by rising repair costs, natural disasters, and more frequent car accidents. This uptick in insurance costs led to record losses for insurers. The latest data suggests that car insurance premiums aren’t done climbing. Insurify projects that car insurance rates will increase by 7% in 2024. That’s almost double the typical annual rise.

The national average cost of a full-coverage policy now stands at $2,019 per year, amounting to 2.6% of the median household income. In comparison, state-minimum liability insurance averages at $1,154 annually.

In 2023, car insurance rates increased by 638% more than the average wage growth. Nearly 62% of Americans reported a rise in their car insurance rates, and about 22% experienced more than one increase in the same year.

To combat these hikes, many drivers opted to lower their coverage limits or increase their deductibles. Insurify’s data shows that most drivers took action to reduce their premiums, often accepting more risk in exchange for lower monthly premiums.

New York stands out with the highest car insurance costs in the country, averaging $3,374 annually for a full-coverage policy.

States with lower incomes are feeling the brunt of these insurance cost increases. Drivers in these states spend a larger portion of their earnings on car insurance, exacerbating the financial strain on households already facing economic challenges.

The past few years have been tough for the insurance industry. After suffering a $3.8 billion net underwriting loss in 2021, losses deepened to $26.9 billion in 2022. 2023’s numbers are still pending, but there were some signs of a recovery late in the year.

The rising costs of maintenance and repairs, increased severity of accidents, and pandemic-induced market fluctuations have all contributed to these losses. The Bureau of Labor Statistics reported an 8.46% increase year-over-year in auto repair costs as of November 2023.

Advanced vehicle technologies and electric vehicles bring new challenges, with repair costs for high-tech cars and EVs like Tesla being substantially higher. Insurance companies are increasingly forced to choose between writing a check for a $20,000 repair bill after a seemingly minor accident, or writing the car off altogether.

In light of the rising car insurance rates, here are some practical recommendations for car buyers looking to save money on their auto insurance in 2024:

By following these recommendations, car buyers can make more informed decisions and potentially save money on their auto insurance in 2024, despite the overall trend of rising rates.For more information on the latest auto insurance trends, check out Insurify’s latest update.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

It’s 2024, but that doesn’t mean that 2023 car models are a thing of the past. In fact, 796,000 new model year 2023 cars, trucks, and SUVs remain on dealership lots in February. While some car buyers may hesitate to take home a 2023 model in the new year, others see them as the best chance for negotiating a great deal. We used CarEdge Data to identify the new cars with the most remaining 2023 inventory right now.

In February of 2024, Ford, General Motors, and Stellantis brands have the highest inventory surplus of new 2023 models. This is what we’d expect from recent trends in our regularly updated guide to the most and least new car inventory.

Here’s a look at the remaining 2023 inventory on dealer lots. Dealers and OEMs alike are eager to sell these vehicles! Learn more about how Market Day Supply is calculated here.

| Make | Model | Market Day Supply | Total For Sale (1/2024) |

|---|---|---|---|

| Ford | F-150 | 107 | 95,948 |

| Nissan | Rogue | 91 | 47,188 |

| Ford | Explorer | 102 | 37,353 |

| Dodge | Charger | 469 | 35,495 |

| Dodge | Challenger | 344 | 26,024 |

| Ford | Mustang Mach-E | 269 | 22,629 |

| Ford | Escape | 76 | 21,998 |

| Jeep | Gladiator | 166 | 17,736 |

| Buick | Envision | 166 | 17,404 |

| Ford | Bronco 4-Door | 136 | 15,886 |

| Hyundai | Santa Fe | 48 | 15,643 |

| Ford | F-150 Lightning | 164 | 13,438 |

| Chevrolet | Traverse | 56 | 12,094 |

| Ford | Bronco Sport | 51 | 11,837 |

| Ford | Transit Van | 79 | 11,422 |

| GMC | Acadia | 117 | 9,933 |

| Toyota | Tacoma | 19 | 9,907 |

| Kia | Sorento | 51 | 9,736 |

| Ram | Ram 1500 | 106 | 9,663 |

| Volkswagen | ID.4 | 85 | 8,994 |

There are over 100,000 2023 F-150s and F-150 Lightnings still on sale in February. However, market day supply is ‘only’ half of one year because of the popularity of America’s best-selling truck (and best selling electric truck).

Ford’s Mustang Mach-E has rave reviews, but that hasn’t been enough to sell cars. There’s a 269-day supply of 2023 Mustang Mach-Es.

When sorting by market day supply, Stellantis brands soar to the top. In February, there are four Stellantis 2023 models with over 100 days of supply. It’s shocking to see how many Dodge Chargers and Challengers remain unsold. At current selling rates, it would take well over a year to sell these cars.

The Ram 1500 isn’t far behind. It would take nearly four months to sell remaining 2023 inventory at today’s selling rates.

The 2023 Buick Envision and GMC Acadia both have over 100 days of supply, with tens of thousands of cars remaining unsold. There are 12,000 unsold 2023 Chevrolet Traverses still out there, but as a quick seller, they will likely be sold in just two months.

The best SUV financing offer this month is the 2023 Hyundai Santa Fe. Finance the Santa Fe at 0% APR for 36 months, or 3.39% APR for 60 months. Plus, get up to $2,000 in cash incentives.

The Dodge Charger and Challenger both qualify for up to $2,000 in cash incentives.

The Ram 1500 Classic can be leased for just $470/month for 36 months, with $4,500 due. Buyers get up to $3,000 in cash allowance this month.

Ford fans can lease a 2023 F-150 Lariat for $577/month for 39 months with $6,525 due. The Ford Mustang Mach-E is one of the best EV lease deals in February. Lease a Ford Mustang Mach-E for $452/month for 39 months with $4,932 due.

The GMC Acadia is one of the best SUV lease deals this month. Lease the GMC Acadia at $249 per month for 24 months with $3,869 due.

👉 See ALL of February’s best new car deals here.

Remaining 2023 models present the best opportunity for negotiating thousands of dollars off of the price of a new car this month. With three quarters of a million 2023s remaining on dealership lots, something has to give. Here’s to hoping that at last, prices could be softening.

At CarEdge, we are committed to helping you navigate through these opportunities to secure the best possible deal, regardless of your budget. From free cheat sheets and guides to our comprehensive Concierge service, we are here to take the hassle out of the second-largest purchase most will ever make.

Don’t forget to check out the most and least inventory right now, and the best deals in January.

👉 Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Choosing the right electric vehicle is about more than just reducing your carbon footprint. Reliability is a crucial factor, particularly as the cost of repairing an electric vehicle outside of warranty becomes a frequent headline. Here, we present the top 10 most reliable EVs for 2025, according to Consumer Reports.

👉 Looking for the most reliable car brands overall? Check it out here.

| Make | Model | Reliability Score | Overall CR Score | Base MSRP |

|---|---|---|---|---|

| BMW | i4 | 82 | 89 | $52,200 - $69,700 |

| Nissan | Ariya | 58 | 68 | $43,190 - $60,190 |

| Lexus | RZ | 57 | 67 | $58,500 - $64,000 |

| Kia | Niro EV | 54 | 70 | $39,600 - $44,600 |

| Audi | Q4 e-tron | 54 | 72 | $49,800 - $58,200 |

| Hyundai | IONIQ 6 | 50 | 76 | $37,500 - $53,650 |

| Porsche | Taycan | 49 | 78 | $90,900 - $197,500 |

| Genesis | GV60 | 47 | 74 | $53,800 - $71,350 |

| Ford | Mustang Mach-E | 43 | 68 | $42,600 - $61,600 |

| Tesla | Model 3 | 42 | 69 | $40,240 - $53,240 |

👉 These are the best EV warranties

| Make | Model | Consumer Reports Reliability Score |

|---|---|---|

| Lexus | RZ | 57 |

| Hyundai | IONIQ 6 | 50 |

| Porsche | Taycan | 49 |

| Nissan | Ariya | 58 |

| BMW | i4 | 82 |

| BMW | iX | 29 |

| Kia | Niro EV | 54 |

| Kia | EV6 | 31 |

| Audi | Q4 e-tron | 54 |

| Toyota | bZ4X | 38 |

| Tesla | Model 3 | 42 |

| Genesis | GV60 | 47 |

| Ford | Mustang Mach-E | 43 |

| Genesis | GV70 Electric | 35 |

| Tesla | Model Y | 41 |

| Audi | Q8 e-tron | 26 |

| Ford | F-150 Lightning | 28 |

| Hyundai | IONIQ 5 | 30 |

| Lucid | Air | 7 |

| Jaguar | I-PACE | 30 |

| Honda | Prologue | 30 |

| Tesla | Model S | 35 |

| Volkswagen | ID.4 | 29 |

| Tesla | Model X | 24 |

| Mercedes-Benz | EQS SUV | 30 |

| Rivian | R1S | 9 |

| Mercedes-Benz | EQE SUV | 30 |

| Mercedes-Benz | EQE | 30 |

| Rivian | R1T | 20 |

| Mercedes-Benz | EQS | 30 |

| Polestar | Polestar 2 | 25 |

| Kia | EV9 | 42 |

| Subaru | Solterra | 38 |

| Chevrolet | Blazer EV | 5 |

We have a number of EV enthusiasts on the CarEdge team, from Tesla fans to Hyundai IONIQ 5 owners. In our opinion, Consumer Report’s EV reliability ratings need to be taken with a grain of salt. Several of the best-rated electric vehicles on the list have some of the slowest charging, lowest range, and in some cases, all-around poor reviews.

Take the all-new Lexus RZ for example. Although it’s a Lexus, it shares the same electric powertrain with the Toyota bZ4X and even the Subaru Solterra. In Out of Spec’s test, the RZ went just 176 miles on the interstate at 70 miles per hour on a full charge in warm weather. Most of the competition is good for at least 200 miles on the highway between charging stops.

Much of the same could be said about the Nissan Ariya, Audi Q4 e-tron, and overpriced Kia Niro EV.

The best-equipped EVs on the Consumer Reports reliability list are, in terms of charging speeds and range, the Hyundai IONIQ 6, Tesla Model 3, Kia EV6, and BMW’s electric offerings. These models offer more range, and less time spent at charging stations.

If you’re planning to keep your next vehicle for years to come, and you’re willing to exchange convenience on road trips for fuel savings and slashing tailpipe emissions, then 2025 is a good time to go electric. If you’re likely to need an upgrade in a few years, we strongly recommend an EV lease. Resale values continue to undergo wild swings in the used EV market. This will continue as better-equipped EVs hit the market in years to come.

👉 See the best EV lease deals this month, or check out the best EV financing offers