CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

As summer 2024 approaches, more drivers are wondering if now is a good time to buy a used car. When it comes to the used car market, the details matter. With the average listing price hovering around $25,540, nearly unchanged from the start of the year, it might seem tough to get a deal. But the price is only half the battle, as you’re about to see.

Let’s dive into the details.

Does Credit Score Matter in 2024? YES. Knowing your current credit score will help you plan for the cost of financing. Planning to pay cash? GREAT! But if not, lenders will use your credit score and debt-to-income ratio to determine if you qualify for a car loan.

In fact, your credit score can help you determine if now is a god tiod time to buy a used car, or possibly even the worst time. Used car loan rates now average north of 13% APR. But that’s just the average. Shoppers with lower credit scores (under 650) will only qualify for higher rates, perhaps approaching 20% APR for the lowest scores, if you can get qualified at all.

Check out the 2023 data from Experian via MarketWatch to see the average auto loan rates by credit score. This is very similar to what shoppers should expect today, as rates have remained high over the past year.

How much does interest rate matter with a used car loan? Let’s look at a realistic example. With a $30,000 car loan over 72 months, the difference in interest paid between a loan at 5% APR and one at 15% APR is substantial. It’s always best to opt for a shorter loan term, but we’ll use this example since more drivers are stretching out their payments as prices rise.

What’s the difference in interest paid? With a 5% APR, you would pay approximately $4,776 in interest over the 72 months of the loan. However, at a 15% APR, the interest spikes to $13,632, resulting in an additional $8,856 in interest costs. This highlights the significant financial impact that APR can have on the total cost of a loan.

No matter when you get serious about buying, DO NOT overlook the power of having a good credit score. It’s the difference between paying a little interest, and eye-gouging amounts owed month after month.

👉 Finance Your Car Like a Pro With This Cheat Sheet (100% FREE)

For more about what credit score car dealers and banks use, check this out.

The reality of 2024 is stark: cars are more expensive, and finding a reliable, low-mileage vehicle under $10,000 is virtually impossible. According to research from iSeeCars, while 49.3% of all used cars were priced under $20,000 in 2019, today that number stands at just 12.4%.

Before you fall in love with a make or model, use tools like CarEdge’s Car Search to set realistic expectations and shop within your means.

👉 Bookmark This FREE Out-the-Door Price Calculator

If you’re not in urgent need of transportation, waiting might be wise. We anticipate used car prices could drop an additional 2-5% later in the summer and potentially even more towards the end of the year. Delaying your purchase could save you thousands, especially if interest rates begin to decrease as predicted. Although with inflation staying stubbornly high, the general consensus is that interest rates will remain at current levels for at least a few more months, if not longer.

Considering New Cars Too? See This Month’s BEST Deals.

Deciding whether to buy a used car now or later in 2024 boils down to your personal circumstances—your budget, your credit score, and how urgently you need a vehicle. If your situation allows, waiting a few months could be financially beneficial, both in terms of lower prices and potentially reduced interest rates. This is especially true if you could use more time to improve your credit score. Qualifying for the best rate possible will save you thousands in interest payments with most used car loans today.

However, if you need a car soon, finding a well-priced deal now is possible IF you’re prepared to negotiate. Check out the free tools below! And remember to use CarEdge Pro to equip yourself with local car market data. You’ll negotiate like a pro in no time!

So overall, is now a good time to buy a used car? The answer is that it’s an okay time, and better times are ahead once prices drop further, and these insanely high interest rates come down. But the future is notoriously hard to predict. If you need a ride quickly, you CAN score a deal with negotiation know-how.

Navigating the used car market can be complex, but with CarEdge, you’re never alone. Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Stay tuned to CarEdge for more insights and tips on car buying in 2024!

Shopping for a new car is an exciting time, but knowing which brands to steer clear of can save you from a lot of future headaches. At CarEdge, we’re diving deep into rankings from Consumer Reports, and complimenting their legendary work with our own car market updates from CarEdge Pro. Here’s a breakdown of the 10 least reliable car brands in 2025. If you buy one of these cars, you ought to have a car maintenance emergency fund at your disposal, or start getting quotes for extended warranty protection!

Looking for the MOST reliable car brands? Check those out here.

We hope you enjoy the real-time car market data we’ve included. Head over to CarEdge Pro for localized data that YOU can use to negotiate effectively.

Consumer Reports provides an annual snapshot of car reliability, all based on data from over 300,000 vehicles that addresses 17 common trouble areas. The non-profit has been helping car buyers make smart choices for 88 years. In 2025, the CR rankings reveal a few brands that, well, might not be your best bet if reliability tops your priority list. For comparison’s sake, we’ve also included the number of recalls for each manufacturer over the past year ending in January 2025, via the NHTSA.

Although Rivian is the least reliable car brand according to Consumer Reports, all GM brand rank near the bottom. Here’s a look at the car brands most likely to give you problems during ownership.

The 10 Least Reliable Car Brands in 2025:

👉 See local car market prices and trends with CarEdge Pro

From frequent breakdowns to excessive recalls, these brands show various signs of potential trouble for consumers. Surprisingly, the least reliable car brands are often expensive. With the likes of Rivian, Tesla, Volvo and Volkswagen on the list, it’s clear that when it comes to reliability, you don’t always get what you pay for.

Other than that, we see a mix of manufacturers from around the world on this unfortunate list. In a massive improvement from last year, only one Stellantis brand is on the list. General Motors, on the other hand, had falling reliability ratings, with three of the four GM brands on the bottom 10. Chrysler, the only GM brand not making an appearance, wasn’t rated by Consumer Reports due to ‘insufficient data’.

👉 By the way, these are the 10 MOST reliable car brands, according to CR

According to Consumer Reports, hybrid vehicles lead the pack among electrified powertrains in terms of reliability. “On average, hybrid powertrains remain reliable, while pure electric vehicles (EVs) and plug-in hybrid vehicles (PHEVs) are improving despite continuing reliability problems.”

On the other hand, plug-in hybrid vehicles tell a different story, facing 70% more issues than gasoline (ICE) vehicles. Consumer Reports found that fully electric vehicles (BEVs) have 42% more problems than gas-powered or traditional hybrid vehicles. This is a big improvement from last year, when EVs had 79% more issues than ICE vehicles.

While it’s crucial to consider reliability, don’t forget to weigh other factors such as fuel efficiency, safety features, and overall cost of ownership. Check out our detailed CarEdge cost of ownership rankings to get a fuller picture.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

As we enter the heart of spring, car shoppers have every reason to mark their calendars for Memorial Day weekend (May 25 – May 27). Traditionally a hotbed for great car deals, 2024’s Memorial Day sales are poised to be especially big. This year, high new car inventory levels and expensive floorplanning costs for dealers are setting the stage for big bargains.

👉 Just want to see the deals? These are the best new car offers today. Now, onto why 2024’s Memorial Day sales will be special.

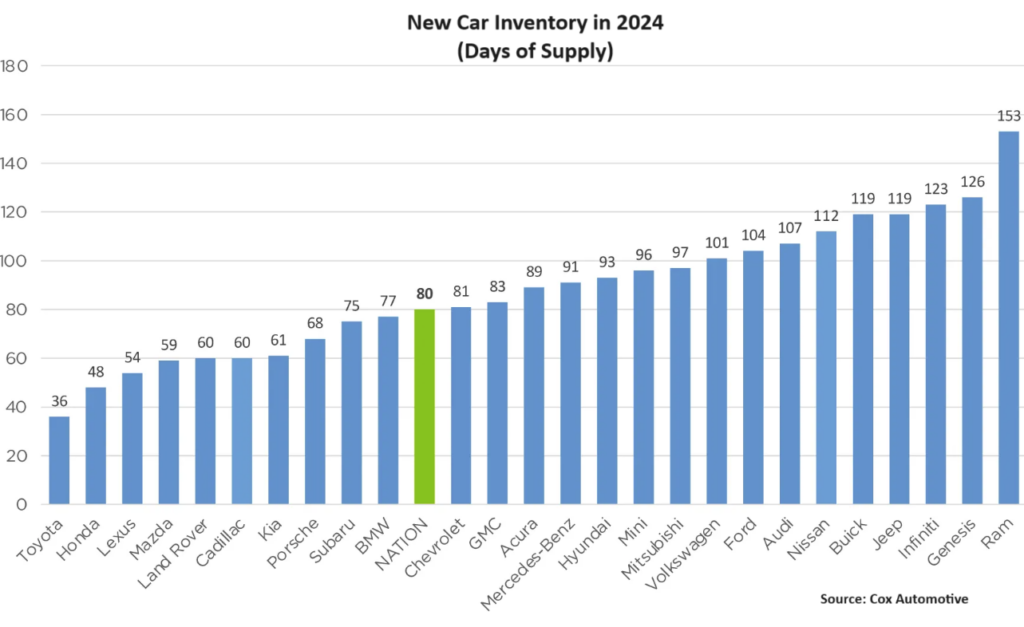

Most automakers are grappling with unusually high levels of new car inventory. According to Cox Automotive, April opened with 72 days of new-vehicle supply industry-wide, a notable increase of 46% compared to a year ago. This glut stems largely from a mismatch between production outputs and a softening consumer demand, influenced by lingering economic uncertainties, high interest rates, and in many cases, ridiculously high MSRPs.

This overstock is particularly pronounced in the truck, SUV, and luxury vehicle sectors. While sales in 2024 are indeed picking up—showing an 11% increase in March compared to the previous year—the rising sales figures are not enough to offset high inventory levels. But that’s what OEMs hope to change with May’s best car deals.

Manufacturers are under pressure to clear out 2023 models, four months into the new year. In late April, 300,000 of the nearly 3.1 million new cars for sale in America were 2022 or 2023 models. Many of them are trucks like the Ford F-150 and Ram 1500. Even with thousands of 2023s on dealer lots, manufacturers are flooding dealer lots with more inventory (more on that here).

This pressure is not just a warehouse issue; it’s a financial imperative. High floorplanning costs driven by stubbornly high interest rates are eating into dealer profits, adding to the sense of urgency.

Despite the modest gains in sales, certain brands like Ram, Jeep, Mazda, Ford, and Nissan are facing significant inventory excesses compared to their competitors. These brands are likely to offer bigger discounts for Memorial Day as they strive to sell cars.

Car brands with less inventory include Toyota, Subaru, and Honda. These brands are less likely to offer big incentives in May.

👉 See the fastest and slowest-selling new cars right now

Low APR deals are a win-win for both dealers and buyers. For dealers, it’s about liquidating stock without slashing sticker prices dramatically, which can devalue the brand. For buyers, these subsidized rates lower the monthly payment, making an upgrade more feasible. Expect to see APR offers as low as 0% for qualified buyers on select models, alongside generous cash-back offers and lease deals.

In fact, there are already several 0% APR offers on the market today…

👉 See the best APR and cash offers this month

As we inch closer to Memorial Day, certain vehicles stand out for their negotiability. While the specific models and deals will be confirmed as the holiday approaches, here are some categories to watch:

This Memorial Day, CarEdge is your go-to resource for navigating these sales. Not only will we provide a one-stop resource for the best car sales, we’ll also share car market insights that you won’t find anywhere else. 👉 Bookmark this page and check back in early May to see what automakers have to offer! Head to this page for the best deals right now, no matter when you’re reading this.

Electric car prices have fallen off of a cliff. Depending on your stance in the market, this could be great news, or far from it. Since September 2022, the average used electric car price has tumbled from $63,069 to $33,645. That is a 47% loss of value in a little over a year and a half.

At the same time, used internal combustion engine vehicles have seen their prices decline too. Since September of 2022, used cars powered by internal combustion engines have seen their average price decline from $34,000 to $32,000. This 6% loss in value over 18 months is more like what we would expect.

A closer look at some EVs for sale today reveals that a 47% drop in value would actually be a better scenario, believe it or not. Should EV buyers consider this drastic drop in value to be a good or bad sign? We’ll get into that too.

The actual value of new electric cars is significantly lower than their starting MSRPs. Take for example this BMW i4 that is currently for sale. The manufacturers suggested retail price is $64,740. The CarEdge Target Discount from the dealer is 8% off of MSRP which is a price of $59,561.

What happens when you plug this vehicle into CarEdge.com/sell and receive instant cash offers? With just 500 miles entered on the odometer, the highest cash offer is $28,370 from CarGurus.

That is an astounding 56% loss of value the moment you drive the car off the lot!

Things get even worse when you look at the Mercedes-Benz EQS. This 2023 Mercedes-Benz EQS has a manufacturers suggested retail price of $156,170. The CarEdge Target Discount is 15% off of MSRP, leading to a selling price of $132,745. 15% off of a Mercedes seems like an excellent deal! Until …

When you plug this vehicle into CarEdge.com/Sell with 500 miles you get an instant cash offer of $67,000. Again, a 57% loss in value.

When Ford launched their flagship ‘Tesla-killer’ EV in 2021, nearly infinite demand was expected by Ford’s leadership. “It’s hard to produce Mustang Mach-Es fast enough to meet the incredible demand, but we are sure going to try,” said Ford CEO Jim Farley at the time.

How times have changed. From boasting production targets of 200,000 copies by 2023, to struggling to sell last year’s inventory even today, Ford EV sales have not lived up to their corporate expectations.

The good news for buyers is that great deals can be had on a new Mustang Mach-E. But is it enough to lift buyers out of negative equity from day one?

Let’s take a look at an example from the CarEdge Community.

This new 2022 Mustang Mach-E was STILL on the dealer lot in early 2024. In fact, about 100 new 2022s remain across the nation. With a $27,000 discount, surely it’s a steal, right? Not so fast…

Here’s how much online car buyers would pay for that exact car, the moment it is driven off of the lot…

That’s right, a 48% drop in market value from day one. Although this was a 2022 model, roughly two-thirds of all new Mustang Mach-Es on dealer lots today are leftovers from 2023. No one should be paying MSRP for last year’s cars in spring or summer of 2024. See how low prices are near you.

Lower selling prices is welcome news for EV buyers, but with a few VERY important caveats.

The only folks who should be buying new EVs right now are those who plan to keep them for a long time. Otherwise, buying an EV is a very risky financial decision if there’s a chance you’ll be looking to sell anytime soon.

Unless a hefty down payment or trade-in is made, buying a new EV in 2024 puts buyers at significant risk of becoming ‘underwater’ on their car loan. This means that your car is worth less than you owe on the loan (learn more here). It’s a situation you want to avoid, no matter what.

Leasing an EV is another great option, and there are some great EV lease offers out there today. Plus, leasing is a low-stress way of trying out the EV lifestyle for the first time.

This is where the EV depreciation crisis turns into good news for some. If you’re open to buying a used electric car, the shocking depreciation of today’s new models is in your favor. Previously, EV buyers had to decide between the benefit of the federal EV tax credit (available only on select models), or somewhat lower prices on the used market. Today, that’s no longer the case.

In 2024, the price gap between new and used EVs couldn’t be more clear. The savings that come along with a used EV are no match for even the most generous of new EV incentives. With new tools like Recurrent Auto, you can even check a used electric car’s battery health before buying.

Used EV buyers can take advantage of rapid depreciation to score a sweet deal on any used EV, from Tesla to Ford and everything in between.

👉 See for yourself with these Local Used EV Listings

In 2024’s changing EV market, there are more reasons than ever to equip yourself with car buying know-how. The good news is that we have 100% FREE resources to get you there!

Ready to outsmart the dealerships? Enroll in Deal School now—CarEdge’s online, completely free car-buying course. Gain the insider knowledge to take charge of your purchase. Start mastering your deal today!

For many, there will eventually come a time when you need to part ways with a beloved car – even when you still owe money on it. Selling a car with an outstanding loan can seem daunting due to the added complexity of dealing with lenders. However, with a proper understanding of the process and careful planning, you can navigate the situation with ease. Here at CarEdge, we’re diving into how you can efficiently and effectively sell your car, even if the loan isn’t fully paid off yet.

When you’re considering selling a car that you still owe money on, the first crucial step is to fully understand the details of your loan. This knowledge is not only essential for setting the right sale price but also for ensuring that the transaction is handled legally and smoothly.

First thing’s first: understand your loan. That means digging up your login credentials to get into your online account with the lender. You may even need to give them a call, or hop on the live chat.

Here’s what to figure out before selling your car with a loan balance:

Next, determine how much your car is worth. Use trusted resources like Edmunds or Kelly Blue Book, and use CarEdge’s valuation tool to see how much online buyers will pay.

If you decide to go the private seller route, it’s important to price your car thoughtfully. Remember, you’re trying to sell the car quickly while also covering your remaining loan balance. Setting the right price can help you attract buyers quickly while ensuring you don’t fall short financially.

You have two main avenues for selling your car: a private sale or a dealership trade-in. A private sale typically yields a higher return but requires more effort on your part in terms of marketing and negotiation. Platforms like Facebook Marketplace, Cars.com, and AutoTrader are great for reaching potential buyers. On the other hand, trading in your car at a dealership is less hassle but is highly unlikely to offer as much for your car, especially with an outstanding loan.

With a dealership trade-in, it’s common to be offered 20-30% less than your car is worth in a private sale. If you could really use that additional money, going through the longer, more tedious process of selling privately may be worth it.

👉 Learn more about your options for selling a car

The financial aspect of selling a car with an outstanding loan can be tricky. But don’t give up now! If you’re eager to sell, it’s worth the hassle. Here’s how to handle it effectively:

Transferring ownership involves a few small hurdles, but it’s nothing you can’t do! You must inform the buyer about the lien and ensure that the loan is fully paid before transferring the title. Even with a lien, you are legally required to provide the buyer with a bill of sale, documenting the transfer of ownership to the buyer. Alongside this, include a payoff authorization when you send the loan payoff to your lender. This authorizes them to release the lien or send the physical title directly to the new owner. Once you receive a lien release from your lender, you can complete the title transfer to the new owner.

Each state has different laws, so it’s important to check your local requirements. Check with your state DMV. The information should be easily found on their website.

If you want to avoid these hurdles, consider paying off the loan balance and securing the lien release before you sell the car. This approach eliminates many potential complications that could delay the sale.

Selling a car with an outstanding loan requires careful attention to financial details and diligent record-keeping. With the right approach, you can sell your loan and transfer ownership without a hitch. Remember, knowledge is power in any transaction. Understanding how to handle this process can save you from potential financial pitfalls. For more insights and resources on managing car sales and ownership, keep it tuned to CarEdge.

👉 Want to become a car market pro? How about that and more for FREE?

Sign up for Deal School today, our free course for anyone interested in buying, selling, or simply owning a car the smart way.