CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Year-end deals are finally upon us, but some offers are better than others. To bring clarity, our team has hand-picked the 5 best Ford yer-end deals in 2023. Click on any of the links to browse live inventory at pre-negotiated pricing. Delivery is available nationwide!

Let’s dig into the year-end sales that are worth your time.

Buying a car just got a whole lot easier.

When you buy your new car with CarEdge, you pay the CarEdge Fair Price and never step foot in a dealership again.

Here’s Our CarEdge Promise:

It’s car buying done right! Learn more about buying with CarEdge.

Finance the 2024 Edge with 0% APR for 36 months, 0.9% APR for 48 months, 1.9% APR for up to 60 months, or 3.9% APR for 72 months. It’s rare to have so many low-APR options today. Plus, the Edge qualifies for a $1,000 cash bonus.

See Pre-Negotiated Ford Edge Prices

Finance the Mustang Mach-E for up to 48 months with 0% APR or 1.9% APR for 60 months. The Mustang Mach-E GT qualifies for $3,000 in cash incentives.

Lease a Mustang Mach-E Select for just $464/month for 39 months with $4,944 due at signing. Or upgrade to the Mustang Mach-E Premium for $492/month for 39 months with $5,372 due.

See Pre-Negotiated Ford Mustang Mach-E Prices

Lease a 2024 Maverick XL for $331/month for 48 months with $2,831 due.

Note: Maverick inventory remains low. See local Maverick inventory numbers and market reports.

Browse Pre-Negotiated Ford Maverick Prices

Lease a 2023 Lightning Pro for $592/month for 48 months with $5,791 due, or upgrade to a Lightning XLT for $634/month for 48 months with $6,333 due at signing.

Also, there’s a $1,500 cash discount on Lightning XLT, or $7,500 cash discount on the Lightning Lariat and Platinum.

Browse Pre-Negotiated Ford F-150 Lightning Prices

Finance a new 2023 F-150 for 1.9% APR for 36 months, 2.9% APR for 48 months, or 3.9% APR for 60 months.

Plus, there’s a $1,500 cash incentive for the XL, XLT, and Lariat.

You can also lease the F-150 XL STX SuperCrew 4×2 for $410/month for 36 months with $5,082 due.

Browse Pre-Negotiated Ford F-150 Prices

Whether you’re looking for low APR financing offers, leasing options with attractive monthly payments, or cash incentives to maximize your savings, these deals have something for every Ford driver. With CarEdge, you can enjoy the convenience of pre-negotiated prices and home delivery, making your car-buying experience hassle-free. Explore these deals and make the most of year-end savings on your favorite Ford models.

As the year draws to a close, automakers are rolling out enticing deals to lure in buyers, and Chevrolet and GMC are no exception. With low APR financing options and huge cash offers, Chevy and GMC’s year-end deals are worth exploring. We’ll take a closer look at the best offers this month, helping you navigate through the available financing and cash deals.

Buying a car just got a whole lot easier.

When you buy your new car with CarEdge, you pay the CarEdge Fair Price and never step foot in a dealership again.

Here’s Our CarEdge Promise:

It’s car buying done right! Learn more about buying with CarEdge.

Browse CarEdge Chevrolet and GMC listings, or click on any of the links below. Enjoy the deals!

If you’re considering a Chevrolet, you’ll find some attractive financing options this year-end car buying season:

1.9% APR for 36 months

2.1% APR for 36 months

2.4 % APR for 36 months

For some Chevy models, multiple cash offers add up to thousands of dollars off of MSRP. These are the best deals right now:

$3,500 cash allowance: 2023 Silverado 1500 Crew Cab RST

$3,250 cash allowance: 2023 Silverado 1500 Crew Cab LT

$2,500 cash allowance: 2024 Silverado 1500 Crew Cab LT

$1,500 cash allowance: 2023 and 2024 Chevrolet Blazer

$1,250 cash allowance: 2023 Chevrolet Equinox

$1,000 cash allowance: 2024 Chevrolet Equinox, 2023 Chevrolet Traverse

Learn more about Chevrolet year-end deals at Chevrolet.com

GMC’s year-end sales also bring some appealing financing deals to the table. At a time when the average new car loan APR is north of 8%, these are great financing offers.

1.9% APR

3.3% APR for 60 months

4.3% APR for 60 months

GMC’s cash allowances provide substantial savings on select models:

$8,000 cash allowance: 2023 GMC Sierra 1500 Crew Cab Elevation with Turbo High-Output Engine

$6,000 cash allowance: 2023 GMC Sierra 1500 with 5.3L ECOTEC3 V8 engine

$1,750 cash allowance: 2023 GMC Terrain (includes $500 GMC Loyalty Cash)

Learn more about GMC year-end deals at GMC.com

In conclusion, these Chevrolet and GMC year-end deals offer a range of financing and cash incentives for buyers. Whether you’re on the hunt for low APR financing offers or big cash discounts, there are enticing options available this month.

However, our team of CarEdge car buying experts agrees that even better deals are to come in December. The stars are aligning for phenomenal year-end car sales in 2023. If you’re thinking about waiting until 2024, here’s what waiting could cost you.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

If you’ve ever wondered whether it’s better to lease or buy a car, you’re not alone. There’s no one-size-fits-all answer, but with careful considerations, the right choice for you is within reach. One thing is for sure – leasing provides a low-cost path to buying a new car at a time when MSRPs are near record highs. In this guide, we’ll talk to CarEdge’s car buying pros to see what advice they’re giving our customers, and how you can put expert insights to work for your own car deal. Buckle in, because we’ve got quite a bit to cover.

For those who prioritize their budget, leasing might seem like an attractive option. Rising interest rates and inflated car prices have resulted in hefty monthly payments for new car buyers. Jerry, one of our CarEdge Coaches, points out that “rising prices and interest rates are generating monthly payments never seen before for new car consumers.”

Financing a vehicle, especially without a substantial down payment, can sometimes result in monthly payments that exceed what many people can comfortably afford. In such cases, leasing a vehicle with a more manageable monthly payment may be the only viable solution.

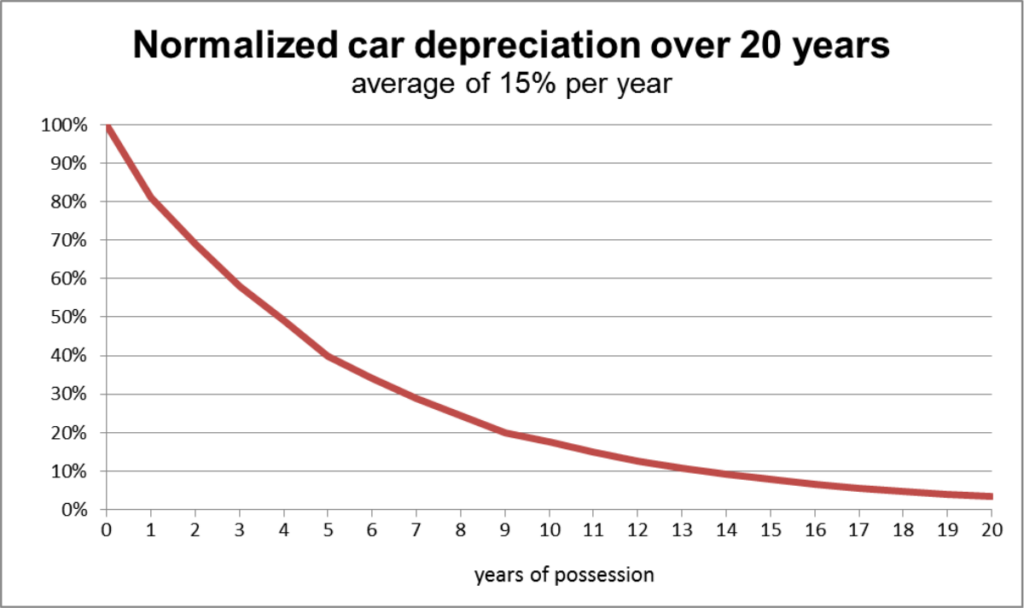

However, if you’re someone who values long-term ownership and plans to keep a car for 7-10 years, purchasing is often the financially sound choice. Mario, one of our veteran CarEdge Coaches, says that long-term car ownership is always best. “There’s no doubt that keeping a car for 7-10 years is the most financially sound option, surpassing any tempting lease deals, no questions asked.” Owning a car outright offers the advantage of not having to worry about monthly payments once the loan is paid off.

For drivers with different priorities or those who frequently upgrade to a new car, leasing can be an attractive option. Leasing allows you to enjoy a new car every few years without the hassle of selling or trading in your vehicle. It’s particularly advantageous for those who prefer to drive the latest models with updated features.

Leasing is also a good option for electric vehicle adopters. By the time your EV lease is up, range and charging speeds will have improved. Plus, EV resale values are hard to predict, as with any new technology. In this case, Jerry advises, “When considering any EV or plug-in hybrid, you definitely will want to research lease deals. There’s a good chance a lease is the better option.”

See the best EV lease deals this month

If you have relatively stable needs but don’t want to bear the risk of maintaining a car out of warranty, the decision becomes more complex. In these cases, financing often comes out ahead, but you should assess the “opportunity cost” of leasing against the financial gain of building equity for 5 years before upgrading, as Mario suggests. By comparing the total cost of ownership over a 3-6 year period for both leasing and financing, you can make an informed decision.

Compare cost of ownership data here (100% free)

To make the comparison, calculate your total leasing expenses for the chosen period, including monthly payments, upfront cash, fees upon returning the car, and other expenses such as fuel and insurance. Then, determine your total monthly out-of-pocket cost by dividing this sum by the lease duration. Repeat the process for financing, adding up the total cost, and determining your projected equity position by month 36.

Finally, compare the out-of-pocket costs for both options to decide which suits your needs and budget. This simple exercise should help you determine if leasing is a better option for your financial situation.

When deciding between leasing and financing, consider manufacturer incentives and resale value. Our CarEdge Coaches never recommend paying for dealer markups, or anything over MSRP. But when the price is right, buying can certainly become the clear solution.

As Mario points out, “Buying becomes a better option for vehicles that offer substantial discounts and incentives from both the manufacturer and the lender.” For vehicles with high resale value, financing may be the better choice, as you can build equity over time. In contrast, for vehicles with significant discounts or depreciation, leasing may be the more economical option.

In the end, the decision to lease or buy a car should align with your specific circumstances and priorities. Budget-conscious drivers might find leasing more accessible, while those planning long-term ownership may prefer financing. Incentives, and resale value also matter. Remember that there’s no one-size-fits-all answer to the leasing vs. buying dilemma. So, whether you opt for a lease or decide to finance, careful research and consideration will lead you to the right decision.

Fortunately, we’ve got dozens of 100% FREE car buying and leasing resources available.

Here are a few CarEdge Community favorites:

See Pre-Negotiated Car Prices With Home Delivery Nationwide

The Best New Car Lease Deals (Updated Monthly)

The Best New Car Incentives in November

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

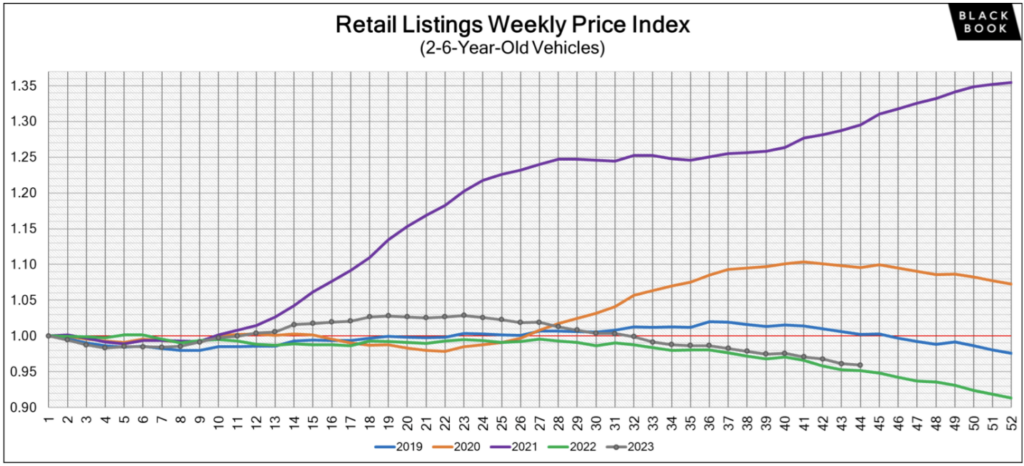

As the 2023 holiday season approaches, the automotive market is showing signs of change, particularly in the used car sector. After a period of record-high prices in 2022, there’s a light at the end of the tunnel for those seeking more affordable options. While used car prices have remained flat at retail lots, a steady decline has continued for months at wholesale auctions. Lower prices may soon reach retail consumers, with year-end sales in the new car market being the catalyst. Let’s take a look at how used car deals could play out in December.

The cost of borrowing money is at a 20-year high, and used car sales are feeling the impacts. Demand for used cars has been on a slight downward trend in 2023. As of the most recent data from October, used car sales are down by 4% year-over-year. Unfortunately, used car prices have resisted downward pressure for most of the year.

Finally, that could be starting to change. Retail used car prices have seen a modest reduction of 0.7% over the past month after numerous ups and downs. However, since the start of 2023, prices have not moved much, hovering around an average listing price of $26,500. This is despite wild swings in wholesale prices.

The pace of this price decline has been slow, largely due to the supply of used cars in the retail market. With a current 49-day supply, down only slightly from previous months, a significant increase in inventory would be necessary for a more substantial drop in prices. However, patient buyers may finally get the relief they’ve been hoping for.

Stay updated with the latest trends and data on used car prices by following our weekly price updates at CarEdge.

For those waiting for a drop in used car prices, December 2023 appears promising. The potential for substantial price reductions is on the horizon, accelerated by Black Friday deals drawing more buyers to new car lots as early as November.

Interestingly, the key to understanding the potential for a used car price drop lies within the new car market, specifically in year-end sales dynamics. The end of the year is traditionally a prime time for new car purchases, as dealers and automakers strive to clear out current year models. This year, an abundance of new car inventory is anticipated, with the overall new car market experiencing an 83-day supply as of November. Some brands, such as Jeep and Ram, have over 100 days of inventory. This surplus exceeds the healthy market-day supply range of 40 to 60 days, indicating a pressing need for sales. How does this play into the used car market?

This surplus in the new car market should benefit used car buyers. Massive new car sales in December are likely to divert consumer attention from used to new vehicles. The appearance of attractive financing offers, like 0% APR could further encourage this shift.

In fact, used car buyers may want to reconsider once they realize the cost of today’s interest rates. A new car at MSRP with 0% APR financing may be a better deal than a used car at 14% APR. Believe it or not, today’s average used car loan rate is 14% APR.

How much will that interest cost you over an entire loan term? A $25,000 used car loan will actually cost you $35,000 over a 60 month term once the average 14% APR is factored in. You could get a decent new car with low APR for about the same price.

Be sure to check the best new car deals this month.

How much might used car prices drop by the end of 2023? Car dealers have been notoriously stubborn with their sticker prices, as evidenced by unchanged average listing prices this year. What will improve most in December is the negotiability of used cars. For car buyers prepared with negotiation know-how, December will present a rare opportunity to save thousands of dollars.

For all but the most in-demand models, buyers should be able to negotiate 10% off of the listing price for used cars. For the average priced used car, that would amount to approximately $2,500 in savings.

Remember, you can always check local market dynamics with CarEdge Data. Perhaps your dream car is more negotiable than you’d think!

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

2023 is shaping up to be an exceptional year for year-end car deals. A perfect storm of high inventory, soaring interest rates, and holiday sales is coming together to bring big discounts. Here’s why savvy car shoppers should take 2023’s year-end car deals seriously.

👉 Just want to see the deals? See December’s best new car incentives here.

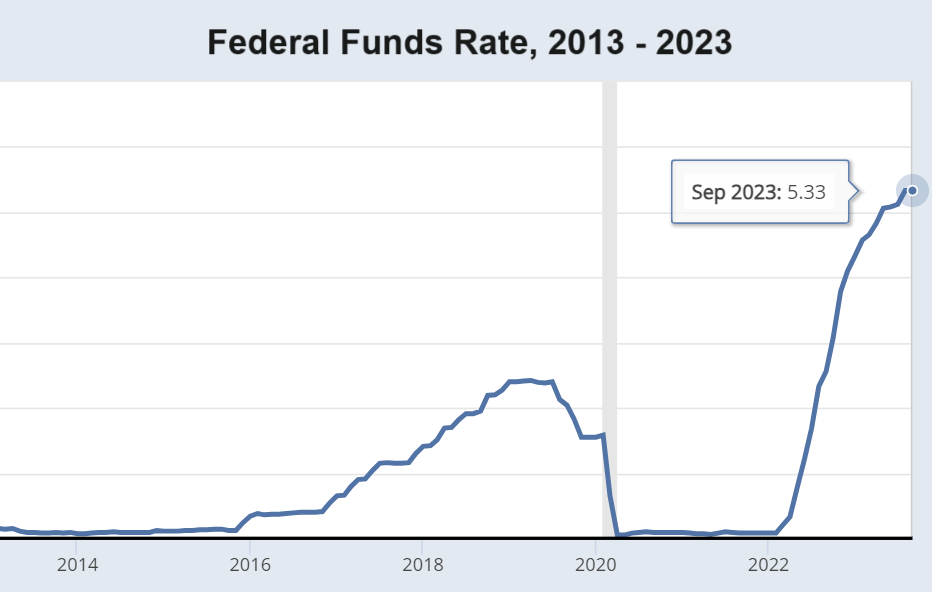

One of the most compelling reasons to expect significant year-end car deals in 2023 is the steady rise in interest rates throughout the year. The average new car loan APR is now 9%, with used car loans averaging around 14%.

As the cost of borrowing money increases, automakers and dealerships will be motivated to lure buyers with more attractive financing options. Simultaneously, rising rates mean higher dealership floorplanning costs, which put additional pressure on dealers to move inventory. With rates on the climb, it’s an opportune moment for buyers to lock in a low-interest loan before they potentially rise even further.

👉 These are the best auto financing offers in December.

The auto industry has seen an influx of new car inventory in 2023. Factors like supply chain improvements, slower sales, and high MSRPs have contributed to a surplus of vehicles waiting for buyers. Dealerships are eager to clear out these excess stocks by year-end to make room for the next year’s models. This means potential discounts, rebates, and promotions that can significantly reduce the purchase price.

👉 See the most recent new car inventory update here.

Sluggish car sales in the earlier part of the year have left many dealerships with excess inventory. In an effort to meet annual sales targets and improve cash flow, dealerships often resort to offering generous discounts and incentives in the final months of the year. For buyers, this translates into an excellent opportunity to snag a deal on the vehicle they desire.

Some things never change. Every year, the holiday season is when car dealerships roll out their best deals. Automakers and dealerships understand that consumers are ready to spend during this time, and they respond with enticing promotions, discounts, and special offers. After decades of holiday sales, consumers have come to expect big discounts in December, and often wait all year for amazing year-end car deals.

As the year comes to a close, automakers and dealerships are eager to clear out remaining inventory to make way for the arrival of new models. This urgency often translates into even more competitive pricing and incentives as they aim to finish the year on a strong note.

👉 December’s big year-end sales are out now! Here’s the best of the best.

In summary, 2023’s year-end car deals are the best sales we’ve seen all year due to a combination of rising interest rates, high new car inventory, holiday promotions, and the need to clear out existing stock. Car buyers who are patient and strategic in their approach can capitalize on these factors to secure a fantastic deal on their next vehicle.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!