CarEdge saved me over 4,500 dollars on a brand new Honda Pilot. I can't say thank you enough.

Price intelligence

Find a wide range of vehicle listings with market insights on new and used listings near you.

Help us personalize your CarEdge experience — it only takes a second.

Your answers help us personalize your CarEdge journey — we’ll follow up with tips and next steps that match your buying timeline.

Buying a truck is a costly endeavor, but not all trucks hold onto their value the same way. Some depreciate faster than others, leaving truck owners with less resale value down the road. In this deep dive, we’ll take a look at five trucks that don’t fare well when it comes to depreciation, so you know what to watch out for.

CarEdge’s depreciation rankings were updated with the latest data in 2024, giving you insights on which models are most likely to drop in value in 2025 and beyond. When we talk about “5-year residual values,” we’re referring to the percentage of a vehicle’s original value that it retains after five years. The higher the percentage, the better it holds its value—but for these trucks, the numbers aren’t looking too good.

The Ford F-150 might be a top-selling truck, but when it comes to value retention, it’s the worst. After five years, the F-150 will have lost around 51% of its original value, leaving you with a resale price of about $30,245. While it does well in the first few years, it starts to lag behind rivals like the Chevy Silverado as time goes on.

Should you avoid this truck? Not necessarily, but be aware of how fast it loses value. If you’re deciding between the F-150 and another truck, it might be worth considering factors other than just resale value, like features, towing capacity, or reliability. For instance, both the Chevy Silverado 1500 and Ram 1500 pickups maintain their value better than the F-150.

The chart above shows the expected depreciation for the next 10 years. These results are for vehicles in good condition, averaging 12,000 miles per year. It also assumes a selling price of $61,927 when new. This is the average selling price of a new F-150 today.” See our full depreciation analysis for the Ford F-150.

Calculate expected depreciation for your F-150 using this free calculator.

The GMC Sierra 2500 HD doesn’t depreciate quite as quickly as the F-150, but it still loses around 45% of its value over five years. If you buy one new at the current average selling price of $87,897, expect it to be worth around $48,247 after five years.

Heavy-duty trucks like the Sierra 2500 often fare better in the long run, thanks to their durability and strong market demand. But even with that in mind, a nearly 50% drop in value is something to keep in mind if you’re looking at this model.

The chart above shows the expected depreciation for the next 10 years. These results are for vehicles in good condition, averaging 12,000 miles per year. It also assumes a selling price of $87,897 when new. See our full depreciation analysis for the Sierra 2500.

Calculate expected depreciation for your Sierra 2500 using this free calculator.

Similar to the Sierra 2500, the Ford F-250 Super Duty retains just over half its value after five years. Starting at an average selling price of $72,489, it’s likely to be worth about $39,833 after that period. That’s a depreciation of $32,656, which isn’t insignificant for a heavy-duty truck.

If you’re set on a Ford Super Duty for its power and towing capacity, this might be acceptable to you. Just remember, the resale value won’t be the strongest selling point. See our full depreciation analysis for the F-250 Super Duty.

Calculate expected depreciation for your F-250 using this free calculator.

The Nissan Titan depreciates a bit more slowly than others on this list, but it’s still going to lose about 52% of its value in five years. From a starting price of $58,711, you’ll be looking at a resale value of around $28,463 after half a decade.

Nissan’s full-size truck may not be as popular as the F-150 or Silverado, but if you’re a fan of what it offers, be prepared for its resale value to dip more than average.

The chart above shows the expected depreciation for the next 10 years. These results are for vehicles in good condition, averaging 12,000 miles per year. See our full depreciation analysis for the Titan.

Calculate expected depreciation for your truck using this free calculator.

The Chevy Silverado 2500 HD edges out the Titan with a 5-year residual value of 59%, meaning it loses 41% of its value over that time. If you purchase one for $66,710, expect it to be worth about $39,139 after five years.

The chart above shows the expected depreciation for the next 10 years. These results are for vehicles in good condition, averaging 12,000 miles per year. See our full depreciation analysis for the Silverado 2500.”

Calculate expected depreciation for your truck using this free calculator.

It’s important to remember that these are the trucks with the worst depreciation. Several popular models fare better, including the Chevrolet Silverado 1500, GMC Sierra 1500, and trucks from Ram and Toyota. Browse our complete depreciation rankings for free.

In the market for a new or used truck? Let us do the negotiating for you. CarEdge Concierge is the best-rating car buying service in America. Learn more about how we can deliver your next truck to your door, all while saving you thousands of dollars.

For many, there will eventually come a time when you need to part ways with a beloved car – even when you still owe money on it. Selling a car with an outstanding loan can seem daunting due to the added complexity of dealing with lenders. However, with a proper understanding of the process and careful planning, you can navigate the situation with ease. Here at CarEdge, we’re diving into how you can efficiently and effectively sell your car, even if the loan isn’t fully paid off yet.

When you’re considering selling a car that you still owe money on, the first crucial step is to fully understand the details of your loan. This knowledge is not only essential for setting the right sale price but also for ensuring that the transaction is handled legally and smoothly.

First thing’s first: understand your loan. That means digging up your login credentials to get into your online account with the lender. You may even need to give them a call, or hop on the live chat.

Here’s what to figure out before selling your car with a loan balance:

Next, determine how much your car is worth. Use trusted resources like Edmunds or Kelly Blue Book, and use CarEdge’s valuation tool to see how much online buyers will pay.

If you decide to go the private seller route, it’s important to price your car thoughtfully. Remember, you’re trying to sell the car quickly while also covering your remaining loan balance. Setting the right price can help you attract buyers quickly while ensuring you don’t fall short financially.

You have two main avenues for selling your car: a private sale or a dealership trade-in. A private sale typically yields a higher return but requires more effort on your part in terms of marketing and negotiation. Platforms like Facebook Marketplace, Cars.com, and AutoTrader are great for reaching potential buyers. On the other hand, trading in your car at a dealership is less hassle but is highly unlikely to offer as much for your car, especially with an outstanding loan.

With a dealership trade-in, it’s common to be offered 20-30% less than your car is worth in a private sale. If you could really use that additional money, going through the longer, more tedious process of selling privately may be worth it.

👉 Learn more about your options for selling a car

The financial aspect of selling a car with an outstanding loan can be tricky. But don’t give up now! If you’re eager to sell, it’s worth the hassle. Here’s how to handle it effectively:

Transferring ownership involves a few small hurdles, but it’s nothing you can’t do! You must inform the buyer about the lien and ensure that the loan is fully paid before transferring the title. Even with a lien, you are legally required to provide the buyer with a bill of sale, documenting the transfer of ownership to the buyer. Alongside this, include a payoff authorization when you send the loan payoff to your lender. This authorizes them to release the lien or send the physical title directly to the new owner. Once you receive a lien release from your lender, you can complete the title transfer to the new owner.

Each state has different laws, so it’s important to check your local requirements. Check with your state DMV. The information should be easily found on their website.

If you want to avoid these hurdles, consider paying off the loan balance and securing the lien release before you sell the car. This approach eliminates many potential complications that could delay the sale.

Selling a car with an outstanding loan requires careful attention to financial details and diligent record-keeping. With the right approach, you can sell your loan and transfer ownership without a hitch. Remember, knowledge is power in any transaction. Understanding how to handle this process can save you from potential financial pitfalls. For more insights and resources on managing car sales and ownership, keep it tuned to CarEdge.

👉 Want to become a car market pro? How about that and more for FREE?

Sign up for Deal School today, our free course for anyone interested in buying, selling, or simply owning a car the smart way.

Diving into the world of car ownership can lead you into murky waters, especially when grappling with negative car equity. Imagine owing more on your car loan than the vehicle is worth – a situation many Americans face today. This comprehensive guide illuminates the shadowy depths of negative equity: exploring its causes, the impact of recent economic trends, and, most importantly, effective strategies to steer clear of or manage it if you’re already caught in its grip.

Negative equity, often described as being “upside-down” on a car loan, occurs when the loan balance surpasses the vehicle’s current market value. This financial quagmire can ensnare car owners due to:

Understanding these factors is key to avoiding or mitigating negative equity and ensuring a financially stable ownership experience.

The phenomenon of negative car equity has been escalating, with recent Edmunds data revealing that 1 in 5 trade-ins have negative equity. The situation has become particularly pronounced in the new car market, where 20.4% of trade-ins are underwater, marking a significant jump from 14.9% in Q4 of 2021.

The average negative equity on car loans has surged to $6,054, setting a new record. This increase is partly attributed to the economic fluctuations during the pandemic when many consumers purchased vehicles at higher prices, leading to loans that exceeded the depreciating value of their cars. Consequently, drivers who bought cars during the pandemic are now facing the brunt of this financial imbalance.

Having negative equity on a car loan is more than just a numerical imbalance. It’s a predicament that can have lasting financial repercussions. Negative equity limits the owner’s flexibility, complicating efforts to sell or trade in the car without incurring losses.

For those looking to buy a new vehicle, negative equity means that the debt from the current car can roll over into the new loan. This leads to a cycle of increased debt that never seems to go away. Moreover, negative equity can affect credit scores and future loan conditions.

To combat these implications, car buyers should prioritize loan repayment strategies that target the principal amount. Also, consider shorter loan terms to align with the depreciation of the vehicle, and stay informed about the car’s current market value to make timely financial decisions. If you’d rather avoid the risk altogether, leasing is also an option.

Navigating out of negative equity requires a proactive and strategic approach. Here are comprehensive steps and solutions to help you manage or eliminate negative car equity:

By employing these strategies, you can tackle negative equity head-on and work towards a more stable financial situation with your vehicle. Each approach has its considerations, so it’s important to evaluate your financial circumstances and car value carefully before deciding on the best course of action.

(Related) 👉 Check out this guide to navigating the finance office like a pro!

GAP (Guaranteed Asset protection) insurance is indeed related to the topic of negative equity in car loans. Thus kind of insurance is designed to cover the difference between the actual cash value of a vehicle and the balance still owed on the financing (loan or lease) in the event that the car is totaled or stolen. Here’s how it connects to negative equity:

In the context of managing negative equity, GAP insurance doesn’t reduce the loan balance or directly help in getting out of negative equity. However, it provides financial protection against the consequences of having negative equity in the event of an accident or theft.

Learn more about GAP insurance with this in-depth guide

Negative car equity, while daunting, is manageable with smart decisions and strategic actions. Understanding its roots and applying tailored strategies can lead car owners from the depths of financial strain to the clearer waters of financial stability and equity.

Want to learn more about how your particular situation may impact your ability to buy or sell? Chat with a CarEdge expert today. We’re here to help!

If you’re thinking about buying or selling a vehicle in 2024, you’ve most likely encountered an unfortunate truth in today’s market: trade-in values have taken a dive. But what’s driving this decline, and how does it affect your next vehicle purchase? Will trade-in values fall further in 2024? Let’s delve into the dynamics of trade-in values in 2024, exploring the causes behind this trend and what you can expect when you decide to trade in your vehicle.

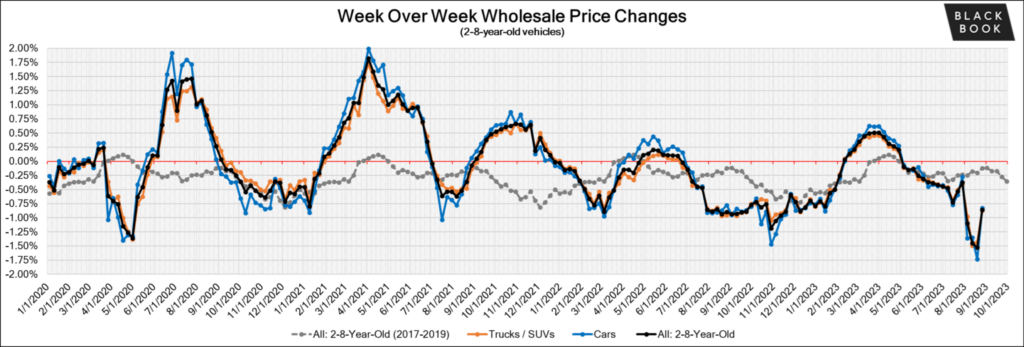

In 2024, trade-in values are trending downward, primarily due to a steady decline in used car values at wholesale auctions. Last year’s volatility in the wholesale used car market has led to an 11% drop in values within just two months towards the end of 2023. We’re seeing that trend carry over into 2024. Despite this decrease at the wholesale level, retail prices have remained stubbornly high, resisting substantial drops as dealers maintain higher price points.

The used car dealers who make offers for trade-ins are nervous about two things: the slowing used car market, and high interest rates. Many dealers suffered huge losses on electric vehicle trade-ins in 2023 as values went into freefall. The same could be said about other vehicle segments, from vans to luxury SUVs.

The used car market turmoil has resulted in trade-in values falling more dramatically compared to retail prices.

👉 See this week’s used car market update

CarEdge Co-founder Ray Shefska has some thoughts to share about trade-in values in 2024. Ray highlights that, despite the drops, trade-in values in 2024 are still far from what they used to be pre-pandemic. The automotive market is slowly inching towards a balance, but it’s a gradual process. “The car market remains out of balance due to the 16 million vehicles that were never built during the pandemic shortages. This shortfall will continue to impact the market throughout the decade, but we’re starting to see signs of improvement,” he noted.

What can you do to stay on top of the latest trends in trade-in values for your car? Get offers from online buyers with no strings attached! See real-time offers from online buyers with CarEdge.

According to Ray, 2024 is expected to bring back some normalcy in terms of market seasonality, which has been absent for a while. The early part of 2024 has already seen a dip in trade-in values, attributed to the post-December buying slump.

However, this trend is likely to reverse during the tax refund season in spring, which typically sees an uptick in used car purchases. This increase in demand often leads to a temporary boost in trade-in values.

“Post-tax season, I expect a slight decline in trade-in values in early summer, followed by a steady market until the year-end car buying season. Remember, depreciation is normal for every vehicle. What we’ve seen over the past few years was abnormal to say the least.”

Ray’s pulse on the market is rooted in over 40 years in the automotive industry. If anyone knows a thing or two about trade-in values, it’s Ray.

Historically, vehicle values take a 20% hit in the first year of ownership. It’s normal to lose around 40% of a car’s original value in the first five years.

Navigating the auto trade-in market in 2024 requires an understanding of these new trends and their underlying causes. From the pandemic’s lasting impact to the return of market seasonality, various factors are shaping trade-in values this year. Whether you’re planning to trade in your vehicle soon or later in the year, staying informed about these trends can help you make a more strategic decision, ensuring you get the best value for your car in a shifting market.

👉 Don’t forget to check your car’s trade-in values from online buyers (no spam, guaranteed!). Get your no-hassle offers here.

Ready to outsmart the dealerships? Download your 100% free car buying cheat sheets today. From negotiating a deal to leasing a car the smart way, it’s all available for instant download. Get your cheat sheets today!

Most car buyers don’t typically think of autumn as a great time to buy a car, but it’s the perfect time if you know where to look. Whether you’re planning to buy, hoping to sell, or are just curious about where the industry is headed, you’ve come to the right place. Buckle up as we steer you through the latest trends, from brand inventories and market conditions to financial forecasts. Let’s roll!

The new car market still hasn’t reached so-called ‘normal’. Will it ever? Only a fool would make bold predictions after what we’ve all witnessed this decade. However, let’s talk about what we do know.

This autumn, we’re seeing an increase in cars on the lot, yet a significant disparity persists between automakers in terms of inventory levels. The current industry average hovers just under 60 days in terms of Market Day Supply. Why should you care about Market Day Supply (MDS)? This metric is crucial when understanding how much bargaining power you might have at the dealership. Brands with a high MDS are more eager to shift their inventory, and therefore, more likely to negotiate on price.

In the present market, Infiniti, Chrysler, Lincoln, Ford, Dodge, Buick, and Jeep have high inventory levels. This makes them prime targets for savvy buyers looking to negotiate a better deal. Here’s a look at nationwide inventory for the most negotiable new car brands:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Infiniti | 119 |

| Chrysler | 179 |

| Lincoln | 128 |

| Ford | 99 |

| Dodge | 190 |

| Buick | 113 |

| Jeep | 179 |

| Market Average | 72 |

As you can see, all of these brands are dealing with a surplus of new car inventory right now. The longer that a new car sits on a dealer’s lot, the more negotiable it becomes for the knowledgeable car buyer. Dealers pay ‘floorplanning costs’ to keep inventory, so every day cuts into their profit margins. Learn how to use this information to your advantage with this 100% free Car Buying Cheat Sheet.

On the flip side, if you’re looking at Kia, Honda, Subaru, Lexus, BMW, and Toyota, be prepared for a bit of a struggle. These brands are facing low inventory levels. In some instances, new arrivals are pre-sold before they even hit the lot!

Here’s nationwide inventory for these new cars:

| Make | Market Day Supply (Nationwide 9/1/23) |

|---|---|

| Kia | 35 |

| Honda | 33 |

| Subaru | 48 |

| Lexus | 50 |

| BMW | 49 |

| Toyota | 40 |

| Market Average | 72 |

See local car market data for every make and model with CarEdge Data.

Surprisingly, Subaru remains a brand that’s willing to negotiate even when their inventory is low. Let’s take a look at some examples of today’s Subaru inventory:

| Make | Model | Market Day Supply | Total For Sale |

|---|---|---|---|

| Subaru | Ascent | 66 | 6,992 |

| Subaru | Solterra | 82 | 2,092 |

| Subaru | Crosstrek | 61 | 18,096 |

| Subaru | Forester | 74 | 26,782 |

| Subaru | Outback | 80 | 24,836 |

| Subaru | Impreza | 63 | 4,031 |

| Subaru | Legacy | 58 | 3,498 |

| Subaru | WRX | 83 | 3,339 |

| Subaru | Brand Average | 71 | 89,879 |

Our Coaches frequently empower Subaru lovers with the skills to negotiate even low-inventory new and used Subaru models. Check out these success stories of what is possible!

These are the top trends that our team of Car Coaches are watching this fall season. Each of these variables has the potential to disrupt the new car market in significant ways.

Inventory Surge: The buildup of new car inventory has already begun, but the question remains, will it last into fall? With sky-high interest rates continuing to dominate buyer’s mindsets, we think it will. We predict a buildup of new vehicle inventory as we near the end of 2023, slowly but surely.

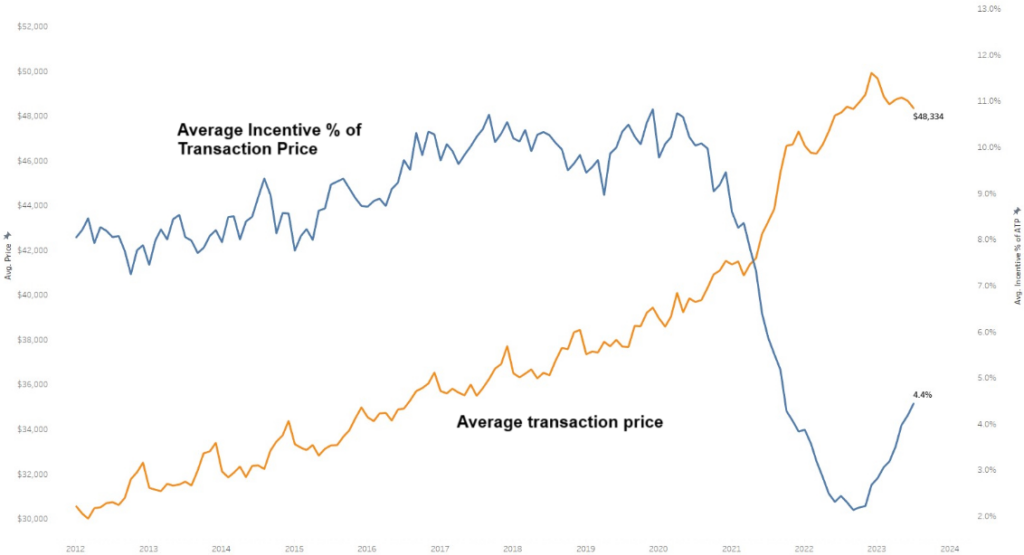

Manufacturer Incentives: Manufacturer incentive spending is at a two-year high, accounting for 4% of the transaction price on average. Brands like Ram and Jeep have recently advertised new models at 10-15% below MSRP. If manufacturers increased their incentives to pre-pandemic historical norms around 7-9%, that would entice more buyers to take action. We don’t expect automakers to raise incentives at such a rapid pace by winter, however.

The UAW Wildcard: There’s speculation of a 10-20 day UAW strike that could cause short-term hiccups. While we don’t expect this to be a game-changer, it’s something to keep an eye on. It would, however, be a bigger deal for automakers like Stellantis and General Motors. Analysts estimate that a 10-day strike would cost them about $5 billion.

CarEdge New Car Market Seasonal Rating: It’s a ‘fine’ time to buy a new car.

Better deals are anticipated this winter, but depending on what vehicle you’re in the market for, this autumn just might be the perfect time to negotiate a great deal.

While used car prices have slightly decreased, they are still far above historical averages. This means you’re unlikely to snag a bargain, especially if you’re gunning for a reliable vehicle with a clean history for under $20,000.

Pro Tip: Never enter the used car market blind. Always get a pre-purchase inspection (PPI) to understand the future maintenance needs and overall condition of the car.

Trade-in values will continue to slowly decline as wholesale auction values are expected to keep falling. Following historically steep declines in wholesale used car prices in July and early August, we expect a more gradual decline in the fall.

Whereas used cars, trucks and SUV values were falling at a rate of -1.00% to -1.5% weekly as of last month, we expect weekly used car values to decline by around -0.5% to -0.3% for most of this season. Why? There’s no indication that a glut of used car inventory will arrive on the market any time soon to drive down values quickly.

The best used car sellers (especially those looking to trade-in) should hope for is slow but steady drops in value in September through November. You’re likely to get more for your trade-in or used car sale today than you will in a few months.

CarEdge Used Car Market Seasonal Rating: very difficult for buyers on a budget.

This is especially true if you’re looking for a vehicle of decent, reliable quality for under $20,000. Interest rates incentivize large down payments and cash buyers, but most of us don’t have the means to put $10,000 or $20,000 down.

No matter what, don’t give up. From free car buying resources to 1:1 expert help with your deal, the CarEdge team is here to help!

If you’re in the market for a new or used car, here’s our most important advice for you: Generally, say NO to market adjustments. A lot has changed since the madness and mayhem of late 2021 and early 2022. The exceptions are true specialty vehicles like Ford Bronco Raptor or Toyota RAV4 Prime, which are so in-demand that markups are almost a given.

For most new and used car models, there’s no way car dealers could justify additional markups in 2023. Staring down a tough deal? Work with a Car Coach to negotiate the BEST deal possible.

We’ll leave you with these reader favorites (100% free). Happy car shopping!

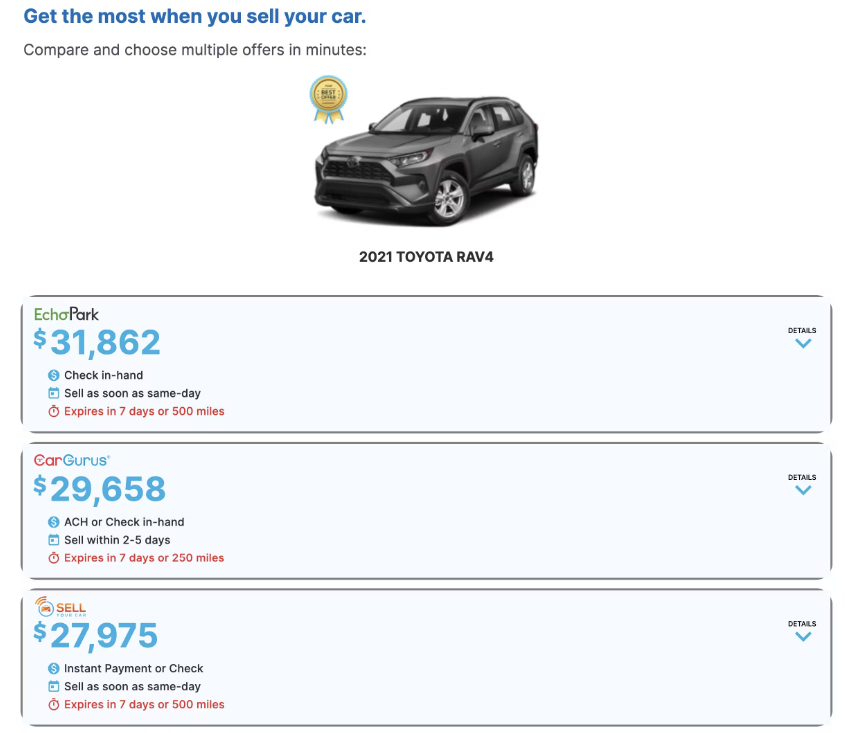

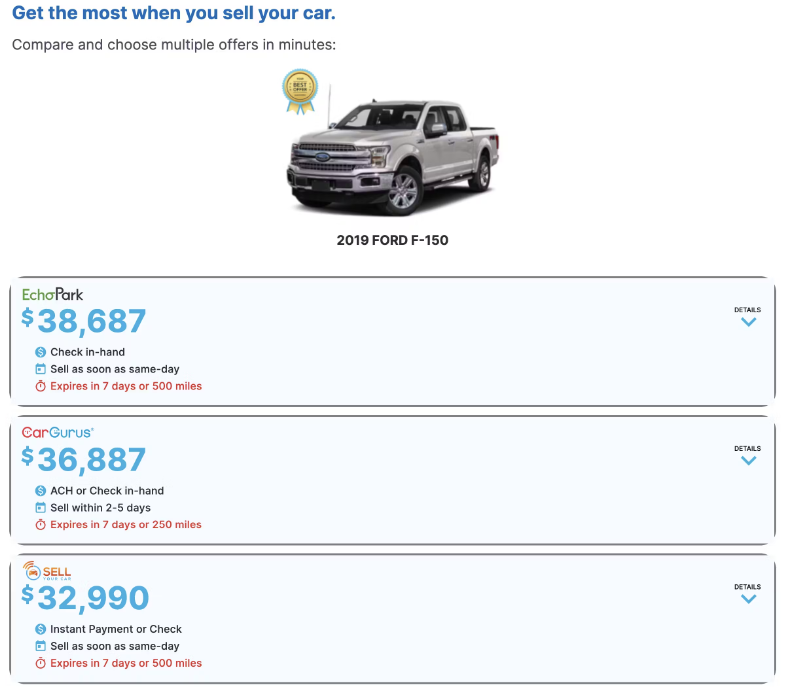

If you’re thinking about selling your car, you need to get a quote from EchoPark Automotive. Why would we insist that thousands of CarEdge Community members consider giving one online car buyer special consideration? Frankly, EchoPark is overpaying for used cars, and writing big checks to sellers in the process. Here’s what our team found using this free CarEdge offer comparison tool.

We did some research with CarEdge’s Sell Your Car offer comparison tool, and we found that EchoPark is paying too much for used cars. “Apparently, EchoPark has decided that they want to be the next Carvana,” exclaimed CarEdge Co-Founder Ray Shefska. Ray says that EchoPark may be putting themselves in a position where they’ll be buying high, and selling low.

We got offers from multiple online car buyers, and the difference was shocking.To get a sense of the overall market conditions for online car buyers today, we requested offers for a number of vehicles in different markets in America.

For example, we found a 2016 Ram 1500 for sale by Carvana in Kansas City, and received offers from multiple online buyers, such as Cargurus and CarMax. It turns out that EchoPark is not yet in the Kansas City market (more on that in a moment).

Cargurus made the highest offer, at $23,000. That’s $9,000 less than Carvana’s current asking price of $32,000. That sounds about right, at least in today’s market. But this is where EchoPark’s growing presence in online car buying enters the scene. They’re not in every market, but where they are, they REALLY want to buy your car.

Now, let’s take a look at EchoPark’s determination to gain inventory. Over at CarMax, we found a 2021 Toyota RAV4 XLE on sale in Colorado Springs, Colorado for $33,000. CarMax is known as one of the higher-priced car sellers, since they claim to have no-haggle pricing (although you CAN negotiate your deal). For this RAV4 on sale for $33,000, EchoPark would pay $31,862 to buy it! It’s absolutely insane to see an online car buyer offering just $1,200 less than the car’s listing price. That’s yet another sign of a used car market out of whack.

Let’s take a look at one more example. To be sure this wasn’t a Toyota fluke, we picked this 2019 Ford F-150 Lariat. CarMax is asking $43,000, but EchoPark is willing to pay $38,700 to buy it. That’s NOT normal in the used car market. This is like if you went out and bought a $500 TV, and your neighbor offers to buy it off of you days later for $475. Crazy, right?

What does it all mean? This is a recipe for selling at a loss. Ray put it best, “Either EchoPark is desperate for inventory and isn’t worried about losing money on used cars, or this is pure insanity!”

These instant offers from online car buyers are generated by an algorithm that is supposed to offer a compelling price for the seller, but an offer that also makes it easy for the buyer to then sell that vehicle for a profit. Clearly, either there’s something wrong with EchoPark’s algorithm, or they seriously need inventory, and are willing to pay a price for it.

Yes, EchoPark is a legit business that buys and sells used cars online. EchoPark does not sell new cars. It’s also important to point out that EchoPark Automotive does not buy and sell in all markets. To sell your car to EchoPark, you’ll need to be close to one of their Vehicle Buying Centers. Most locations are in the southern half of the country, from coast to coast. See the latest EchoPark dealership locations here.

When you get an offer to sell your car to EchoPark, your offer is good for 7 days or 500 miles, whichever comes first. If you complete the deal within two days, they throw an extra $250 onto the offer.

When it comes to inventory, EchoPark mostly buys and sells 1-5 year old cars with low mileage. All of EchoPark’s cars come with a 7-Day Money Back Guarantee, similar to Carvana’s 7-day money-back guarantee, and CarMax’s 30-day money-back guarantee, as long as you’ve driven under 1,500 miles.

Before you sell to EchoPark Automotive, we highly recommend that you compare offers from multiple online car buyers. You’ll get offers from reputable buyers like CarGurus, CarMax and EchoPark in seconds!

Thinking about buying from EchoPark? It’s possible that you’ll find a great deal, but it’s also possible (almost likely) that they’ll be overpricing their used car inventory to try and recoup money from overpaying for inventory.

We want to help you buy confidently. Do your due diligence and guarantee savings with the latest local car market data on CarEdge Car Search. How about premium market insights like Black Book trade-in values, negotiability score and official CarEdge recommendations for every listing? With CarEdge Data, you’ll get that and more.

Have you sold a car to EchoPark? Perhaps you’ve bought a used car from them? How did it go? Let us know in the comments below!