CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Take one look at this month’s incentives, and one thing becomes clear: zero percent financing is on the rise. Whether you’re buying or leasing, here’s a look at the best new car offers for September 2024. It’s worth pointing out that automakers update their incentives between the second and fifth business day of each month. Check back for updates!

Seeking to finance your new vehicle with a low interest rate? Given that the average APR for new car loans is now over 9%, securing a low rate isn’t easy. However, these brands are stepping up to the plate with rare offers.

👉 Slash Your Car Loan Interest: Expert Tips for New and Used Car Buyers

What do automakers do when they seriously need to sell some cars? They bring on zero percent financing. In a serious effort to attract buyers, all of the following models are all advertised for 0% APR in September 2024. These are by far the most widespread sales so far this year.

FORD – 2024 Ford F-150 (36 months), 2024 Ford Mustang Mach-E (72 months), 2024 Ford Expedition (36 months)

MAZDA – 2024 Mazda CX-30, CX-5, and Mazda3 (0% APR for 36 months)

JEEP – All Jeep models, from the legendary Wrangler to the Grand Cherokee, have 0% APR for 36 months right now. See Jeep listings near you.

KIA – 2024 Kia EV9, EV6 (0% APR for 48 months). The slower-charging Niro EV is offered with 0% financing for 60 months.

NISSAN – 2024 Nissan Rogue, Pathfinder (0% APR for 36 months); 2024 Nissan Titan (60 months)

VOLKSWAGEN – 2024 Volkswagen ID.4 (0% financing for 72 months), 2024 Volkswagen Tiguan (0% APR for 60 months).

SUBARU – 0% financing for 72 months: 2024 Subaru Solterra

The deals don’t end at zero percent financing. Several more models are available at just 0.9% APR this month.

These are the models advertised with 0.9% APR in September:

In September, Chevrolet is joined by Subaru, Nissan, and Kia with 1.9% APR financing deals. Considering that the average new car APR is now approaching 10%, this is a steal.

Chevrolet: Colorado, Equinox, Blazer, Trailblazer

2024 GMC Acadia, 2024 GMC Canyon

👉 Here’s every automaker’s best financing offers this month.

When it comes to new car incentives, more shoppers are considering a lease as MSRPs soar ever higher. These are the best lease deals this month.

Sedans may be out of style, but they’re the most affordable. Check out these sedan lease offers for September 2024:

This month, SUV lease deals provide compelling offers for families. Now is a great time to consider leasing, especially if you go for one of the best new car offers listed below.

For truck fans, the Ford F-150 is the best truck lease deal in September 2024.

See all of this month’s best truck offers here.

👉 See ALL of the best lease deals from every major automaker

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Jeep has some of the worst reliability ratings of any automaker today, but some models are considerably better than others. We had originally planned to identify the five most reliable Jeep models, but we ran into a problem. None of the nine Jeep models earns higher than 3 out of 5 stars for reliability. Therefore, we’ve listed the models from most reliable to least reliable, according to Consumer Reports testing and surveys.

Overall, the Jeep brand ranks #24 out of the 25 car brands that CR tests for reliability. Who scored worse? Believe it or not, it was Mercedes-Benz.

We also included current inventory numbers, and there are A LOT of Jeeps sitting on dealer lots today. The deals are out there, if you learn how to negotiate. More on that below.

Base Price: $37,695

Current Nationwide Inventory: 198 market days of supply

Reliability Rating: 3/5

Satisfaction Rating: 2/5

Overall Score: 64

About the rating: Despite receiving a face-lift, new minor features, and a turbocharged engine option, the refreshed Jeep Cherokee remained a lackluster model in a competitive segment. As a result, the Cherokee was discontinued in 2023. It continues to suffer from transmission issues, a stiff ride, and uninspiring handling. The optional turbo engine fails to provide a noticeable improvement in performance. While Jeep addressed some design concerns, this updated version falls short of expectations, highlighting the gap between its promising specs and on-road performance.

See Jeep Cherokee listings with the power of local market data.

Base Price: $61,595

Current Nationwide Inventory: 260 market days of supply

Reliability Rating: 2/5

Satisfaction Rating: 3/5

Overall Score: 51

About the rating: The all-new Wagoneer, built on the Ram 1500 pickup’s body-on-frame construction, offers a comfortable three-row experience with seating for up to 8. However, its pricing, starting at about $10,000 more than competitors before factoring in a high $2,000 destination charge, raises eyebrows. The 5.7-liter V8 engine delivers a robust 392 horsepower, but it’s accompanied by very poor fuel economy, achieving just 15 mpg overall. The independent rear suspension contributes to a smooth ride, but the SUV’s bulk becomes apparent in corners and turns. Inside, the cabin boasts space, leather, and upscale materials, although some controls and displays are less user-friendly. Safety features like forward collision warning and automatic emergency braking come standard, with optional advanced driver assistance features available.

See Jeep Wagoneer listings with the power of local market data.

Base Price: $91,140

Current Nationwide Inventory: 264 market days of supply

Reliability Rating: 2/5

Satisfaction Rating: 3/5

Overall Score: Not Tested

About the rating: Consumer Reports says that the Grand Wagoneer’s expected reliability and satisfaction ratings are based on similar models, which in this case, is surely the 2023 Wagoneer that was tested.

See Jeep Grand Wagoneer listings with the power of local market data.

Base Price: $36,495

Current Nationwide Inventory: 200 market days of supply

Reliability Rating: 2/5

Satisfaction Rating: 3/5

Overall Score: 55

About the rating: The redesigned Grand Cherokee offers a more premium cabin, improved fuel economy, and added refinement compared to its predecessor. It retains the same core powertrain, a 293-horsepower 3.6-liter V6, delivering smooth acceleration and linear power delivery. While it handles relatively well for its size, it falls short of the agility of competitors like the Ford Explorer. The cabin is quiet and well-finished with ample space and comfortable front seats. However, some controls are cluttered and confusing, and the instrument cluster changes can be distracting. The Grand Cherokee comes with a standard suite of safety features, but its historically below-average reliability may deter some buyers.

See Jeep Grand Cherokee listings with the power of local market data.

Base Price: $42,130

Current Nationwide Inventory: 175 market days of supply

Reliability Rating: 2/5

Satisfaction Rating: 3/5

Overall Score: 53

About the rating: The Grand Cherokee’s long-awaited three-row “L” version bridges the gap between mainstream and luxury SUVs but has performance limitations. The base 290-horsepower V6 struggles with acceleration and gets 19 mpg overall. It handles reasonably well, but the steering lacks feedback, and tire grip is mediocre. The cabin is spacious but may not comfortably accommodate adults in the third row. The interior has glossy-black trim, wood, and some misaligned panels, and the controls are cluttered. Connectivity is good, and safety features are standard, but it’s not ideal for serious off-roading.

See Jeep Grand Cherokee L listings with the power of local market data.

Base Price: $32,095

Current Nationwide Inventory: 224 market days of supply

Reliability Rating: 2/5

Satisfaction Rating: 3/5

Overall Score: 25

About the rating: The current Jeep Wrangler maintains its rustic charm, iconic design, and off-road capabilities while enhancing its powertrain, amenities, and connectivity features. However, it comes with drawbacks such as awkward access, excessive wind noise, and a rough ride. The Wrangler’s body-on-frame construction, solid axles, and removable features cater to off-road enthusiasts, especially the Rubicon version. Nevertheless, its on-road performance falls short of modern SUV standards, with stiff handling, pronounced body roll, and a jittery ride, making it less suitable for daily commuting or highway driving. In conclusion, the Wrangler excels in off-road adventures but is not a good choice for any other driving scenarios.

See Jeep Wrangler listings with the power of local market data.

Base Price: $38,775

Current Nationwide Inventory: 190 market days of inventory

Reliability Rating: 2/5

Satisfaction Rating: 3/5

Overall Score: 36

About the rating: The Jeep Gladiator, essentially a Wrangler-based pickup truck with a 5-foot bed, inherits many of the Wrangler’s pros and cons. It stands out in the small truck class due to its unique character and better ride quality, thanks to a rear suspension borrowed from the Ram 1500. Off-road capabilities are impressive, and it offers a robust 3.6-liter V6 engine with good towing capacity, though fuel economy is average. On the downside, handling is clumsy, and the cabin lacks some comfort features, including power seat adjustments. Wind noise can be bothersome at highway speeds, and while it’s appealing for off-road enthusiasts, its higher price and optional safety features may give potential buyers pause.

See Jeep Gladiator listings with the power of local market data.

Base Price: $28,400

Current Nationwide Inventory: 210 market days of inventory

Reliability Rating: 2/5

Satisfaction Rating: 1/5

Overall Score: Not Tested

About the rating: Consumer Reports says that the Jeep Compass’ expected reliability and satisfaction ratings are based on similar models, which in this case, is likely the Cherokee and Renegade, which were tested. Consumer Reports did drive the Compass, however, and didn’t find much to like about it. CR says that when compared to its competitors, the Compass falls short in various aspects. It offers a stiff and jittery ride, and the rear seat is both low and flat, detracting from its overall appeal.

See Jeep Compass listings with the power of local market data.

Base Price: $28,343

Current Nationwide Inventory: 194 market days of inventory

Reliability Rating: 2/5

Satisfaction Rating: 1/5

Overall Score: 40

About the rating: Don’t buy a Jeep just for the brand name. The Jeep Renegade boasts a modern design and a solid build, offering decent rear cargo space. However, its charm wanes quickly due to cumbersome handling, a choppy ride, uncomfortable front seats, and limited visibility. The nine-speed automatic transmission can be hesitant, paired with the 2.4-liter engine, affecting power and performance. While its Trailhawk version shines off-road, the Renegade faces tough competition from more refined and economical compact SUVs like the Honda CR-V and Toyota RAV4. With a score

See Jeep Renegade listings with the power of local market data.

While reliability is a crucial factor in choosing your next vehicle, it’s essential to consider other elements. Factors like fuel efficiency, comfort, safety features, and the car’s total cost of ownership play significant roles in your decision-making process. While we understand that every driver has their own preferences, there’s an undeniable truth car buyers must confront: Jeep does not score well in any of these categories.

From ride comfort to fuel economy, maintenance costs to recalls, Jeep is not a top performer. But we get it: Jeep makes offroad adventures possible at an affordable price point. That’s something special, so we’re sure Jeep will continue to do well in the future. However, we hope that Jeep does improve the common complaints and faults, with the simple goal of having a better product in the future.

You’re not alone in this journey! Our dedicated team of CarEdge Coaches is here to assist you every step of the way. With expert advice and personalized guidance, we ensure you not only choose a reliable vehicle but one that truly fits your lifestyle and brings joy to every drive. Ready to embark on a stress-free and informed car-buying adventure? Contact a CarEdge Coach today, and let’s find your next car at a price you can afford!!

Love the daily Ray and Zach show? Check out our new podcast, AutoInsiders with Ray Shefska!

The Chevrolet inventory landscape is undergoing a shift. Currently, there’s a varied supply of new Chevrolet vehicles across the U.S., but some models, like the Silverado 1500, Blazer, and Equinox, offer opportunities for negotiation and deals. But where does Chevrolet stand compared to its peers, and more critically, which Chevy models are most ripe for negotiation? As we steer through the current state of the market, we’ll take a look at where Chevrolet fits within the broader industry, and spotlight models that present the best opportunities for a deal.

Here’s how Chevrolet’s competition compares this month. It’s clear that new car inventory is rising across the board.

| Make | Inventory % Increase (3 Months) | Market Day Supply - December 2023 | Market Day Supply - September 2023 |

|---|---|---|---|

| Honda | +68% | 47 | 28 |

| Kia | +89% | 53 | 28 |

| Toyota | +37% | 41 | 30 |

| Hyundai | +50% | 75 | 50 |

| Chevrolet | +63% | 88 | 54 |

| Nissan | +58% | 112 | 71 |

| Volkswagen | +52% | 96 | 63 |

| Ford | +43% | 127 | 89 |

| Jeep | +31% | 191 | 146 |

Chevrolet is in the middle of the pack when it comes to inventory. Ford, Volkswagen, Nissan, and Stellantis’ Jeep have an oversupply.

American automakers have high inventory right now. Is that because they’re hot sellers? Not exactly. In recent years, Asian automakers like Toyota, Honda, Hyundai, Kia, and Mazda have all taken larger chunks of market share in the United States. These brands rely less on large SUVs and trucks, and more on crossover SUVs that prove popular.

How did the likes of Hyundai, Kia, and Mazda end up so competitive? In comparison to the imported cars of year’s past, today’s models offer improved reliability, better looks, and in most cases, improved reliability. These improvements from Chevy’s competition have given car buyers more reasons to cross shop.

For buyers aiming to save money on a new Chevrolet, it’s smart to harness the power of car market data. Let’s take a look at today’s inventory numbers across the Chevrolet model lineup.

Using the tools available through CarEdge Data, we analyzed Chevrolet inventory for every model on sale in America. These numbers reflect nationwide supply. You can check out local Chevrolet inventory using CarEdge Data.

| Make | Model | Starting MSRP | Market Day Supply | Total For Sale | Negotiability |

|---|---|---|---|---|---|

| Chevrolet | Malibu | $25,000 | 47 | 4,615 | Average |

| Chevrolet | Bolt EV | $26,500 | 53 | 1,204 | Average |

| Chevrolet | Traverse | $34,520 | 54 | 14,893 | Average |

| Chevrolet | Bolt EUV | $27,800 | 55 | 4,218 | Average |

| Chevrolet | Camaro | $30,900 | 76 | 4,744 | Average |

| Chevrolet | Equinox | $26,600 | 85 | 37,708 | High |

| Chevrolet | Blazer | $35,100 | 97 | 12,984 | High |

| Chevrolet | Silverado 1500 | $36,300 | 107 | 77,118 | High |

The higher the inventory, the more negotiable a new car will be. Remember, these figures are for nationwide inventory. For local Chevrolet inventory numbers, try CarEdge Data.

The most negotiable Chevrolet models right now are the Silverado 1500, Blazer, and Equinox. With 107 days of supply, the Silverado 1500 is ripe for negotiating. Trucks across the market are slow-selling as buyers step away from expensive trucks during this extended period of high interest rates. Ram trucks have the highest inventory and most negotiability, with Ford faring slightly better.

For shoppers looking for a deal on an affordable SUV, the Chevrolet Equinox and Blazer are two great options for well under $40,000. In today’s market with average selling prices north of $48,000, that’s not a bad deal. Just be sure to avoid these dealer fees.

The Bolt EV and EUV have average inventory and negotiability. Surprisingly, these two electric models are in higher demand than most electric competitors, such as the Ford Mustang Mach-E and Hyundai IONIQ 5. It looks like the market for $50,000+ EVs has dried up, but there remains demand for more affordable electric vehicles.

Ready to negotiate a great deal on a Chevy? We can help you save thousands. From 1:1 help to free guides, we’ve got resources for every buyer. Our goal is to simplify car buying while saving you money.

New car models with less than 40 days of supply are generally less negotiable. There’s never any reason to justify paying dealer markups, but scoring a deal under MSRP is always tougher for these models.

These are the Chevrolet models with the lowest supply this month:

| Make | Model | Starting MSRP | Market Day Supply | Total For Sale | Negotiability |

|---|---|---|---|---|---|

| Chevrolet | Colorado | $29,200 | 22 | 4,442 | Low |

| Chevrolet | Corvette | $66,300 | 30 | 2,017 | Low |

| Chevrolet | Trax | $20,400 | 32 | 12,939 | Low |

| Chevrolet | Tahoe | $54,200 | 33 | 7,724 | Low |

| Chevrolet | Suburban | $57,200 | 36 | 3,107 | Low |

| Chevrolet | Trailblazer | $23,100 | 39 | 10,775 | Low |

Chevrolet’s most affordable truck, the Colorado, has the least supply right now. The Corvette, always a low-volume model, is typically on this list. The most notable model is the Chevrolet Trax. The Trax just received a major facelift, and is proving to be tremendously popular among budget car shoppers.

Why don’t automakers just make more affordable cars? Sadly, it’s all about profit margins. Manufacturers like General Motors make a lot more money per vehicle selling high-end trucks and SUVs than $30,000 models. To make matters worse, the car market volatility during and after the pandemic showed them that buyers will pay more for cars.

What can we do about it? For starters, never pay junk fees, forced add-ons, or additional dealer markups. Need assistance negotiating your car deal? Let us help!

While Chevrolet’s inventory varies across models, there’s a clear indication that deals are out there, especially for those who know where to look. Regardless of the popularity or scarcity of a particular model, buyers should never settle for unnecessary dealer markups, inflated add-ons, or costly warranties.

Should car buyers wait for 2024 to score a better deal? Don’t expect prices to drop substantially next year. If you’re thinking about waiting to buy, check out our 2024 car buying forecast.

Ready to master the art of negotiation? Equip yourself with the CarEdge advantage! With these invaluable resources, you can transform your car buying journey, gaining insights into market fluctuations, crafting a solid negotiation strategy, and clinching the best Chevrolet deal in town. Our mission is to guide you every step of the way.

Learn more about CarEdge Coach, CarEdge Data, and a member favorite, CarEdge Consults. We’re here to help!

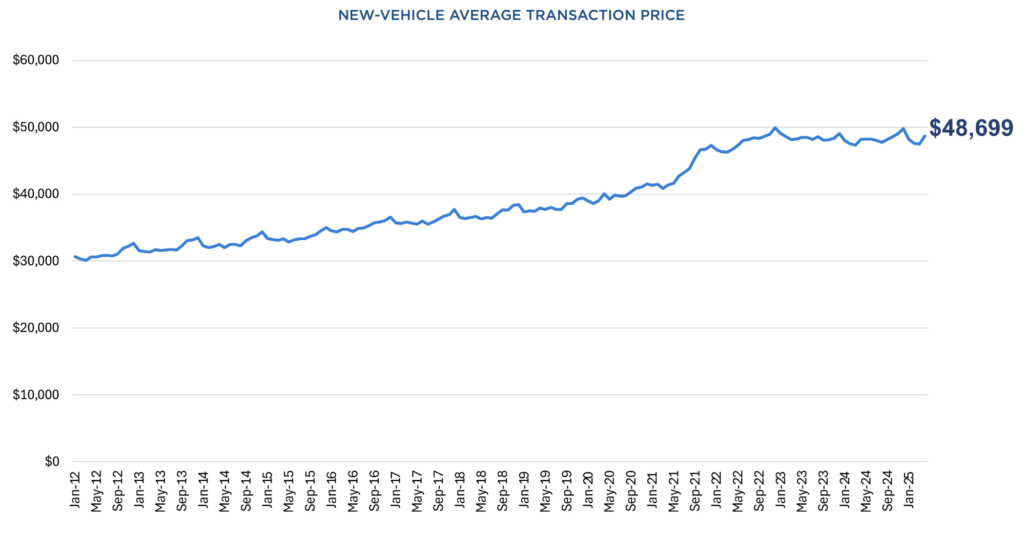

In 2025, the new car prices remain within a few percent of 2022’s all-time record highs. This stability comes after a year of slow but steady price drops, followed by a jump in prices in late 2024. As new car price trends prove tough to forecast, keeping an eye on the market’s subtle movements becomes crucial for potential buyers and sellers alike.

Let’s delve deeper into the current state of the new car market.

Which segments of new cars are experiencing price drops, and which are seeing a rise? Is now a good time to buy a new car, or is it a good time to sell? We will address these pressing questions and more.

According to the most recent data from Cox Automotive, the average transaction price for new cars is $48,699. That’s down slightly from the peak of $49,929 in December 2022. New car prices increased in April 2025, but were 1.3% higher than one year prior. The month-over-month price increase of 2.5% was sharp was the largest since April of 2020. Prices had previously fallen as low as $47,244 earlier in 2024, before bouncing back. Here’s a look at new car prices over the past year.

| Month-Year | Average New Car Transaction Price |

|---|---|

| 1/1/2024 | $47,401 |

| 2/1/2024 | $47,244 |

| 3/1/2024 | $47,218 |

| 4/1/2024 | $48,368 |

| 5/1/2024 | $48,389 |

| 6/1/2024 | $48,424 |

| 7/1/2024 | $48,166 |

| 8/1/2024 | $47,870 |

| 9/1/2024 | $48,397 |

| 10/1/2024 | $48,623 |

| 11/1/2024 | $48,724 |

| 12/1/2024 | $49,740 |

| 1/1/2025 | $48,641 |

| 2/2025 | $47,577 |

| 3/2025 | $47,462 |

| 4/2025 | $48,699 |

Some new car segments saw notable price declines last month, while others are holding firm. New car incentives have fallen sharply since year-end sales concluded. The luxury vehicle segment has experienced notable price reductions, with Tesla, BMW, Audi, Cadillac, and Lexus seeing lower prices last month. Tesla is now a top-10 luxury brand in America, not just the leader of electric vehicle sales. We’ll see how the first month of 2025 turns out for new car price trends.

If you’re looking for the BEST deal on a new or used car, remember this: knowledge is power when it comes to negotiating car prices. When you have an understanding of local inventory dynamics, car price trends, incentives, and the negotiable aspects of a car deal, you’re better prepared to drive away proud of your deal.

Free Car Buying Help Is Here!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

What do you think 2024 will bring? Hopefully next year will be less exciting than the past few. Already in this decade, we’ve seen a pandemic cause a freefall in car sales, followed by a severe supply shortage that sent prices through the roof, only for car prices to stabilize at a new, much higher normal. Will car prices drop in 2024? Is there relief in sight for buyers facing high interest rates and slim supply? CarEdge co-founder Ray Shefska, with his four decades of auto industry insight, shares his car market predictions for 2024. Let’s explore.

As much as we’d love to be wrong, it’s very likely that both new and used car prices will remain high in 2024. CarEdge co-founder Ray Shefska recently shared his thoughts on the most likely scenarios in the short-term.

All things considered, Ray says that continued high prices are all but guaranteed. When automakers see an opportunity for ‘price adjustments’, they’re not going to pass it up.

“I don’t foresee better pricing soon with various factors at play. For instance, the ongoing UAW strike is pushing labor costs up, despite them comprising only five percent of total vehicle production costs. This increase will inevitably lead manufacturers to adjust their MSRPs, providing a convenient excuse for doing so.”

Multiple factors are converging that lend to this thinking.

For new cars, it’s fair to blame high prices on the manufacturers. Despite consumer demands for more affordable options, OEMs keep producing over-priced SUVs and trucks. Gone are the $30,000 base models.

The continuous production of high-margin vehicles by manufacturers, which are typically priced out of reach for the average consumer, is a losing strategy in our eyes. Nevertheless, with $100,000 trucks and glamorous SUVs coming out of American and foreign automakers alike, this is the road we’re headed down.

“I’m skeptical about the auto industry having a stellar year in 2024, considering that a significant percentage of consumers feel they can’t afford new cars. Manufacturers are increasingly relying on fewer buyers to pay higher prices in order to turn a profit. The average buyer does not benefit in this situation,” said Ray.

This is all in addition to the costly EVs that are filling up dealer lots.

Here’s where it gets interesting. The continued production of high-margin vehicles is primarily motivated by the manufacturers’ need to fund their ventures and investments into the electric vehicle (EV) market. Unlike Tesla, the likes of GM, Ford and Stellantis are still figuring out how to make mainstream EVs that can turn a profit.

This isn’t merely hearsay. In Ford’s earnings report, executives noted the continued profitability of their internal combustion-powered lineup, but also the financial woes of their EV division. Ford expects to lose $4.5 billion on EVs by 2023’s end, despite overall profits rising. The ‘Blue Oval’ has $100,000 trucks to thank for that.

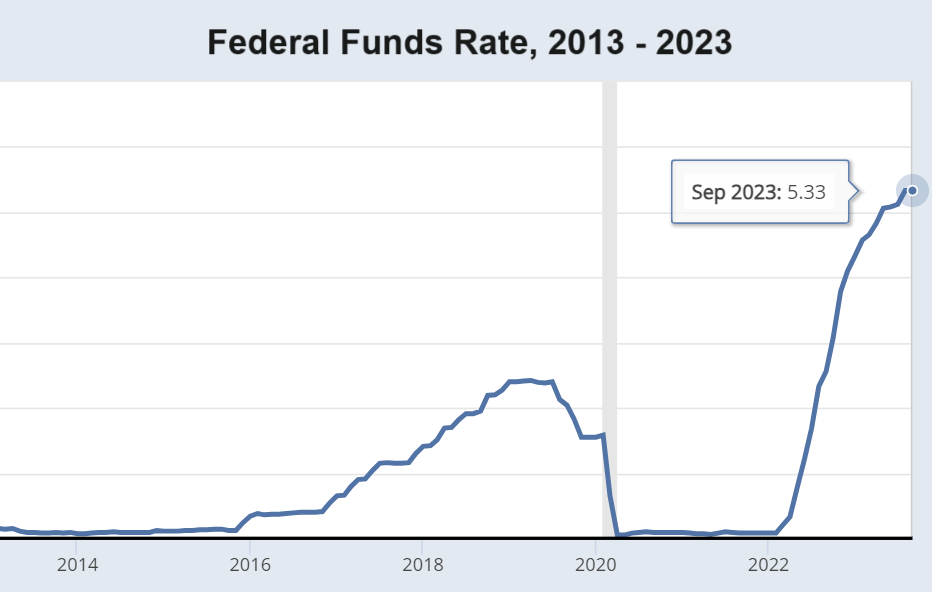

Cash will remain king in 2024. As of October 2023, the average new car loan APR is north of 9%. Used car loans are even more expensive, with the average APR at 14%. See the latest monthly payment statistics here.

The Federal Reserve has stated that rates will remain near current levels through at least the first half of 2024. With that said, auto loan interest rates are forecasted to remain high in 2024.

The tandem of soaring prices and stiff interest rates creates a scenario where affordability takes a significant hit. It’s the sad truth that some buyers will be priced out of the market as a result.

The lowest auto loan rates will continue to be found with manufacturer incentives. New car inventory has been steadily rising, leading to low APR offers from some automakers. Zero percent financing is still possible if you shop for deals, and APRs under 3% are quite common.

See this month’s manufacturer incentives, featuring the lowest APR offers.

As we gaze into the automotive crystal ball for the forthcoming year, a rather annoying trend appears to hold its ground: the significant shortage in the used car market is on track to persist in 2024.

When it comes to used car prices, supply and demand drive the market. In 2023 and 2024, it’s the reduced supply of used cars that ensures prices will remain elevated. Used car prices rose 36% in 2021, only to fall 7% the year after. As 2023 comes to a close, it looks like used car prices will end the year about where they began 12 months ago.

The roots of the used car shortage can be traced back to the supply chain problems of 2021-2022. The production of new cars slowed, and sales dropped like a rock. Fewer cars sold in 2021-2022 resulted in fewer trade-ins and subsequently, a tightened supply of used vehicles. With approximately 15 million new cars that were initially scheduled for production globally never seeing the light of day, the ripple effect has led to a lasting shortage of used cars.

This is not a short-term hiccup. Industry insiders like Ray predict that the scarcity of pre-owned vehicles is likely to extend through this decade.

Ray emphasized the connection between today’s new car market and the shortage of used cars that he expects to see continue in 2024. “Manufacturers aren’t motivated to produce vehicles under $30,000 since they need high profit margins to support their EV initiatives. Production will continue to focus on high-margin vehicles, not affordable models and trims. The problem is that these expensive new cars are accessible only to a small fraction of buyers. Ultimately, more buyers will turn to the used car market for prices they can afford, no matter how inflated used car values may be.”

Consumers in the market for used cars should understand that higher prices and limited options will be around for a while. See the latest used car price date, courtesy of Black Book:

Used Car Price Trends for 2023 (Updated Weekly)

Legacy automakers have invested over half a trillion dollars in electrifying their lineups. The sad reality is that not a single one of them is anywhere close to Tesla in EV market share.

As of last check, 60% of electric vehicles sold in America were Tesla models.

In 2024, we expect Tesla to continue to dominate. Even if Tesla EV market share drops to 40-50%, that’s still domination by anyone’s standards. Tesla invested so heavily in mastering low-cost production that it will continue to have an advantage over Ford, GM, and the rest of the gang.

Tesla’s EV dominance increasingly puts legacy manufacturers such as Ford, General Motors, and Stellantis in a precarious position. This will become much more evident in 2024. How so? Some BIG name, long-awaited EVs will arrive from legacy brands. Here are just a few…

If the above-mentioned electric models fail to attract large numbers of buyers, it will become crystal clear that legacy automakers have a BIG EV problem on their hands.

Traditional automakers are bracing for a turbulent period ahead, grappling with the dual headwinds of rising manufacturing costs and their struggling EV divisions. By the end of 2024, we’ll have learned a lot about the long-term prospects for legacy EVs. It’s possible that Tesla, once the laughing stock of Detroit executives, will indeed have the last laugh.

The automotive industry in 2024 faces a confluence of challenges, some of which are yet unknown. Aside from the variables discussed here, there are other wildcard scenarios that have the potential to disrupt market dynamics.

The UAW strike is over, but the negotiated agreement may force new car prices higher as OEMs spend more on manufacturing costs. As CarEdge’s Ray Shefska has noted, labor costs are a small fraction of total manufacturing expenses. However, that won’t keep automakers from using employee raises as an excuse for MSRP hikes.

The Detroit ‘Big Three’, General Motors, Ford, and Stellantis, are already at a disadvantage in the growing EV market. Rising labor costs and shaky supply chains threaten to wipe away what progress they have made.

An even more important unknown is the health of the global economy in 2024. Most experts agree that there’s only a slight possibility of an economic recession, but it’s a non-zero chance.

Here’s how economic recession impacts car prices.

This economic uncertainty is further exacerbated by conflicts overseas, and a looming election year here at home. Globally, there are dozens of situations that could, in theory, boil over into the automotive market. For starters, there’s the volatile situation in the Middle East, the simmering tensions in Ukraine, and the precarious state of affairs surrounding Taiwan. Each of these geopolitical hotspots has the potential to inject uncertainty into the global markets, creating ripple effects that could inevitably impact the automotive industry.

Moreover, with 2024 being an election year in the United States, the industry is bracing for potential policy shifts and market reactions that often accompany electoral cycles, adding yet another layer of unpredictability to an already uncertain landscape. These combined factors make the outlook for the auto industry in 2024 particularly challenging to forecast.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!