CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Honda’s new car inventory has risen 38% in just two months. Just in time for the best year-end car sales in ages, an oversupply of both new and used Honda models presents a rare opportunity to negotiate a great deal. We’ll take a look at which new and used Honda cars and SUVs are the most negotiable today, and how you can make a data-powered deal in December.

Snapshot:

Read on for the latest details and money-savings tips.

December is always the best time to buy a car. This is especially true for new Honda inventory in 2023. What’s so special about 2023’s year-end car deals? In a high interest environment, the biggest sales of the year are a long time coming. With automakers and dealers eager to sell remaining 2023 inventory, and everyone eyeing an end-of-year bonus, phenomenal deals are everywhere you look.

Today’s car buyers have options. For those willing to master car buying the smart way, thousands of dollars in savings await. Sure, you could simply browse the best Honda deals this month, or you could negotiate like a boss with the added leverage of Honda inventory numbers. CarEdge is here to help you get there.

First, let’s talk about the inventory trends of new Honda models in the U.S. Back in October, Honda was just beginning to climb out of the inventory lows that had plagued the automaker for a few years. Ever since the pandemic supply chain shortages pummeled Honda and other Asian automakers with record-low inventory levels, the beloved brand has been struggling to return to normal.

Finally, in late 2023, Honda’s supply of new cars is rising, to the benefit of holiday car shoppers.

By using a behind-the-scenes industry metric, we can see exactly how negotiable new or used cars are today. This metric is called Market Day Supply. Market Day Supply takes into account the existing inventory of a new or used vehicle, and the selling rate over the last 45 days. What you get is the number of days it would take to sell ALL vehicles in stock at current selling rates, assuming no new inventory was added. In simple terms, MDS reflects the level of demand for a car.

For starters, a ‘healthy’ MDS in the car market is somewhere between 45 and 60 days of supply. Anything below 20 days is a real shortage, and anything above 80 is a serious oversupply. Today, Honda averages a healthy 47 days of supply. For Honda, this is quite high. It’s all relative, though. If this was one of the domestic brands (Ford or Chevrolet, for example), 47 days of supply would be below average. For Honda, it’s higher than normal.

With the power of understanding market conditions in mind, let’s take a look at how much Honda’s new car inventory has risen in late 2023:

| Model | Year | October Market Day Supply | December Market Day Supply |

|---|---|---|---|

| Accord | 2024 | N/A (new model) | 56 |

| Accord | 2023 | 30 | 58 |

| Civic | 2024 | N/A (new model) | 50 |

| Civic | 2023 | 34 | 62 |

| CR-V | 2024 | 24 | 34 |

| CR-V | 2023 | 12 | 99 |

| HR-V | 2024 | 47 | 58 |

| HR-V | 2023 | 151 | 891 |

| Odyssey | 2024 | N/A (new model) | 45 |

| Odyssey | 2023 | 31 | 120 |

| Passport | 2024 | N/A (new model) | 55 |

| Passport | 2023 | 45 | 30 |

| Pilot | 2024 | N/A (new model) | 45 |

| Pilot | 2023 | 26 | 45 |

| Ridgeline | 2024 | N/A (new model) | N/A (new model) |

| Ridgeline | 2023 | 39 | 53 |

Overall, Honda’s new car inventory has risen from 34 market days of supply in October to 47 days of supply in December, an increase of 38% in just two months.

The jump in supply has been notably greater for some Honda models, such as the CR-V, and Accord. The selling rates of the Accord and HR-V are greatly skewed by a seatbelt recall that has affected 2023 and 2024 models. Dealers can’t sell affected HR-Vs and Accords until a fix is implemented.

However, with 2024 just days away, dealers will be eager to sell 2023 Accords and HR-Vs as soon as a recall fix is installed, making them particularly negotiable in the weeks ahead.

See new Honda listings with the power of local market data

With negotiation know-how, today is the ideal time to use local market data as leverage for negotiating a bargain of a deal.

Honda’s used cars are popular for several reasons. With great reliability ratings and high driver satisfaction, pre-owned Hondas are always quick to sell.

In December of 2023, used Honda inventory is rising. What could be behind this unusual trend? The culprit is clear: high interest rates. Today, the average used car loan rate is hovering around 14% APR. More and more car shoppers are opting for new car deals as opposed to forking over extra cash for interest on a used car loan.

Here’s a look at how hard Honda’s used inventory is being hit in today’s high-interest environment.

| Model | Year | October Market Day Supply | December Market Day Supply |

|---|---|---|---|

| Accord | 2022 | 49 | 60 |

| Accord | 2021 | 49 | 54 |

| Civic | 2022 | 50 | 60 |

| Civic | 2021 | 53 | 58 |

| CR-V | 2022 | 45 | 60 |

| CR-V | 2021 | 47 | 62 |

| HR-V | 2022 | 59 | 48 |

| HR-V | 2021 | 52 | 54 |

| Odyssey | 2022 | 74 | 79 |

| Odyssey | 2021 | 61 | 62 |

| Passport | 2022 | 56 | 76 |

| Passport | 2021 | 60 | 71 |

| Pilot | 2022 | 52 | 71 |

| Pilot | 2021 | 48 | 59 |

| Ridgeline | 2022 | 57 | 63 |

| Ridgeline | 2021 | 61 | 64 |

7 out of 8 used Honda models are seeing rising inventory in December. Does that mean that you should buy used instead of new? Not exactly. Honda is offering attractive APR deals in December, ranging from 1.9% to 3.9% APR. You will NOT be able to secure an auto loan rate anywhere near that low for a used car right now. With an average of nearly 14% APR, used car buyers with an excellent credit score will be lucky to qualify for anything under 7%.

If you can afford the higher sticker price, we recommend giving new Honda cars and SUVs a serious thought in today’s car market. You’ll save thousands in interest over the life of your loan.

See used Honda listings with the power of local market data

In closing, with Honda’s inventory hitting a peak and used car supply also on the rise, December 2023 is shaping up to be a buyer’s paradise. Whether you’re eyeing a new CR-V or considering a pre-owned Accord, the current market dynamics offer a unique opportunity for negotiation. Armed with the latest data and understanding of market trends, savvy shoppers are in a prime position to secure some of the best deals on Honda models before we ring in 2024. Don’t miss this chance to drive home value like never before!

See local market insights with CarEdge Data, the ultimate car buying toolkit.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

What do the top states for year-end car deals in 2023 have in common? It’s simple: the best states for December bargains have affordable, popular models with high inventory this month. We can’t say it enough: where there’s high new car inventory, opportunities for negotiation offer the chance for major savings. With today’s high interest rates, saving a thousand dollars means more than ever.

It’s important to keep in mind that today’s new car market is dynamic, with inventory levels, manufacturer incentives, and dealer’s willingness to negotiate constantly in flux. That’s why the latest data is critical for car buyers on the hunt for deals in December. Using CarEdge Data, we’ve looked at the market day supply of new cars in all 50 states to uncover opportunities for extra savings.

Why does market day supply matter to car buyers everywhere? If you like to save money on your car purchase, you should start paying attention to this little-known industry metric. Market Day Supply (MDS) is calculated by dividing the current inventory of a specific car model by the average number of units sold per day. In a ‘normal’ healthy market, MDS averages somewhere between 40 and 60 days of supply for mainstream models. Today, the nationwide average for new cars is 83 days of market supply. In states with the highest negotiability, MDS figures are MUCH higher.

With the power of local market data, we now have a clear picture of where the greatest oversupply of new cars is today. Without further ado, here’s a look at the best states for year-end car deals in 2023.

Vermont

New car market day supply: 101 days

The most negotiable new cars right now: Ford Mustang Mach-E (238 days of supply), Jeep Wrangler Unlimited (194 days of supply), Ford Escape (129 days of supply), Ram 1500 (129 days of supply)

Louisiana

New car market day supply: 97 days

The most negotiable new cars right now: Dodge Charger (453 days of supply), Ford F-150 (194 days of supply), Ram 1500 (181 days of supply), Ford Explorer (175 days of supply), Chevrolet Silverado 1500 (154 days of supply)

Nebraska

New car market day supply: 97 days

The most negotiable new cars right now: Ram 1500 (219 days of supply), Ford F-150 (176 days of supply), Chevrolet Silverado 1500 (93 days of supply)

Oklahoma

New car market day supply: 82 days

The most negotiable new cars right now: Dodge Charger (444 days of supply), Jeep Grand Cherokee (387 days of supply), Ford Edge (374 days of supply), Ram 1500 (186 days of supply), Ford F-150 (168 days of supply)

Montana

New car market day supply: 96 days

The most negotiable new car right now: Chevrolet Silverado 1500 (136 days of supply)

Washington

New car market day supply: 89 days

The most negotiable new cars right now: Ram 2500 (444 days of supply), Jeep Wrangler Unlimited (353 days of supply), Ram 1500 (296 days of supply), Ford Mustang Mach-E (295 days of supply)

👉 Can you buy a car in another state? Yes! Here’s how.

Remember, the key to unlocking great year-end deals lies in understanding local market dynamics. States with higher-than-average Market Day Supply (MDS) are your hotspots for negotiation. Whether you’re in the Northeast looking at a Mustang Mach-E, or in the West Coast market for a Jeep Wrangler Unlimited, the end of the year presents a unique window of opportunity.

Don’t miss the best year-end manufacturer incentives, from 0% APRs to phenomenal leases.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Northeast Region

| State | Market Day Supply (December) |

|---|---|

| Connecticut | 91 |

| Delaware | 80 |

| Maine | 89 |

| Maryland | 76 |

| Massachusetts | 85 |

| New Hampshire | 74 |

| New Jersey | 85 |

| New York | 81 |

| Pennsylvania | 85 |

| Rhode Island | 84 |

| Vermont | 101 |

| Virginia | 84 |

Southeast Region

| State | Market Day Supply (December) |

|---|---|

| Alabama | 83 |

| Arkansas | 81 |

| Florida | 77 |

| Georgia | 79 |

| Kentucky | 86 |

| Louisiana | 93 |

| Mississippi | 85 |

| North Carolina | 77 |

| South Carolina | 78 |

| Tennessee | 80 |

| Virginia | 84 |

| West Virginia | 87 |

Southwest Region

| State | Market Day Supply (December) |

|---|---|

| Arizona | 82 |

| New Mexico | 82 |

| Texas | 80 |

| Oklahoma | 82 |

Midwest Region

| State | Market Day Supply (December) |

|---|---|

| Illinois | 85 |

| Indiana | 80 |

| Iowa | 91 |

| Kansas | 84 |

| Michigan | 87 |

| Minnesota | 81 |

| Missouri | 86 |

| Nebraska | 97 |

| North Dakota | 85 |

| Wisconsin | 79 |

Interior West

| State | Market Day Supply (December) |

|---|---|

| Colorado | 80 |

| Montana | 96 |

| Wyoming | 92 |

| Utah | 87 |

| Nevada | 82 |

| Idaho | 83 |

Pacific Coast

| State | Market Day Supply (December) |

|---|---|

| California | 83 |

| Oregon | 89 |

| Washington | 89 |

If you’ve been holding off on a used car purchase due to record high used car prices, December brings good news for buyers. So far, market declines have been largely confined to wholesale auctions. Will wholesale price drops finally translate to lower sticker prices? Let’s dive in and talk about why December 2023 is different.

For much of 2023, there has been an unusually wide gap between auto auction price trends and the listing prices we’ve seen on dealer lots. However, with changes accelerating over the past month, it looks like retail used car prices are finally about to take a dive.

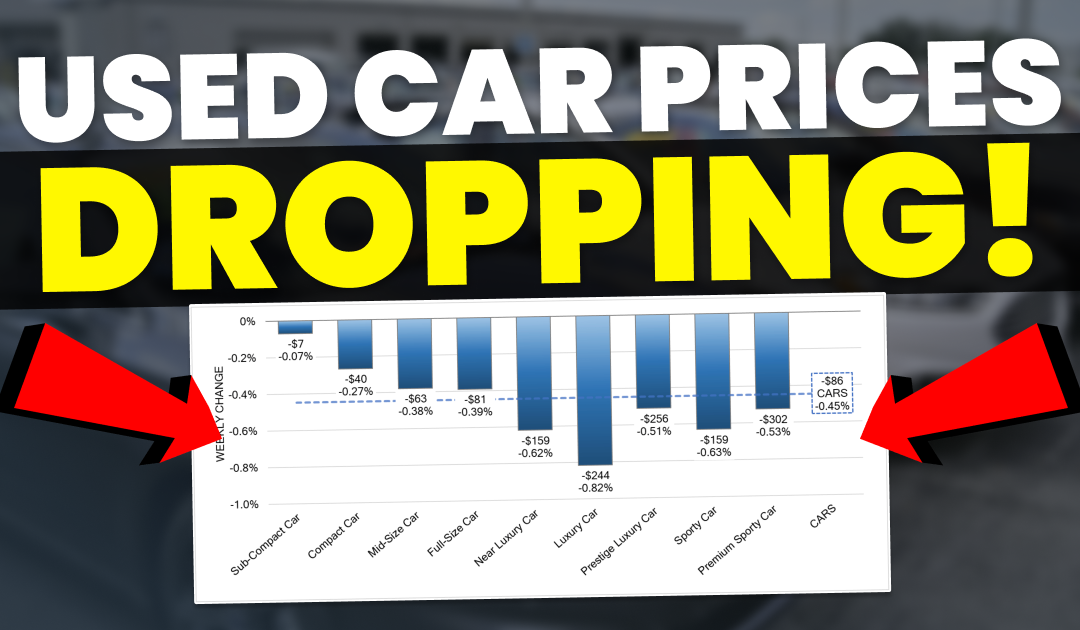

In November alone, used car prices were down -5.47% at wholesale auctions, according to Black Book weekly updates. The magnitude of this downward trend isn’t normal. In fact, prices are dropping at 5x to 6x the normal rate for some vehicle segments.

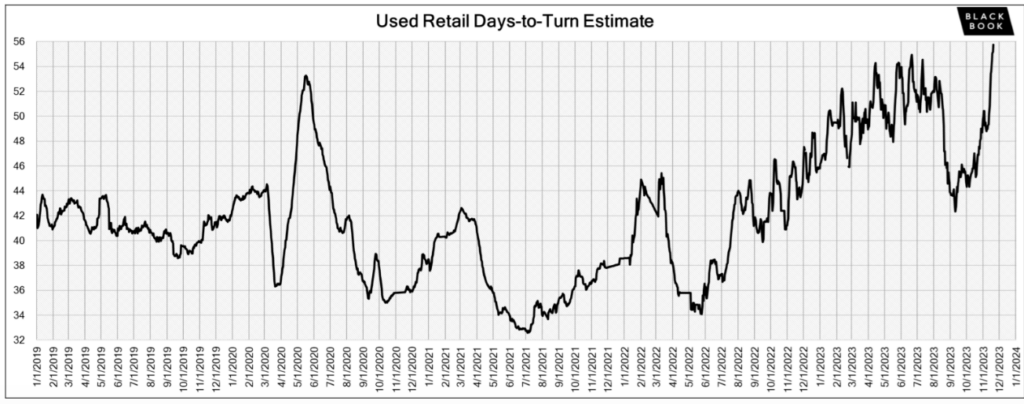

Retail days-to-turn, a metric indicating how long it takes for used cars to sell, has reached a 5-year high at 55 days. This statistic suggests that used cars are staying longer on dealership lots, giving buyers more options and potentially putting pressure on dealers to make sales.

The stage is set for a buyer’s market in the used car industry, offering consumers greater choice and increased bargaining power.

Just how quickly are used car prices dropping? A closer look at the last month’s wholesale prices reveals shocking trends. The decline in used car prices is not uniform across all segments. Here’s how some of the most volatile used car segments fared in November:

Compact Vans: Down 13.98%

Full-size Trucks: Down 6.49%

Compact Cars: Down 6.98%

Full-size Luxury SUVs: Down 5.11%

Remember, these price drops occurred in only four weeks. Normally, price changes are measured in the tenths of a percentage point. These significant price changes indicate that certain vehicle categories are experiencing rapid depreciation. With negotiation know-how, car buyers have more leverage than at any other point in 2023.

👉 Enroll in Deal School to master car buying today. It’s 100% free!

The allure of new car incentives is pulling buyers away from used car lots. As more buyers opt for new cars, the used car market is experiencing increasing downward pressure on prices. This trend indicates that used car buyers are very likely to see better deals in December. However, a used car purchase may not make sense for everyone. Let’s talk about why.

At a time when the average used car loan rate is at 14% APR, shoppers are second guessing a used car purchase with good reason. But that doesn’t mean you must hold off on buying altogether. Consider this: the best new car offers feature low and even zero percent financing offers. Our CarEdge Coaches are recommending that all used car shoppers consider low APR new car deals before committing to high interest used car loans.

👉 See the best year-end car sales today.

For more on how new car deals will impact used car prices, check out our deep dive.

Car dealers don’t typically own their lot inventory outright. They actually finance their inventory when they buy cars at the auction, and pay monthly ‘floorplanning costs’. With interest rates at 20-year highs, car dealers are feeling the pain like the rest of us. What does it all mean for used car buyers? Buyers should know that dealers are motivated to sell their inventory sooner rather than later, even if they try to act like they don’t need to. You certainly have negotiating power, especially in December of 2023.

CarEdge’s Ray Shefska offers some valuable insights into the changing landscape of the used car market:

“We’re finally seeing a real correction in wholesale used car prices. My expectation is that we’ll soon see this translate to retail prices too. But even with stubbornly high dealership prices, you have MUCH more negotiating power today after a month of steep declines at the wholesale auctions that they buy cars from. Don’t hesitate to show the car salesperson that you’re aware of the recent used car price trends. Heck, print out the latest numbers if you have to. Not all car dealers will be willing to budge, but the smart ones will. You can always shop elsewhere.”

In conclusion, if you’re in the market for a used car, December 2023 may be the ideal time to make a purchase. High interest rates, increased inventory, slow used car sales, and enticing new car incentives have given used car dealers multiple reasons to lower their prices or at least display a willingness to negotiate. Interestingly, these same reasons are enticing more buyers to the new car market, especially with low APR offers featuring unmatched savings.

👉 If you’re in the market for a used car, bookmark this to stay on top of the latest: Used Car Price Trends (Updated Weekly)

Last month, the average used car selling price was $26,752. With what we’re seeing in today’s market, we wouldn’t be surprised if that figure is 10% less by the time we see the December data. December is the best time to buy a car in ages, for both new and used shoppers alike.

Here’s our car market forecast for 2024. We don’t expect the great deals to last into the new year!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Safety should always be a top priority when car shopping. Fortunately, the Insurance Institute for Highway Safety (IIHS) takes the guesswork out of vehicle safety ratings with their extensive crash testing. As IIHS standards evolve, more models are achieving the coveted Top Safety Pick+ status, reflecting car manufacturers’ commitment to designing vehicles that excel in crash tests. Plus, we’ve also included links to Consumer Reports reviews for each model. These are the safest new cars, trucks, and SUVs for 2024.

According to the most recent IIHS safety tests, these are the safest cars you can buy today. All of the following sedans earned the highest safety rating of Top Safety Pick+ in testing conducted in 2023 for 2023-2024 model year vehicles.

Starting MSRP: $22,995

CR Overall Score: In Testing

Why it’s great: This time-tested compact car is known for standard all-wheel drive, and is a big hit in the car tuning scene. For 2024, the redesigned Impreza is available exclusively as a hatchback for the first time ever.

Flaws and Shortcomings: The Impreza is perfect for small car lovers, and there are fewer and fewer of those these days. It doesn’t get the great fuel economy that you’d expect from a compact car. Due to the standard AWD, the Impreza averages 29 miles per gallon in combined driving.

Browse Impreza listings with the power of local market data.

Starting MSRP: $27,895

CR Overall Score: 80

Why it’s great: The Accord has been a best seller for decades, but the recent refresh has taken this sedan to a whole new level. With better styling both inside and out, the 2024 Accord is simply great.

Flaws and Shortcomings: The Accord’s chief competition has always been the Toyota Camry. The Camry’s MSRP starts at $1,400 less than the Accord. If you’re pinching pennies, the Camry may sway you with savings.

Browse Accord listings with the power of local market data.

Starting MSRP: $28,895

CR Overall Score: 79

Why it’s great: For those who live in colder climates, the Outback is an all-around great choice. All-wheel drive aside, the Outback offers a spacious cabin, modern tech, and improved looks. That’s all on top of 8.7 inches of ground clearance.

Flaws and Shortcomings: If fuel economy (and emissions) is a factor in your car buying decision making, the Outback loses its appeal with just 28 miles per gallon in combined driving. Inventory is slim as is expected from Subaru, so finding a certain trim and color combo may be difficult.

Browse Outback listings with the power of local market data.

Starting MSRP: $27,650

CR Overall Score: 80

Why it’s great: The 2024-2024 Toyota Prius is a gamechanger. The image above speaks for itself. With phenomenal styling and an EPA-rated 57 miles per gallon, the reimagined Prius has come a very long way over the past two decades.

Flaws and Shortcomings: Today’s drivers are all too accustomed to crossovers and SUVs. The Prius is a small hatchback, and lacks the interior space and all-terrain capabilities of its larger cousins.

Browse Prius listings with the power of local market data.

Starting MSRP: $26,420

CR Overall Score: 82

Why it’s great: Drivers love the Toyota Camry for its exceptional reliability and comfortable ride, making it a dependable and enjoyable car for everyday use. Its reputation for longevity, practicality, and affordability has endeared it to a wide range of drivers.

Flaws and Shortcomings: The Toyota Camry has a conservative design and a dated infotainment system, which are some of its flaws. Its base engine offers great fuel economy, but unexciting performance. In 2025, the Camry will be sold strictly as a hybrid.

Browse Camry listings with the power of local market data.

Starting MSRP: $42,450

CR Overall Score: 81

Why it’s great: The IONIQ 6 is the fastest-charging electric car on sale today for under $50,000. Hyundai’s eGMP electric platform enables the IONIQ 6 to add 250 miles of range in 18 minutes in ideal conditions.

Flaws and Shortcomings: There’s really only one big flaw, unless you’re not a fan of the styling. The IONIQ 6 does not qualify for the federal EV tax credit in the United States. The IONIQ 6’s main competitor, the Tesla Model 3, does qualify.

Browse IONIQ 6 listings with the power of local market data.

See the complete list of Top Safety Pick+ rated sedans at Consumer Reports.

According to the most recent IIHS safety tests, these are the safest SUVs you can buy today. All of the following models earned the highest safety rating of Top Safety Pick+ in testing conducted in 2023, for 2023-2024 model year vehicles.

All of the following SUV models earned a perfect score in each category of the IIHS’ safety testing.

Starting MSRP: $35,990

CR Overall Score: 87

Why it’s great: The Kia Telluride, introduced in 2020, has gained popularity in the highly competitive SUV market for several reasons. It offers a spacious interior, appealing design, advanced technology features, all at a competitive price point. Despite its size, the Telluride drives like a smaller crossover, providing easy maneuverability in various driving conditions.

Flaws and Shortcomings: Compromises come at a cost. The Telluride doesn’t offer the spaciousness of a full-size SUV, nor the fuel economy of a compact SUV, but it’s a happy middle ground for most family haulers.

Browse Telluride listings with the power of local market data.

Starting MSRP: $49,950

CR Overall Score: 81

Why it’s great: The recently redesigned RX delivers a relaxed ride, a luxury cabin for the price, and great reliability.

Flaws and Shortcomings: The Lexus RX makes a lot more sense closer to its base MSRP. Once you’re looking at higher trim RX options, it becomes tougher to justify paying $60,000+ for what is essentially a premium Toyota.

Browse Lexus RX listings with the power of local market data.

Starting MSRP: $40,605

CR Overall Score: 77

Why it’s great: Safety, reliability, and affordable luxury characterize the popularity of the Lexus NX. A highly-acclaimed plug-in hybrid option is now available for those wanting to test the waters before committing to an EV.

Flaws and Shortcomings: This is a relatively compact SUV. If you’re looking for an abundance of passenger and cargo volume, you’ll want to look elsewhere.

Browse Lexus NX listings with the power of local market data.

Starting MSRP: $36,690

CR Overall Score: 75

Why it’s great: The UX is Lexus’ entry-level luxury compact SUV. It’s fuel efficient, reliable, and safe, and starts well under $40,000. The UX comes standard with a hybrid powertrain that’s good for 42 miles per gallon in combined driving.

Flaws and Shortcomings: Reviewers agree that the UX is noticeably small, and lacks easy-to-use infotainment.

Browse Lexus UX listings with the power of local market data.

Starting MSRP: $34,195

CR Overall Score: 75

Why it’s great: Subaru’s three-row SUV, the Ascent, boasts impressive all-around performance. Its smooth ride, practical interior, and seamless power delivery have been key factors contributing to its success.

Flaws and Shortcomings: The Ascent really only has two big shortcomings. It drives like a large SUV, and therefore lacks agility. More importantly, it doesn’t score well in the fuel efficiency department with an EPA-rated 22 miles per gallon.

Browse Subaru Ascent listings with the power of local market data.

Starting MSRP: $44,995

CR Overall Score: 75

Why it’s great: Arriving with standard all-wheel drive, the Solterra was engineered in partnership with Toyota. Subaru’s first EV is essentially an electric Crosstrek with a new name.

Flaws and Shortcomings: Charging speed. Range is below average at 227 miles on a charge, but charging is where the Solterra seriously falls short. Charging peaks at 100 kilowatt speeds, meaning that adding 150 miles of driving range will take about an hour at a ‘fast’ charger. Competitors like the Hyundai IONIQ 5, Kia EV6, and Tesla Model Y can do the same in well under 30 minutes. The Hyundai and Kia cost the same as the Solterra, and offer much more if you can do without the Subaru brand.

Browse Subaru Solterra listings with the power of local market data.

See the complete list of Top Safety Pick+ rated SUVs at Consumer Reports.

Across the board, pickup trucks don’t score as highly on IIHS safety tests. However, these two trucks bucked the trend to earn the honors of Top Safety Pick+ in 2023 testing.

Starting MSRP: $73,000

CR Overall Score: 63

Why it’s great: There are few electric trucks on sale as we head into 2024. The Rivian R1T stands out from the legacy OEM competitors with bold, futuristic styling and supreme off road capability.

Flaws and Shortcomings: If you don’t live near a Rivian service center, getting any needed maintenance completed will be a hassle. In order to qualify for the U.S. federal tax credit, the vehicle price must not exceed $80,000. That’s tough to do with the Rivian R1T.

Learn more about the Rivian R1T at Rivian.com.

Starting MSRP: $39,965

CR Overall Score: 61

Why it’s great: The Tundra is the most affordable pickup truck with great reliability ratings. It’s also known for excellent reliability.

Flaws and Shortcomings: While the base MSRP is around $40,000, it’s very difficult to find one on Toyota dealer lots for under $55,000.

Browse Tundra listings with the power of local market data.

Where are the other trucks?! Sadly, no pickup trucks made it to the next tier of ‘Top Safety Pick’. If occupant safety is a priority, it may be wise to reconsider a truck purchase.

See the complete list of truck safety ratings at Consumer Reports.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

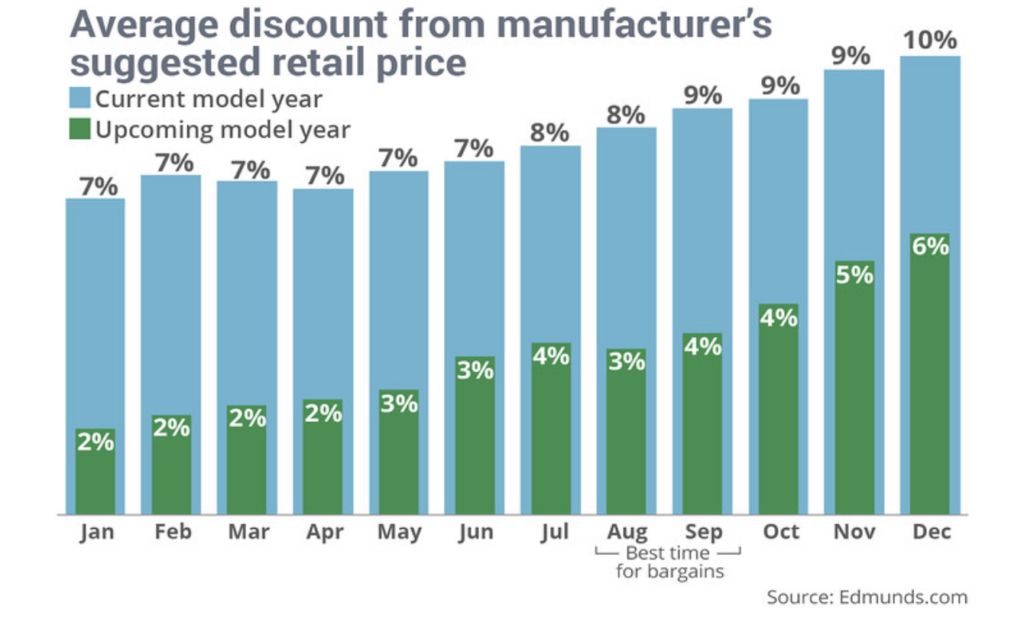

Is there truly a perfect moment to buy a car? As it turns out, there most certainly is. In fact, the difference is so profound that new car incentives are 40% higher during the best time of the year to buy. Our team of Car Coaches, equipped with decades of combined experience, keeps a close eye on the auto market, and there’s no doubt about it—the best time of the year to buy a car has arrived.

In today’s auto market, every dollar saved is magnified by interest rates that now average north of 8% for new cars, and nearly 14% APR for used cars. In other words, you’re not ‘just’ saving $5,000 on that new truck or SUV. You’re saving a lot more than that once the cost of borrowing money is factored in.

Think about the unfortunate predicament of EV, van, or truck buyers who drove home a new car in early 2023. Prices remained sky high earlier this year, but 11 months later, we’re in a different car market entirely. New car prices are down 3.5% in 2023 market-wide, but some segments have seen MUCH steeper price declines.

Retail EV prices have fallen 10% in 2023, and trucks, vans, and luxury cars have all seen similar price drops. The same Ford Mustang Mach-E or Ram 1500 that would have sold for 10% over MSRP months ago is now sitting on the lot for months at under invoice pricing.

Patience is a virtue that is handsomely rewarded in car buying. But you’re here looking for deals, so let’s get you some answers. When is the best time of the year to buy a car?

In a perfect storm of downward pressure on car prices, the end of the year offers car buyers opportunities that reward patience. In December, automakers are pushing 2024 model year vehicles to dealer lots that are already full of 2023 inventory. On top of that, OEMs and dealers alike know that most folks wait until the end of the year to try and snag a deal. This results in the best new car sales of the year arriving all at once.

Anytime from now through December 31 is a great time to shop for new car deals. This year, new car sales are so attractive that used car prices could take a hit as buyers flock to new car lots. More on that here.

So, when is the best day to buy a car?

If you’re seeking the absolute best time to buy a car, look no further than the final days of December. It’s during this period that automotive manufacturers, dealers, and sales staff are highly motivated to achieve year-end sales goals. Their drive to negotiate stems from the fact that dealers receive year-end bonuses from manufacturers upon reaching annual sales quotas.

Factory-to-dealer incentives can translate into substantial income for dealerships. As a result, it’s common practice for them to offer enticing perks, including discounted prices, significant rebates, and special financing terms to customers.

These incentives not only benefit the buyers but also contribute to the dealership’s financial gains. Call it a win-win situation, something that’s all too rare in the automotive business.

Every year, year-end car sales emerge as the most significant sales events of the year by a wide margin. Several automakers, especially U.S. domestics, currently grapple with an excess of inventory.

See the best year-end car sales here, updated weekly.

So, as we navigate through the final months of 2023, seize the opportunity to make the best car deal of the year. With motivations high and incentives even higher, you’re primed to make a purchase that leaves both you and your wallet smiling.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!